Housing housing for military personnel is a service that allows any person serving in the Armed Forces of the Russian Federation to purchase housing on more favorable terms. The decoding of this abbreviation sounds like “targeted housing loan”.

This term was first mentioned in the law adopted in August 2004. It states that every serviceman has the right to receive housing, money for which is allocated from the regional budget. One of the most common ways to do this in practice was the issuance of funds for the purchase of real estate, taking into account all legal provisions.

According to the law, there is a special savings and mortgage system (NIS) for military personnel, which allows him to purchase housing immediately after the start of service, but not earlier than after three years of participation in the NIS.

For what purposes can you take out a loan?

A targeted housing loan can be used for:

- Purchase of residential premises, land with a house or part thereof located on it (provided that the account allows you to make this purchase without using credit money).

- Repaying the down payment when taking out a mortgage, or to pay off obligations on a previously taken out one.

- Purchasing housing under DDU.

It is also possible to spend it on paying expenses when completing a transaction to purchase a home or concluding a loan agreement. These expenses may include:

- insurance costs;

- payment for the services of an appraiser;

- payment for services for selecting a plot of land or apartment and paperwork;

- creditor payments.

Payment for these procedures can be made from the funds of the Center for Life Protection. However, this is only possible if all services are in full compliance with the terms of Rosvoenipoteka.

Current samples of CZL contracts

as of 10/01/2019

no credit

purchasing an apartment on the secondary market

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

purchasing an apartment in a new building under DDU

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

purchasing a house with land

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

with a loan

purchasing an apartment on the secondary market

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

purchasing an apartment in a new building under DDU

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

purchasing a house with land

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

civil mortgage repayment

for an apartment (resale)

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

for a new building according to DDU

Sample CZHZ agreement

Sample of the CZL agreement (by power of attorney)

Applicable agreements, their features

It is necessary to approach the execution of a targeted housing loan agreement very carefully, because obtaining preferential housing depends on it. If errors or corrections are made during this procedure, the document will not be accepted for consideration.

Depending on the nature of the property being purchased, the CLP agreement may be of the following type:

- For purchase without a mortgage. It is concluded if you plan to purchase housing using funds accumulated during your service.

- For the purchase of a private house. To do this, the contract specifies the area and cadastral number of the land plot. It should also contain information about the cost, category and number of storeys of the building.

- For the purchase of secondary housing. In this case, you should carefully consider the data in the column with the amount. They must exactly match the amount in the personal invoice. If there are the slightest discrepancies, the contract is not signed. In addition, the characteristics of the apartment and the buyer’s details must be indicated as accurately as possible.

- For the purchase of housing under construction. In addition to the above standards, it is necessary to accurately indicate the full address of the facility under construction. It will also be necessary to indicate all the characteristics of the apartment, such as the number of rooms, area and others.

Samples of targeted housing loan agreements:

- to pay the down payment when purchasing residential premises (residential premises) using a mortgage loan and repaying obligations under the mortgage loan;

- in order to repay obligations under a mortgage loan agreement provided to the participant as the only borrower for the purchase of residential premises (residential premises) before receiving a targeted housing loan;

- for the acquisition of residential premises (residential premises) on the security of the acquired residential premises (residential premises);

- to pay part of the price of an agreement for participation in shared construction and (or) repayment of obligations under a mortgage loan for the purchase of residential premises (residential premises);

- in order to repay the mortgage loan provided to the participant as the only borrower for the purchase of residential premises (residential premises) under an agreement for participation in shared construction before receiving a targeted housing loan;

- for the purpose of purchasing residential premises (residential premises) under an agreement of participation in shared construction without the use of a mortgage loan.

Questions and Answers on Military Mortgage

home

Military mortgage

Questions and Answers on Military Mortgage

Does a military man have the right to independently choose a lending organization to obtain a mortgage loan or does the Agency work only with accredited Banks?

A serviceman has the right to independently choose a credit institution to receive a mortgage loan under the terms of the Military Mortgage program. If in the future the credit institution plans to refinance this loan to the Agency, it will be necessary to conclude the appropriate Cooperation Agreements. The Agency considers for refinancing loans that meet the basic requirements of the Military Mortgage mortgage program developed by the Agency.

Such a loan (in full accordance with the Agency’s requirements) can be obtained from the Agency’s partners. The list of Agency partners is posted on the Agency's official website.

Is it necessary to have the requirements specified in clause 3.8 in the bank account agreement? Order of interaction. Will an application for the transfer of funds be sufficient? And if these conditions are not met, will this loan be refinanced?

Yes. These requirements are mandatory. Considering that the statement can be changed at any time without the approval of the bank, the inclusion of such a condition in the bank account agreement ensures the protection of the interests of all NIS participants. In the absence of these requirements, mortgage loans will not be considered for

Is it possible to open a bank account on demand with or without issuing a plastic card? Is it permissible to open a bank account on demand?

Opening a bank account on demand is not permitted. It is necessary to conclude a bank account agreement between the borrower and the credit institution.

The said agreement must contain a provision granting the credit institution the right to draw up a settlement document on behalf of the borrower for:

transfer of targeted housing loan funds to the seller of the residential premises;

repayment of the down payment and repayment of obligations under the mortgage loan (loan);

return of the specified funds to the Federal Administration in the event of failure to carry out state registration of the NIS Participant’s ownership of the purchased residential premises within 3 months.

When are Targeted Housing Loan (THL) funds provided and is it possible to transfer this loan to the current account of a mortgage agency?

Funds from a targeted housing loan are transferred only to the serviceman’s bank account.

According to paragraphs 12-14 of Section II “Rules for providing targeted housing loans to participants of the savings and mortgage housing system for military personnel, as well as repayment of targeted housing loans”

(approved by Decree of the Government of the Russian Federation of May 15, 2008 N 370).

The authorized federal body, within 7 working days from the date of receipt of the documents (including the CLC Agreement) specified in paragraph 10 of Section II of the Rules, makes a decision on concluding a targeted housing loan agreement, transfers funds from the targeted housing loan to the bank account of the participant opened at an authorized credit institution.

However, given that actual deadlines may change, and the Agency does not regulate these deadlines, the Agency considers it advisable to clarify this information with the Authorized Federal Body.

The NIS participant is issued a Certificate of the NIS participant's right to receive a targeted housing loan, which is valid for 3 months, if the NIS participant has not exercised the right to receive a Central Housing Loan. Is the Certificate renewed or does the NIS participant need to apply again to the Federal State Institution for a new Certificate?

In accordance with clause 6 of the “Rules for providing participants of the savings-mortgage housing system for military personnel with targeted housing loans, as well as repayment of targeted housing loans” (approved by Decree of the Government of the Russian Federation dated May 15, 2008 No. 370 as amended by Decree of the Government of the Russian Federation dated December 16, 2010 No. 1028; hereinafter referred to as the Rules) The NIS participant certificate is valid until the day of signing the CZL agreement, but no more than 6 months from the date of signing the Certificate. According to clause 7 of the Rules, if within 6 months from the date of signing the Certificate a CLC agreement has not been concluded, the military personnel - NIS participant has the right to re-apply to the Federal State Institution "Rosvoenipoteka" with an application for the provision of a CLC in the manner prescribed by clause 4 of the Rules.

When calculating the remaining service life of a military personnel (before retirement), how should partial months of use of funds be taken into account?

If the RO/SA conducts an initial consultation with an NIS participant and the date of issuance of the loan (loan) is not yet known, then the number of full months remaining until 45 years from the date of consultation is calculated.

If, when preparing documents for granting a credit/loan, the remaining months until the age of 45 are calculated, in this case the month of actual provision of funds is taken into account as full (if the last month of the loan period coincides with the month in which the serviceman turns 45 , this month is also counted as a full month).

What is the maximum estimated period for using the credit/loan. Does your expected retirement date affect the calculation?

In accordance with the main parameters of the Military Mortgage program, a loan/loan is provided to a military personnel until the age of 45. Accordingly, at the age of 45, this loan must be repaid.

In case of continuation of military service after the age of 45, the NIS participant will continue to receive funds into his personal savings account, which he can use to purchase real estate.

Thus, the maximum period for using the loan cannot exceed a period equal to the age of the military personnel until the age of 45.

When calculating the maximum loan amount available to a military member, is it possible to take into account the income of a spouse or other persons?

No. The mortgage/loan provided to a military personnel is calculated based on the amount of the savings contribution provided to the NIS Participant and the maximum service life.

Is there a maximum loan amount under the Military Mortgage program?

Subject to compliance with the requirements of the “Basic parameters of the Military Mortgage program” in absolute terms, the maximum loan amount cannot be more than 2 million rubles. (Order of the General Director of the Agency No. 163-od dated September 29, 2009 “On amendments to the order dated May 22, 2009 No. 84-od)

Will the military personnel's personal account continue to receive monthly funds from the Federal State Institution until the end of their service period, if the serviceman managed to repay a previously issued mortgage loan, but has not reached 45 years of age and continues to serve?

After repaying the loan to a military personnel, until he reaches 45 years of age, the Federal State Institution accumulates funds in his personal account. A serviceman can take out a second loan (provided that the previous one is fully repaid) or receive the specified funds after retirement, upon reaching 45 years of age.

Can a military serviceman, a participant in the NIS, additionally use his own funds when purchasing residential premises and fulfilling obligations under a credit agreement (loan agreement)?

Yes maybe. This is provided for by the standard forms of documents under the Military Mortgage program (loan agreement, loan agreement).

If a serviceman already has a loan obtained according to AHML standards, can he take out a loan under the Military Mortgage program?

A military member - a participant in the NIS, who has obligations on a loan received within the framework of AHML standards, can apply for a loan (loan) under the Military Mortgage program if his length of service is at least 10 years (length of service is confirmed by an extract from his personal file) for the moment the Agency buys out the mortgage on a new mortgage loan (loan).

If a serviceman received a loan under the Military Mortgage program, can he also receive a regular loan according to AHML standards?

A military member who is an NIS participant and has obligations under a credit agreement (loan agreement) concluded under the terms of the “Military Mortgage” program can also receive a credit (loan) within the framework of the Agency’s standard conditions, if at the time of the Agency’s purchase of the mortgage on the new mortgage (loan) The serviceman's length of service is at least 10 years (the length of service is confirmed by an extract from the personal file).

Is it possible for a military man to purchase an apartment from his parents or brothers?

According to clause 3.15 of the General Part of the Standards, the purchase of Residential Premises from Family Members of a military personnel and/or Dependent Persons (including brothers/sisters - full and half-blooded, grandparents, adoptive parents/adoptees) is not allowed. Since, in accordance with the legislation of the Russian Federation, other persons may be recognized as members of a military personnel’s family and/or persons interdependent with him/her,

if they live together with a military man, run a common household with him (incur common expenses), provide mutual assistance and otherwise demonstrate their relationship with him, indicating the presence of family relations, the acquisition of Residential Premises in particular is not allowed:

- close relatives of the serviceman;

- close relatives of the military spouse;

- parents of the military spouse and/or other members of the spouse’s family.

brothers/sisters of the serviceman's parents;

At the same time, close relatives in accordance with the Family Code of the Russian Federation (Article 14) are relatives in a direct ascending and descending line (parents and children, grandparents and grandchildren).

Can the Apartment Purchase and Sale Agreement be signed by a third party under a power of attorney issued by the owner of the property (seller)?

According to clause 4.4. Part I of the AHML Standards The agreement for the purchase of a Residential Premises by the seller - an individual must be signed exclusively by the owner of the Residential Premises in his own hand, and not by a third party acting on the basis of a power of attorney issued by the owner;

If the Borrower is absent, can his authorized representative sign documents using a notarized power of attorney?

Yes, it can, if this power of attorney complies with the requirements of the law, is notarized and contains these powers. In this case, a copy of the power of attorney must be submitted as part of the loan file documents when offering a loan for redemption.

An officer, a 2005 graduate, being a member of the NIS (since 2005), 3 years after joining the system receives a targeted housing loan for the purchase of an apartment. Buys an apartment. Upon expiration of the first contract, he RESIGNS from the RF Armed Forces and is drafted into another federal body (FSB, FSO) in the same year. What will happen to the apartment in this situation? Do I understand correctly, in order to keep an apartment you need not to quit, but to transfer? (According to Article 9, paragraphs 3 and 4 of the Federal Law “On the savings and mortgage system of housing for military personnel”). Thanks in advance.

Specialist comment : A serviceman’s participation in the savings-mortgage system is terminated if he terminates the contract for military service. The personal savings account is closed and loan payments will be stopped. Thus, in order to continue repaying the loan using savings from your personal account, you really need to transfer to another federal executive body.

Why, to obtain a certificate, should I contact the commander of the military unit, who sends a report to the district, the district to Moscow, and the Moscow military is only in the Federal State Institution NIS - SO MUCH TIME IS LOST!!! I'm not even sure that he will get there. Isn't a report addressed to the commander enough? Why can’t a report signed by the commander of the military unit, a photocopy of the registration number of the NIS participant and a certificate of military service be sent by mail to the Federal State Institution NIS.

Specialist comment : Without checking with the accounting data available in the military command and control authorities, your report cannot be sent directly to the Federal State Institution “Rosvoenzhilyo”. To ensure the functioning of the NIS for housing provision for military personnel, the Housing and Arrangement Service of the Defense Ministry has developed and approved Temporary Methodological Recommendations that determine the procedure for submitting information about participants in the NIS for housing provision for military personnel who have expressed a desire to receive a targeted housing loan (hereinafter referred to as the Temporary Guidelines). You submit a report addressed to the commander of the military unit in which your personal file is stored. Next, the commander of the military unit acts in accordance with the approved Temporary Recommendations: generates information about NIS participants who have expressed their desire to receive the CLC and sends it, upon command, to the military command authorities, which verify the data, indicated in this information with the accounting data available at the military command authority. If the data submitted from military units coincide, the military control body submits the information to the Main Housing and Operations Directorate of the RF Ministry of Defense (registration authority). The registering authority, based on the information provided by the military control authorities, generates summary information and submits it to the Federal State Institution “Rosvoenzhilyo”. There are no exceptions for the Moscow Military; they operate in accordance with the same regulatory documents.

I'm a soldier, lieutenant. Participant of the Accumulative Mortgage Lending program for military personnel since February 2008. Question - Can the funds allocated to me in my individual mortgage account within the framework of Law N 117-FZ be used to repay a PREVIOUSLY taken out mortgage loan. Those. for example - in 2010 I took out a mortgage loan and bought a home with it; in February 2011 (as in the law, after 3 years) the deadline for starting to use the funds accumulated in my individual account within the framework of the mortgage savings system is approaching, and I use them for repayment of a previously taken loan. Is this situation possible???? And what is the algorithm for using these funds (all accumulated over 3 years at once or some other way)? And another question: was I correctly included in the mortgage system only in 2008? I signed my first contract in 2006, but I transferred to military service from a civilian position after graduating from a correspondence university without a military department (I was a civilian employee of a military unit) . And the third question - if after 3 years of participation in the program I use the funds for a down payment on the purchase of an apartment, then the amount of funds transferred annually to my savings account will also increase (for example, in 2008 89.9 thousand rubles, in 2009 168 .8 thousand rubles) or will the amount accumulated on my account for 3 years be fixed at the time of issue to me and remain unchanged (fixed) for the remaining 17 years? That is, in 2011 it will be 3 years since I have been a participant in the program, for example. the contribution to my individual account in 2011 will be 200 thousand rubles, I take the funds accumulated over 3 years and purchase an apartment - the amount of the subsequent contribution (2012, 2013, etc.) will also be 200 thousand. rub. (fixed) or will also increase in accordance with the funds planned in the federal budget. Thank you.

Specialist comment : 1. The Federal Law “On the savings and mortgage system of housing support for military personnel” allows the use of savings funds for housing support to pay off obligations on a previously received mortgage loan. To do this, it is necessary that the housing purchased with a mortgage be registered as your property, as well as obtaining the consent of the lender to conclude an agreement between you and the Federal Administration of the Savings Mortgage System for the subsequent mortgage of the apartment in favor of the Russian Federation. Thus, the purchased apartment will be pledged to the lender (until the loan is repaid) and to the Russian Federation (until you have the right to use savings - Article 10 of the Federal Law). The funds accumulated over three years can be used to repay the mortgage loan early (if permitted by the loan agreement). Further repayment of loan obligations will be carried out monthly from your personal account in the amount of no more than 1/12 of the approved contribution of the current year during the entire period of your service.

2. To answer your second question, it is necessary to clarify the following data: military position (officer or warrant officer) and military rank when concluding the first contract, as well as the basis for assigning the first military rank.

3. The amount of savings transferred to your personal account is indexed annually taking into account the level of inflation. The amount of the annual savings contribution is established by the federal law on the federal budget for the next year (clause 2 of article 5 of the Federal Law).

I have been participating in mortgages since 2005, and this year I am going to purchase an apartment using a targeted housing loan. However, in light of the new reforms, it is possible that they will be transferred to civilian status. How will the loan be repaid in this case?

Specialist comment : In the event of dismissal of an NIS participant, including due to organizational and staffing events, before he has the right to use savings (Article 10 of the Federal Law of August 20, 2004 No. 117-FZ), the personal savings account is closed and repayment the loan will be terminated. All funds transferred to repay the loan, including the down payment, will need to be returned and interest paid for using them. The balance of the loan will have to be repaid using personal funds. The grounds for the emergence of the right to use savings are: 1). If there are 10 years of calendar service - dismissal due to general military service or in case of recognition as limitedly fit for military service, reaching the maximum age for military service, family circumstances provided for by the legislation of the Russian Federation; 2). The total duration of military service is 20 years or more, including in preferential terms; 3). Recognition as unfit for military service (without limitation of length of service); 4). Death or death of a NIS participant. Thus, in your case, dismissal from military service due to general military service if you have less than 10 years of calendar service will entail the need to independently repay the borrowed funds to both the state and the creditor bank. It should be noted that the order of the Minister of Defense of the Russian Federation dated February 20, 2006 No. 77 determined the procedure for payments supplementing savings for housing provided to certain categories of NIS participants who are dismissed after 10 years of service on the above grounds. These payments, which can be used to pay off the balance of the loan, are calculated up to the date when the total duration of military service could be 20 years.

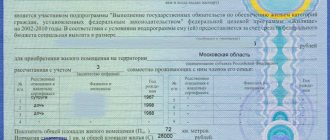

How much can I expect by mid-2009 if I have been a member since September 1, 2005?

Specialist comment : In accordance with the order of the Russian Ministry of Defense dated June 16, 2006 No. 225 “On approval of the Procedure for providing participants of the savings and mortgage housing system for military personnel of the Armed Forces of the Russian Federation with information on the status of their personal savings accounts,” commanders of military units (organizations of the Armed Forces of the Russian Federation Federations) within 10 days, but no later than June 15 of the current year, inform participants about the status of their personal savings accounts. In accordance with the Federal Law of August 20, 2004. No. 117-FZ “On the savings-mortgage housing system for military personnel”, the amount of the savings contribution per participant is established by the federal law on the federal budget for the year of making the savings contribution in the amount of no less than the savings contribution received by indexing the actually accrued and transferred savings contribution of the previous year taking into account the level of inflation. In 2005 the amount of the savings contribution was 37,000 rubles, in 2006 - 40,600 rubles, in 2007 - 82,800 rubles, in 2008 – 89,900 rubles, in 2009 – 168,000 rub. The above data can be used for an approximate calculation (excluding investment) of the amount of savings on your personal account: 1) for 2005: 3083 * 3 (October, November, December - the number of months remaining until the end of the year, since accruals on the personal account savings account is opened from the first day of the month following the month of inclusion in the register) = 9,249 rubles; 2) for the full year 2006: 40,600 rubles; 3) for the full year 2007: 82,800 rubles; 4) for the full year 2008: 89,900 rubles; 5) for 6 months of 2009: 14,000 * 6 = 84,000 rubles. Total: 306,549 rubles.

Am I obligated, as a member of NIS, to pay for the services of a realtor, bank, insurance company, and home appraisal?!

Specialist comment : In the case of purchasing housing using mortgage loan funds, it is necessary to conclude an insurance agreement (for the entire term of the loan), as well as payment of related expenses (appraisal of residential premises, bank commissions). The need to attract a realtor and pay for his services is determined by you personally.

I am a senior liter graduate of 2005. It seems like you can take out a loan for a mortgage, my wife is also a military personnel... her first 3-year contract ends only in November, when can we pool our savings to purchase one apartment? after 3 years from the date of entry into the mortgage? or immediately after her entry into the mortgage?

Specialist comment : As we understand, your wife’s first 3-year contract ends in November 2009, she is not yet a participant in the NIS for housing provision for military personnel. The categories of NIS participants and the grounds for their inclusion by the federal executive body, in which federal law provides for military service, in the register of NIS participants are determined by Article 9 of the Federal Law of August 20, 2004. No. 117-FZ “On the savings and mortgage system of housing for military personnel.” According to Article 14, Part 1 No. 117-FZ, each NIS participant, after no less than three years of his participation in the NIS, has the right to conclude a targeted housing loan agreement with the authorized federal body. Consequently, you will be able to pool your savings to purchase one apartment after 3 years of your wife’s participation in the NIS.

If in 2009 the amount of the savings contribution is 168 thousand rubles, then why is the CZHZ only 1,800,000 rubles, because if 168,000 * 20 (years) then that’s 3 million rubles! Are the Government of the Russian Federation and the Ministry of Defense going to somehow regulate the housing estate depending on the cost of 1 square meter in the region where the serviceman is serving, as well as on the number of people in his family!

Specialist comment : 1) The maximum amount of a targeted housing loan provided to an NIS participant to repay the down payment and mortgage loan obligations is calculated based on the amount of savings up to the age limit for military service, i.e. up to 45 years old. The contribution is approved annually by the Federal Law “On the Federal Budget” and cannot be less than the contribution of the previous year, increased by the inflation rate. Annual inflation is also determined by the federal law “On the Federal Budget”. At the same time, the indexation of the interest rate for inflation is calculated using the consumer price index, and the indexation of the funded contribution is calculated using the deflator index for the Construction industry, predicted by the Ministry of Economic Development and Trade. Therefore, it is not possible to calculate the total amount of a targeted housing loan. Currently, the amount of a mortgage loan provided under a special product developed by OJSC AHML for 20 years is 2,300.0 thousand rubles plus your savings for three years in your personal savings account. 2) The basis for the creation of a savings-mortgage system is the long-term nature of military service (the average duration of military service is 20 years of calendar service). The average standard of housing area per discharged serviceman is assumed to be 54 square meters, based on the estimated composition of a family of 3 people and the average cost of 1 square meter. meters of housing in Russia.

Our offers for military mortgages are here >>

Mortgage calculator >>

Required documents

The following documents are required for the CLP:

- A report on the need for a loan, in which you must indicate:

- The purpose for which the loan is taken;

- Agreement that Rosvoenipoteka may, under trust management, require funds for the purchase of residential premises from a personal savings account;

- Evidence. You can purchase it in a manner that is best discussed with a specialist.

- CZZ agreements concluded with Rosvoenipoteka and drawn up in accordance with a standard agreement.

Step-by-step process for obtaining a life certificate

To receive a loan certificate, a serviceman must comply with the following rules for granting a loan:

Step 1. Registration of a certificate for the right to receive CLP

At the first stage, the serviceman must submit a report to the unit commander.

If everything is in order with the documents and the serviceman falls into the category of those persons who can receive a CLC, then Rosvoenipoteka issues a certificate for receiving a loan.

The certificate is only valid for 6 months, so the service member will need to meet this deadline to purchase housing.

Step 2. Contact the bank

With a certificate of entitlement to receive a CLC, the interested person must contact the bank where he plans to take out a loan . When choosing a credit institution, it is important to check whether they have a mortgage program for military personnel. If there is no such program in a particular bank, then getting an apartment/house on a mortgage will not work.

The bank employee, having reviewed the applicant’s documents, must inform him of the amount of funds that the bank can provide him. And when this amount is already announced, then it will be easier for the citizen to look for housing.

Step 3. Choosing housing

Having decided on housing in a new building, the potential buyer must sign a preliminary agreement for participation in shared construction with the developer.

If a military man is considering housing on the secondary market, then he can immediately draw up a purchase and sale agreement.

Before signing a deal with the seller, the buyer must apply to the bank for credit money . And if the bank approves of the client’s choice, then he can safely sign the agreement.

Step 4. Signing the CZL agreement

Having chosen housing, the military man will have to sign a mortgage agreement with the bank, as well as a Central Housing Agreement agreement with Rosvoenipoteka. The applicant must send the necessary documents by mail to Rosvoenipoteka, where the papers are reviewed, after which money is transferred to the applicant’s account.

When the documents are sent to Rosvoenipoteka, the serviceman will go into standby mode.

To simplify and facilitate the waiting process, you can track the status of document processing on the Rosvoenipoteka website. Thanks to this innovation, interested military personnel have the opportunity to see what stage the documentation review process is at.

To view this information, a serviceman must enter his certificate number on the website, after which tracking access will open:

- the date and entry number by which the documents were registered in Rosvoenipoteka will be indicated;

- the date when the documents were submitted for legal examination is indicated;

- indicates whether incoming document control has passed. If the control is passed, then it is indicated that all papers have been submitted for signature;

- If the decision is positive, a note will appear at the end stating that the documents were sent to the bank. After this stage, the applicant can safely go to the bank and apply for a mortgage.

Step 5. Registration of the transaction, receipt of an extract

When the purchase and sale agreement is signed, then you should contact Rosreestr to register the transaction and obtain an extract from the Unified State Register of Real Estate . With this statement, the military man needs to go to the bank, pay the seller, and then go to Rosvoenipoteka and provide copies of the documents.

From the first month of taking out a mortgage, Rosvoenipoteka will begin transferring the military personnel’s funds to pay off the mortgage.

Is it possible to get a tax deduction when buying an apartment/house through the Central Housing Estate?

No, a military serviceman will not be able to receive a tax deduction, since savings contributions for this category of citizens are not subject to taxation.

Legal features

Housing purchased with the help of the housing estate is registered as the property of a military personnel. For the duration of the mortgage, it is considered collateral, and the mortgagee is Rosvoenipoteka. If it is purchased with mortgage funds, then the mortgage holders are both the above-mentioned organization and the lender.

In the event of dismissal from the armed forces, which resulted in the impossibility of using savings, the borrower is obliged to return the full amount of the CZL received within a certain period of time, not exceeding 10 years. In addition, he will have to pay interest on the loan. This usually occurs through equal monthly payments. If a person has the right to use savings, then they will be transferred to pay off the debt under the CLP.

If an NIS participant falls into the category of dead, dead or missing, repayment of the CLP is not provided. His relatives may take on the responsibilities of servicing the loan agreement. They can do this using funds held in the IRA until the mortgage is completely closed.

The NIS participant has the right to repay the mortgage early. After the debt is closed, the mortgage on the property is removed in a certain order. If he continues to serve in the armed forces, then accruals to the personal account continue under standard conditions.

Targeted housing loan for military personnel

There are a number of features when applying for a mortgage loan for military personnel who participate in the NIS and for clients who have a maternal or family certificate.

If a serviceman takes out a mortgage, he does not make scheduled payments on his own. Payment is made by the Ministry of Defense from funds accumulated over the years of service in a special account.

The client has the right to make partial early payments to quickly close the mortgage, but this occurs on a voluntary basis from his personal funds.

When the money in the NIS account runs out, the military man will make monthly payments on his own, so he is directly interested in partial early repayment. To take advantage of your savings, you need to submit a corresponding report to your military unit.

As for maternity capital, this money can be used to pay off the principal debt early in the manner prescribed by law. The transfer is carried out from the Pension Fund.

In this case, you will need to collect a complete package of documents and wait for the application to be reviewed. The transaction is completed within 30–60 days after submitting the application.

Construction loan for maternity capital

To use maternity capital to build your own home, you will need to obtain a permit for construction work. Such documents are issued by local governments. The process of constructing a structure must begin on a plot of land that belongs to the spouse.

The next stage is a visit to a notary, who registers the property as the common shared ownership of both family members. This formality must be completed within six months after the construction is put into operation. The state issues maternity capital after the child reaches the age of three by applying to the Pension Fund office at the place of residence.

Loan agreement for maternity capital

If a young family has decided to take out a loan “for maternity capital,” the necessary package of documents will have to be thoroughly prepared. In addition to the certificate itself, you will need:

- Certificate of unspent amount of maternity capital.

- Documents for housing.

- Copies of passports of the borrower and co-borrower.

After a positive decision is made, an agreement is concluded. It specifies the purposeful nature of the loan. In our case, this means the possibility of using funds only to purchase housing. If there are no errors in the execution of the document, the pension fund transfers the funds to the lender’s details.