A financial-personal account from a place of residence is a document containing a list of all the key parameters of real estate: residential and non-residential space, material amenities, full names of the owners and people registered in the apartment, number of floors of the building, etc.

A document is required, as a rule, in two cases - to solve everyday problems (clarifying debts for housing and communal services, paying for housing and communal services), to create a legal documentary basis for divorce, division of inheritance, etc. Therefore, an FLS extract is not issued to everyone who wants it, but only to the owner or tenant of the premises. You can obtain an extract from the MFC or district administration, as well as online through the State Services portal. In both cases, the procedure takes no more than 10-20 minutes.

Financial and personal account for an apartment - what is it?

As a rule, apartment owners wonder where to get a copy of the financial and personal account for the apartment when the sale of the apartment, exchange or donation procedure is on fire. This is understandable: the personal account lists key information about the living space, including technical characteristics and the number of citizens registered in the apartment.

Relatively speaking, a financial and personal account is a certificate with a complete list of data about the premises . An invoice is issued not only for a specific apartment, but also for residential buildings, private properties with buildings, land plots and even rooms. Thus, the account is issued not for administrative units, but for premises - and it does not matter at all whether the premises are located inside a larger premises (room), or whether the premises refers to the entire house (relevant for private houses).

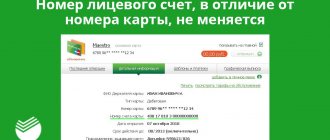

The document looks like an A4-A5 sheet - in some cases there may be several sheets. It contains many tables, divided according to a certain parameter: “Amenities”, “Documents for living space”, “List of residents”, etc. The paper must have the seal of a government agency - for example, the MFC. In addition, the signature of an authorized employee must be affixed.

For your convenience, we have placed below a sample financial and personal account for an apartment below. The sample provided is for illustration purposes only and cannot be used as a payment document.

How to divide between homeowners

The issue of separating personal accounts in a regular apartment and in a communal apartment has its own peculiarities.

This is especially true when former family members or relatives who do not want to pay the entire utility bill live together in the same living space.

If the housing is owned and there are shares allocated in kind (for example, ½ for a brother and sister), then each of them can apply for division of the personal account in proportion to the share owned.

This issue can be resolved pre-trial by concluding an appropriate agreement on the distribution of payments for utility bills. However, the conclusion of such a document is difficult to achieve, since it is very convenient for the owners living in the residential premises when the responsible tenant (the person for whom the personal account is opened) pays for the utilities. Difficulties may also arise if the apartment is divided into shares, but the number of square meters of each owner is not determined. In this case, you can go to court to resolve this issue.

It is impossible to split a personal account in a municipal apartment, but not in a situation where one of the citizens has ceased to be a family member. A person who leaves the family (for example, after a divorce) is required to independently bear the costs of paying for utilities, but at the same time he does not lose the right to use the allocated premises. In this case, you can try to conclude an agreement on the distribution of utility bills. If you cannot sign this document, you must go to court. The court's satisfaction of a claim for division of a personal account in a municipal apartment does not entail the conclusion of a separate social tenancy agreement.

Why is FLS needed?

A number is assigned to the premises to track all property or technical changes associated with the living space. A copy of the FLS, i.e. An account statement is always taken for a certain period - for example, for a period of 1 month before the date of application. A copy of the FLS is required in the following situations:

- Checking debts for housing and communal services;

- Confirmation of apartment ownership (the document always indicates who owns the property and who is registered in the premises);

- To check the characteristics of the status of housing and communal services accounts;

- To check the condition of the housing, as well as material amenities: whether the house is in the queue for major repairs, whether it is going to be demolished, whether there is gas/water wiring, etc.;

- Distribution of shares when dividing property - for example, during a divorce or inheritance.

In all these cases, a copy of the FLS is required. The personal account itself in this case serves as a repository of information, a kind of register of all key information about housing. In simple, one might say, everyday use, the document is useful primarily for paying for housing and communal services. Technical and legal aspects are of secondary importance in this case.

What does the document contain?

An extract from the individual personal account of the insured person has a format established at the legislative level. Regulation of pension accruals is carried out on the basis of the following regulations:

| Federal Law No. 173 of December 17, 2001 | Regulates issues related to the calculation of labor pensions |

| Federal Law No. 400 dated December 28, 2013 | Regulates insurance savings |

| Government Decree No. 192 of July 31, 2006 | Sets the format for recording and providing information |

The document is presented in a table and includes the main points about the insured person. The following sections are required:

- record number;

- Full Name;

- individual personal account number;

- the name of the insurance company that distributes accruals;

- insurance part;

- accumulative amount;

- organizations from which contributions were made.

Information about places of work and periods of work is also included. Information is provided in the most convenient and understandable form, without causing the possibility of double interpretation.

Attention! Deciphering the recordings is not difficult. Only sections from the document with the closest issue date are taken into account. It is always taken into account that deductions are made monthly. Information is also updated regularly.

What is the content of the document?

The document displays all relevant information about the apartment in as much detail as possible:

- The name of the management company, if there is one, the name and surname of the recipient of the extract, the address of the management company and the address of the premises itself;

- Indication of the title document - purchase and sale agreement, equity participation agreement, cadastral passport, etc. Previously, certificates of ownership were always indicated, but after their abolition, any title paper is indicated;

- Characteristics of the house in which the premises are located: type of covering (wooden or reinforced concrete), year of construction, number of floors and type of heating (central or private);

- Detailed characteristics of housing: number of rooms, total residential and non-residential area in the premises, as well as area broken down into rooms, kitchen, bathroom, etc.; apartment number and floor on which the apartment is located;

- All amenities are listed, such as an elevator, the presence of a gas pipeline, satellite or cable TV, etc.;

- The section “Information about owners and tenants” lists all persons registered in the apartment, as well as those who have a share in this property. The type of registration, date of birth, presence or absence of an established fact of family relations, etc. are also indicated here.

From the above, it becomes clear that the FLS form actually lists the most important and up-to-date data on real estate. This document can be used when conducting transactions with an apartment, starting with its sale and ending with the imposition of an encumbrance on it when receiving a large loan.

What to do with the document

It can be left online, downloaded and printed, or sent by email. The information obtained is used for personal purposes and compared with information from the employer.

If the document is needed to defend interests in government agencies, at work or in court, you will have to submit a request to receive a paper version. This is due to the fact that only the version with the seal and signature of the responsible person has legal force. It is better to obtain it immediately before contacting a certain authority.

Pension fund specialists recommend requesting a statement at least once a year to monitor savings. This is due to the fact that the indicators are entered manually, so inaccuracies due to the human factor cannot be ruled out. It is also recommended to obtain a 2-NDFL certificate from the employer, which indicates deductions. If an error is identified in the transfers, the situation is corrected promptly upon application to the employer. Otherwise, it will remain unnoticed.

Thus, the resulting accrual statement is available via the Internet. To do this, use several services, choosing the most convenient one. Detailed information is provided to support the determination of employer contributions.

How to apply for FLS?

Personal accounts are issued exclusively to legally capable and adult citizens. It does not matter whether the applicant is a Russian citizen, a foreign citizen or a stateless person. The main thing is to comply with the condition: the applicant must have a permanent residence permit in the premises, and also have at least a 0.1% share in the real estate specified in the application.

Making changes, adjusting them, or registering a personal registration document “from scratch” is carried out in the management company or in Rosreestr. It is worth considering that in most cases there is no need to issue an invoice - it is already tied to the apartment, even if the owners of the property often change. You only need to find out the financial and personal account number.

If the property was put into operation quite recently, i.e. it is a new building, registration of the FLS is carried out at the Unified Information and Settlement Center. You can also open an account at a multifunctional center (MFC). To carry out the procedure you will need:

- A document confirming ownership - an extract from the Unified State Register, a purchase and sale agreement, etc. will do;

- Internal passport of the Russian Federation;

- Notification about putting the building into operation.

The document evidencing the opening of the FLS must have the signature of an authorized employee and the seal of the MFC/EIRC.

Remember: when purchasing housing on the secondary market, you do not need to open a new account, because... he becomes attached not to a person, but to a specific room/apartment. In this case, you only need to change the owner of the property in the FLS.

Extract from the Pension Fund

An extract from the personal account of each person insured by the Pension Fund is an official document containing certain information. With its help, a person gets access to the following information:

- insurance premiums;

- coefficients;

- insurance or funded pension;

- number of years of pensionable service.

You need an extract:

- When applying for a pension;

- monitor accruals;

- When applying for a loan (if required by the bank);

- For certain types of social benefits.

Some pensioners use this document to control the correctness of calculation of insurance premiums, others need a declaration for creditors. Banks actually often ask for this when applying for a loan. And this is completely legal. But the banking organization does not have the right to receive this statement. To do this, the borrower must personally contact the Pension Fund with a corresponding application.

Until 2013, all information was submitted to the Pension Fund in the form of appropriate letters. However, thanks to Federal Law No. 242, notifications were stopped. Now you must contact the Pension Fund yourself. The extract is prepared within 10 days.

The bank account statement service is free, so the pensioner is not required to pay a state fee. The Pension Fund has no reason to refuse to issue the document to the applicant. Any refusal can be easily appealed in court.

How and where can I get an FLS statement?

The key question of our article: where can I get an extract from a financial and personal account. In fact, the answer is very simple - this can be done in person at the MFC or district administration, as well as online through the State Services portal .

If you apply in person, take with you your passport and a document confirming ownership: an extract from the Unified State Register of Real Estate, a social lease agreement, a purchase and sale agreement, etc. Contact any employee of the district administration or MFC - you will be given a form to fill out and a sample.

Just provide the following information in the form: your full name and contact information, the address of your property and the type of title document. Hand over the documents and application to the employee; if everything is entered correctly, the application will be accepted for processing. It usually takes 1-2 business days to issue an extract.

The same thing, only faster and without visiting branches, can be done through the State Services portal at https://www.gosuslugi.ru . To carry out the operation, you need to be registered in the system - all that is required is to indicate your passport data and confirm the operation with a code from SMS.

After registration and authorization, find the “Services” tab in the top panel. In the menu that opens, find the item “Apartment, construction and land.” Next, you need to click on the line “Personal account” and “Get statement”. If such a tab is missing, check whether you are logged in to the service - without proof of identity, the service is simply not available to the user.

In both the first and second cases, the service is provided completely free of charge. Only as a rare exception, regional MFCs can set a commission or fee for issuing an extract.

Help: it doesn’t matter whether you are registered in your own apartment. The main thing for service employees is that you document your ownership of the property. Registration in a given apartment or in the region where the property is located is not important. If instead of the owner, a responsible person approaches the authorities - for example, a tenant - it is necessary to provide additional documents certifying the applicant’s right to receive an extract (a lease agreement, etc. will do).

Copy validity period

It is useful to know how long an extract from the tenant’s financial and personal account is valid. This is especially important if the document is used when concluding real estate transactions.

In this case, the certificate must be current, otherwise it will not be possible to carry out the planned activities. The validity period of the FLS extract is 30 calendar days from the date of its receipt. Therefore, you should order a copy of the financial and personal account on the eve of the transaction.

If the certificate has lost its relevance, the citizen has the right to receive a new document. The old version of the statement cannot be extended.