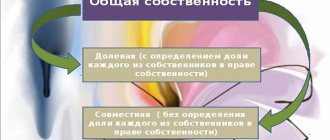

The right of common ownership of land plots refers to the types of private ownership of land and is characterized by a plurality of subjects of property rights, called participants in common property or co-owners, when using a land plot together (Article 244 of the Civil Code of the Russian Federation). In essence, the emergence of common property is the unification of subjects of land ownership and the connection of land plots into a single object, confirmed by an act of state registration. The right of common ownership of a land plot is divided into two types:

- General joint ownership of land (without determining shares).

- Common shared ownership of land (with determination of the shares of each co-owner).

The differences between the types of common property rights concern both the scope of the powers of the owners and the institution of the emergence of legal relations. Let us consider each type of common land ownership separately.

Common property and its varieties

Land relations are regulated by the Land Code of the Russian Federation, however, the right of ownership of land is also covered by the norms of civil legislation, and is regulated in certain situations by other special regulations.

Art. 244 of the Civil Code of the Russian Federation establishes the types into which the right of common ownership is divided. Thus, each property, not excluding land, can be owned by several entities, and all of them can own a specific share in it. The legislator calls this type of property shared.

There are situations in which shares in property are not established, then the land or other object will be jointly owned. This means that the rights to the land plot of any co-owner will extend not to part, but to the entire plot as a whole, but subject to the restrictions set by the Civil Code.

Share sizes

They are determined according to the norms of the Civil Code. As a general rule, co-owners can agree among themselves and decide which part each of them will own. If such an agreement has not been drawn up, the territory is divided into equal parts.

In some cases, the size of the share may change. For example, two sisters own a dacha plot and their shares are equal. But one hasn’t been to the dacha for several years, and the other has been cultivating the land, renovating the house, laying out a garden, laying out paths, and putting up a gazebo. Such transformations, by law, are recognized as inseparable improvements to property. And the sister who contributed them has the right to demand in court an increase in her share.

Joint ownership

As a general rule, almost any common property is considered shared property, unless regulations establish that it is joint. Based on legislative norms, joint property is recognized as:

- The property of spouses acquired by them in the union. Taking into account the requirements of Art. 256 of the Civil Code of the Russian Federation, such property will be considered joint, unless it is acquired by the husband or wife before or after marriage, is not received as a gift and does not constitute an item for personal use. At the same time, shares in such property can be established on the basis of an agreement between husband and wife or by decision of a judicial authority.

- Farm property. Based on the interpretation of Art. 6 of the Law “On Peasant (Farm) Economy”, the assets of this association of citizens belong to them by right of joint ownership. However, like spouses, participants in a peasant farm have the right to establish the shares of each of them by concluding an appropriate agreement.

- The property of a gardening or other non-profit citizens' union, which is acquired by this society through contributions from its members, is also joint (Article 4 of the Federal Law of April 15, 1998 No. 66-FZ).

- Privatized property.

The difference from shared property is that the disposal of joint property can be carried out exclusively with the consent of absolutely all co-owners. For example, to sell land owned by a married couple, it is necessary to obtain the consent of the second spouse. In the absence of such, the latter has the right to demand recognition of the transaction as invalid through the court if he proves that the buyer knew, or at least should have known, about the need to obtain this permission.

Joint property can be divided, but to do this, first of all, it must be transferred to shared ownership. Also, creditors have the right to foreclose on a plot that is jointly owned. To do this, it is necessary to apply to the court with a claim for the allocation of a share, and subsequently apply a penalty to the allocated share (Article 255 of the Civil Code of the Russian Federation).

Capitalization of objects

If the purchase and sale agreement separates the prices for the building and the plot, there will be no problems with their recording. But in the case where the contract contains a single price, the initial cost of each of the purchased objects must be determined by calculation. The amounts shown on the summary invoice are not suitable for this purpose.

However, it is necessary to separate the cost of the building and the site when they are taken into account as part of fixed assets. And if a property is purchased for subsequent resale - as a commodity, then there is no need to distribute a single transaction price.

Price distribution is carried out in the interests of taxation, therefore it must have an economic justification (clause 3 of Article 3 of the Tax Code of the Russian Federation). Distribution options are presented in the letter of the Ministry of Finance of Russia dated June 28, 2013 No. 03-05-05-01/24812.

Fact

If you do not exclude the price of land from the cost of the building, it will fall under “double” taxation. But if property tax is paid on the cadastral value of the building (clause 2 of article 375, article 378.2 of the Tax Code of the Russian Federation) - such a problem does not arise.

Option 1, proposed by the taxpayer: conduct an assessment of the market value of the land plot by an appraiser, and determine the initial cost of the building as the difference between the price in the sale and purchase agreement and the value of the plot indicated in the appraiser's report.

Indeed, in the absence of a purchase price, the original cost of the property is considered to be its current market price. However, regulatory documents do not oblige the involvement of a professional appraiser to determine it. The requirement is as follows: “data on the current price for this or a similar type of property must be confirmed by documents or experts” (clause 23 of the Regulations on accounting and financial reporting in the Russian Federation).

Option 2, proposed by the Ministry: the amount of costs is distributed between real estate objects (land and building) in proportion to their cadastral value. A cadastral certificate on the cadastral value of a property is provided free of charge upon request of any person by the territorial bodies of Rosreestr (clause 1, subclause 4.1, clause 2, clause 13, article 14 of the Federal Law of July 24, 2007 No. 221-FZ “On the State Cadastre” real estate").

A cadastral valuation is essentially a market valuation at the date of its implementation. The difference is that it is carried out at least once every five years (Article 24.12 of the Federal Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation”).

EXAMPLE Let's use the conditions of example 2. The transaction price excluding VAT is RUB 140,471,355.93. (158,000,000 – 17,528,644.07). Cadastral value: buildings - 105,000,000 rubles, land plot - 45,000,000 rubles, total - 150,000,000 rubles. (105,000,000 + 45,000,000). Taking the cadastral value as the basis for price distribution, we obtain an estimate of the initial cost: buildings - 98,329,949.15 rubles. (RUB 140,471,355.93 X RUB 105,000,000 / RUB 150,000,000), plot – RUB 42,141,406.78. (RUB 140,471,355.93 X RUB 45,000,000 / RUB 150,000,000).

A similar approach is used when purchasing premises. The difference is that the buyer acquires a share of ownership of the site proportional to the share of ownership of the building. The latter is calculated based on the ratio of the area of the room and the building.

Shared ownership of land

Among the reasons on which the type of property under consideration may arise are the following:

- Emergence from legislative acts.

- Formation as a result of the acquisition of an indivisible object into the ownership of two or more entities.

- Arising from contractual relations.

The share of each co-owner in the type of common property under consideration is usually specified by agreement. Such shares are determined by the contributions of the participants, how much each of them contributed to their common property. So, when buying a plot of land by two persons, if their financial costs are the same, then the share of both will be the same - ½ for each. If their contributions are different, then the shares are determined in proportion to these contributions.

In the absence of an agreement on the establishment of shares, and also if the size of these shares cannot be determined in accordance with the law, they are considered equal.

To which areas can it be applied?

Most often, common shared ownership arises in the following cases:

- When it comes to farm and rural land.

- If plots of land were acquired by members of various associations (for example, a farming, gardening, gardening or dacha association of citizens) at the expense of general contributions.

- When purchasing a plot of land by two persons who are married.

- A plot of land was purchased by members of a non-profit association using common money for gardening, farming, horticulture or agriculture.

- The share is provided on payment terms.

Possession, use and disposal of the site

The disposal of a land plot that is in shared ownership and the disposal of a certain share in this plot are different. To complete a transaction in relation to the entire such plot, an appropriate agreement of all co-owners is required. When buying or selling a plot of land that is in shared ownership, all co-owners will act as sellers. In case of disposal of shares of a land plot, the consent of the co-owners is not required. The owner of a certain share can dispose of it at his own discretion, however, in a paid transaction, he will have to comply with the right of first refusal.

Possession and use, as established by Article 247 of the Civil Code of the Russian Federation, is carried out by co-owners in the same way as an order, that is, on the basis of an agreement between them. Participants in shared ownership can use the property both as a whole and in parts. The choice in favor of one type or another is determined depending on the object. In relation to a land plot, the owner of the share can use either his part of the land directly, or, with the consent of the others, the entire plot.

Ownership and use of agricultural land plots that are in shared ownership are regulated by Federal Law No. 101-FZ dated July 24, 2002 and have their own characteristics. In order to exercise these powers, it is not necessary to obtain the consent of all participants. As a rule, such a decision is made at a meeting at which at least 20% of the co-owners must be present. If 2/3 of the votes are received, the decision on the procedure for owning and using the land plot is considered adopted. This procedure is due to the fact that often agricultural lands have a huge number of owners, and obtaining appropriate consent from each of them in most cases becomes impossible.

Who is the defendant when dividing land in kind?

If the land plot is jointly owned by a married couple, then the defendant will be considered the one of the spouses against whom the demand for division of the plot of land is made.

For example, if a husband decides to allocate his share of a joint plot in kind, then his wife will be the defendant.

In cases where several people are co-owners, all co-owners except the one who filed a demand for division will be defendants.

For example, a plot of land is the joint shared ownership of members of a gardening partnership. One of them decided to actually allocate his share of the land. In this case, all other owners of the land plot will become defendants.

Income from property and expenses for its maintenance

A plot of land, used in accordance with its intended purpose, naturally brings income and other fruits. Their distribution can be carried out between co-owners in two ways, in which the income and products received:

- become part of the common property;

- distributed proportionally among the co-owners according to their shares.

The owners can establish a different procedure by concluding an appropriate agreement.

The maintenance of common property is an integral part of its use and ownership. Therefore, all owners must bear the costs of maintaining the land plot. Moreover, these costs are also set in proportion to shares. A participant in shared ownership of land who has paid, for example, land tax for the entire plot, has the right to demand compensation from the others in proportion to their shares. On the other hand, some expenses can only be carried out with the consent of all owners. Thus, a participant in shared ownership who has paid for the protection of the entire land plot without the consent of the other owners will not have the right to demand compensation from them.

Pre-emptive right to purchase

As stated above, the owner of the share has full right to dispose of his part of the land plot. Without obtaining the approval of other participants, he can donate his part of the land, pledge it, etc. However, if he wants to make a paid transaction, then for this he needs to follow a certain procedure. Each co-owner has a pre-emptive right to purchase the share of the other participant.

The owner of a part of the land plot, before selling it, must invite the other participants to buy out his share. The price is set by the owner himself. If the remaining owners of shared ownership refuse to purchase this share, he does not have the right to sell it at a price lower than the one for which he offered it to them.

Article 250 of the Civil Code of the Russian Federation stipulates that a person intending to sell a share must notify all co-owners in writing. This notice must state the price and other terms of sale. If within one month none of the participants declares a desire to buy out the share on such terms, then the owner of the share can freely sell it to a third party.

If these rules are violated, the co-owners have the right to demand through the court that such a transaction be declared invalid. To do this, they are given a three-month period (from the moment they learned about their violated right).

Building sale agreement

You intend to buy a building. Let's assume that the land plot under the building is also owned by the seller. By virtue of the law, the buyer is transferred ownership of the land plot occupied by such real estate and necessary for its use (clause 2 of Article 522 of the Civil Code of the Russian Federation). The corresponding site must be described in the contract (Article 554 of the Civil Code of the Russian Federation). In other words, when selling a building, it is necessary to determine the parameters of the site necessary for the operation of the building. Such a plot cannot be the subject of an independent transaction.

The sales contract may provide for the price of the building and the price of the plot separately, but not necessarily. If the contract establishes only the price of the building, then it includes the price of the corresponding part of the land plot transferred with this building (clause 2 of Article 555 of the Civil Code of the Russian Federation).

In the first option, there are no problems with determining VAT. There is no tax charged on the price of the plot. Therefore, the buyer will only be issued an invoice for the cost of the building specified in the contract.

EXAMPLE The contract sets prices: for a non-residential building - 100 million rubles. excluding VAT, for the land plot located underneath it – 40 million rubles. In this situation, the buyer will be charged VAT in the amount of 18 million rubles. (RUB 100 million X 18%). The transaction amount, including VAT, is RUB 158 million. (100 + 18 + 40).

If the price of the plot is not isolated, then the tax base should be determined in the manner established for the sale of the enterprise as a whole as a property complex. This point of view is reflected in the letter of the Ministry of Finance of Russia dated March 27, 2012 No. 03-07-11/86. The seller draws up a consolidated invoice indicating the transaction price in the “Total including VAT” column. An inventory report indicating the book value of each of the objects is attached to the consolidated invoice (Clause 4 of Article 158 of the Tax Code of the Russian Federation). In such an invoice, the building and land plot are separated into independent items. The price of an object is taken to be equal to the product of its book value and the adjustment factor. And since operations for the sale of land plots are not recognized as an object of taxation, dashes are added to the line in which data on the plot is reflected in columns 7 “Tax rate” and 8 “Tax amount”. This procedure is supported by the resolution of the Federal Antimonopoly Service of the North-Western District dated February 12, 2007 in case No. A05-13851/2005-33.

On the line that reflects the data on the building, the sale of which is subject to tax, in columns 7 “Tax rate” and 8 “Tax amount”, respectively, the estimated tax rate of 15.26% (18/118 x 100%) and the tax amount are indicated , defined as the percentage of the tax base corresponding to the estimated tax rate.

EXAMPLE Let's assume that the transaction price is the same as in example 1 - 158 million rubles, including VAT, but it is the same. Prices for the building and the plot were not set separately. The book value of each of these objects in the seller’s accounting: building – 80 million rubles, land plot – 30 million rubles. Based on these data, the tax base is determined (clauses 2 and 3 of Article 158 of the Tax Code of the Russian Federation). The book value of the sold property is RUB 110 million. (80 + 30) – below the selling price – 158 million rubles. Therefore, the adjustment factor is 1.4364 (158 million rubles / 110 million rubles). Tax base: for the building – RUB 114,910,000. (RUB 80,000,000 X 1.4364), for the site – RUB 43,090,000. (30,000,000 X 1.4364). VAT is charged only on the building and amounts to RUB 17,528,644.07. (RUB 114,910,000 X 18/118).

We remind you that the following are exempt from VAT:

- sale of residential buildings, residential premises, as well as shares in them (subclause 22, clause 3, article 149 of the Tax Code of the Russian Federation);

- transfer of a share in the right to common property in an apartment building when selling apartments (subclause 22, clause 3, article 149 of the Tax Code of the Russian Federation).