Each owner or tenant of housing is obliged to regularly pay for the utilities provided to him and the resources consumed - water, gas, electricity. However, cases when there is not enough money in the family budget are not uncommon and can be caused by various reasons. Gradually, the debt of the residents reaches an impressive amount, which they are unable to pay. A way out of this situation could be the restructuring of utility debts. Let us analyze all the stages of this procedure in detail.

How debt for housing and communal services is formed

Relations between citizens and management companies (MCs) are regulated by the Housing Code of the Russian Federation. Section VII covers all issues of paying for utility services, and also lists the categories of consumers who are required to promptly transfer money to the accounts of resource suppliers and home maintenance workers.

These include:

- employers under a social tenancy agreement;

- tenants of state or municipal housing stock;

- members of a housing cooperative;

- home owners;

- developers or persons who accepted the premises under the transfer deed.

Article 155 of the Housing Code of the Russian Federation establishes deadlines for making payments. The money must arrive no later than the 10th day of the next month: for August - before September 10, for March - before April 10, and so on. The same article provides for the right of the management company to charge penalties if payment is not received within 30 days after the due date. The amount of penalties is 1/300 of the refinancing rate of the Central Bank of the Russian Federation, penalties are added to the amount of the debt and make it even larger.

If the amount of the debt exceeds half a million rubles, the Criminal Code has every right to contact the magistrate with a request to issue an order, on the basis of which the bailiff service begins to collect the arrears.

The debt structure includes payments for all types of utilities not paid by the owner or tenant of the property, as well as penalties for late payments. The longer the debtor does not deposit funds into the management account, the faster the amount that needs to be repaid grows.

Both sides of the relationship suffer from the lack of payment of invoices:

1. Management company:

- suffers losses due to the fact that she does not receive the funds due to her in full;

- is not able to perform its duties with proper quality due to lack of funding, as a result, owners and tenants of apartments who pay their rent on time suffer.

2. Owners and tenants – debtors:

- risk being left without vital resources - water, electricity and gas; the management company may limit access to them until the debt is paid in full;

- there have been cases when public utility employees used measures such as stopping the intake of sewage, but this is contrary to the law (as is limiting heating, which, moreover, most often cannot be done technically);

- The management company may go to court, by decision of which the debtor’s property will be seized and a procedure will be launched for collecting utility debts through the bailiff service;

- the restriction also applies to the impossibility of performing legally significant actions with residential property - selling, donating or bequeathing it;

- as a last resort, when the amount of debt reaches astronomical figures, and tenants do not take any measures to repay it, by a court decision they can be forcibly evicted from the apartment to premises of less comfort, and the difference will be used to pay bills.

Having debt for housing and communal services is an extremely unpleasant situation for both residents and management companies. The former are constantly under the pressure of the problem that has arisen and its negative consequences, while the latter are forced to waste time collecting the resulting debt.

The most optimal way out of this situation is to restructure utility debts. Thanks to this procedure, both parties benefit: the management company begins to receive the money owed to it, and apartment owners or tenants can gradually pay off accumulated arrears without fear of sanctions from bailiffs.

In order to reduce the financial burden on residents, the management company can propose the following measures:

- Postponement of the deadline for payment of accumulated debt, subject to timely and full payment of current bills.

- Establishing monthly transfers to pay off debt in an amount that is comfortable for residents.

- Extension of the period during which all allocated funds must arrive at the account of the management company.

- Cancellation of accrued penalties, reduction of debt to the amount of payment for services rendered without penalties.

- Other ways to reduce the amount payable by the owner or tenant of the apartment.

Measures to collect debts for utilities

When concluding an agreement with the management company, residents undertake the obligation to pay in full and on time for the supplied resources and maintenance of the house in proper condition, and the service organization, in turn, guarantees the uninterrupted supply of electricity, water, gas to the apartments, cleaning of the common area and the necessary repair.

Compliance with the terms of the contract by both parties is an important condition for cooperation between homeowners and the management company. Violation of the agreement by one or another participant is unacceptable and is fraught with the application of certain sanctions.

If residents violate the contract by not paying for the provided utilities and consumed resources, the service organization has the right to apply the following enforcement measures in succession:

- Warning . The debtor is sent a written notice indicating the exact amount that should be voluntarily transferred to the account of the management company. Five days are given for execution.

- Accrual of penalties . Without penalties, the owner or tenant of the property can delay payment for no more than a month. From the 31st day, the Criminal Code begins to accrue penalties under Art. 151 Housing Code of the Russian Federation.

- Administrative liability under Article 3.5 of the Code of Administrative Offenses . If payments are not received within several months, and the amount of debt has reached impressive sizes, the service organization files an application to court.

- Initiation of a criminal case under Article 315 of the Criminal Code of the Russian Federation . The reason for initiating proceedings may be a long-term malicious evasion of the execution of a court decision. As a result, the defaulter faces real imprisonment.

- Eviction . This measure does not apply to owners, but those who rent municipal housing may well be forced to vacate the premises they occupy. Evictions are carried out by bailiffs based on a court decision.

There is no point in hoping that the management company will “forgive” the debt and eventually leave the defaulter alone. On the contrary, the longer you do not transfer money for utilities, the more severe the penalties that the service organization can use within the framework of current legislation. This means that it is in the interests of residents to find a way out of this situation as soon as possible by concluding an agreement on the restructuring of housing and communal services debts with the management organization.

Housing payment due date

The time given to pay for utilities is indicated on the receipt itself. But she may be delayed or not come at all. But this does not exempt you from paying, and therefore you still need to know the standard deadlines: usually all utility payments must be made before the twentieth - in this case, services for the previous month are paid. If you don’t have a receipt, you can go to the housing office, where it will be quickly issued.

What is the restructuring of utility debts

The meaning of this concept is revealed in Article 105 of the Budget Code of the Russian Federation. Restructuring is a change in debt obligations on new terms and within a different time frame than provided for in the original agreement. The possibility of a partial reduction in the amount that the borrower must pay to the lender cannot be excluded.

As a result of the launch of the procedure for restructuring debts in housing and communal services, both parties benefit – both consumers of utility services and suppliers. Residents can gradually repay the resulting debt, which will not increase due to penalties. The service organization is freed from the need to file lawsuits and monitor the execution of decisions by bailiffs.

Debts for housing and communal services arise for various reasons, we list only the most common:

- cases of deliberate failure to make payments due to the low quality of services provided or disagreement with current tariffs;

- a sharp decrease in income due to job loss or other problems;

- personal factors: serious illness, shift work, etc.

When considering the possibility of restructuring utility debts, the management company takes into account the specific circumstances of each debtor based on the availability of a permanent place of work, family composition, health status and other factors. Thanks to an individual approach, the optimal way to pay with suppliers of resources and services is selected for defaulters.

The legislative framework

Since the collection of utility bills almost always occurs in an indisputable manner, home owners and tenants need to know what laws govern the calculation and procedure for paying utility bills.

Having studied the relevant regulatory documents, it is easy to figure out in which cases the conclusion of a restructuring agreement is beneficial to the payer, and in which it is not.

Since the contract is the main regulator in any area of relations, including housing, the main legal act regulating obligations and the procedure for their fulfillment is (Articles 420-453).

The issues of providing utility services and their payment are discussed in more detail in Section VII of the Housing Code of the Russian Federation.

The relationship between providers and consumers of utility services, the procedure for quality control and determining the amount of payment is regulated.

Controversial relations between consumers of utility services and management companies, as well as resource supplying organizations, are regulated. An example is the illegal shutdown of electricity or other housing and communal services.

Pros and cons of restructuring utility debts

Signing an agreement with a management company, under which residents have the opportunity to gradually pay off their bills, has both positive and negative sides. The advantages of restructuring utility debts undoubtedly outweigh the disadvantages:

- Municipal housing remains for the use of tenants.

- The apartment continues to receive the necessary resources - water, gas, electricity, heating.

- The dispute between the debtor and the service organization is resolved in a working manner, without going to court.

- Providing a deferment for the payment of utility debts allows you to find the necessary amount.

- Further increase in the amount of debt due to penalties is stopped, in addition, already accrued fines can be written off.

- The tenant retains the opportunity to receive assistance from the state budget (subsidies, benefits, subsidies).

The negative aspects of the restructuring of utility debts are mainly related to the very fact that the parties signed the agreement and the obligation to fulfill its terms:

- The limitation period is counted anew from the moment the contract is concluded.

- The management company is interested in receiving the funds due to it, but is not obliged to provide defaulters with preferential conditions for repaying the debt.

- Restructuring does not mean exemption from payment of current payments; the owner or tenant of the apartment must timely pay funds according to new receipts.

- The amount of debt is considered fixed at the time of conclusion of the agreement and cannot be changed even in court.

- Installment plans are provided if residents really had good reasons for not paying utility bills on time - loss of a job, serious illness, and so on.

- The agreement on the restructuring of utility debts must be fulfilled by the debtor, otherwise he faces administrative liability provided for by the Housing and Civil Code.

- The absence of regular payments to eliminate the debt may cause the management agreement to be terminated unilaterally and a claim to be filed in court.

Arrears in payment

Delays in paying utility bills are fraught with the formation of debt, for which penalties will be charged, and with further non-payment, it threatens to shut off utility services and even go to court.

Let us note that if the fine is assessed upon the fact of a violation, and no separate notifications are required regarding it, then before disconnecting the services, the debtor must be notified, and twice - first twenty days before the planned shutdown, and then three days. This time is given to pay off the debt or reach an agreement on restructuring in order to still avoid a shutdown.

Reasons for education

Debt among citizens can arise for various reasons: loss of work, long-term illness or disability, orphanhood and other similar ones can be classified as valid. Of course, it is necessary to pay rent in any case, if there is even the slightest opportunity, but in its absence, the state provides assistance in such cases - benefits, subsidies are provided, and if it is still necessary to collect the debt, then it is taken into account that the reasons for its formation are valid. In this case, it will not be difficult to restructure it.

On the other hand, not all non-payers have really good reasons for this - some have funds to pay, but they simply prefer to use them for other, unnecessary expenses like alcohol, do not work, having such an opportunity, or simply do not want to pay. In such cases, it is usually difficult to count on benefits, and restructuring is not always possible.

In the absence of truly valid reasons for non-payment of utility services, it is difficult to seriously hope for the leniency of the management company; the debt collection procedure will be carried out with all rigor.

Of course, it is difficult to foresee all possible situations: there are those that do not clearly fall into either the first or second categories. For example, receiving real estate by inheritance and not being able to pay for it. The decision regarding collection and its methods in such cases is made on an individual basis, and if it does not suit the debtor, then he always has the right to file a claim.

Accrual of penalties

If payment is still not made on time, a penalty will be charged. It begins to accrue when there is a delay of one month compared to the payment date indicated on the receipt. After this, for each subsequent day of delay, 1/300 of the refinancing rate should be charged - this can continue for 90 days, after which the penalty for each day of delay will increase to 1/130.

As a result, the debt will begin to grow every day, and it will only become more difficult to pay. Therefore, it is better not to let the penalty accrue, and to pay as soon as possible - especially since when 90 days are up for accrual of the initial penalty, the utility companies will need to disconnect the consumer from the unpaid service (while continuing to charge the fine).

Who can apply for the restructuring of utility debts

In most cases, residents are unable to pay management company bills on time and in full due to lack of money in the family budget. However, not all reasons are considered valid and allow us to hope for the restructuring of utility debts. For example, the desire to go on vacation abroad or buy a new car cannot be regarded as a good reason not to pay for water and electricity.

The initiative to apply for an installment plan to pay the accumulated debt may be taken by the owner of the apartment or the tenant of municipal housing who has become a victim of certain circumstances:

- became seriously ill or lost the opportunity to work;

- lost a breadwinner and has disabled dependents;

- left without a job and cannot find a new one;

- is on parental leave and does not have the opportunity to enroll him in kindergarten;

- I have taken out a lot of loans, and all my earnings go to pay them off.

Any fact explaining the difficult financial situation must be supported by documents. Depending on the specific case, these may be certificates from the employment center, from medical institutions, birth or death certificates, statements of accrued pensions, and so on.

Terms of debt restructuring for utility bills

When discussing a payment schedule with a defaulter, management companies, as a rule, rely on the provision of Article 138 of the Labor Code of the Russian Federation, according to which more than 20% of wages cannot be withheld (except in special cases). Residents transfer funds to pay off the utility debt on their own, but from the point of view of legislation, it is precisely one fifth of the income that is considered optimal - a citizen can pay current receipts and repay the arrears.

During the restructuring of utility debts, service organizations often take such an important step for defaulters as writing off accrued penalties. This takes into account:

- proportionality of the penalty and the principal debt under Article 333 of the Civil Code of the Russian Federation;

- limitation periods established by Article 196 of the Civil Code of the Russian Federation.

The conditions for restructuring debts for housing and communal services offered to a specific owner or tenant of an apartment are influenced by the following factors:

- how long have payments for services rendered and resources consumed not been received;

- what caused the formation of debt - difficult financial situation or indiscipline of residents;

- how the amounts of debt and accrued penalties relate to each other;

- does the debtor have a real opportunity to contribute funds to pay the arrears and pay for fresh receipts.

As a rule, dysfunctional families whose members abuse alcohol or drugs do not regularly pay for housing and communal services. Management company employees know that concluding an agreement on the restructuring of utility debts in this case will lead to nothing; such families have completely different priorities, so the only way out for the service organization is to go to court.

A statement of claim against defaulters who owe less than 500,000 rubles is considered by a magistrate without calling the parties in accordance with the norms of Chapter 11 of the Code of Civil Procedure of the Russian Federation. Based on the issued court order, the collection of utility debts is carried out by FSSP employees.

Debt restructuring procedure for utilities

Documentary evidence that the tenant and the management company have agreed on the procedure for repaying the resulting arrears is the agreement they signed. It lists all the conditions under which the debt to utilities will be considered liquidated, including the payment schedule.

During the restructuring of housing and communal services debts, homeowners or tenants must perform several mandatory actions:

- collect documents confirming your difficult financial situation;

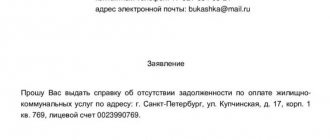

- draw up an application addressed to the head of the management company with a request to provide the opportunity to pay the debt in installments;

- submit the prepared package of documents to the service organization;

- in case of a positive decision, enter into an agreement with the management company and comply with its terms.

The law provides for the possibility of an application by both the debtor and his legal representative; in this case, a notarized power of attorney is attached to the application. Documents can be sent by mail or registered mail. The application is drawn up in free form, but the mandatory elements of any written application are provided for in Art. 7 of the Law of the Russian Federation dated May 2, 2006 No. 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation”:

- name of company;

- Full name, address and telephone number of the applicant;

- the basis for the appeal and a brief description of the situation;

- signature and date of preparation.

The petition for the restructuring of utility debts must also include data on the amount of arrears and the conditions under which the owner or tenant of the apartment would like to repay it. The application indicates the reason why the tenant did not make payments and attaches supporting documents.

These include:

- passport or other identification document;

- certificate of family composition;

- certificate of the amount of debt or meter readings;

- a certificate of employment or work record book with a record of dismissal due to staff reduction or liquidation of the enterprise;

- income certificates for all family members;

- certificate of stay in a medical institution or the need for long-term rehabilitation;

- basis for legally residing in an apartment: certificate of ownership, rental agreement or social lease.

It is enough to attach photocopies of documents, with the exception of certificates of family composition, income and place of work, which must be submitted in the original.

The management company, having reviewed the application received and assessed the evidence of the debtor’s difficult financial situation, chooses one of the options:

- increasing the deferment period for making a monthly payment or the entire amount of the debt;

- exemption of the defaulter from accrued penalties for the entire period of delay.

The procedure for drawing up a contract agreement on the restructuring of debt for utilities

Management companies are interested in solving the problem of non-payments without court settlement, since this entails additional expenses. Each service organization has developed a mechanism for concluding agreements with debtors, standard forms of agreements have been developed, into which it is necessary to insert the data of the owner or tenant of the apartment and specify the amount and timing of depositing money to pay off the arrears.

A standard agreement on debt restructuring for housing and communal services includes:

- name and details of the management company and full name, passport details, citizen registration address;

- information about the occurrence of debt, amounts repaid and plans for paying the balance;

- payment schedule;

- liability of the parties in case of failure to fulfill their obligations;

- duration of the agreement.

Since there are two parties to the contract, a separate copy is drawn up for each of them, which has the same legal force. Once the parties have signed, no more penalties will be charged on the debt.

The conclusion of an agreement on the restructuring of utility debts confirms the readiness of the owner or tenant of housing to fulfill their obligations to make both overdue and current payments. Failure to comply with the terms of this act will lead to unilateral termination of the contract for the provision of housing and communal services by the service organization and the filing of a claim. In the future, the debt will be collected on the basis of a court order by bailiffs.

A separate clause of the agreement contains the procedure for making payments, their amounts and terms of transfer to the account of the management company. Typically these are fixed monthly amounts. If the utility debt is 46,000 rubles, it can be divided into ten equal parts - 4,600 rubles each. per month Current payments must also be received on time so that new arrears do not arise.

The amount of regular payment to repay the debt is set individually, based on the resident’s income. As a rule, the limit of 20% of wages provided for in Art. 138 Labor Code of the Russian Federation.

The agreement on the restructuring of utility debts allows citizens to receive subsidies if they meet the conditions for its appointment. To apply for state assistance, social security authorities require from applicants a document confirming the absence of debt or a copy of the agreement with the Criminal Code on its repayment in installments.

Possibility of restructuring

According to the law, the management company can influence debtors, not only trying to achieve their punishment, but also gently, without resorting to litigation. This way to achieve debt repayment is its restructuring. First we should explain what it is. Restructuring is called installment payment of debt, usually expressed in the distribution of payments in equal shares for a certain period.

To implement it, a special agreement is signed between the parties, which stipulates the basic conditions. The amount of debt is distributed by month based on the debtor’s income - the monthly payment should usually not exceed a quarter of the total income, and for pensioners and disabled citizens - no more than 20%.

Since debtors have different income levels, each case requires a separate repayment schedule. Once a restructuring agreement has been reached, the debtor must make all required payments on time, otherwise he will be charged a penalty for violating the agreement.

Management companies often agree to restructuring so as not to enter into litigation with debtors. Therefore, if you have a difficult situation and there is no way to pay, then it is better not to accumulate debts and fines, but to apply for restructuring in this regard. It will be a mutually beneficial solution, which will also allow the debtor to avoid a grueling trial, and if he loses, which is likely to happen, then he will also have to pay legal costs. And, of course, subsequent measures - first of all, seizure of property for debts.

Important nuances of drawing up a contract

The right to sign an agreement on the part of the housing and communal services organization belongs to the manager or other official vested with the appropriate powers. For the owner or tenant of the apartment, if necessary, his representative, acting by proxy, can confirm agreement with the terms of the agreement.

The standard form usually provides for an agreement between a legal entity and an individual. Cases when the debtor is an organization that owns a living space are less common; for such a situation, you will need to slightly change the prepared contract form.

Some management companies practice drawing up an agreement on the restructuring of utility debts with a payment schedule attached to it as a separate document.

The standard contract form can be taken for preliminary review and shown to an independent lawyer, but, as a rule, this document does not contain any pitfalls. By concluding an agreement with the debtor, the management company strives to solve the problem of non-payment with the least possible losses and does not pursue any extraneous goals.

Reasons for carrying out

We have already noted that the reasons for arrears are divided into those in which restructuring is usually granted, and others in which it is not worth relying on much. Let us outline in more detail the grounds for a request for debt restructuring:

- reduction or loss of income;

- loss of a job due to downsizing, dismissal, or liquidation of an enterprise;

- death of a family member with whom a common household was conducted;

- call for service;

- retirement and a decrease in income because of this;

- loss of ability to work, both temporary and permanent;

- emergence of new dependents;

- economic problems in the place of residence - sharp rises in prices, jumps in exchange rates, etc.;

- other life circumstances.

In the last two cases, the extent to which the circumstances are significant and conducive to the provision of restructuring will be determined by the management company.

Is it possible to appeal a refusal to restructure utility debts?

Cases when a service organization makes a negative decision in response to a tenant’s request for an installment plan to pay arrears are extremely rare. The law does not oblige management companies to provide defaulters with preferential conditions for fulfilling their obligations to pay for services rendered, but usually the utilities themselves insist on concluding restructuring agreements. If for some reason the Criminal Code refuses to cooperate, you can try to contact the district or city administration, social security authorities, or the housing inspectorate. Perhaps these authoritative bodies will convince the service organization to sign an agreement with the citizen on the restructuring of housing and communal services debts.

If this step does not give the desired result, it makes sense to go to court, but first you should make sure that the refusal of the service organization is not related to a violation of a previously concluded restructuring agreement. In this case, the management company is absolutely right in its reluctance to sign an agreement with a tenant who does not fulfill his obligations.

When there are no apparent reasons for refusal, the owner or tenant of the apartment has the right to appeal the actions of the housing and communal services organization in court or write a statement to the prosecutor's office.

The following documents are attached to the lawsuit:

- utility bills;

- statement of the amount of debt;

- a written application to the service organization requesting restructuring;

- negative response from the management company;

- income certificate.

What points should you pay attention to when signing it?

After reviewing the papers and application, the organization will make one of the decisions:

- refuse installment plans;

- draw up and sign an agreement.

If the company meets the debtor halfway, then a restructuring agreement will be concluded with him.

What you need to pay attention to when signing this agreement:

- The period for which repayment is due and the amount of payments .

The owner needs to determine whether he can pay the set amount each month. IMPORTANT! The amount of monthly payment for housing and communal services should not exceed 25% of the owner’s total income. - Accrual of penalties . If an installment agreement is signed, there should be no additional charges. The only thing that will have to be paid is the penalties that were accrued before applying for restructuring.

- Total amount of debt . It is important to pay attention to the amount of debt specified in the contract: does it coincide with the actual amount of debt?

Is it possible not to pay utility debts?

Since relations between suppliers and consumers of housing and communal services are regulated by agreement, they are no different from a legal point of view from other types of interaction between market participants. This also applies to the limitation period, which, according to Article 196 of the Civil Code of the Russian Federation, is three years. This means that the utility debt is not payable if 36 months have passed since its formation.

1. Legal aspects.

The application of the limitation period is regulated by Art. 199 of the Civil Code of the Russian Federation. In the housing and communal services sector, general principles apply, but there are some nuances that affect the possibility of not repaying overdue debt.

The limitation period must not be interrupted, that is, the owner or tenant of the property cannot:

- agree with the claims put forward by the Criminal Code;

- contribute funds to repay a debt or allow another person to do so;

- pay interest;

- apply to change the terms of the contract.

All these actions, including the signing of an agreement on the restructuring of utility debts, reset the statute of limitations. By committing any of them, the defaulter confirms his agreement with the existence of unfulfilled obligations to the service organization.

2. Duration of the term.

The Civil Code establishes the general duration of the statute of limitations as three years. If payment is due on the 10th, the next day is considered the first day of the limitation period. By agreement of the parties, it can be extended.

3. Application of the statute of limitations.

The management company in its claim may insist on collecting debt for all the years when payments were not received from the owner or tenant. According to Article 199 of the Civil Code of the Russian Federation, the court applies the limitation period only on the basis of a statement by a party made before the decision is made. This means that the debtor must indicate that the deadline for collecting the arrears has passed beyond the limitation period. In this case, the court will make a decision according to which the accumulated debt will have to be paid only for the last three years.

There is no point in expecting the service organization to “forget” about the defaulter. As a rule, management company lawyers keep such tenants under special control. The closer the statute of limitations expires, the more active actions they take to pay off the debt.

We remind you that any action of the defaulter, which confirms his recognition of his obligations to utility providers, resets the statute of limitations. Servicing organizations can use a trick and use payments from a fresh receipt to write off old debts. As a result, it turns out that formally the owner or tenant of the apartment agreed with the claim and began to repay the arrears. To avoid this, it is necessary to indicate in the payment purpose for what period the funds are being transferred.

How to write off utility debts

Legal grounds for getting rid of the need to pay for consumed resources and services provided, in addition to the expiration of the statute of limitations, include the death of the homeowner, the impossibility of executing a court decision by the bailiff service, and the bankruptcy of the debtor in accordance with Federal Law No. 127-FZ.

Citizens who collectively owe at least 500 thousand rubles and have not fulfilled their obligations to creditors for 3 months or more can apply to declare themselves insolvent. The bankruptcy procedure is quite lengthy and requires the preparation of an impressive package of documents that confirm that the applicant really does not have the ability to pay off the accumulated debts. The court considers all the circumstances and, depending on the conclusions reached, either declares the citizen insolvent or decides to sell his property to pay off the debt.

As for writing off utility debts in the event of the death of a defaulter, it is only possible if no one inherits his property. If relatives or other persons declare their right to an apartment, the responsibility for paying utility debts will pass to them.

Debt repayment procedure

After signing the agreement, the debtor undertakes to make payments according to the schedule established in the document. It is compiled individually for each defaulter, depending on his income and amount of debt.

Typically, the repayment procedure is as follows: every month, along with making the current payment for utilities, the owner also pays part of the debt amount. If the amount of debt is 20 thousand rubles, it can be divided into 12 months. In this case, every month for a year the owner will need to deposit 1,666 rubles into the housing and communal services account.