What type should apartments in new buildings be classified as?

It would seem that there is nothing simpler than counting real estate sold directly by the developer. But housing, most often, is sold during the construction process. It is being sold by the owners who bought this property earlier.

Experts from the real estate industry agreed that an object should be classified as primary or secondary according to its legal status. In their opinion, primary housing includes apartments that are sold by developers under a purchase and sale agreement or equity participation. However, when the owner resells real estate in an unfinished building, with unregistered title to the property, this housing is considered primary. When registering the right to property, the property falls into the category of secondary housing.

Registration of a loan agreement

So, you’ve chosen a bank, decided on an apartment, submitted an application, and now your mortgage has been approved. The next step is concluding an agreement.

At this stage, it is worth discussing the following parameters with the lender:

- Possibility of early closure of the loan agreement.

Even if now it seems that you will never be able to close your mortgage ahead of schedule, it is worth leaving this “escape route”.

Although this may not always be beneficial to financial institutions, in the future you can refinance your mortgage, win the lottery, or move to another place and simply sell your apartment.

- Conditions for changing the loan rate.

It is useful to know even if you are confident in the lending bank. In the event that the rate changes without your knowledge, you will be aware of what to do and which party is right.

- Payment schedule.

It is useful to keep this in mind so as not to miss a payment due to inattention. The agreement must be read - it can serve as a complete instruction for the mortgage.

Which object will be considered a new building?

The situation when almost all of the housing in a newly built building has been sold, with the exception of a few apartments, can be considered by each analyst at his own discretion. Depending on the number of remaining unpurchased apartments and the period when the house was put into operation.

As for reconstructed buildings, it can hardly be called primary housing in which the owner carried out repairs, although it looks like new. However, some analysts classify such housing as new buildings. They consider it necessary to take into account the change in the number of apartments, the presence of an entry in the register and the cadastral number. If the answer is negative, the housing will be considered secondary.

Bank selection

The choice of a mortgage partner who will provide a loan is based on three parameters:

- reliability;

- suitable conditions;

- mortgage interest and down payment.

These requirements are not very different for each bank. For some, it is enough for the client to work in his current place for three months, for others it is necessary for a year. Some offer 12% per annum, while others offer 16%.

Your peace of mind and financial success depend on these little things. For example, 9% and 11% per annum are not very different, but in the future, perhaps, with the money saved you will be able to renovate one room.

Banks also have requirements for the apartments themselves. They are not important if you do not yet know where you want to live. In this case, you just need to look for a place that meets the banking conditions. The latter, as a rule, do not cause problems.

Why is the status of an apartment so important?

Information about what category housing belongs to is actually of considerable importance. It helps determine the price of real estate and the start of new construction. In fact, not all real estate on the primary housing market is truly primary. Consumers think more simply. They believe that a new building is a type of housing that can be purchased inexpensively, but will subsequently increase in price.

It turns out that there are no strict examples classifying housing as one type or another. There is also no definition of when a new building should be considered for sale.

What is considered a new building?

The author of knowrealty.ru finds out which house is considered a new building according to legal standards and how many years it retains this status.

New in price

At the end of last year, Moscow real estate market experts unanimously predicted an increase in prices for new buildings. These forecasts were largely based on statistics from capital construction companies, whose revenue in 2021 grew by 30% and exceeded a trillion rubles. In other words, new buildings are still in price, and buyers still prefer them to secondary housing.

Who cares

So what kind of house can be considered a new building? In everyday and everyday situations, the concept of “new building” is used much more widely than it actually is. Most often, this is the name given to a house that was built no more than five years ago, and even better if no more than 2-3 years have passed since its commissioning. Ads with this term are a dime a dozen on real estate sales sites.

But the only correct answer is this: a new building is a house that is sold directly from the developer. Legally, as soon as construction officially ends, the house still has the status of a new building. And as soon as the process of settlement takes place, and residents come to the apartments, this status is lost, even if the living space has only been in use for two days. The fact whether the owner lived in the apartment or whether it was empty does not matter from a legal point of view. “New building” is new housing from the hands of the developer. Everything else is secondary.

From the plan and pit

This difference affects the way documents for housing are processed. They buy a new building in a house under construction, when instead of a house there is only a dug pit or even just a plan on paper. Later, after completion of construction, in order to obtain the rights to the apartment and register it in your name, you need to receive from the development company:

- protocol for the distribution of residential and commercial real estate in a shared construction project,

- BTI technical passport,

- permission to put a newly built facility into operation,

- act of acceptance and transfer.

The new building must also be assigned an address; sometimes, to indicate the location of the residential premises, a decree is even issued on the appearance of new streets on the city map. That is, it is clear that the list of documents differs significantly from what buyers of secondary housing collect.

Not the same thing

Surprisingly, one apartment can be considered a new building, and the second, in the same building and on the same staircase, can be considered a secondary building. If you buy an apartment in a newly completed building, but from a former shareholder, this is secondary housing. And if the developer has unsold meters in the same building, they will be sold as primary living space.

Maria Solovyova

Carry out the apartment acceptance process no less carefully.

This advice is easier to implement when buying an apartment in a secondary property. But even after receiving the keys to an apartment in a new building, do not delay checking it. Inspect the living space in daylight - are there any defects that appeared during construction work? Are the walls smooth? What about the floor? Are all communications working properly? The sooner you notice all this, the easier it will be to force the developer to correct his shortcomings. Unless, of course, you are eager to do the repairs yourself. Carefully read the act of acceptance and transfer of the apartment and all its annexes; the condition of the object at the time of your actual entry into use should be recorded there. Do not accept an apartment if you know about its shortcomings.

Gather all the documents that will be needed from you

Take the preparation of the necessary documents seriously on your part - let them be required of you less than from the developer. Let's consider the documents required for registering an agreement on shared participation in construction:

- passport,

- statement,

- receipt of payment of state duty,

- notarized consent to conclude a transaction from the spouse.

Don't worry, the latter is only true if you are married. That is, you will not be forced to get married in order to register a preschool education.

Registration of DDU is carried out by the Federal Service for State Registration of Cadastre and Cartography (aka Rosreestr)

. You can submit documents there in person, you can send them by mail, or you can use the State Services portal. In about a week you will receive a DDU with a special registration note. In the same way, the right of ownership is registered in the same Rosreestr - a set of legal norms that assigns your right to use the apartment.

How to buy a new building with a mortgage: step-by-step instructions

Reading time: 8 minutes(s) Buying your own home for many citizens becomes the most important step in life. However, it often takes several decades to accumulate the required amount, so in the modern world mortgage lending is becoming increasingly relevant.

There are two options for buying an apartment on credit - a mortgage on a new building or purchasing housing on the secondary market. Each of these options has its own characteristics, advantages and disadvantages, which, of course, need to be studied and carefully analyzed before deciding to take such a serious step.

What is considered new construction for mortgage purposes?

Some people mistakenly assume that a new building means a new, recently built house, while secondary housing means an apartment in an old housing stock. In fact, this division is carried out based on the presence of a record in the Unified State Register of Real Estate that the ownership of housing is registered in the name of one or another owner.

The primary fund refers to all apartments for which no one yet has ownership rights. When a house is put into operation, buyers register ownership of the property, and from the moment they receive the certificate, the legal status of the apartment changes to “secondary housing.”

The significant difference between a mortgage on a new building and the purchase of secondary real estate lies directly in the peculiarities of these transactions.

Citizens purchasing housing on the secondary market with a mortgage must only fill out an application once and submit it along with documents for registration to the Federal Registration Service, after which the right to property will be registered.

If a bank client chooses a mortgage on the primary market, then at the construction stage the pledge of the right of claim in accordance with the agreement on participation in shared construction will act as collateral for the loan. Only upon completion of construction, when the apartment is put into operation, will it be possible to obtain a mortgage loan.

What is better: a resale or a new building with a mortgage?

It is definitely impossible to answer the question of what is preferable – a resale or a new building with a mortgage. A person who wants to formalize such a significant commitment must proceed from his individual life situation and preferences.

Apartments on the secondary market are convenient because they can be used immediately. This option implies that the house is already ready, and there is no risk that construction will be delayed. Another advantage is the large selection of options. In this case, the housing will be located in a populated area with developed infrastructure, and literally immediately after obtaining a mortgage, the happy owner will be able to submit documents for permanent registration in the new apartment.

However, when designing such housing, there are also disadvantages. Thus, the apartment must be checked extremely carefully for legal cleanliness. In addition, it is necessary to take into account that secondary housing may be in a worn-out condition and need major repairs.

Apartments on the primary market also have their pros and cons. Firstly, they are noticeably cheaper than similar secondary options, and the difference sometimes reaches 30-50%. By purchasing a primary home, a person will be sure that he is its first and only owner. In addition, in the new apartment he will not have to correct the repair mistakes of previous residents and change communications. Another quite important advantage of purchasing new housing is the presence of a unified social infrastructure - all the neighbors who will surround the happy owner of an apartment in a new building will be approximately his same status and income.

Taking out a mortgage for a new building also has its disadvantages. It should be borne in mind that usually such houses are located far from the city center or even outside it. The long wait for the construction of a house is also important. At the same time, the risk is a completely justified price to pay for the low price of housing, but you need to be very careful when choosing a bona fide developer. Do not forget about the likelihood of shrinkage of a new house - it will occur up to 7 years, regardless of the quality of construction.

How to buy an apartment in a new building from a developer with a mortgage?

The procedure for purchasing an apartment with a mortgage in a new building has its own nuances and specifics. Obviously, years can pass between the purchase of real estate and the housewarming celebration. This feature is due to the fact that the sale of apartments begins at the construction stage, and when the building is put into operation, all apartments have already been sold. There are a number of other pitfalls that need to be carefully studied before undertaking such a responsible procedure as applying for a mortgage for a new building.

A brief step-by-step instruction of the purchase stages is as follows.

Step 1. Search for suitable housing accredited by the selected bank. Step 2. Contact the bank and apply for a mortgage. Step 3. Property assessment – without conducting a market examination of the apartment, the bank will not be able to determine the loan amount. Step 4. Approval of the apartment by the bank. Step 5. Conclusion of a loan agreement. Step 6. Settlement with the seller - money is transferred according to the method applicable by the specific bank. Step 7. Notarization - all documents must be certified. Step 8. State registration – the transfer of ownership is registered, and the presence of an encumbrance (if any) is documented.

Step 9. Insurance (can be taken out before the start of the transaction). Insurance is concluded in relation to the mortgaged property.

Where to start shopping?

The process of purchasing a new building with a mortgage always begins with choosing a bank and a specific object that the potential borrower of loan funds plans to purchase. In this case, you can either choose a specific developer and property, and then look for a bank, or vice versa, choose a bank with the most suitable interest rate conditions and loan term, and then study its accredited real estate properties.

It should be noted that with the first option, it is advisable to start searching for a new building with a mortgage by visiting the office of the developer’s company and familiarizing yourself with the list of banks with which the company cooperates.

With both the first and second options, the conditions and the process of purchasing a home will be somewhat different from standard mortgage transactions. A citizen has the right to apply for a home loan from a company unknown to the bank, but the likelihood of such a loan being approved will be minimal.

It is important to note that in many respects the conditions and the ability to get a mortgage for a new building depend on what stage of construction the property is at. If it is fully built and has passed state registration, there will be no problems with lending. But at the excavation stage it will be extremely difficult to get a loan; it is possible that additional collateral will be required for security.

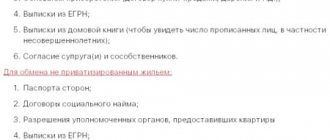

What documents are needed for registration?

In a mortgage for a new building, documents are considered the main point, and the outcome of applying to the bank largely depends on their preparation. The study and collection of all documentation should be taken extremely seriously, since when searching for an apartment there is always the possibility of becoming a victim of fraud (especially if the shareholder wants to buy an apartment by transfer).

Before the main agreement is signed with the developer, it is necessary to obtain from him copies of documents - certificates of state registration of ownership of the land plot where construction is taking place, permission from government authorities to carry out construction, an act of preliminary distribution of real estate, an investment contract.

The bank may require all this documentation when applying for a loan. The specific list of documents will depend on the credit institution chosen by the potential borrower.

After receiving all the necessary papers and initial approval of the loan application, the borrower must provide the bank with the following package of documents:

- citizen's passport;

- income certificate (form 2-NDFL);

- a copy of the work book;

- copies of the tax return and employment contract;

- copies of diplomas and professional certificates;

- investment agreement or agreement for participation in shared construction (provided by the developer company);

- copies of the constituent documentation of the developer company;

- a copy of the relevant decision of a legal entity on the sale of an apartment indicating the cost and technical characteristics (provided by the developer);

- documentation confirming the right of the developer company to construct and subsequently sell the property;

- mortgage documents.

It is important to understand that if a new building is purchased in an accredited facility, the bank already has all the documentation for it, and the borrower will only need to provide a minimum package of documents.

Why do you need an apartment appraisal?

The procedure for assessing a home is similar to the examination for determining the market value of living space. This assessment of apartments in new buildings can be carried out by both special organizations (agencies) and bank specialists.

During an appraisal, the bank and the borrower often want to achieve different goals.

Credit organizations strive to calculate everything in such a way as to reduce the price of the collateral property, so that even in a negative situation on the real estate market, they will be able to sell an apartment if its owner has debts to repay the loan.

The owner of the property, on the contrary, wants the cost of an apartment in a new building to be as close as possible to the market price in order to obtain a larger loan. That is why it is advisable for the parties to agree on the candidacy of the appraiser.

In any case, the bank will carefully study the expert opinion on the appraised value, and in case of significant disagreements, it may insist on a revaluation of the apartment by its appraisers or refuse to provide a loan.

How to register ownership of an apartment purchased under a DDU with a mortgage?

Registration of ownership of an apartment in a new building depends significantly on the construction company. The procedure for obtaining a certificate begins if the developer has passed the acceptance of the object by the state architectural and construction commission, has made a registration certificate for the apartment building at the BTI, has registered the new building with the cadastral register and has registered the object in Rosreestr.

The procedure for registering ownership of an apartment begins with an application to the construction company with which a shared construction agreement (DDU) or another agreement for the purchase of residential premises was concluded.

Stage 1. The developer must provide the apartment owner with the following documents:

- act of acceptance and transfer of the apartment;

- implementation of an investment agreement for construction work;

- copies of documents on the commissioning of the constructed house and its acceptance by the state commission.

It is important to note that residents are often asked not to bother registering property rights, entrusting this procedure to the developer. This service will be very expensive - up to 2.5% of the cost of the apartment.

Stage 2. Contacting the BTI. Ordering documentation with a technical description of the object:

- technical passport;

- cadastral passport;

- floor plan with explication.

After the procedures described above, the shareholder must wait until he receives the keys to the apartment and begin registering ownership.

When can I register in a new building with a mortgage?

It is possible to register a new building only from the moment when ownership has already been registered, otherwise it is impossible to do this.

After collecting all the documents and obtaining ownership of the apartment, the owner can already register himself, his family members and anyone else he wishes at the new address (only by agreement with the bank). To do this, you will need to submit the following documents to the nearest MFC:

- registration application;

- passport of a citizen of the Russian Federation;

- documents confirming the ownership of housing.

What to do after receiving the keys?

If the bank client has already received the keys to the apartment, it means that all the main difficulties are behind us - the house has been accepted and you can live in it. However, this is not the final stage of the deal.

The next step will be the conclusion of an agreement with the management company for the maintenance of the building and payment of operating fees - this condition is often taken into account in the share participation agreement. The next step is to hand over a memo to the client on the operation of the premises, as well as documents for meters and keys to the mailbox. After this, the shareholder can begin repair work, while simultaneously registering ownership.

To register ownership rights, you must contact the territorial body of Rosreestr or the MFC. To do this you will need the following package of documents:

- owner's identification card;

- title document or agreement with the developer;

- mortgage agreement;

- written consent of the mortgagee (bank) on the possession and use of property;

- all the above documents received from the developer and papers from the BTI;

- payment of state duty in the amount of 2000 rubles.

According to the law, the period for registering ownership of residential real estate should not exceed 3 months. If everything is in order with the papers, the procedure lasts up to 18 days.

Which banks offer the most favorable conditions?

At the moment, many large banks in the country offer to take out a mortgage for a new building. A potential borrower needs to carefully study the conditions in order to choose the most suitable option for himself. An important nuance is that, unfortunately, well-known banks rarely offer the service of obtaining a mortgage without a down payment.

When studying bank offers, you should keep in mind that when purchasing a home with a mortgage, in addition to the main tax deduction, the owner can also receive a deduction for the loan interest paid (return 13% of the actual mortgage interest paid).

Sberbank of Russia

The largest bank in the Russian Federation offers quite favorable lending conditions for primary real estate.

The loan amount starts from 300,000 rubles, there is no maximum threshold, but it should not exceed 85% of the contractual value of the mortgaged housing or 85% of the assessed value of the property. The mortgage is issued for a period of up to 30 years at an interest rate of 7.5% (for military mortgages from 9.5%). The down payment is 15%.

You can learn more about the bank’s offer here: https://www.sberbank.ru/ru/person/credits/home/buying_project.

VTB

VTB 24 offers its clients to obtain a mortgage for a new building in the amount of 600,000 to 60,000,000 rubles at an interest rate of 9.3%. The loan term reaches 30 years, the down payment is equal to 10% of the value of the purchased property.

It is important to note that the bank does not require permanent registration in the region in which the client applies for a loan.

On the official website of the bank, information is presented at the following link: https://www.vtb.ru/personal/ipoteka/novostrojki.

Sovcombank

This credit organization allows its clients to purchase a new building with a mortgage with a loan amount from 300,000 to 30,000,000 rubles for a period of up to 30 years. The down payment starts from 10% of the value of the real estate, and the interest rate is 7.9%.

It is important that the bank makes the most loyal demands to the client - the minimum length of service at the place of employment must be 3 months, and the client’s age can reach 85 years at the time of loan repayment.

More details here: https://sovcombank.ru/retail/credits/novostroyka.

Raiffeisenbank

Raiffeisenbank offers to buy a new building with a mortgage, choosing from more than 1,000 accredited properties. The mortgage loan amount for Moscow ranges from 800,000 to 26,000,000 at a rate of 10.25%. For other regions, the loan amount varies from 500,000 rubles.

The mortgage is repaid monthly, in equal payments, for a period of 1 to 30 years. The down payment at this bank involves making 10% of the cost of the mortgaged home.

Link to the bank's offer: https://www.raiffeisen.ru/retail/mortgageloans/kvartira-v-novostrojke.

Alfa Bank

At Alfa Bank, a mortgage for a new building can be obtained at an interest rate of 9.29% for a period of up to 30 years. A down payment of 15% is expected. The credit institution is ready to offer a loan of up to 50,000,000 rubles.

You can study this issue in more detail here: https://alfabank.ru/get-money/mortgage/ipoteka-na-novuyu-kvartiru.

Thus, a mortgage in a new building allows you to purchase a new home, in which the happy new resident will be the first owner. The procedure for obtaining this service from a bank is quite labor-intensive and requires collecting a large number of documents, but it is often much more profitable than buying housing on the secondary market.

Did this article help you? We would be grateful for your rating:

1 0

9.Select a seller

The easiest way is to buy an apartment directly from the developer, especially since this option is not only the easiest, but also the most common and, probably, the most reliable. Unfortunately, there are scammers among developers, but it’s worth taking the time to check them and the risk of losing money will be minimized. And remember - those who do not take risks drink champagne only in a rented apartment.

It happens, however, that an apartment in a new building is sold by a contractor who, while performing work for the developer, can receive several apartments as payment for his activities. Buying an apartment from a contractor carries great risks - sometimes the contractor sells it before he fully fulfills his obligations to the developer. The rights of the buyer will be a continuation of the rights of the contractor who failed to cope with the work - and you will not be able to return the apartment even in court.

You can also buy an apartment from the owner in a recently completed new building, but even here you should be as careful as possible - in an effort to save money through the work of intermediaries, you can give money to scammers. And in general, to be honest, this is not the best way to save money - it is unlikely that anyone will resell an apartment cheaper than they bought it themselves.

Define your desires

Buying an apartment should be approached in detail - it’s not like going to the grocery store.

So it would be a good idea to start by figuring out what you really want. Ask yourself the following questions:

- Do you really need an apartment - maybe they can arrange apartments? What if you are still not going to register at your place of residence and like to spend money on utilities.

- Is the geographical location of the apartment important to you? What should it depend on - the place of work, the apartment of relatives, the proximity of a favorite cafe?

- Is the class of housing important to you? Is he obliged to be tall - or with a cute paradise and in economy?

- What infrastructure facilities should be around the house - kindergarten, school, shops, fitness club, hairdresser? Or maybe you really want to live, say, next to a cinema?

- What about transport? Are you hoping for a public one? Or do you have a car - and therefore the main thing is that there are fewer traffic jams near your home?

- Will the duration of construction confuse you - or are you in no hurry?

- How many rooms should there be in an apartment?

- Should there be a balcony? Or does it have to be a loggia?

- Are you able to do the renovation yourself - or is it better to look for an apartment with finished finishing?

- And this is a place for at least one more question - what is important to you in an apartment?

Write down a list of honest answers so you have something to start with.

Start searching for an apartment on the Internet

It seems like gone are the days when finding the perfect (okay, let's face it - the right)

apartments, it was necessary to collect and leaf through various newspapers and magazines with real estate advertisements. Today, all this waste paper has been replaced by the Internet. The Internet is full of sites that search according to the parameters you specify, others offer similar options, and others show the most popular and profitable offers.

And to save time, read sites where real professionals write about new buildings (by the way, you don’t have to go far)

, select interesting projects there, and then look at the websites of specific residential complexes or developers.

Contact the developer - call the sales office

If the information from the Internet and a quick look at the house suits you, it’s time to contact the sales manager. You can simultaneously open the site and ask clarifying questions about all the information presented there. Or open a residents' forum - then the questions will not be clarifying, but provocative. The main thing is don’t be afraid to seem intrusive, believe me: the sales manager needs you no less than you need him. Find out the latest news, special offers and promotions.

You can even try to get a discount. Doing this is not as difficult as people usually think - especially if you have arguments (and after reading forums and visiting a construction site, they may well appear)

. Everyone loves discounts, so here too sometimes it becomes a key factor in favor of a certain option. By contacting the seller, you become one step closer to your future apartment - and this is what we achieve.

Find out if you can find an apartment on your own - or is it easier to hire a realtor

When you already understand what you want, and most importantly, what you can afford, it’s time to decide whether you will look for an apartment on your own - or seek help from a real estate agent. Yes, you have a difficult task ahead of you - some immediately entrust it to intermediaries, albeit for large commissions.

But be careful when hiring a realtor! Fortunately, the times of “black realtors” have already passed, but you can still fall into the clutches of scammers or simply lazy people. Also, be sure to make sure that your requests are accurate, and, of course, be prepared to shell out a considerable amount - realtors usually ask for a few percent of the cost of the apartment for their work. How much effort and time will you spend while saving money - that is the question.

You can compromise with yourself - conduct the search yourself, and leave the legal part to the intermediary.