A notary deposit is an effective way to fulfill the debtor’s financial obligations to the creditor, as well as secure settlements for transactions. The full name of this instrument is a notary public deposit account.

It applies:

1. If you have debt obligations, but it is technically impossible to fulfill them: the creditor (lender) or management company does not want or is not able to accept funds. In this case, the notary’s deposit allows you to avoid paying penalties on utility bills, a loan agreement, mortgage or loan.

2. When settling purchase and sale transactions, especially if you want to avoid unnecessary risks when transporting and storing large amounts of cash.

How does a notary's deposit work in case of repayment of monetary obligations?

The Civil Code of the Russian Federation specifies cases when you can use a notary’s deposit if:

— the lender (creditor) or his authorized representative is absent from the place of fulfillment of obligations;

- the lender refuses to accept funds as payment for the debt;

- the lender is incapacitated and does not have a legal representative;

- if it is impossible to determine who the lender is, for example, if disputes arise on this topic between the creditor and other persons.

The bank where you took out the loan can act as a lender. But it happens that his license is revoked or he does not work for another reason. If in such a situation you do not fulfill your debt obligations, then the bank or the one to whom the loan was transferred may impose a penalty or fine. And if you have a mortgage, the bank may increase the interest rate for the remaining period until it is fully repaid.

The same situation may arise with payments for housing and communal services, when, for example, there is a change of management companies. Or you have a loan agreement, but there is no contact with the lender, for example, he moved to another city and changed contacts. At the same time, the contract specifies penalties for late repayment, and payment must be made urgently.

In such cases, you can use the notary's deposit, and no one will accuse you of non-payment or delay in repaying the debt. The notary himself will transfer the money to the account of the creditor (lender) as soon as the opportunity arises. However, for you, the date of fulfillment of debt obligations will be considered the date of depositing funds with the notary. In this case, the lender has no right to demand penalties, and your credit history will remain impeccable.

Deposition by a notary is a guarantee of fulfillment of obligations

In both domestic and commercial contracts, the timing of settlement is the most important condition, since the transaction may involve a long period of performance. Deposit is a convenient and reliable tool for ensuring the fulfillment of obligations, guaranteed by a notary. It has become widespread among individuals and legal entities in the following situations.

Settlements for real estate transactions

The peculiarity of the purchase and sale of real estate is that the transfer of ownership of them must be registered in the Unified State Register of Real Estate (Rosreestr). Thus, there is a time gap between the signing of the contract and the registration of the transfer of rights. If you submit documents through the MFC, the registration period is up to 2 weeks, and the documents must be submitted by both parties to the transaction together.

Both the seller and the buyer of real estate face a dilemma. It is risky to give money before registering the right - what if it is suspended? The seller also does not agree to receive a settlement after registering the property in the name of the buyer - the apartment will become his property without actual payment. The best way out of this situation is to deposit funds with a notary, who will transfer them to the seller after registering the apartment under the new owner. This method of calculation has many advantages:

- a notary can submit an application for transfer of ownership to Rosreestr via electronic communication channels - in this case, registration takes only one day;

- if the purchase and sale transaction is certified by a notary, the buyer can deposit funds without the participation of the seller;

- parties to the transaction save time - there is no need to get together to submit documents to Rosreestr.

The most important thing is the absolute security of the transaction. After receiving an extract from the Unified State Register of Rights on the transfer of rights, the notary transfers it to the buyer of the property, and the seller receives the funds deposited in the account. This eliminates the possibility of fraud on either side of the contract.

Escrow

In this case, the notary’s acceptance of funds for deposit means that he assumes the function of an escrow agent: he keeps the money in his account until the obligations of one party (or two at once) are fulfilled, after which he transfers them to the beneficiary. The terms of the transfer are specified in the agreement between the parties to the transaction, and it also indicates on the basis of which document the notary can verify the fulfillment of the agreement. Escrow is widely used in commercial transactions and between ordinary citizens. This method of calculation has many advantages:

- funds in the notary's account cannot be seized and are not subject to collection by bailiffs;

- neither the recipient of funds under the agreement nor the depositor can dispose of the money (withdraw it before the condition is met);

- deposited funds cannot be used as collateral for transactions and debts of the depositor.

Escrow by a notary guarantees the fulfillment of obligations under the transaction, regardless of changes in the situation and complicating circumstances. The notary is financially responsible for the preservation of funds and their transfer to the addressee. An added benefit is that he carefully checks that the terms and conditions are met before handing over the money or other deposited items.

Depositing funds is widely used:

- upon delivery of goods (transfer of payment after submission of shipping documents);

- when selling the results of intellectual property (electronic and paper media with texts, music, and program codes are deposited);

- in shared construction agreements (the developer receives money after drawing up a transfer and acceptance certificate for the object);

- in business purchase and sale transactions (guarantees the safety of material and other assets at the time of transfer);

- when purchasing securities, licenses, trademarks.

Comments from Moscow notary Kolganov I.V.

: When depositing things (documents, storage media), money, securities, the notary acts in the interests of both parties. He acts as an independent, legally qualified intermediary, guaranteeing the execution of settlements under the transaction.

Advantages of a deposit for settlement of transactions:

- the notary's activities are insured in accordance with current legislation;

- the notary can additionally individually insure his risks;

- insurance of the regional Notary Chamber;

- the compensation fund of the FNP is 0.5 billion rubles;

- the notary is liable with all his property;

- the minimum costs for the parties when making payments through a notary's deposit are due to the regulation of the notary tariff by the state and this is much cheaper than renting a safe deposit box or making payments through a bank letter of credit;

- huge time savings, since all functions under the purchase and sale agreement are assigned to the notary - preparation of the purchase and sale agreement, making payments, registering the transaction, monitoring compliance with all terms of the transaction and receiving the amount of money by the seller;

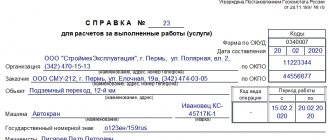

- To store funds, notaries open special public deposit accounts through which payments are made; storing material assets in the office is prohibited;

- the funds deposited by the notary belong to the person who placed them.

How much does it cost to draw up a loan agreement with a notary?

For notarial acts, a tariff (state fee) is paid in accordance with the Tax Code, plus legal and technical services or UP&T are paid.

Under loan agreements with a notary, the price of technical work is a fixed amount, the amount of which is established by the chamber, and the amount of the state duty depends on the amount of the transaction. *see current rates in the appropriate section

Certifying a money loan agreement from a notary will cost less than paying possible court costs and legal fees if it is necessary to collect a debt from an unscrupulous borrower. The use of a writ of execution saves time and does not allow the debtor to transfer assets to dummies.

The notary office of Igor Vladimirovich Kolganov is located at st. Mnevniki, 23, open daily until 20:00, and also on Saturdays until 17:00. Please contact the telephone numbers listed on the website to arrange a convenient appointment time to certify a loan agreement between individuals (legal entities), including urgent ones, in urgent situations.

Is it necessary to contact a notary?

The donation agreement does not provide for notarization. But the parties have the right to contact a notary at their own request. It is advisable to do this if the transaction amount is large or for a targeted donation.

We cover everything an accountant needs to know about working with contracts in the Clerk online course - more details here.

What to do if the debtor becomes bankrupt or dies

Both a legal entity and an individual, including an individual entrepreneur, can be declared bankrupt.

If the loan agreement was drawn up through a notary, the lender, based on the application, is included in the register of creditors. You need to contact the temporary (administrative) manager within 2 months after the publication of information about the debtor’s bankruptcy on Fedresurs or other publications (“Kommersant”).

If the borrower dies, the debt is legally transferred to his heirs. They are obliged to pay it within the value of the inheritance received.

What are the benefits of a notarized loan?

Borrowing money from an individual (legal entity) has significant advantages compared to a bank loan. As a rule, the bank requires a certificate of income, the involvement of guarantors, and collateral. In addition, the interest rate changes depending on specific conditions (income level, loan term), the decision can take a long time. If it is negative, an entrepreneur or private individual who urgently needs money will waste time.

At the same time, a loan agreement between individuals is certified by a notary on the day of application, which significantly simplifies the borrower’s task.

Moscow notary Kolganov I.V. comments: “The creditor more easily agrees to such a transaction, knowing that he receives guarantees of debt repayment through the use of the writ of execution mechanism. The debtor, in turn, protects himself from unfounded claims: unexpected increases in interest rates, demands to return the money ahead of schedule.”

How to issue a deed of gift

The main condition that must be included in the text is an indication that the transfer is free of charge. The structure of the agreement does not differ from that usually applied to transactions:

- preamble, which contains the date, place of conclusion of the agreement and details of the parties;

- subject (in this part it is required to reflect the gratuitousness of the transfer of money);

- rights and obligations (in this section the parties have the right to include the procedure for transferring the gift);

- grounds for termination of the deed of gift;

- other provisions at the discretion of the parties, for example, about liability, confidentiality, dispute resolution procedures;

- details and signatures of the parties to the transaction.

Sample:

Another example is a sample agreement for donating money between close relatives for the intended purpose:

VAT – 2022

The best speaker on tax topics, , will prepare you for filing your return on January 14 . There are 10 out of 40 places left for the online workshop . The flow is limited, as there will be live communication with the teacher live. Hurry up to get into the group. Sign up>>>

How to draw up a loan agreement through a notary

The form of agreement between the lender and the borrower provides for the inclusion of the following main provisions:

- description of the item (amount of money, things, items);

- deadlines for fulfilling obligations (schedule for installment plans);

- procedure for calculating and paying interest (if provided);

- rules for resolving conflict situations;

- liability of the parties for violation of the contract;

- identification data of the parties.

In practice, private loans against a notary receipt are the most common, but there can be many options. Often contracts include a collateral clause, then in addition to the main document, a collateral agreement is drawn up.

If real estate is used as collateral, the loan agreement must be notarized - this is a legal requirement.

The text of the agreement must indicate which party actually has the collateral. The second case, also often encountered in practice, is a notarized loan between the founders and the management of the LLC. As a rule, an interest-free agreement is drawn up, which must be expressly stated in the document.

Competent loan processing

As a rule, when receiving borrowed funds, the debtor writes a receipt for their receipt, which indicates the amount and period of repayment. The lender (the person who lent the money) is often confident that this is enough to confirm his rights. Indeed, a receipt is a document that can be presented to the court if it contains all the necessary information to establish the existence of a debt.

Unfortunately, the receipt often forgets to indicate other essential conditions: the interest rate on the loan, the frequency of repayment if the debt is to be paid in installments, passport details and place of residence of the borrower. If he violates the agreement and payment terms, the creditor has the right to go to court.

Moscow notary Kolganov I.V. comments:

“This is a troublesome procedure that takes a lot of effort and time. If you certify the loan agreement with a notary, the debt collection procedure is significantly simplified.”

Rules of the Civil Code on loans

- If the borrowed amount is over 10,000 rubles, a written agreement must be drawn up between individuals. When one of the parties is an organization, the agreement under any conditions must be written, regardless of the size of the loan.

- The date of conclusion of the agreement is considered the day of transfer of money (things), which is confirmed by a receipt or other document confirming their receipt by the borrower (an act indicating in the agreement that the subject of the agreement has been transferred and received).

- Before notarizing the loan agreement, the notary will make sure that the amount is indicated in ruble equivalent. Foreign exchange transactions in private relationships are not permitted.

- The document must specify the procedure for repaying the debt: in parts, in full and terms, as well as a condition on interest. If the loan is interest-free and its size is over 100 thousand rubles, this must be indicated directly. If there is no indication, interest is charged at the Central Bank rate in the general manner.

- If the loan agreement certified by a notary does not indicate a repayment period at all (on demand), then the creditor can demand the debt only after a written warning to the debtor 30 days before the day the demand is made.