When such a situation arises in life, when the time has come to enter into inheritance rights, each person has the right to decide for himself whether he wants to accept the inheritance or wants to refuse it. But before you make this or that decision, you need to know a few important rules.

Firstly, such a decision must be made before the moment when it is necessary to draw up documents for the inheritance.- Secondly, you can refuse or accept an inheritance only in full, and not in parts.

- Thirdly, if a person refuses an inheritance, then he will no longer be able to change his decision.

Deadlines for accepting an inheritance

The heirs must accept the inheritance within six months from the date of death of the testator (Article 1154 of the Civil Code of the Russian Federation). The expiration of the period for accepting an inheritance does not depend on the specifics of its receipt - it is the same for both inheritance by law and inheritance by will.

If you are late in entering into the inheritance, your share will be divided equally among the remaining legal successors. If you were the only heir of the first stage, the property passed to those in the second stage: full and half brothers and sisters, grandparents of the testator (Article 1143 of the Civil Code of the Russian Federation).

Another thing is inheritance by will. In this case, your share is distributed among the remaining legal successors indicated in it. If there are none, it is transferred to other heirs of the first priority: spouse, child, parents of the testator (Article 1142 of the Civil Code of the Russian Federation).

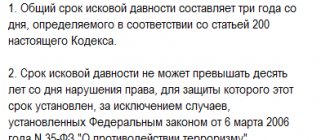

Statute of limitations for a will

Do not forget about the need to comply with the deadlines for challenging a will. Russian civil legislation has adopted the following limitation periods, which allow one to challenge a testamentary document and distribute the property of the deceased among the heirs according to the law.

- 1 year for contested wills. These include documents drawn up under threats, blackmail, pressure, breach of trust and other influence of third parties.

- 3 years for void wills. These are considered documents drawn up in violation of mandatory legal requirements. For example, this may be the absence of a notarization, the date of drawing up the document, etc.

The limitation period for this type of case is not counted from the date of opening of the inheritance. The countdown begins from the moment when the interested party either learned or should have learned about the violation of his legal rights and interests.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

Important reasons for missing a deadline

If you missed the deadline for accepting an inheritance, it can be restored without going to court.

But the remaining legal successors must give written consent. In this case, the reasons for the omission are unimportant. With the court everything is more complicated. You will have to go there if other heirs are against reinstating the term for you. The court will consider the reasons why it was omitted.

Detailed explanations about the reasons are provided in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in cases...”. They are indicated in paragraph 40. For example, if you did not know and could not know about the death of the testator, or contact a notary in time for the following reasons:

- serious illness;

- ignorance of the death of the testator;

- illiteracy;

- helpless state;

- serving a sentence for a crime;

- compulsory military service.

That is, the circumstances must be inextricably linked with your personality and not depend on you.

If you knew about the death of the testator, but you did not have information about the inheritance or the notary who is handling the inheritance case, the court will not restore the missed deadline - these are not valid reasons.

Here are some practical examples:

No. 1. The man had two sons. One of them was serving a sentence in a correctional colony when his father died. His property included an apartment and a house with a plot of land. They went to the second son, who was at large. The one who was in the penal colony was released two years after his father’s death and learned about the inheritance. I tried to come to an agreement with my brother, but in vain: he refused to divide the property and re-register everything in a new way.

Then the former prisoner filed a lawsuit to restore the deadline for accepting the inheritance. In support of his demands, he indicated that on the day of his father’s death and the next two years he was serving a sentence, and could not submit documents to the notary on time. In addition, he did not know about the death of his parent, because... did not maintain communication with him.

No. 2. The woman became seriously ill with coronavirus. She spent two months in the hospital, another month in a rehabilitation center, then four months in a hospital home. She needed oxygen support and could not go long without a concentrator. While she was still in the hospital, her father died. She knew about this, but for objective reasons she was unable to submit documents to inherit the inheritance. Her sick leave was closed only 7 months after her father’s death.

Her sister received an inheritance in the form of a house with a plot of land. It was not possible to come to a peaceful agreement with her; she was against restoring the missed deadline for accepting the inheritance. Then the woman went to court, presenting an extract from the hospital and all sick leave certificates, thereby confirming that she could not come to the notary on time for a good reason.

Actual acceptance of inheritance

How to draw up a statement of claim to establish the fact of acceptance of an inheritance?

Calculation

When determining the possibility of going to court, it is necessary to calculate the limitation period. In this case, the moment from which a given period begins to flow is of fundamental importance.

From what moment does the countdown begin?

Thus, the limitation period should be calculated:

- From the moment of opening of the inheritance. Most often it is used when considering cases of actual acceptance of inheritance.

- From the moment the interested person became aware of a violation of his rights. This circumstance is the subject of proof in court. In addition, the period may begin to run from the moment the circumstances that did not allow applying for acceptance of the inheritance or to the court are eliminated.

Rules for calculation

The current civil legislation defines special rules that should be followed when making calculations.

Thus, the period begins to run not from the day when the basis for the application of the limitation period arose, but from the calendar date following it . The end of the term falls on the corresponding month and date of the last year of the term. If the statute of limitations has not expired by the time the application is filed in court, then it expires when the claim is accepted.

What to do if the deadline is missed?

First, try to negotiate with other heirs to visit a notary so that they give their consent. If they refuse, go to court. Six months are allotted for everything from the moment the reasons for missing the deadline no longer exist. For example, if you did not have time to accept the inheritance due to a serious illness, this can be done within six months from the end of the sick leave. If it was not formalized - from the moment of complete recovery. But you will need medical documents.

Let's look at all the nuances in detail.

Through a notary with the consent of the heirs

If all heirs agree that the period for entering into inheritance be restored and you receive part of the property, you must contact a notary with a statement of consent. It is drawn up from everyone, but you can issue one for everyone. The main thing is that it has their signatures on it. If at least one of the legal successors is against it, you will have to go to court.

The whole process looks like this step by step:

- You negotiate with the heirs and determine the day of the notary's visit.

- The consent is signed in the presence of a notary. He explains the consequences in advance, because other heirs will have to share the property with you.

- The old certificate of inheritance is canceled and a new one is issued. You may request multiple copies for each if that is more convenient.

An important feature of restoring a deadline by consent is that the latecomer does not need to explain the importance or validity of the reasons for missing the deadline. It is sufficient to provide consent from the remaining recipients of the property.

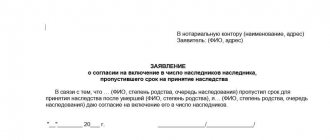

Contents and sample consent

There is no unified consent form. Most likely, the notary will give the form and sample to the heirs, but is not obligated to do so.

What it says:

- name of the notary office;

- Full name, addresses of legal successors;

- your full name, address;

- date and number of the inheritance certificate;

- consent to include you among the heirs;

- date of compilation, signatures of all legal successors.

Through the court

You have the right to go to court if you failed to reach an agreement with other heirs on restoring the deadline for accepting the inheritance. To do this, you need to draw up a statement of claim in several copies according to the number of defendants + for the court. Copies of the application and other documents must be sent before going to court by registered mail with acknowledgment of receipt. When the defendants receive them, follow these steps:

- Submit the application along with other documents to the district court at the defendant’s place of residence. If there are several of them, go to the address of one of them.

- Wait until the judge accepts the materials for production. This is done within five days, after which you should receive a determination by mail, which will indicate the date and time of the preliminary hearing.

- Come to the preliminary meeting. It is conducted in the form of a conversation. There the judge will clarify whether it is possible to draw up a settlement agreement and, if necessary, request additional documents.

- Participate in legal proceedings. If it was not possible to agree on a settlement agreement at the pre-hearing, the case is assigned to trial. There the judge is already studying the evidence, hearing the opinions of the parties, and the testimony of witnesses.

- Receive a certified copy of the decision. It is issued within five days after adoption in final form, but comes into force after a month.

The period for consideration of the dispute cannot exceed two months, according to paragraph 1 of Art. 154 Code of Civil Procedure of the Russian Federation. However, in practice, inheritance disputes can last for years, depending on the general actions of the heirs and their opinions regarding the decision made. If an appeal is filed, the deadlines will be delayed.

You can make your life easier and submit a statement of claim along with other documents through the State Automated System “Justice”. There you can then track the progress of the case.

Contents and sample of the statement of claim

The statement of claim, regardless of the reasons for filing it with the court, is drawn up in accordance with the provisions of Art. 131 of the Code of Civil Procedure of the Russian Federation, however, depending on the specifics of the case, the applicant can independently add the information necessary for consideration of the case.

The statement of claim must reflect:

- full name of the court;

- Full name of the plaintiff or plaintiffs, indicating the address of their place of residence or registration, as well as telephone numbers and, if possible, email addresses;

- Full name of the defendant or defendants, the plaintiff must indicate all information known to him: telephone number, residential or location address, fax, e-mail, etc.;

- Full name of the representative, if he is involved in the case, his residential address and telephone number;

- the essence of the application, which reflects all the circumstances of the case, the grounds for accepting it for consideration, a list of violated rights, and so on;

- the reasons why the deadline was missed;

- claims: to restore the period for accepting the inheritance, to include in the list of heirs, to allocate a share in the inherited property;

- a complete list of documents attached to the claim.

- date and signature.

Sample statement of claim for restoration of the period for accepting an inheritance:

Documentation

What you will need for the trial:

- passport;

- a document confirming relationship with the testator;

- will (if any).

You also need documents confirming valid reasons for missing the deadline for accepting the inheritance. If you missed it due to illness, you will need medical certificates and closed sick leave certificates. They served their sentence in the penal colony - certificates from there and a copy of the court verdict. If the deadline is missed due to limited legal capacity or temporary incapacity - a copy of the court decision and a certificate from the guardianship authority.

Depending on the circumstances of the restoration of terms, documents on the ownership of property or other papers may be required. If you are missing some information, file a petition in court to request evidence.

State duty

If you make a claim only for the restoration of the missed deadline for accepting an inheritance, it is considered non-property. The state duty will be small - 300 rubles. (Clause 3, Clause 1, Article 333.19 of the Tax Code of the Russian Federation). If at the same time you ask to be allocated a share right away, this is a property claim. The duty will be calculated depending on the price of the claim (clause 1, clause 1, article 333.19 of the Tax Code of the Russian Federation):

- Up to 20,000 rubles: 4% of the claim price, not less than 400 rubles.

- From 20,001 to 100,000: 800+3% of the amount over 20,000.

- From 100,001 to 200,000: 3,200+2% of the amount exceeding 100,000.

- From 200,001 to 1 million: 5,200+1% of the amount over 200,000.

- From 1 million: 13,200+0.5% of the amount over 1 million.

For example, if an apartment costs 5 million and you want to get 1/2 share in the ownership, the cost of the claim will be 2.5 million rubles. The state duty will be 20,000 rubles. This money can be recovered from the defendant as legal costs.

The maximum amount of state duty is 60,000 rubles.

Increasing the time limit for claims to inherited property through the court

The general limitation period for all court cases (3 years) also applies to inheritance cases. The right to it remains in the case when two periods of six months have expired. You can apply for restoration of your rights if illegal actions are detected in the inheritance procedure. If the plaintiff proves that he did not receive notice of the death of his relative, the court decision will cancel the rights of the remaining heirs.

In the case where the plaintiff has a court decision in his hands, this does not mean that he will receive part of the inheritance in kind. Often property is sold after inheritance. For this reason, the heir who restores his property rights will actually have claims to the monetary equivalent of his share, which will be paid to him by the rest of his relatives.

Legislation allows you to increase the statute of limitations for inheritance if there are compelling reasons. This right is enshrined in paragraph one of Article 1196 of the Civil Code. At the same time, the same article describes the possibility of increasing the statute of limitations to 10 years. This rule exists for conducting proceedings with particularly complex and confusing cases that involve the division of real estate.

Arbitrage practice

Let's look at a few examples of real cases on the restoration of a missed deadline for accepting an inheritance:

No. 1. The man's grandmother died. He never managed to enter into the inheritance, although he actually accepted it: he paid utility bills, looked after the house and lived there. The inheritance was never accepted within the prescribed period. As the heir explained, he believed that he had no right to it, because The successor in the first place is the father, and even without this he already lived in the ancestral house. But the father died, so inheritance is possible by right of representation, which the notary told him about later. Another relative managed to accept the inheritance.

In court, the plaintiff asked to restore the deadline for accepting the inheritance. The requirements were satisfied: it was established that the plaintiff learned about his right six months after the death of his grandmother (Decision No. 2-1079/2020 2-1079/2020~M-690/2020 M-690/2020 dated September 25, 2020 in case No. 2-1079/2020).

No. 2. The plaintiff filed a lawsuit against the city administration. The requirements include recognition of family relations with the deceased, establishment of the place of opening of the inheritance, restoration of the period for its acceptance, and establishment of the burial place of the testator.

Here is how it was. The testator was the plaintiff's paternal grandfather. The father himself never communicated with him, nor did his mother, the plaintiff’s grandmother. When her grandmother died, the plaintiff's mother began searching for her grandfather and learned that he died in 2015. He had nothing of property, but about 40,000 rubles remained. in an account with the Pension Fund of Russia, which the heiress could receive. She wanted to achieve this through the court simultaneously with the restoration of the period for entering into inheritance. However, the court refused to satisfy the claim, since family ties with the testator could not be established (Decision No. 2-562/2020 2-562/2020~M-444/2020 M-444/2020 dated September 22, 2021 in case No. 9- 409/2019~M-1214/2019).

Enter into an inheritance without a will

Relatives do not always make a will before passing away. The primary heirs are natural/adopted children, spouse, and parents. All other relatives can receive a certain share if the heirs from the first line are not alive, or they have refused to assume these rights.

Each relative needs to contact a notary’s office within 6 months and write an application to assume their inheritance powers.

You need to know that land and a residential building are different real estate objects. Therefore, they will have to be issued separately. This also applies to independent assessments by experts; each of them will be assessed separately.

When there is a will, this issue is regulated quite quickly. Each heir declares his rights within the established time limits, draws up documents and becomes the full owner of this property. But relatives are not always satisfied after the shares are announced. All controversial issues can be resolved by filing a claim.

Lawyer's answers to questions about restoring the deadline for accepting an inheritance

I missed the deadline to contact a notary. I don’t have any valid reasons: I didn’t contact the notary’s office because I didn’t have time. Can I get my share of the inheritance?

Yes, if other heirs agree. If not, the court is unlikely to restore the term

All the heirs missed the deadline for entering into inheritance, what should we do?

If there are no successors of the third and subsequent stages who accepted the inheritance, file a claim in court. If they are, try to negotiate with them so that they agree

I accepted the inheritance after the fact and did not contact the notary's office. A year has passed, now I fully provide for the property, pay bills and receipts, and invest in repairs. Do I need to contact a notary?

It would be desirable. Otherwise, you will not be able to dispose of the property: rent it out, exchange it or sell it, or pass it on by inheritance. File a lawsuit to establish the actual acceptance of the inheritance

I am the heir of the first stage and missed the deadline for entering into inheritance. The heirs of the second stage entered into the inheritance and registered the property as their own. Can I restore the terms and will the property belong to me if the terms are restored?

If you can prove the validity of the grounds for the omission and restore the deadline, then the procedure for entering into inheritance rights will be carried out according to the general rules. The heirs of the second stage will lose the right to receive property, the court will oblige you to return all the property they received in full, and if it is impossible to actually return it, they undertake to return its market value.

I am the only heir and missed the deadline for entering into inheritance. Where should I contact?

It is necessary to go to court, but the defendant in such a case will not be the other heirs (since there are none), but the municipality, as the recipient of the escheated property.

Extrajudicial procedure

The heir turns to the notary who is involved in this matter, along with documents on consent to the redistribution of the inheritance. The signatures of relatives must be notarized, otherwise it has no legal force. After the specialist receives all the necessary documents about previously issued certificates of inheritance, they are revoked. The title documents will be re-issued after the revision and redistribution of the inheritance.

This method of restoring the period cannot be applied if the applicant is the only heir or all related persons have not declared their rights within the time limits established by law. Exactly six months are allotted for this.