Ask a question Order a service

Notarization of donation agreements for apartments, plots, houses and other objects of movable or immovable property or property rights ensures that these documents are correctly drawn up from the point of view of Russian legislation. The notarial form of the agreement in these cases is not always mandatory - sometimes a simple written form is sufficient. But if you want to be confident in these documents, then contact the notary Yuldasheva T.V. - in her office you can certify the deed of gift before its registration at the cost established by law.

When should you contact a notary?

Notarization of a gift agreement (hereinafter referred to as DD) can be mandatory or by agreement of the parties. In the latter case, it means affixing the signature and seal of a notary, when this is not provided for by law, but the owner and the donee want to minimize the risks for themselves.

Mandatory certification of the contract is provided in several cases:

- Instead of the donor or donee, another person – a proxy – signs;

- a share in the authorized capital of the enterprise is alienated (except for cases when it is distributed among the owners);

- donation of real estate, if documents are provided by one of the parties by post;

- alienation of a share in the right of common ownership of real estate.

Case study:

The woman decided to donate her share in the right to an apartment purchased during marriage to her child. To do this, she agreed with her husband - his father. By law, spouses each own 50% of the right to real estate, but conditionally: in fact, shares are not allocated. To allocate shares, citizens drew up an agreement and registered everything with Rosreestr.

The donor became the owner of ½ of the right to the property and was able to give it to her daughter. The husband’s consent was not required after the allocation of shares, but the DD had to be certified.

Note! If the parties wish to change or terminate the deed of gift signed by an authorized lawyer, an agreement is drawn up. It also needs to be certified.

When is it not necessary to certify a deed of gift?

There are several situations in which a specialist’s signature is not required:

- movable property is donated: car, money, jewelry, etc.;

- the owner is an adult and the sole owner of the property.

Briefly: a certificate of gift is required if a share in the right of common property is alienated, the donor is a child or a person with limited legal capacity, or one of the citizens cannot be present in person.

Summary

What owners of shares in an apartment should remember when donating it:

- A deed of gift can be issued not for the entire apartment, but for its share. But only if the apartment is registered as shared ownership.

- It is not necessary to obtain the consent of other owners when registering deeds of gift for a share. Even if we are talking about donating a room in a communal apartment. The right to mandatory consent only applies to sales contracts.

- A child under 14 years of age does not have the right to give his share to anyone, only to sell it.

- Donation agreements regarding shares in real estate are in written form and are subject to mandatory notarization. If, as part of an agreement, all shares are donated at the same time, such an agreement does not have to be certified by a notary.

- The fee for notarial acts is tied to the cadastral value of the property and is paid regardless of the presence of family ties.

- The gift agreement is not subject to state registration, but is involved in the procedure for transferring ownership of the property.

- For the received share, the recipient will have to pay tax at a rate of 13% of the price of the share. Close relatives are given preferential status and are exempt from tax.

Why do you need a notary?

The presence of a specialist makes it possible to reduce all risks for the parties, and in some cases, to protect citizens from unscrupulous people who want to dispose of their property without prior consent.

When working with people, a specialist performs a number of functions:

- establishes the identities of the parties: checks passports and other documents giving them the right to conclude an agreement;

- checks the legal capacity of persons or their representatives;

- checks the existence of ownership rights to the property alienated by the owner;

- checks the deed of gift for compliance with legislative norms;

- explains to citizens their rights and obligations, the nature and consequences of the transaction.

The donee and the donor sign the DD in the presence of a specialist. His signature confirms that at the time of signing the people were in an adequate state and were aware of the consequences of their actions.

Legal advice: even if a notary is not required by law, for your own safety it is better to contact one. The costs of certification are distributed by the parties independently by agreement, but usually everything is paid by the donors.

What can be the subject of a gift agreement?

When does the gift restriction apply and what does the donor need to do to complete the transaction correctly?

Legislator's position in 2021

I would like to note right away that, in most cases, the parties do not need to apply for support for the donation transaction. However, based on the information established by the legislator in the Federal Law “On State Registration”, the deed of gift must be certified in the following cases:

- The subject of the donation is the share of an apartment, land or other property that is owned by other persons in addition to the donor (according to Part 1 of Article 42 of the above-mentioned legislative act).

- The donating party is a person with limited legal capacity or a minor child who has already turned 14 but has not yet turned 18 years old (Part 2 of Article 54 of the same Federal Law).

In addition to the cases described above, the legislator provides other situations when the parties to a transaction need to seek the services of a notary, but not to certify the gift agreement, but to draw up other documents, such as:

- Spouse's permission to conduct a transaction . We remind you that if the object of the gift is an object of jointly acquired property, the donor is obliged to obtain written permission from the husband/wife to donate this property to another person.

- Power of attorney to conclude a transaction . In some cases, one of the parties cannot be present when signing the gift agreement, and in this case, the legislator allows the document to be signed by a proxy, who must have a notarized power of attorney.

At the same time, based on the practice of experienced lawyers on the Legal Ambulance website, it can be argued that every year more and more citizens choose the option of registering a deed of gift with the participation of a notary, because the participation of a specialist is a guarantee of a transparent transaction and the absence of problems in the future!

ARTICLE RECOMMENDED FOR YOU:

Form of gift agreement: oral, simple written, notarial

Price of deed of gift certificate

The cost of services depends on several parameters:

- whether identification is required by law;

- whether clients order additional services.

If certification is required by law, a state duty is established. In other cases, a tariff is paid.

Important! The fee or tariff is payable only for certification. If a person needs technical registration of a deed of gift, collection of certificates and other services, this is paid separately. The price depends on the price list established by the regional notary chamber.

If notarization is required

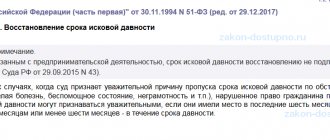

For transactions requiring mandatory certification, a fee is established in accordance with Art. 333.24 Tax Code of the Russian Federation:

- 0.5% of the contract amount for the subject to be assessed. Maximum 20 thousand.

- For transactions that are not subject to assessment - 500 rubles.

Cadastral or market value can be used for calculation. It all depends on the type of property being alienated.

If you don't need a certificate

If a specialist’s signature is not required, but citizens still want to protect themselves, a fee is established in accordance with Art. 22.1 “Fundamentals of legislation on notaries.”

The cost depends on the presence or absence of family ties between the owner and the donee:

- children (natural and adopted), parents, sisters, brothers - 0.3% of the cost, minimum 200 rubles;

- other people – 1%, from 300 rubles.

The specified rate applies to all gifts, except housing.

If real estate is donated, a different fee is established:

- gift value up to RUB 1,000,000. – 2,000+0.3%;

- from 1 to 10 million – 5,000+0.2%;

- from 10 million – 23,000+0.1%.

Briefly: if certification is not required, a tariff is paid. For transactions requiring a notary's signature, a state fee is established. The amount of expenses depends on the value of the gift and the family ties between the parties.

How to calculate the fee or notary fee?

As mentioned earlier, the tariff or duty is calculated depending on the market, inventory or cadastral value of the “gift”.

The right to choose the cost from which the calculation will be made is given to the client. For real estate objects, the cadastral value is used by default. A specialist can obtain information about it from Rosreestr independently. Let's look at a few examples of calculations.

Real estate

If real estate is donated and the DD is subject to certification, a state duty is paid - 0.5% of the cadastral value.

Calculation example:

A man gives a share in an apartment, the cost of the share is 1,500,000.

1,500,000 x 0.5% = 7,500.

If it is not necessary to certify the DD, a fee is paid for certifying transactions the subject of which is subject to assessment.

Automobile

The transfer of a car as a gift does not need to be certified by law, but the parties have the right, by agreement, to contact a notary office, paying in accordance with paragraphs. 2 clause 1 art. 22.1 “Fundamentals of the legislation of the Russian Federation on notaries.”

Calculation example:

A citizen gives his wife a car purchased before marriage. The estimated cost of the car is 10 million.

How is the calculation made:

10,000,000 x 0.3% = 30 thousand.

If the donee were not the donor’s spouse, he would have to pay more:

10,000,000 x 1% = 100 thousand.

Cash

You can give money in Russian or foreign currency. In the latter case, the amount depends on the exchange rate at the time of the transaction. You do not need to certify the DD of money, but you can do this if you wish.

Here the tariff provided for the rest of the movable property is established. It depends on family ties.

Calculation example:

A woman gives her daughter money in the amount of 5 million rubles, the DD is verified. The following amount is paid:

5,000,000 x 0.3% = 15 thousand.

When concluding a DD with someone other than a relative or spouse, the fee is higher:

5,000,000 x 1% = 50 thousand.

Jewelry

Donating jewelry does not have to be done in the presence of a specialist, otherwise a fee will be paid for signing. The size depends on the value of the gift, as determined by the appraisal examination.

Calculation example:

A man gives his girlfriend an expensive piece of jewelry (3 million rubles), but they agreed that the DD should be certified. The owner pays:

3,000,000 x 1% = 30 thousand.

Advantages

Do I need to notarize the deed of gift for an apartment? The main advantage of registering a deed of gift for housing in a notary's office is its 100% legality and legal literacy . By contacting a notary, you can be sure that the rights of both parties will be respected in the agreement.

The notary is responsible for completed transactions with his property and the right to further practice, therefore he guarantees one hundred percent legality of transactions concluded through him.

The second advantage is a correctly executed contract , which will definitely be accepted for registration by Rosreestr. It is also worth remembering that in a number of transactions for registering the transfer of housing as a gift, notarial consent of the spouses is required.

Registering a transaction with a notary will allow you to avoid unnecessary running around the authorities and prepare all the necessary papers in one place.

The donor can also get advice on the contents of the agreement from a notary, and, if necessary, remove or add some points to it that he himself would not have paid attention to.

And another weighty argument is for those who are afraid of subsequent disputes on the part of the donor’s heirs or relatives or of meeting them in court.

When concluding a contract in a notary's office, the notary acts as a third party, confirming that the transaction took place with the consent of both parties, without coercion, and was made by the donor in his right mind.

This is an important point if the parties are afraid to subsequently face an attempt to terminate the deed of gift.

You can find out in what cases and who can challenge a deed of gift for an apartment, as well as under what conditions an agreement to donate an apartment can be declared invalid on our website.

How to contact a notary for a certificate of gift: step-by-step instructions

The procedure for registration and certification of DD consists of several stages:

- Collection of information for registration of DD.

- Registration of deed of gift.

- Payment of certification fee.

- Submitting documents to the office.

- Signing the DD.

- Re-registration of ownership (in case of alienation of real estate or car).

Let's look at each step in detail.

Step 1: collecting documents

At the first stage, the donor needs to collect all the documents.

The list depends on what exactly he is going to give:

| Present | Documentation |

| Real estate |

|

| Vehicle |

|

| Share in the authorized capital |

|

| Land plot |

|

| Money in bank account | Certificate of bank account balance |

Important! Passports of the parties must be provided. If another person is acting on behalf of the donor or recipient, a certified power of attorney will be required. When alienating a child's property as a gift, permission from the guardianship authorities will be required, but in practice it is almost impossible to obtain it.

Step 2: drawing up a contract

The deed of gift is drawn up by individuals independently, but you can contact a notary office to draw it up. This service is paid separately from the state fee. The total amount of expenses may increase by 5-20 thousand rubles.

Sample donation agreement

There is no unified form of DD, but it must contain complete information about the transaction:

- Full name, registration addresses, dates of birth, passport details of the parties;

- information about the gift (item). For real estate: cadastral number, address, area, floor, etc. For a car: make, color, license plate, year of manufacture, VIN, STS series and number, etc.;

- the intention of the owner to transfer the gift to the donee free of charge;

- date of entry into force of the DD;

- signatures of participants.

The deed of gift is drawn up in four copies. One each remains with the donee and the donor, the third is transferred to Rosreestr to register the transfer of ownership if real estate is donated. The fourth is to be kept in the office.

Sample apartment donation agreement:

Step 3: payment for services

Depending on the nature of the transaction, a duty or tariff is paid. Payment details can be obtained from the office.

Money is deposited in any convenient way: online, using a terminal or ATM, or at a bank branch. After payment you should take a receipt.

Step 4: Submitting documents

You can take the documents to any notary office, regardless of the location of the property and the registration of the parties.

Legal advice: It is recommended to make an appointment in advance, otherwise you will have to wait a long time.

Step 5: Checking the Sides

During the inspection, the specialist will establish the legal capacity of citizens and check the information provided.

Step 6: performing notarial acts

If there are no comments on the DD and other documents, the specialist explains to people the consequences of the donation, their rights and obligations. After this, the donor and donee sign the deed of gift, followed by the signature of the specialist.

Step 7: registering a new owner

Since the fall of 2021, specialists have been sending information about the alienation of property to Rosreestr free of charge at the request of clients, and ownership will be re-registered upon request.

But the donee and the donor can refuse the services of a specialist and contact Rosreestr or the MFC independently, submitting the information listed above along with the DD.

Important! An application to Rosreestr is only necessary if real estate is being alienated. When alienating a car, it is enough to make changes to the title, then the new owner independently registers it with the traffic police.

State duty

For registration of real estate rights for citizens, a fee of 2 thousand rubles is established.

Enterprises pay more - 22 thousand rubles.

Who can be the recipient

The owner of a share in the gratuitous transfer of property is called the donor, the second party to the gift is called the donee. The donation of an apartment can be made in favor of any legally capable person, including a minor.

The law establishes only a few categories of recipients who are not entitled to receive such gifts for anti-corruption reasons. These are teachers (in relation to donations from students and their parents) and civil servants.

Relatives

Deeds of gift are most often concluded between relatives as an alternative to wills and inheritance by law.

By default, gift agreements are taxable transactions, as they involve the receipt of income in kind. But when alienating a share of an apartment in favor of close relatives, the donee is exempt from taxation for the property benefit received.

The list of beneficiaries is contained in the Civil and Family Code. The list of relatives who do not pay personal income tax for a gift received includes:

- spouse;

- daughter and son;

- brother and sister;

- grandparents;

- granddaughters and grandchildren.

When registering a deed of gift, the parties should indicate in the agreement the degree of relationship and attach copies of supporting documents: marriage certificate, birth certificate, etc. On this basis, a tax benefit will be provided.

Minors

Minors can act as recipients of a gift without restrictions, since receiving an apartment free of charge does not violate their property rights. But the child himself cannot always donate a share:

- Persons over the age of 14 have the right to sign gift agreements independently and act as donors. But in order to alienate the child’s share, it will be necessary to obtain the preliminary consent of the guardianship and trusteeship authorities (based on Article 21 of the Federal Law No. 48 “On guardianship and trusteeship”). To register a deed of gift, you will need to prove to the controlling authority that the interests of the child will not be harmed as a result.

- For children under 14 years of age, deeds of gift are certified by parents. And young children do not have the right to act as donors of shares (under Article 575 of the Civil Code). Even if you have previously obtained parental consent.

If a minor is not the owner, but is simply registered in the apartment, no problems should arise when registering a deed of gift.

Outsiders

The owner of a share has the right to donate it to anyone without restrictions (according to paragraph 2 of Article 246 of the Civil Code). Many owners are confused by the provisions of paragraph 1 of Article 246 of the Civil Code, which talks about the agreement of the owners when disposing of an apartment. But this rule applies only when donating (selling) the entire property.

When transferring a share to another person, it is not necessary to obtain consent from the other owner, which distinguishes a deed of gift from a sale and purchase agreement.

The transaction is carried out without additional approval, since it is free of charge. It is also not required to obtain consent from the guardianship authorities if one of the share owners is a minor.

The owner is not obliged to ask permission for donation from persons registered in the apartment (without ownership rights).

Transactions in communal apartments occur in the standard manner: the owner of the share does not have to notify neighbors about the donation.

The absence of any additional approvals is confirmed by the provisions of Chapter 32 of the Civil Code on donations and Federal Law No. 218 of 2015 on state registration of real estate transactions.

Lawyer's answers to popular questions

My husband and I bought the car when we were married, and now we want to give it to our son when he comes of age. What will it take?

Both of you can act as donors, or get consent from your spouse and have it certified by the office. It will cost 500 rubles.

My ex-husband and I bought an apartment while married; after the divorce, we did not share the property. I live in an apartment. Now he wants to give his share to his ex-wife. They refused him, saying that everything had to be divided first. Is it true?

Yes. If you have not drawn up a marriage contract, you must divide the property by formalizing an agreement or going to court. Before division it is in joint ownership.

Are there any benefits when paying state fees to a notary?

Yes. According to Art. 333.38 of the Tax Code of the Russian Federation, complete exemption from state duty is provided to state or municipal authorities. Disabled people of groups 1 and 2 pay a 50% discount.

The donee and I ourselves drew up a deed of gift for a share in the property right, but the MFC refused to accept the documents, saying that we needed to contact a notary. Is this legal?

Yes, the demands of MFC employees are legal, because... alienation of a share requires certification.

The notary refused to accept us, was rude and did not explain the reasons. What to do?

You can request a written reasoned refusal from him, or immediately file a complaint with the notary chamber of your region.

Risks

Is donation required to be notarized? What to expect if the contract is not notarized ?

The main risks of independently drawing up and registering a deed of gift are the possibility of challenging it in the future.

The inability to take into account all the legal subtleties and nuances of these types of agreements can also lead to the fact that the rights of one of the parties to the transaction will not be properly respected .

Here's an example:

You are a donor, and you plan to donate to your second cousin a room that is your only place of residence (read about donating a room in a communal apartment). In the agreement, you want to include a clause stating that the right to dispose of this area, the right to sell and live on it passes to the donee only after your death.

This is called a deferred deed of gift . It is not easy to formulate this condition in an agreement on your own. In the absence of notarization, the recipient may go to court and challenge your right, or simply not comply with it. As a result, you will lose your only place of residence.

The conclusion follows that you should apply for notary services if there are additional conditions that are mandatory.

Or if there are risks of its subsequent termination by one of the parties or representatives of the parties.

The notary also keeps a copy of the agreement, which can later be restored if the original of one of the parties is lost.

You can learn how to conclude a deed of gift for an apartment with the right of lifelong residence of the donor in our article.