If you want to sell part of an apartment that is in your shared ownership, this is not an entirely trivial task. How to sell an apartment in shared ownership , what are the difficulties of such a sale and how to properly manage your share, we will tell you in this material.

In reality, of course, the apartment is not divided in any way. To divide a living space into several shares, it is necessary to equip each share with a separate entrance and a separate connection to utility networks.

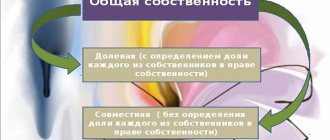

- Shared ownership of housing

- Ideal share - what is it in property rights

- How to sell your share in a shared apartment

- The right to purchase shares by owners

- How to circumvent the right of first refusal for the purchase of a share by the owners Using an inflated purchase and sale price

- Using a loan agreement

Shared ownership of housing

Shared ownership of an apartment may arise under the following circumstances:

- When several heirs inherit an apartment.

- When privatizing an apartment for all residents registered in it.

- Finally, when dividing an apartment during a divorce.

This can only be done in private individual housing construction houses, and there are many cases of dividing a house into several separate apartments. For a city apartment, when dividing, we can only talk about “ideal shares.”

Shared ownership of the common property of apartment buildings, gardening, etc. Parking space

The regime of common shared ownership of common property in an apartment building, in a communal apartment, as well as for common property located within the boundaries of gardening or vegetable gardening has great specificity. In particular, a share in the ownership of such property is not subject to alienation separately from the ownership of the corresponding premises in an apartment building, a room in a communal apartment, a garden or vegetable plot of land; cannot be allocated in kind (see Articles 37, 42 of the Housing Code of the Russian Federation, paragraphs 4 - 7 of Article 25 of the Law on Citizens' Gardening and Trucking, Part 1 of Article 42 of the Law on State Registration of Real Estate) .

A parking space is an independent piece of real estate; it can be registered in the cadastral register and acquired as sole property. Any participant in common shared ownership can allocate his share in kind by establishing the boundaries of a parking space in accordance with the requirements of Federal Law No. 218-FZ of July 13, 2015 “On State Registration of Real Estate” and, accordingly, register ownership of it.

Any “re-registration” of ownership rights to parking spaces, information about which is already contained in the Unified State Register of Rights, is not required. However, if the ownership of the property has already been registered, the replacement of previously issued documents for a parking space is carried out at the request of the owner.

The procedure for registering ownership of a parking space is regulated by Federal Law No. 315-FZ of July 3, 2021 “On amendments to part one of the Civil Code of the Russian Federation and certain legislative acts of the Russian Federation.” Article 6 of this Law states:

- in order to highlight a place as an independent object, you need to establish its boundaries;

- To do this, shareholders need to contact cadastral engineers, who will prepare a technical passport of the object and mark the boundaries of the parking space in the parking lot so that it can be identified. Borders are marked with paint or using special stickers;

- To register ownership of a parking space, the owner must submit to Rosreestr or a multifunctional center an application for registration of ownership of a parking space, attaching to it either an agreement of all co-owners or a decision of the general meeting defining the procedure for using real estate that is in common shared ownership.

Ideal share - what is it in property rights

The physical meaning of the concept “ideal share” is a share in the ownership of an apartment.

This is not a share of the apartment, it is a share of the property. It is ideal because in reality it cannot be shown, seen or touched. The owners of shares do not own the actual share of the apartment, such as, for example, a room, but only a share of ownership, as a type of ownership of this apartment.

According to the ideal shares of owners, each owner has the same right to an apartment and can use it without violating the rights of other owners. To organize the joint use of one living space, you can draw up a regime for the operation of shared spaces and determine in which room each owner will live.

In the case of ideal shares, each of the owners must understand that the apartment also remains common, and the rooms in which the owners live are also common.

If, according to the court, the ideal shares amounted to half of the apartment, and in the mode of using the apartment, the court determined that one of the owners lives in a room of 12 square meters. m., and the second received a room of 14 sq. m. m., then both owners will pay utility bills for electricity, water and gas in equal shares, half each. This is the whole meaning of the concept of “ideal share”.

As long as the owners live peacefully in the same apartment, this does not cause any difficulties. However, when you try to sell your share, problems may arise.

Disposal of property in common shared ownership

Disposal of common property , as a rule, is carried out by agreement of all participants in shared ownership (clause 1 of Article 246 of the Civil Code of the Russian Federation). If such an agreement is not reached, the law does not allow the court to determine the procedure for disposing of common property. In other words, if, for example, one of the two shared owners of an apartment does not want to sell it to a third party, then the second co-owner who has such a desire does not have the legal means to force the first to do so.

Each of its participants can dispose of a share Each of them has the right, at his own discretion, to sell, donate, bequeath, pledge his share or dispose of it in another way, taking into account the right of the other co-owners to preemptively acquire the alienated share - in case of its alienation for compensation (Clause 2 of Article 246 of the Civil Code of the Russian Federation) to an outsider .

Pre-emptive right to purchase . To ensure the pre-emptive right to purchase, a co-owner who wishes to alienate his share to a third party is obliged to notify other participants in shared ownership of his intention to sell the share, indicating the price and other conditions of sale. The notification must be made in writing and received by the addressee (taking into account clause 1 of Article 165.1 of the Civil Code of the Russian Federation). If the remaining co-owners within a month - when selling real estate or within 10 days - when selling movable property from the moment of their notification do not acquire the share being sold (including by ignoring the message about the sale), then the seller, after the expiration of these periods or earlier (if there is a written refusal of the subjects of the right of first refusal to exercise it) will be able to sell their share on the conditions specified in the message to a third party. The mentioned deadlines are preemptive - with their expiration, the pre-emptive right ceases.

If the seller violates this obligation, any of the participants in shared ownership has the right, within a shortened period of limitation - three months - to demand in court the transfer of rights and obligations under the transaction to him, i.e. the latter is not recognized as invalid, there is only a change in the subject on the buyer’s side (see paragraph 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 10, the Plenum of the Supreme Arbitration Court of the Russian Federation No. 22 of April 29, 2010 “On some issues arising in judicial practice when resolving disputes related to protection of property rights and other real rights”, clause 1.2 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 10, 1980 N 4 “On some issues of the practice of consideration by courts of disputes arising between participants in common ownership of a residential building”).

By virtue of clause 5 of Art. 250 of the Civil Code of the Russian Federation, the above rules also apply to an exchange agreement (but if the share is exchanged for some unique thing, for example, a residential building or an original painting by a famous artist, the remaining co-owners are unlikely to be able to exercise their right of advantage; this, however, does not mean that their no need to notify me of the upcoming exchange).

Notarial form of the transaction . As follows from paragraph 1 of Art. 42 of the Law on State Registration of Real Estate, transactions for the alienation of shares in the right of common ownership of real estate, including in the case of joint alienation by all shared co-owners of a common immovable property, are subject to conclusion in notarial form, with the exception of:

1) transactions in the case of alienation or mortgage by all participants in shared ownership of their shares under one transaction; 2) transactions related to property constituting a mutual investment fund or acquired for inclusion in the mutual investment fund; 3) transactions for the alienation of shares in the right of common ownership of land plots from agricultural lands, the turnover of which is regulated by Federal Law of July 24, 2002 N 101-FZ “On the turnover of agricultural lands”; 4) transactions for the alienation and acquisition of shares in the right of common ownership of real estate when concluding an agreement providing for the transfer of ownership of residential premises in accordance with the Law of the Russian Federation of April 15, 1993 N 4802-1 “On the status of the capital of the Russian Federation” (for except for the case provided for in part nineteen of Article 7.3 of this Law); 5) agreements on mortgage of shares in the right of common ownership of real estate, concluded with credit organizations; 6) transactions for the alienation of shares in the right of common ownership, concluded in connection with the seizure of real estate for state or municipal needs.

In contrast to the general rule of paragraph 1 of Art. 223 of the Civil Code of the Russian Federation, the share in the ownership right passes to its acquirer under the contract from the moment of its conclusion. But if the agreement itself or the transfer of the right in which the share is acquired requires state registration, the transfer of the corresponding share is determined by the moment of such registration (Article 251, paragraph 2 of Article 223, Article 8.1, 131 of the Civil Code of the Russian Federation).

How to sell your share in a shared apartment

Let’s say right away that selling a share of ownership in a shared apartment will be more difficult than selling a room in a communal apartment, because this share is ideal, and few people would want to share an apartment with strangers on such terms.

At the same time, there is another difficulty: when selling a share in a shared apartment, the other owners of the same apartment have the preemptive right to purchase it.

This preemptive right works like this: an individual owner, having decided to sell his share, is obliged to offer his share first to his co-owners.

If they agree to the terms of the transaction, no difficulties arise in selling the share. But if they do not agree, or if they do not buy this share within one month of notifying them of the sale, then they will only have to offer to sell this share on the real estate market.

At the same time, the owner no longer has the right to change the conditions and price and must sell the share on the same conditions that he offered his owner.

What happens if the owner decides to change the terms of the sale of the share? Then the remaining owners, having learned about a change in the price or terms of sale, within a period of up to 3 months from the moment they learned about such a violation of their rights, can file a lawsuit to transfer ownership rights under the share purchase agreement to themselves.

The right to purchase shares by owners

If there is no desire to sue the co-owners and risk selling it, the owner must not only send his co-owners an offer to purchase his share in writing, but also make sure that he has confirmation that they received this offer.

To do this, you can either submit the proposal in 2 copies with a signature on receipt on the second, or use the Russian Post service “Registered or valuable letter with acknowledgment of receipt.”

In these ways, you will protect yourself from dishonest steps of co-owners who may declare that you have not received any notification of the sale.

In a share exchange agreement, the advantage of co-owners is observed in the same manner.

How to bypass the right of first refusal to purchase a share by the owners

There are ways to get around these difficult circumstances, but as in most cases where legal tricks are used in an attempt to circumvent the law, they can work, but only if the buyer of the share is in absolute good faith. If you are not sure of this, it is better to carefully weigh all the risks before embarking on a risky venture. But what can be done?

Using a gift agreement

One of the situations in which the right of your co-owners of the apartment to acquire your share in the first place ceases to work is a gift agreement drawn up on the basis of Article 572 of the Civil Code of the Russian Federation.

You have the right to donate your share; none of the co-owners has the right to prohibit donation to you. But, as always, options are possible.

Firstly, there is a risk for the buyer, who in this case acts as the recipient. According to the co-owners, who clearly will not like this situation, your gift transaction may well be recognized as imaginary, hiding an ordinary purchase and sale behind its façade. The co-owners will require that the ownership rights received by the buyer be transferred to themselves. This is risky for the buyer, because having given the money, he may be left with nothing.

However, this situation will be no less risky for the seller - the donor, because if the buyer does not pay you, you will not be able to receive payment from him - a gift is a gift.

Using an inflated sales price

The second trick is to make an official offer to the co-owners of the apartment to buy out your share at a disproportionately high price. Since after receiving a refusal (and it will definitely happen, or the co-owners simply do not pay the required amount within a month), you enter into a regular purchase and sale agreement, and since you do not have the right to sell the share for an amount different from your offer to the co-owners, for this amount you and sell your share. On paper, but in fact you receive a real amount from the buyer, that is, corresponding to the state of affairs.

Of course, if the sales price increases, the tax on the sale of the share will also increase proportionately, since the tax is calculated from the amount specified in the agreement.

Whether the game is worth the candle, let everyone decide for themselves. The only thing that can save you from being overtaxed is a situation where the sale of your share when selling an apartment in shared ownership will not be subject to income tax. This needs to be clarified further.

Using a loan agreement

The third trick is concluding a loan agreement for an amount that will be equal to the price of your share in the common ownership of the apartment and an additional agreement to this agreement, in which the parties agree to secure this loan as collateral for your share.

Simply put, you borrow from the buyer an amount equal to the value of your share against the security of your share. And you don’t repay the loan or miss the loan payment deadline. The share goes towards payment of the mortgage to the lender.

This can be done through the court, but more often and easier it is formalized by a compensation agreement, where the parties agree that the creditor receives the right to a share of the apartment instead of the amount lent. This collateral agreement is essentially nothing more than a mortgage, so the agreement must be registered. State registration of a mortgage costs 1,000 rubles.

What are the risks in this case? As in the first case, your co-owners of the apartment will not silently observe this and will file a lawsuit to cancel the loan transaction as a transaction covering the purchase of a share. If the court grants this claim, the buyer will have to return your share, that is, the settlement agreement will be invalid and you will have to pay your creditor in the usual way.

Compensation instead of allocating a share in kind

Under certain circumstances, the law, in principle, does not recognize the right of shared co-owners to allocate their share in the common property in kind, allowing only the possibility of appropriate compensation. This right to compensation arises in the following cases:

1) the law does not allow the allocation of a share in kind (paragraph 2, paragraph 3, article 252 of the Civil Code of the Russian Federation). Corresponding cases of such prohibition are provided for, for example, by the following legal provisions:

- by virtue of the provisions of subclause 1 of part 4 of Article 37 of the Housing Code of the Russian Federation, the owner of premises in an apartment building does not have the right to allocate in kind his share in the right of common ownership of common property in an apartment building;

- During the validity period of the investment partnership agreement, the division of the common property of fellow investors and the allocation of shares in kind from it at the request of a partner are not allowed, unless otherwise provided by the investment partnership agreement (Clause 2, Article 7 of Federal Law No. 335-FZ “On Investment Partnership ");

- The formation of a land plot (including as a result of the allocation of a share in kind) which is part of artificially irrigated agricultural land and (or) drained land and the size of which is less than the minimum size of a land plot established by the constituent entities of the Russian Federation for artificially irrigated agricultural land and (or) is not allowed. ) drained lands (paragraph 3, clause 1, article 4 of the Federal Law of July 24, 2002 N 101-FZ “On the turnover of agricultural lands”);

- monuments and ensembles that are in common ownership, including monuments and ensembles related to the housing stock, as well as land plots within the boundaries of the territories of monuments and ensembles are not subject to division. The allocation to the owners of their share in kind is not carried out (Clause 14, Article 48 of Federal Law N 73-FZ “On objects of cultural heritage (historical and cultural monuments) of the peoples of the Russian Federation”).

2) the allocation of a share in kind is impossible without disproportionate damage to the common property (paragraph 2, paragraph 3, article 252 of the Civil Code of the Russian Federation). Such damage should be understood as the impossibility of using the property for its intended purpose, a significant deterioration in its technical condition or a decrease in material or artistic value (for example, a collection of paintings, coins, libraries), inconvenience in use, etc. (Clause 35 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 6, Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 of July 1, 1996 “On some issues related to the application of part one of the Civil Code of the Russian Federation”). Disproportionate damage to the economic purpose of a building should be understood as a significant deterioration in the technical condition of the house, the transformation of residential premises into non-residential premises as a result of conversion, the provision of premises that cannot be used for housing due to the small size of the area or the inconvenience of using them, etc. . (Clause 7 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 10, 1980 N 4 “On some issues of the practice of consideration by courts of disputes arising between participants in common ownership of a residential building”).

3) by a court decision on the payment of such compensation, regardless of the consent of the co-owner who made a request for the allocation of his share in kind , if the latter is insignificant, cannot be actually allocated, and the interest of the allocated co-owner in the use of common property is insignificant (clause 4 of Article 252 of the Civil Code RF).

A co-owner who has not made a claim for the allocation of his share in kind , under the above conditions, compensation can be awarded by the court in exceptional cases, in particular, if there are signs of abuse of rights in his actions (Article 10 of the Civil Code of the Russian Federation) or taking into account special legal regulation (for example , Article 1168, 1170 of the Civil Code of the Russian Federation).

Judicial practice is more inclined to the position that the provisions of paragraph 4 of Art. 252 of the Civil Code of the Russian Federation applies to the claims of both the separating owner and the remaining participants in the common shared ownership, that is, the right to a share can be deprived without an application from the separating owner . Thus, a participant in common property has the right to file a claim to deprive another participant of the right to a share with payment of compensation to him, if he does not have a significant interest in the use of the common property, his share is insignificant and cannot really be allocated.

A case considered by the Supreme Court of the Russian Federation is indicative (Determination No. 46-KG16-8 dated July 12, 2016). The Supreme Court overturned the appeal ruling, which upheld the decision to reject the co-owner’s claim to recognize the defendant’s share of 7/100 in the right of common shared ownership of the residential premises as insignificant and to terminate his right. The court of first instance refused, citing the fact that the defendant did not make a demand for the allocation of a share, did not express consent to the payment of monetary compensation, bears the burden of maintaining the apartment, and has no other real estate. The Supreme Court of the Russian Federation indicated that the court’s conclusions are not based on the law, since a participant in shared ownership has the right to demand the allocation of his share from the common property, and when deciding on the presence or absence of a real interest in the use of an insignificant share in the common property, the proportionality of the person’s interest in the use must be established common property with the inconveniences that its participation will cause to other (other) owners.

We set out the opposite position in the article “Compensation instead of allocating a share in kind under clause 4 of Art. 252 of the Civil Code of the Russian Federation. Arbitrage practice".

Cases when the advantage of co-owners of an apartment ceases to apply

The legislation provides for one unique case in which the sale of a share of an apartment in the case of the sale of an apartment in shared ownership is permitted without taking into account the preemptive right to purchase a share by the co-owners. This case is the sale of a share of an apartment at a public auction and it applies only when this share is sold to pay off the debts of the owner of the rights to the share by his creditors, if the share in the apartment is the only thing he has left, and for the full repayment of the debt of everything else his property was not enough.

And even then, there are limitations. Thus, it is not allowed by law to take away the debtor’s only home, so if the debtor only has this home, they will not be able to sell it.

In fact, the sale of an apartment in shared ownership by auction is allowed only in two cases:

- When the person who owns the share does not live in this apartment, owns another home or is registered under a social tenancy agreement in another place.

- And in the case when a share in an apartment is acquired through a mortgage, then the only residential premises can be taken away.

Division of property in common shared ownership, allocation of a share

The division of property that is the subject of common shared ownership is carried out by agreement of its participants and entails the termination of the latter. If only one of the subjects of common property wishes to withdraw from its participants, he has the right to demand the allocation of his share in the relevant property (after the allocation between the remaining participants in the common property, the relations of shared ownership are preserved). By agreement of the participants in the common shared ownership, the allocated co-owner, instead of allocating a natural share by other co-owners, may be paid compensation for its value.

If an agreement is not reached between the co-owners, the division of common property, as well as the allocation of a natural share from it, can be carried out in court.

Possibility of allocating a share . A participant in shared ownership has the right to demand the allocation of his share from the common property (Article 252 of the Civil Code of the Russian Federation).

The allocation of a share from the common property or its division is not always possible. For example, in relation to a residential building, they are permissible only if it is possible to isolate its isolated part with a separate entrance or convert the corresponding part of the house into an isolated one. If the shares in the property formed as a result of the division do not correspond to the size of the shares in the right of common shared ownership, the corresponding difference is compensated (see paragraph 11 of the Resolution of the Plenum of the Supreme Court of the USSR dated July 31, 1981 N 4 “On judicial practice in resolving disputes related to right of personal ownership of a residential building").

When considering a request for the allocation of a share from a privatized apartment, the courts take into account the technical possibility of transferring to the plaintiff an isolated part of not only residential, but also non-residential, utility rooms (kitchens, corridors, bathrooms), as well as the possibility of equipping a separate exit. In the absence of such an opportunity, the allocation of part of the apartment to one of the co-owners is excluded. The separated owner has the right to rely only on compensation for the cost of his share in the apartment or on determining the procedure for using the apartment by agreement with other owners, and if an agreement is not reached, by a court decision (clause 12 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of August 24, 1993 No. 8 “On some issues of application by courts of the Law of the Russian Federation “On the privatization of housing stock in the Russian Federation”).

Sale of an entire apartment with shared ownership

If the apartment is too small to provide comfortable accommodation for all its co-owners who own the rights to shares in the apartment, all owners will sooner or later have the idea of selling such an apartment.

If all co-owners of the apartment unanimously decide to sell it, the sale of the shared apartment can be formalized in only two ways:

- Using several agreements for the sale and purchase of shares to one buyer. The entirety of these agreements will result in full ownership of the entire apartment.

- Or one purchase and sale agreement with several sellers and one buyer.

Several agreements for the sale of each share separately can be used in cases where the owners do not communicate and do not trust each other. Here you will have to pay a state duty for each share in the amount of 1,000 rubles and observe the pre-emptive right, that is, each time offer to buy out the share first to all co-owners, and only after receiving a refusal from them to sell the shares to the buyer. This option is very inconvenient for the buyer.

The second option is more convenient and profitable in all respects. The fee is paid only once, there is no need to maneuver between different owners.

But here you need a power of attorney in the name of one of the owners for his right to sign the agreement on behalf of all the others.

There are also differences in processing a tax refund for these methods of sale; we will look at this in the paragraph on tax deductions.

Sale of a shared apartment if the co-owner refuses to sell

Let us assume that several persons live in an apartment, each of whom has the right to their share of the property. If they want to sell the apartment, and one of them is against it, what should they do?

In this situation, the owner of the largest share will have the decisive voting right and, accordingly, if the opponent’s share is the largest, then it will be impossible to do anything in this situation.

But if the opponent’s share is small, you can make an attempt to forcibly buy out his share, for which you file a lawsuit in court, justifying your demand by the small size of his share, you must ask the court to oblige him to transfer his share to the ownership of the remaining owners for material compensation. The court will not be able to fulfill this requirement only if the opponent of the sale permanently resides in this apartment.

Possession and use of property in common shared ownership

Possession and use of property in shared ownership is carried out by agreement of all co-owners, and in the event of a dispute, by the court at the request of any of them. Each of the shared co-owners has the right to claim ownership and use of a part of the common property commensurate with his share. If any of the co-owners owns and (or) uses a part of the common property that does not correspond to the size of his share, this discrepancy is subject to compensation. The procedure for using common property may also be determined by established custom.

the costs of maintaining common property in proportion to the size of their shares (Article 249 of the Civil Code of the Russian Federation). Moreover, as a general rule, the obligation to bear the burden of maintaining common property does not depend on whether the co-owner uses it or not. As stated above, co-owners have the right by agreement to determine the procedure for bearing the costs of maintaining shared property, which differs from the principle of proportionality of the participation of co-owners in bearing the burden of maintaining common property.

Tax on the sale of a share in an apartment

As a general rule, the money received by the seller for a share in the apartment or for the entire apartment is considered income and, therefore, you will have to pay income tax of 13% on the amount received for your property.

However, this rule only applies when you are selling your property, which you have owned for less than 3 years. If you owned the apartment for more than three years, you do not pay tax. The period of three years is calculated from the date on your Certificate of Title.

If you sold the apartment before three years, you pay tax, but are entitled to a tax refund. The tax refund is considered as the amount by which the tax base will be reduced when calculating the tax, that is, this amount will be equal to your income from the sale of the apartment, but it cannot exceed 1 million rubles for each individual property.

If you sell a share of an apartment in common property, the tax deduction is calculated slightly differently.

Tax deduction when selling a share of an apartment - calculation examples

Since, as we have already said, the largest amount is 1,000,000 rubles. to calculate the tax deduction is applied to only one object, it is considered that such a separate object is a separately sold apartment. But if the apartment is sold in shares, with a separate agreement for each share, then each share becomes a separate object. One purchase and sale agreement – one object.

That is, when the owners sell their apartment under one agreement, the amount of tax refund for each of them will be proportional to the size of their shares, for example, with two equal shares, each owner will receive 500 thousand tax refund. But if the shares in the apartment are sold separately, each co-owner will receive a return of 1 million; of course, this is only true if the apartment is sold for an amount greater than or equal to the number of co-owners multiplied by a million.

Accordingly, if you sell an apartment or share of ownership in an apartment that you have owned for up to 3 years, you will need to prepare a tax return indicating your income from the sale of real estate.

In the declaration, find the column for tax refund, and if you were the owner of half of the apartment, then after selling the entire apartment in one agreement, you will have to pay tax not on the entire price of your share, but only on part of this amount.

Let’s say an apartment that was owned in equal shares by two owners was sold for 2,400,000 rubles. In this case, income tax will be paid not on 1 million (the maximum tax amount), but on 500 thousand, that is, you will pay 13% of 500,000 = 65,000 rubles, and the tax office will provide you with a tax refund for the remaining 500,000. But If you sell your shares in separate agreements, then in this case you will not be charged tax at all, you will simply indicate a deduction in the amount of RUB 1,000,000 in your tax return.