Re-registration of an apartment for a child has its own characteristics. There are situations when this procedure cannot be avoided. Anyone can figure this out on their own.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

The right of minor children to a share in an apartment

A person aged 0 to 18 years can be the full owner of real estate. Including shares in the apartment. The owner can own and use the object for its intended purpose.

However, due to the lack of full legal capacity, the child cannot dispose of the object. He does not have the opportunity to sell a share in real estate, donate it or lease it.

The authority to dispose of the property of a minor is vested in the legal representative (parent, guardian/trustee). At the same time, the law limits its capabilities.

The representative has no right:

- donate a share in real estate on behalf of the child;

- sell property without approval from the district guardianship department.

Therefore, the parent can only freely transfer the property for rent.

If the owner of the share is a minor (from 0 to 13 years), then the parent can make decisions on renting out the property independently. A minor (from 14 to 18 years old) enters into a transaction independently. However, the written consent of the representative is additionally required.

Joint ownership

A minor child, on an equal basis with adult family members, has the right to own property belonging to the parents, or part of it, as well as to use such property without the right of disposal. The child has the right to independently dispose of the share due only upon reaching the age of majority.

Joint ownership of housing requires the mandatory participation of all owners in purchase and sale transactions, rentals and other transactions related to the disposal of joint property. For example, the sale of such a home is possible only with the general permission of all owners. In the context of marriage relations, joint ownership of housing by spouses presupposes the equal right of each of them to half of the property, regardless of whose name this property is registered in.

Registering a share in an apartment for a minor child

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The child may be the owner of the property. The grounds for the emergence of rights directly depend on his age.

Since a minor cannot be an independent party to the transaction, his interests are represented by a parent. He is empowered to carry out the transaction on behalf of the minor and gives consent to the minor. Although the child is not actually present when the transaction is executed, he or she has rights and responsibilities.

A child may acquire ownership of a share in real estate in the following cases:

- when accepting a share as a gift;

- when purchasing a share in real estate;

- when fulfilling an obligation by parents (using maternity capital);

- transferring part of the apartment as alimony;

- upon inheritance.

When executing a transaction involving shares in real estate and the participation of minors, the transaction is subject to mandatory notarization. Otherwise, Rosreestr will refuse state registration.

When buying an apartment

One of the options for re-registering a share in an apartment for a child is to include the minor in the purchase and sale agreement. To conclude a transaction, the consent of the district guardianship department is not required.

However, if the settlement of the transaction requires the use of funds from the child’s account, then it is necessary to obtain permission for the disposal. To do this, the parent must submit a preliminary purchase and sale agreement to the guardianship department at the place of registration of the minor.

The document must contain information about the child’s acquisition of a share corresponding to the amount of money or more. Reducing part of the property when using children's funds is not allowed.

In practice, this situation arises when a family wants to improve their living conditions. But there is no money to buy a new apartment. Therefore, they sell their own home and use the proceeds to buy a new one.

If the child had a share in the old apartment, then it can be sold in such a situation, with the consent of the guardianship department. But the funds must be transferred to the child’s personal account. When a new home purchase transaction is completed, the money is transferred directly to the seller. But the minor must receive a share in the property equal to or greater than the amount sold.

When donating a share

Donation is a one-sided transaction. But the recipient must agree to accept the property.

A child cannot independently express an opinion when making real estate transactions. Therefore, the parent expresses consent to receive property as a gift.

Important! When transferring property as a gift, obtaining permission from the guardianship department is not required.

The donor can be either a parent or another person. If the transaction is from a distant relative, you will need to pay tax. Minors are not exempt from paying personal income tax when making a gift.

If a share in an apartment is given by one of the parents, then the second acts on behalf of the child. In the absence of the second parent, this responsibility falls on the guardianship department.

When fulfilling an obligation when using maternity capital

Since 2007, the Russian Federation has had a program to provide families with maternity capital when they have a second child. Assistance can be spent for purposes provided for by law. One of them is improving living conditions.

When spending financial support on housing (purchase, mortgage repayment, construction), parents give an obligation to allocate shares in the residential premises to their children.

The obligation is drawn up in written notarial form and must be fulfilled within 6 months. The exception is the situation with mortgage repayment. In such a situation, the share must be allocated within 6 months after repayment of the loan.

A minor's right of ownership arises on the basis of an agreement to allocate a share for the purpose of fulfilling an obligation. The document is drawn up in simple written form and is subject to registration with Rosreestr.

When inheriting

A child can receive a share in real estate by inheritance. Moreover, he can act both as an heir by law and as a beneficiary under a will.

Acceptance of inheritance on behalf of a minor is also carried out by a legal representative. However, he cannot refuse to receive property if the deceased has debts.

To issue a waiver, you must obtain the consent of the guardianship department. To do this, you need to prove the obvious unprofitability of accepting the property. For example, the share is too small, and the debts of the deceased are much greater.

When concluding an agreement on alimony

Art. 104 of the RF IC provides for the possibility of replacing regular child support payments with a one-time transfer of property. In such a situation, the father may, when drawing up an agreement on the payment of alimony, provide for the transfer of a share in the apartment to the child.

The cost of the share must be taken into account. It should approximately correspond to the amount that a man will pay if he makes regular payments. In addition, the recipient (mother or child between the ages of 14 and 18) must agree to accept the property for child support.

The implementation of the agreement ends from the moment the share in the apartment is registered in Rosreestr. Moreover, it is the minor who must become the owner of the share.

Obligation to allocate shares to stepchildren

The formalization of the mother's obligation to allocate shares to her children and spouse has some nuances regarding stepchildren. In particular, the person on whose behalf the obligation is drawn up is not obliged to indicate in it children with whom he has no established legal relationship.

For example, if a child of one of them, born from a previous marriage, lives and is raised with the spouses. In such cases, a parent is not required to allocate a share to his or her spouse's child, with the exception of children who have been legally adopted by that parent.

Only the direct owner of the housing has the right to allocate a share to his minor children born in a previous marriage and who are supported by one of the spouses, that is, the spouse who purchased the housing with his own funds, or has single-handedly fulfilled the obligations under the loan agreement, or was the owner of the residential premises even before entering into a new marriage.

Step-by-step algorithm

The registration procedure varies little depending on the type of transaction. Each option has common points.

Algorithm of actions:

- Collection of documents.

- Payment of duty.

- Contacting a notary office.

- State registration.

- Payment of tax (if necessary).

All actions to register a share for a child are carried out by his representatives. If the recipient is a minor, then he visits the notary's office to sign.

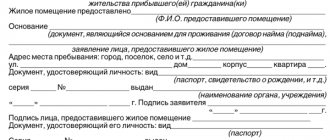

Collection of documents

List of documentation for registering a share in an apartment for a child:

- owner's civil passport;

- child's birth certificate;

- civil passport of the minor recipient;

- civil passport of the legal representative;

- documents that confirm the authority of the representative;

- title document for a share in the apartment;

- extract from the Unified State Register of Real Estate;

- fee payment receipt;

- certificate of absence of debt for housing and communal services;

- extract from the house register;

- technical documentation from BTI.

Documents that confirm the authority of the representative

| No. | Representative | Documentation |

| 1 | Parent | Civil passport of parent and child (if available), birth certificate |

| 2 | Guardian/Trustee | Civil passport of the guardian and the child (if available), birth certificate, resolution on the appointment of guardianship, certificate of the guardian/trustee |

| 3 | Adoptive parent | Civil passport of the guardian and the child (if available), birth certificate, agreement on the transfer of the child to the family, certificate of the adoptive parent |

| 4 | Head of the orphanage | Civil passport of the guardian and the child (if available), birth certificate, order for placement in an institution, order for the appointment of a director |

Options for documents on the basis of which ownership rights are transferred to the child:

- contract of sale;

- gift contract;

- notarial agreement on replacing alimony with property;

- agreement on the fulfillment of the obligation for maternity capital;

- certificate of inheritance rights.

All documents, with the exception of the certificate of inheritance rights, are prepared in 4 copies (to the owner, to a minor, to a notary, to Rosreestr).

Payment of duty

Regardless of the type of transaction, the parties bear certain costs. One of them is paying the notary fee.

Since a minor cannot bear the expenses on his own, their payment is entrusted to the legal representative. The amount of costs directly depends on the type of transaction.

The amounts depend on the region of circulation; expenses are indicated for 2021 in Moscow.

At the notary's office you must pay:

- when registering a transaction – 0.5% of the transaction amount;

- in case of inheritance - 0.3% - if the child is a brother/sister, son/daughter, 0.6% - if the minor is not one of the listed relatives;

- notary services for registration of sales and purchase agreements, donations – 11,000 rubles;

- when certifying an agreement to replace alimony with shares in an apartment - 8,000 rubles;

- certification of the agreement on the allocation of shares upon fulfillment of the obligation for maternal capital - 5,000 rubles;

- legal and technical services for inheriting a share in an apartment – 6,000 rubles.

Contacting a notary office

Notarization of transactions with shares in real estate with the participation of minors is mandatory.

Possible options:

- In case of inheritance, contact the notary office at the place where the inheritance was opened.

- When completing transactions, contact any notary office at the request of the parties.

- Calling a notary to your home (costs increase by 1.5).

State registration

From 2021, when contacting a notary office to certify a real estate transaction, the parties to the transaction are exempt from visiting Rosreestr. The notary independently submits documents for registration.

However, payment of the state duty is still the responsibility of the parties. In 2021, when registering a share in an apartment, you must pay 2,000 rubles.

The ownership right to a share arises in a minor from the moment of making changes to the Unified State Register.

What to include in a notarial undertaking

Allocation of shares to children without a notary does not imply the signing of an agreement that has a form strictly defined by law. The agreement is drawn up arbitrarily, but it must reflect its essential terms, as well as data on the subject. For example, allocating a child’s share in mortgaged property.

Agreement details:

- Passport details of homeowners.

- Information about children.

- Housing data. In particular, the basis for acquiring property rights.

- The essence of obligation.

- The amount of ownership shares allocated to children in the apartment.

As additional clauses, the document may specify the rights and obligations of the parties to the agreement. As well as the number of copies of the document, an indication of the person who bears the costs associated with paying remuneration to the notary.

Deadlines

The registration procedure does not take additional time if the participant in the transaction is a minor. Registration period:

- preparation of a draft document – 1 – 2 days;

- certificate from a notary – 1 day;

- state registration – 7 – 14 days.

In case of receiving property by inheritance, registration of ownership is possible after receiving a certificate of rights to the apartment. It is issued 6 months after the death of the owner.

It may take additional time to obtain permission from the district guardianship department. It is issued within 14 days from the date of application. However, the legal representative must prove that the minor’s property rights are protected.

Taxes

A minor owner does not have tax discounts. Therefore, in case of receiving the property, he must pay the necessary fees (if any).

When receiving a share in an apartment as an inheritance, a minor is exempt from income tax.

When receiving property as a gift, the child pays tax in the case of a gift from an outsider or distant relative.

When drawing up an agreement on alimony and an agreement on the fulfillment of an obligation, as well as a purchase and sale agreement, tax payment is not expected.

Rights of a minor to the father's share

Minors do not have automatic rights to the property of their mother and father. Therefore, a child can receive a share only if the parent voluntarily transfers part of the property to him.

If the mother and father divorce and share an apartment that is jointly owned, the child does not receive a share. The parents' property remains their property.

The registered child is not the owner of the apartment. Registration is not the basis for the emergence of ownership rights.

How can I apply?

So is it possible to register an apartment for a minor child and how to do it? Such transactions are completely legal, so there is no need to look for workarounds. Registration of real estate for a child is possible in several ways:

- By completing a standard purchase and sale transaction.

- Through privatization for a minor child - a share or the entire apartment.

- By drawing up a gift agreement.

- According to the will, but this cannot be called a full transfer of the object for the use of a minor.

The process of registering real estate for a child is considered separately if the property is under mortgage.

Please note that if an apartment is purchased using maternity capital, the child will in any case be the owner - the entire property or part.