A current account can handle from one to hundreds of transactions per month. Their number, amounts and purpose may be of interest to third parties - from government agencies to investors. We'll tell you how to get an extract and why you need it.

What is a bank statement

Example. What's on a bank statement.

- Explanation of the column “Type of transaction” in a bank statement

Why do individual entrepreneurs and organizations need an extract?

- Keep accounts

- Represent the tax

- For other cases

How to get a bank statement

How to store a bank statement

What is an extract?

A personal account is automatically created for the owner after he receives housing. Bills for rent and utility bills will be charged to it, registration information is reflected here, and sometimes fines are indicated. What is an extract from a financial personal account? This is a certificate that will definitely be needed in many cases. Although the account is opened by the service company, you can order the document not only at its office.

What information is included in the statement?

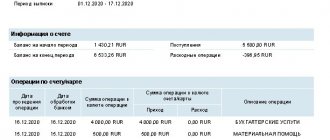

Bank account statements may differ slightly in appearance because they are printed on different technologies. It is more important to find out what information is indicated in the statement.

- “Posting date” – the date of the transaction on the client’s account;

- “Recipient’s account” – recipient’s current account number;

- “VO” – type of financial transaction;

- “Nom. doc. Bank” – incoming document number;

- “Nom. doc. Client” – payment document No.;

- “BIC bank corr” – BIC of the recipient’s bank;

- "Corr. Account” – a corresponding bank account;

- “Payer’s account” – payer’s account number;

- “Debit” (client arrival);

- “Credit” (customer expense).

In what cases is it necessary

So, the inscription on the receipt “FLS No. + set of numbers” is now clear what it is. Proving registration of a living space is important in a number of cases:

- for purchase/sale;

- during redevelopment;

- during privatization;

- to determine room parameters (area, wear, etc.);

- to confirm the composition of residents;

- if entry into inheritance is required after the death of the father or mother;

- for calculating debts for housing and communal services.

Information about the state of the FLS does not affect how long the privatization of the apartment lasts, but in this case it is impossible to do without its registration. A certificate of no debt on utility bills can be obtained within 5 days.

When and how the Federal Tax Service will provide information

Paper documents are received from the tax office in person or the Federal Tax Service sends them by mail to the company. The desired method of receipt must be indicated in the request. The electronic document is sent to the taxpayer via TKS.

The tax inspectorate is obliged to provide information on mutual settlements with the counterparty, both in paper and electronic forms, no later than 5 working days (clause 10, clause 1, article 32 of the Tax Code of the Russian Federation). But, as practice shows, the Federal Tax Service provides information in electronic form via telecommunication channels much faster. The response time, as a rule, does not exceed one or two days.

Where to contact

There are several ways to obtain an extract from a financial personal account.

- Information is provided by the administration if it is a small settlement.

- In the accounting department of the management company.

- You can get a copy of your financial personal account at the MFC.

- Registration is carried out through the State Services portal.

The choice of a specific method does not change the course of the procedure and does not affect its cost.

Who has the right to registration

An extract from the personal account of the residential premises is provided:

- one or more owners of living space;

- to the tenant, subject to legal hiring;

- to the employer under an agreement with the local government on social rent;

- representatives of citizens (with a power of attorney);

- official guardians or parents of a person, as well as representatives of the guardianship and trusteeship authority.

Other categories of persons do not have the right in question.

How to get a bank statement

The legislator does not regulate the procedure for issuing statements, so the conditions for its provision will be announced by the bank. Some organizations issue account statements automatically every month, sending them to the client’s email. There are several ways to obtain a document:

- order at a branch or terminal;

- by mail or e-mail - contact the bank manager by phone, e-mail or SMS and ask to send the statement by mail;

- online - select the appropriate service on the bank’s website or mobile application.

The cost depends on the chosen method. For example, online statements are usually free, but paper versions may cost money.

If the extract is needed for internal use, an electronic version received by e-mail or online is suitable. It is usually certified by the bank’s electronic signature, so it will be accepted at the place of request, for example, at the Federal Tax Service.

At the request of the authorities, you can obtain an extract from the bank office with the signature of the person responsible for the formation and a seal.

To issue an account statement, the bank needs the following information:

- the name of the company that is requesting an extract - for legal entities;

- Full name and registration address - for individuals and individual entrepreneurs;

- the period for which an extract is needed;

- justification for the request.

Can they refuse?

The application is rejected under the following circumstances:

- the extract is requested by an outsider - not the owner or tenant or their representative (this measure was introduced to protect personal data);

- the applicant violated the procedure and did not submit all required documents;

- when checking the submitted papers, it was discovered that the applicant provided incorrect information (for deliberate falsification of certificates, the guilty person may be fined or even face criminal liability);

- technical or grammatical errors.

It is important to remember that debts for rent and housing services are not a reason for refusing to provide a certificate. If the paper is not issued for the specified reason, the employee’s unlawful actions can be appealed by submitting an application to his immediate management.

Why do individual entrepreneurs and organizations need an extract?

Keep accounts

An extract is needed to reflect payments and receipts in accounting. Having received the extract, the responsible employee checks it with other primary documents. He is obliged:

- check the presence and correctness of all documents confirming transactions in the statement (for example, the presence of invoices, TORG-12, UPD);

- check the correctness of the amounts in the statement and their coincidence with the amounts in other documents;

- check the coincidence of the numbers of the supporting documents in the extract with the real documents.

If errors are found, the employee contacts the bank.

Represent the tax

A current account statement will be useful in a conversation with regulatory authorities, although they will not request it from a company or entrepreneur. It is easier for government agencies to obtain a bank statement. Tax officers study account statements during the audit.

For other cases

In some cases, a statement of open accounts is required. It does not contain information on the movement of funds, but all open accounts of the company or entrepreneur are indicated. This document is needed for:

- bank loan;

- participation in tenders;

- liquidation or reorganization;

- negotiations with investors;

- provision to the court upon request.

The extent of information disclosed varies. At a minimum, the statement will indicate all the company’s accounts, opening dates and current status - open or closed. Or there may be an extended version indicating the places of operations, amounts and names of counterparties.

How to open a personal registration certificate for a residential premises?

Most real estate owners receive an apartment with an already opened financial and personal account. This happens if the premises are purchased on the secondary market. But sometimes there is a need to open an FLS on your own. This process is not difficult and does not take much time.

A financial account must be opened by the owner of the apartment. A FLS is issued for residential real estate that belongs to a citizen on the basis of social tenancy or ownership. A person who plans to open a financial and personal account must meet the following requirements: be an adult, legally capable, officially registered in the apartment and reside in it on a permanent basis.

To open an account you will need:

- collect a package of documents . These include a civil passport, a state registration certificate, a purchase and sale agreement for residential real estate, and an act of acceptance and transfer of premises. If the interests of the tenant are represented by another person, then a notarized power of attorney is additionally required. Copies and originals of the above papers will be required;

- contact the authorized body for issuing FLS . As a rule, bills for apartments are issued by management companies or structures involved in the provision of housing and communal services. You must submit an application and attach a package of documents to it.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How can I find out the personal account number of an apartment?

There are several options for clarifying your personal account number:

- Its number is indicated at the top of the receipt for payment of housing and communal services. This is the simplest and most understandable method, because indicating the account is mandatory when generating a payment document.

- Contact the management company by phone number or in person. You will need to provide the address of the apartment and the employee will tell you your personal account number.

- Information about the account number can be taken from the State Services portal. It is enough to know the address of the premises and have a registered account. Here you can find out about the presence or absence of debt.

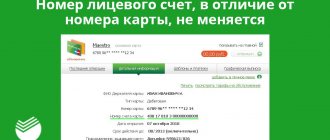

- If payments for housing and communal services were made from a Sberbank card, then information about the service provider, the tenant’s personal account, the payment amount, etc. is stored in the history.

Why do you need an FLS extract?

The extract is for informational purposes only. There may be the following reasons for requesting and receiving it:

- for transactions with real estate (purchase and sale, donation, lease, etc.) as a confirmation document of the absence of debts on payments for services, as well as the deregistration of all citizens who previously lived in the apartment;

- entry into inheritance rights;

- registration of privatization in relation to the apartment;

- legalization of redevelopment;

- registration at the specified address of the citizen;

- receiving benefits for housing and communal services and social assistance;

- resolving housing disputes in court.

Ways to receive an account statement

Every month on the reporting date, the bank sends an account statement to the client by email. If you need the original, with the bank’s seal, you can get it in several ways.

There are ways to get an extract:

:

| Bank office | You must present a passport or power of attorney if the document is requested by a third party. The document issuance time does not exceed 10 minutes. |

| Via Russian Post | Send a request by registered mail or through the “feedback” form on the bank’s official website. |

| By email | You can request an account report through a specialist online chat or by calling the hotline. |

| Via SMS message | This option is suitable if you have activated a paid SMS notification service. |

| ATM | The method is relevant if you have a bank card linked to your account. |

Information can be obtained verbally through support staff.

Note!

An ATM statement includes no more than 10 operations: