When you provide services or sell goods, you need to register your business activity. Without registration, they can be fined up to 200,000 rubles under Article 14.1 of the Code of Administrative Offenses of the Russian Federation.

Registering a legal entity is difficult: you need a company charter, capital, and a lot of documents for the Federal Tax Service. It’s easier to become self-employed or an individual entrepreneur. Let’s figure out what’s better: registering an individual entrepreneur or registering for self-employment.

Who can register an individual entrepreneur?

Almost anyone can register an individual entrepreneur. There are several restrictions: the legal capacity of the future entrepreneur should not be limited by law or court, he should not be in government or military service. If a citizen has not reached 18 years of age, he can become an individual entrepreneur only in one of the cases:

- He got married.

- He received his parents' consent to start a business.

- There is a decision of the court (or the guardianship and trusteeship authority) on the full legal capacity of the citizen.

Even foreigners and stateless persons can open an individual entrepreneur if they have a temporary residence permit or residence permit in the Russian Federation.

Who is a private entrepreneur

A private entrepreneur is an individual who, without legal education, carries out entrepreneurial activities. Private businessmen in Russia appeared at the dawn of entrepreneurship in the early 90s of the 20th century. At first they began to be called state of emergency, but in the mid-90s the abbreviation PBOYUL (entrepreneur without the formation of a legal entity) began to be used in official documents.

Today, not a single current legal act contains the concept of “private entrepreneur”. Instead of this term, there is now the concept of an individual entrepreneur, so in the article we will talk about an individual entrepreneur.

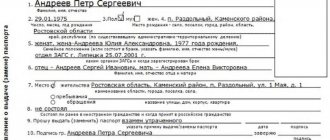

Is it possible to register an individual entrepreneur not at the place of registration?

It is possible if you do not have a residence permit (permanent registration). In all other cases, registration of individual entrepreneurs is carried out only at the address of permanent residence indicated in the passport. The tax office is determined at the same address, to which you will need to submit documents for registration, and subsequently reporting.

Even if a citizen is registered in one region and conducts activities in another, registration of an individual entrepreneur and registration with the tax office is still carried out at the place of registration. If you do not have a residence permit, you can register an individual entrepreneur at your place of temporary stay or actual residence, which will have to be confirmed by documents.

Entity

Entity:

- This is an organization that is registered, has the right to do business and has certain property.

- Has its own separate name and registration address (the registration address cannot be the business registration address)

- Bears separate responsibility.

- Required to keep accounting records, submit reports to the Federal Tax Service, as well as other funds.

- Has the right to obtain certain business licenses that are not available to individual entrepreneurs.

- Must have a stamp and bank account.

What is important is that a legal entity operates in the form of a certain team, in which there are managers and subordinates (each has their own responsibilities and rights).

Upon registration, the organizers of a legal entity invest part of the authorized capital into the “common piggy bank” of the business.

Where to submit documents to register an individual entrepreneur?

Documents for registration of individual entrepreneurs are submitted to the tax office: in person, through a representative or online.

In some regions there are tax inspectorates that only deal with the registration and closure of business entities. For example, in Moscow this is Interdistrict Federal Tax Service No. 46. Having registered an individual entrepreneur, the tax office itself will report the new entrepreneur to the district inspectorate, branches of Rosstat and the Pension Fund.

If there is no separate inspection for registration of entrepreneurs in your region, documents for registration of individual entrepreneurs must be submitted to the regional Federal Tax Service Inspectorate at the place of registration.

Unified agricultural tax

What is this. Special regime for agricultural producers, including fisheries and other organizations specified in the Tax Code.

What are the restrictions? An individual entrepreneur’s income from work in agriculture must be at least 70% of his total income. Up to 300 employees.

How much taxes to pay. 6% of income, but in some regions the rate is lower.

When to pay. Every six months, the first payment is made no later than July 25, the second payment is made by March 31 of the following year.

What reporting. Tax return - once a year, no later than March 31 of the following year.

Suitable for: Individual entrepreneurs who work in agriculture.

What taxes should I pay?

This depends on the tax regime you choose. By default, the general taxation system (OSNO) is applied, which involves the payment of taxes on personal income (NDFL), value added tax (VAT) and property.

In special regimes, which are not available to all individual entrepreneurs, one or two taxes are paid instead of the above. You can find out more in the article “All about tax regimes”.

The choice of taxation system also affects the reporting submission schedule.

When and how can you choose a tax regime?

You don’t need to do anything to select BASIC - it will be applied automatically.

You can switch to UTII within 5 working days from the date of actual start of work by submitting an application to the tax office using form No. UTII-2.

To switch to the patent system, you need to submit an application to the tax office in form No. 26.5-1 immediately along with registration documents or later - 10 days before the start of work on the patent.

To apply the simplified tax system, a notification in form No. 26.2-1 is submitted to the tax office. To immediately work on the “simplified” system, the notification must be submitted along with documents for registration of an individual entrepreneur or within 30 days after actual registration. If you do not meet these deadlines, you will be able to switch to the simplified tax system only from the new year.

Structure

The structural system is simple for citizens who are not involved in business. This is one citizen who has a certain list of opportunities and responsibilities. In the structure of a legal entity, everything is not so simple. The following requirements must be met:

- Unity in the enterprise

- Process control and management

- Orderliness of contacts and interactions

The main points, as well as the working and existence conditions of the legal entity, are prescribed in the statutory documents. To register, a certain package of documents is collected.

The structure of any legal entity arises when the capital of several persons and their property units are combined.

All decisions are made on the basis of meetings or sessions where participants and shareholders of the company discuss current issues. At the first meeting, a protocol must be drawn up, which records the positions and powers of each person. Often the determination is made by voting. If the order is not followed, sanctions will be applied. If necessary, the participants in the process will also be liable with their property.

A company may include one manager or several. Responsibility is determined by applicable laws and regulations.

Is it necessary to open a bank account?

No, not necessarily. An individual entrepreneur can receive payment from clients in cash, and pay taxes or pay suppliers by receipt at a bank branch.

Despite this, a bank account is convenient because you can:

- Pay taxes and pay bills through online banking.

- It’s safe to store your money (individual entrepreneurs’ accounts are covered by the deposit insurance system).

In addition, there is a limit for cash payments with other individual entrepreneurs and organizations: no more than 100,000 rubles for each agreement, while there are no such restrictions for non-cash payments.

Status selection criteria

For those who are just planning their own business or from time to time practice the provision of paid services privately, sooner or later the moment comes when they need to decide on their legal status. Control by tax authorities and banks is becoming increasingly strict - these are the requirements of the state, which is actively targeting mass legalization. Continuing to work without paying taxes, you can at any time not only find yourself with blocked accounts and cards, but also receive unpleasant questions from representatives of departmental structures, having become more familiar with the regulations for bringing to justice for illegal business.

How to start running your own business with minimal losses? Until recently, there were only two options - either an individual entrepreneur or an LLC. In fact, this has led to the fact that the number of officially unemployed people who actually earn money through the provision of services or the sale of goods of their own production has increased several times. The conditions and rules of legal registration, both in the first and second cases, differ too much from the income that a conditional nurse or photographer receives, and the presence of mandatory payments that are not tied to real profits minimizes the likelihood of turning a profit for those who whom such work appears only from time to time.

The pilot project launched by the government in 2021 is seen as a soft and mutually beneficial solution to the current situation. Today, self-employment and entrepreneurship are two priority options for official registration, which anyone can use.

Can an individual entrepreneur have employees?

An entrepreneur can hire employees under employment contracts. Limits on the maximum number of personnel are established only by the applicable taxation system. For example, on the simplified tax system or UTII the number of employees should not exceed 100 people, and when working under a patent - 15. If the number of employees exceeds the limit, the individual entrepreneur will lose the right to apply the regime and will have to switch to a general taxation system.

Hiring workers will require the individual entrepreneur to register as an employer with the Pension Fund of the Russian Federation and the Social Insurance Fund. There is no need to do this in advance; the funds will need to be notified when signing an employment contract with the first employee.

Rights and obligations of an individual entrepreneur

The individual entrepreneur enjoys the following rights:

- manages his own activities;

- freely chooses partners;

- decides how and in what amount to pay wages to employees;

- disposes of the received profit at its own discretion;

- can act in court as both a plaintiff and a defendant.

Responsibilities of the entrepreneur:

- document monetary transactions;

- all employees hired must be officially registered;

- submit tax and employee reports;

- pay taxes, employee salaries and insurance premiums on time.

How to pay fixed fees?

Fixed contributions must be paid throughout the existence of the individual entrepreneur. They consist of two parts: mandatory and optional.

The mandatory part of contributions does not depend on the actual receipt of income and is indexed annually. It is important to pay it before December 31 of the current year. Within this period, you can pay as conveniently as possible: in a one-time payment or in installments and at any time of the year. In the year of registration of an individual entrepreneur and in the year of termination of activity, the mandatory contribution is proportional to the number of days during which the status of an individual entrepreneur was valid.

The additional part of the fixed contribution depends on the income received by the entrepreneur without taking into account expenses. An additional contribution is paid in the amount of 1% of the amount of income per year exceeding 300,000 rubles until April 1 of the year following the accounting year.

Temporary suspension of activity (for example, at the preparatory stages of activity or in the case of a seasonal business) does not exempt the individual entrepreneur from paying contributions.

Separate ownership

Is the main aspect. Property assets may be used by a legal entity. However, regardless of this fact, they will be recognized as separate.

The property is owned by individuals who legally carry out business. In addition, it is used not only for business, but also for personal purposes and needs that do not contradict the law.

Who and how to notify about the start of activities?

In most cases, there is no need to notify anyone about the actual start of activity. The obligation to report this is provided only for a small list of activities - in order to protect consumer rights.

For example, Roszdravnadzor must be notified about the start of work in the field of social services; when providing transport services, Rostransnadzor must be notified; about the provision of household services and the start of trading activities, Rospotrebnadzor must be notified.

Notifications to regulatory authorities are sent before the start of actual activities.