Who among us would not like to live in a new house in a green area with developed infrastructure and good transport accessibility? So that there are enough parking spaces near the house, the area is inhabited and well-groomed. And the main thing is that this apartment is affordable.

However, everything described is an ideal model that cannot be found either in new buildings or on the secondary market. Because both the primary and the secondary have their pros and cons, which cannot be avoided. Real estate market experts spoke in an interview with a MIR 24 correspondent about how to choose an apartment to buy.

Everything is new, or the advantages of the primary

Buying an apartment in a new building is now more relevant than ever. The real estate market is actively developing, and developers offer options for every taste and budget. “The advantages of buying apartments in a new building are significant,” says legal specialist Lyudmila Shadrina

. – This is a new apartment in which no one has lived; new modern residential complexes; usually young neighbors; comprehensive infrastructure offered by developers.

“Together with an apartment in a new building, the buyer receives new engineering communications and modern public spaces,” says Alexander Kozlov, commercial director of the RUSICH concern.

. “It is also possible to save time and money by using the ‘builder’s finishing’ option, in which case the cost of repairs can be included in the mortgage payment.”

According to the expert, the advantages of buying an apartment on the primary market include the absence of additional costs for paying for the services of a realtor, since large developers sell their properties on their own. In addition, there is no need to worry about the legal purity of the apartment: unlike an object on the secondary market, there is no “history” of the apartment. In addition, registration of the DDU (share participation agreement) takes place in Rosreestr.

By choosing an apartment in a new building, you can not only save on mortgage payments by taking advantage of a preferential lending program, but also earn money. “The difference in the cost of an apartment at the excavation stage and at the time the house is put into operation can reach 20-25%,” says Alexander Kozlov.

Which apartment to choose

How profitable the purchase of housing will be depends not on the market (primary or secondary), but on the characteristics of the apartment or house itself:

- When purchasing a home from a developer, you should check how reputable he is on the market and whether he has any frozen properties.

- A resale apartment should be checked in the State Register, where the real owners and other data are indicated.

- The choice of real estate should be based on such characteristics as area, location in the city, number of floors, materials for constructing walls, and transport support for the area.

It is worth considering several options in order to be able to compare certain features and make an informed choice.

“Pig in a poke”, or Disadvantages of primary

It would seem that the choice in favor of the primary is obvious. But before investing large sums in the purchase of a new building, you should clearly weigh the pros and cons. “For convenience, we will briefly systematize the risks of buying an apartment in a new building,” says Lyudmila Shadrina. Here they are:

Risk of long-term construction

. Unfortunately, the vast majority of developers do not transfer apartments within the time period stipulated by the contract. Delays in the transfer of objects can range from several months to several years. At the same time, the equity holder is forced to continue to pay the mortgage, and sometimes at the same time rent rental housing. The law provides for measures to protect equity holders from long-term construction, for example, a penalty for late transfer of an object or the right to unilaterally withdraw from the contract if there is a delay of more than two months. However, in conditions of unstable financial position of the developer, these protection measures may be ineffective.

Area change risk

and room configurations during construction. It often happens that the share participation agreement agrees on the same conditions regarding the area and configuration of the premises, but in the end what happens is what happens. In such cases, you can sue the developer, demand compensation, etc., but the main goal of the transaction - getting a new dream apartment - may never come true.

Risk of poor quality finishing

. Often renovated apartments are purchased on the primary real estate market. But the quality of the finish is often far from what the sales manager promised. The courts are considering quite a lot of cases involving claims for a reduction in the contract price due to poor-quality repairs of the apartment received under the DDU.

The risk of a poorly built house

. Surely many have seen frightening videos on social networks of how façade materials fall off in pieces from a new house directly onto passing residents or parked cars. Often on the forums of real estate investors you can see stories of how the heating and plumbing systems fail, and the whole house literally floods. These are the risks of buying real estate that does not yet exist.

Risk of non-receipt of promised infrastructure facilities

. Often selling a new residential complex and launching active sales, developers paint magical pictures of the residential complex - their own pond, running tracks, equipped areas for pets, and no problems with parking. Don't take my word for it. Always study project documentation. Has the developer really committed to implementing all this?

Risks of purchasing an apartment under an assignment agreement

. All of the listed risks are more relevant when the construction stage is still in its early stages and it is impossible to accurately assess what will happen in the end. However, an apartment on the primary market can also be purchased at the final stages of construction. For example, everything has already been actually built and the permit for commissioning is being processed. In such cases, apartments are most often sold not directly from the developer, but from affiliates under agreements for the assignment of rights of claim. When purchasing an apartment by assignment, be sure to check all the documents, and also request primary documents confirming that the seller has paid the entire cost of the original DDU.

Endless repairs.

“The disadvantages of primary testing also include repairs and noise from them that continue for several years after the house is put into operation, possible accidents with floods due to the replacement of pipes and radiators, identification of construction flaws (for example, freezing of monolithic houses due to violations in the installation of insulation) “says

Alexander Tsyganov, head of the Department of Housing Mortgage Lending at the Financial University under the Government of Russia

.

The risk of becoming a defrauded shareholder

. “It is not uncommon for a developer to fail to implement a project and go into bankruptcy. This is a long and nervous process for shareholders. You need to be included in the register for the transfer of residential premises as part of a bankruptcy case, prove your right to receive compensation or an apartment, wait for the appointment of a new developer, etc.,” says Lyudmila Shadrina.

According to Sales Director of Ingrad Group of Companies Konstantin Tyulenev

, after the industry switches to escrow financing, this risk is reduced. However, there are still players on the market working according to the old scheme. “At the same time, it is important for shareholders to take into account that escrow is still not a 100% guarantee of protecting funds,” the expert warns. – In the event of bankruptcy of the developer’s escrow agent bank, the maximum amount that clients will receive from the Deposit Insurance Agency (DIA) is 10 million rubles. While this amount is sufficient for the regions, for Moscow and St. Petersburg it is not. Here, a significant part of the housing is sold at a higher price. Accordingly, clients will lose funds that go beyond the maximum DIA payment.”

“If the developer goes bankrupt, the bank will return to you only the funds that you deposited into the account. The bank does not accrue interest on funds placed in escrow accounts. This means that you will lose at least due to inflation. Another feature of escrow is that if the developer goes bankrupt, only the body of the loan is returned to you. No one will compensate for the mortgage interest paid over the entire period,” says the expert.

Risks

In general, equity participation in construction is a process that, despite all the attractive aspects and legal “purity,” is associated with a number of risks. The main ones are the high difficulty of predicting the completion date of house construction, the possibility of bankruptcy of the developer, and the emergence of social and economic changes within the state.

There is only one point that attracts attention: if the construction goes without problems, you can get an expensive and legally “clean” property.

Advantages of resale

Secondary housing, according to lawyer Elena Larina

, has a number of advantages over the primary one. Here they are:

It's ready to move

immediately after purchase. There is no need to wait for years for the facility to be put into operation, handing over the keys, or fear for the possible bankruptcy of the developer.

There's more of him

and it is in any city and any area. Despite the fact that developers are now more active than ever, there will always be more secondary housing, and therefore the choice is much more diverse. For example, in the center of Moscow there are practically no new buildings, but there is always a lot of secondary housing in any area you are interested in. Well developed infrastructure. This factor always depends on the area, but in most cases, when buying housing on the secondary market, you find yourself in a populated area with shops, schools, kindergartens, clinics, and so on.

Neighbors don't do repairs.

For 1.5 years after the commissioning of a new building, apartments in it are not subject to the rules prohibiting repairs on weekends and during certain periods on weekdays. This was done due to the fact that most new buildings rent out apartments without finishing and in order to take advantage of them, all buyers are forced to bring them to a habitable condition. By purchasing an apartment in a secondary stock, you greatly reduce the likelihood of being surrounded by renovation work on all sides.

The condition of the house and apartment is obvious

. “Resale presupposes a house in which massive renovations have already been completed, and the main structural problems have either been overcome or are immediately visible,” says Alexander Tsyganov. This means that you have much less risk of buying a “pig in a poke”. You can immediately evaluate the advantages and disadvantages of a house, apartment, and local area. Therefore, you make an informed purchase, and do not shell out a round sum under the influence of advertising brochures, as often happens with primary products.

What is primary housing

Primary real estate is objects for which ownership is being formalized for the first time. Accordingly, the primary real estate market is residential and non-residential premises under construction or just commissioned new buildings, which are sold by construction companies through their own property These sales offices or intermediaries.

Interesting! An apartment in a new building can also be a secondary property. For example, if it is not being sold by the developer, but by a shareholder who has already received ownership rights. At the same time, the housing itself could not be used for its intended purpose.

In general, the primary housing market is a set of transactions for the sale of newly created objects - apartments in new buildings, as well as privatized objects that were previously not sold received state registration. Through the primary market, real estate enters economic circulation.

In addition to developers and their representatives, the sale of primary real estate is carried out by federal, territorial, and local executive authorities.

Advantages and features of primary real estate

Advantages:

???? Several options for payment for purchases - new buildings are sold in installments, mortgages, credit conditions from developers differ favorably from bank offers. In addition, you can buy ready-made housing after putting the house into operation, or save up to 30% and invest money at the construction stage.

???? High quality - when constructing new houses, they use modern materials and technologies, and are guided by new standards when developing the project. New buildings have higher thermal insulation rates, new wiring, ventilation systems, each apartment has an individual heat supply system, there are no walk-through rooms, and everything The rooms are more spacious. The number of parking spaces depends on the number of apartments; it is possible to buy and reserve your own parking space.

???? Low costs for maintaining the facility. The finishing of the housing and communications are new, so they will last 10-15 years without repair or replacement. Houses are additionally insulated already at the construction stage, so heat loss from the premises and heating costs are less.

???? Less costs for completing a transaction. There is no need to pay realtors - many developers sell through their own sales centers or pay for the services of intermediaries themselves.

???? Pure sale - no owners who can challenge the deal. Only the reputation and documents of the developer require verification.

???? A profitable investment. Over time, due to the development of the area, the cost of an apartment may increase.

Features:

???? In terms of price - if you compare new buildings and resale buildings in the same area and with an equal number of rooms, the average cost of apartments in new buildings will be 20% higher due to the larger area, hundred properties of 1 m2 and more demand for new real estate.

???? By location - due to dense buildings and the high cost of land plots in the central and developed areas of the city, developers more often use vacant land for construction territories on the outskirts, where infrastructure and transport are less developed. The exception is large residential complexes - in addition to multi-apartment buildings, their projects include kindergartens, sports complexes, shops, beauty salons. In addition, construction companies approve in advance new public transport routes and stops within walking distance of the complex.

???? With shared participation - if you invest money at the stage of construction of primary housing, there is a risk that the construction documents and land plot were not prepared That's right. Because of such errors, it is impossible to put the object into operation or connect it to the central water supply and sewerage system, which means it is impossible to live in the house. Another category of risks is delays or freezing of construction due to underfunding or fraudulent actions of the developer. To avoid becoming a victim of unscrupulous companies, experts advise buying with a mortgage. When developing a credit program, banks independently check the documents and reputation of the construction company.

Interesting! In Russia, when purchasing a new building, you must pay the entire amount in installment before completion of construction or in an even shorter period. In many European countries, there is another settlement scheme in place that protects the shareholder from possible delays and loss of invested funds. For example, in Spain, to reserve an apartment in a building under construction, it is enough to deposit about 5 thousand euros, another 30% of the cost must be paid when signing an agreement with the developer, and the remainder is after the house is put into operation.

Features of pricing

The cost of 1 m2 in the primary market depends on the location of the house and the class of housing - economy, business or standard. The price includes the costs of purchasing the site, materials and construction, as well as the company’s profit. The total cost of the apartment depends on the area and additional services: the buyer can order a clean fit-out of the premises or a turnkey renovation from the developer.

The minimum cost of new housing is determined by construction costs: if the selling price is lower than the costs, the company will incur losses. In the primary market, sharp changes in supply and demand are less often observed for several reasons:

???? new real estate is in great demand;

???? The construction process involves a number of organizations that are interested in the implementation of their markets, for example, contractors, so it is impossible to stop the construction process at one point zhno;

???? It is impossible to quickly increase supply - project development and construction of real estate takes from one to several years.

In general, to choose which home is best to buy, evaluate the offers on the market and your capabilities. The cost of primary real estate is higher, but you can get a mortgage, buy in installments or get a discount by investing money at the construction stage. If you have a certain amount, you can buy a resale apartment of different quality and move in immediately.

Disadvantages of old housing stock

Of course, the secondary product also has a lot of disadvantages. Here's what lawyer Elena Larina says:

Old house, same communications

and outdated layouts. If you buy an apartment in a building that is older than 10-15 years, then breakdowns occur more and more often. Either the elevator doesn’t work, or the taps are leaking. Most likely, renovations to the apartment will have to be done in the first 1-3 years after purchase. At the same time, the layouts are very different from modern ones: they have much less space and often there is no possibility for redevelopment (especially in panel houses).

The need for thorough due diligence

object (pledges, challenging ownership in court) and the owner (especially for bankruptcy).

Higher mortgage rates

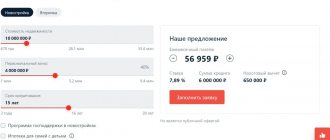

. Especially after the introduction of preferential mortgages for primary homes, the difference in percentage is felt. On average 4-6% for primary, 7-7.5% for secondary.

"Alien Spirit"

and the presence of a history with the apartment, which not all potential buyers are willing to put up with.

Condition of common areas.

“Often the problem is also the condition of the common premises and the heterogeneous population of residents,” says Alexander Tsyganov.

Advantages of primary housing

- New area with new roads.

- Apartments with an open plan - you can put walls where it suits you without any approval.

- Neighbors are about the same age and social status, their children are future friends.

- New house with new communications.

- When purchasing at an early stage of construction, significant savings on the price of the apartment are possible.

- Relative environmental cleanliness compared to the city center.

- Freedom of choice - in the early stages of construction, you can choose an apartment to suit any requirements: floor, area, layout, orientation to the cardinal points.

- Legal cleanliness of housing - no unpleasant surprises in the form of old residents returning from prison.

Price issues, or All new buildings will become secondary

And yet, often the main question when choosing an apartment is its price. “If you buy an apartment in a new building that is not at the excavation stage, it is very expensive,” says the owner of the construction company Maxim Lazovsky

. – Otherwise, you need money for both a mortgage and rented housing. For example, for the same conditional 7,000,000 rubles, you can find many options in the secondary market within the city, but among the primary housing it will be either studio apartments or apartments with poor infrastructure, views of the Moscow Ring Road or daily traffic jams. Unless, of course, you buy a new building at the foundation pit stage.”

But, as the expert reminds, a large number of preferential programs now apply to the primary market, but there are none on the secondary market. Mortgage rates here directly depend only on the key rate of the Central Bank.

“Primary housing is an option for a young family that is eligible for benefits, mortgage holders and investors. Resale is a “here and now” solution for quick move-in or in the absence of the necessary funds. And also - if an area where there are no new buildings or they are shamelessly expensive is important to you,” says Maxim Lazovsky

“The choice of a resale property is indeed often associated with attachment to certain places, the need to quickly move, and in some cases save a little,” says Alexander Tsyganov. “After all, in any case, all new buildings will quickly and certainly become secondary.”

Marcel Akhmetshin, general director of the real estate agency “HOMEWAY”, says

:

“In my opinion, if you need an apartment for living, then it is better to focus on the secondary market. When buying a ready-made apartment, upon inspection you yourself will be able to evaluate the quality of the house, learn about your future neighbors, and see the atmosphere in the entrance and in the yard. And the most important thing is that you can start using the apartment immediately after purchase. By investing money in a new building, you are buying an image of a future apartment, drawn for you by specialists from the developer’s sales department.”

According to the expert, they will, without a doubt, paint you a cloudless picture, keeping silent about the possible delay in delivery deadlines, about the quality of the apartments being rented, about problems with repairs, about possible quirky neighbors, about the noise in the house in the first years due to renovations carried out by neighbors, about shrinkage of the house, about large payments for utilities, because the management company is often imposed by the developer. And also that in new buildings there are problems with elevators, the Internet and even mobile communications. And another thing is that if you buy a new building without renovation, then its area will change after renovation. So in a three-room apartment with an area of 75 sq. m., purchased in a new building without erected walls, after renovation the total area of the premises may be reduced to 70 square meters. m. And you paid the developer for 75 sq. m. m., and your losses can range from 5 to 10% of the paid area.

“If we compare the cost of apartments in Moscow between the secondary market and new buildings, then the secondary market wins,” says Marcel Akhmetshin. – Due to the introduction of escrow accounts, it has become less profitable to buy new buildings at the initial stage of construction. For the same money, you can buy an apartment on the secondary market and start using it immediately: live in it or rent it out under a rental agreement. At the same time, the dynamics of growth in the cost of apartments in new buildings and the secondary market are usually the same. To summarize the above, today it is more profitable to buy an apartment on the secondary market, both for living and for investment.”

New buildings, according to the expert, are profitable to buy from the developer only during the period of special promotions with significant discounts or in houses with a high degree of readiness, upon assignment of the DDU from investors who previously invested in the construction (as a rule, their prices are cheaper than those of the developer).

This is what Dmitry Shchegelsky, general director of the BENOIS real estate agency, president of the St. Petersburg Chamber of Real Estate, told a MIR 24 correspondent:

“For comparison, I will give two real cases of investment in primary and secondary. One investor bought a studio apartment of 24 square meters for 2.5 million rubles at the excavation stage in the Nevsky district of St. Petersburg in November 2021. To get the maximum discount, he paid the developer the entire amount at once. I waited not only for the house to be delivered, but also for the documents on ownership of the new apartment. In November 2021, the investor put the apartment up for sale and, due to the rush of demand, sold this studio for 3.8 million rubles. The investor’s income amounted to 1.3 million rubles or 52 percent of the initial investment.”

“Another buyer, also in November 2021, in the Nevsky district of St. Petersburg, in a Soviet-built panel house, bought a one-room apartment of 40 sq.m. for 3.5 million rubles. in satisfactory condition for living. He immediately rented out this one-room apartment with an average income of 190 thousand rubles per year. This is the amount taking into account downtime in finding employers and coronavirus non-payments in 2021. For 3 years, his rental income amounted to 570 thousand rubles. Plus, over three years, the apartment’s price has increased to 4.5 million rubles. The total income of the second investor amounted to 1 million 570 thousand rubles or 45 percent of the initial investment. It turns out that the one who bought an apartment on the secondary market did not lose much from his investment to the one who bought an apartment in a new building. At the same time, the liquidity of investments for the second investor is many times higher, because in case of problems with a construction site, it is more difficult to sell an apartment there than an apartment on the secondary market,” says Shchegelsky.

Move-in dates

Everything is clear with pie in the sky: you will have to wait a couple of years for a budget apartment under construction, worrying about a successful outcome. And you also need to add time for repairs: the cheapest apartments are rented in such a “rough” version that you won’t be able to move in and live right away.

- You can buy a new and expensive apartment a couple of months before the house is put into commission.

- An old, cheap "resale" property is usually suitable for housing immediately after the transaction.

- Time is the same as money: everyone chooses for themselves the most necessary embodiment of it.

The question is “primary” or “secondary”? — awakens passions no less than Hamlet’s classic “To be or not to be?” And each time each buyer is forced to answer it independently.

The most important thing is liquidity

According to the head of the architectural bureau "MAD Architects" Maria Nikolaeva

, when choosing an apartment, its future liquidity is much more important than belonging to the primary or secondary market. “The appearance of a preferential mortgage instrument on the market has led to a return to the trend of purchasing budget housing in standard-class residential complexes in Moscow and St. Petersburg,” says the expert. – Previously, sales were so strongly heated only during the initial spontaneous growth of the market. Today, when buying a home, people seek to preserve their savings during periods of economic instability.” However, according to Maria Nikolaeva, such assets are not as attractive as they might seem at first glance.”

The fact is that new residential areas sometimes present an environment devoid of comfort. The race to build a large volume of square meters without the necessary attention to apartment design, landscaping, infrastructure, and zoning of the territory can lead to the creation of neighborhoods with a low level of comfort. In the future, many of these objects will lose liquidity.

When talking about choosing apartments for purchase, including during a crisis, you first of all need to remember their potential demand on the market in the future. “In this context, the most attractive for investment is quality housing,” says the expert. “These are lots in houses with a good location and transport accessibility, thoughtful architecture and apartment layout, high-quality common areas and landscaping.”

Today, a situation has arisen where not only the highest quality supply is being washed away from the market, but also the majority of available assets of any format. But in the long term, according to Maria Nikolaeva, budget housing may become a “dead weight.” Therefore, if you have funds, it is always better to buy a high-quality asset, the liquidity of which will increase.