Prepayment for an apartment is a kind of confirmation of the seriousness of the buyer’s intentions. The essence of prepayment is to fix the agreements between the parties to the transaction. After the Buyer transfers money to the Seller, the apartment is considered “reserved” for him. From this moment on, the Seller should not show the apartment to other applicants. Ideally, the advertisement for the sale of such an apartment should be removed.

You can agree on the “reserve” of an apartment either in writing or orally.

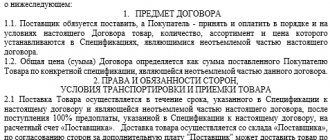

Prepayment for an apartment can be made as a deposit, advance payment or security deposit. Sometimes the Buyer is asked to make an advance payment to an agency acting on behalf and in the interests of the Seller. In the latter case, it is important to study in detail the document that the Buyer is offered to sign. There are often cases when an agency takes a so-called fee for its services, which consist only of assistance in concluding a purchase and sale agreement and does not bear any responsibility if the transaction does not take place.

Making a deposit imposes certain obligations on the parties to the transaction. That is, in addition to the function of prepayment, this payment performs the function of securing the contract.

If a transaction for which a deposit was made is canceled due to the fault of the Buyer, the funds remain with the Seller. If the Seller is the reason for the failed contractual relationship, the deposit is returned to the Buyer in double amount. This means that the deposit is more beneficial to the Buyer.

The deposit agreement is made exclusively in writing. This norm is enshrined in Art. 380 Civil Code of the Russian Federation.

The advance is beneficial to the Seller. The buyer in this situation risks not only personal time, but also money. A clear example of such a risk: The buyer has made an advance payment and is already preparing the documents. At the same time, a new Buyer approaches the Seller, who outbids the price upward. The Owner agrees to a new transaction and returns the advance payment to the previous Buyer. As a result, the owner loses nothing (except for reputation).

A deposit is mutual control, which implies the financial responsibility of the parties to each other. That is why the Buyer should insist on this particular method of ensuring contractual relations. Property owners who cooperate with realtors, in most cases, want to receive an advance payment from the Buyer. In addition, in such situations, the advance payment is fixed in the form of a written agreement, which stipulates additional penalties for the buyer.

The essence of the penalties is that if the Buyer refuses the transaction, the funds that were paid as an advance will not be returned to him. That is, in this case, the amount of money transferred to the Seller is a security payment.

In practice, most often an advance payment is made as an advance payment. However, the agreement stipulates additional obligations for both parties.

Advance payment period for the apartment

The advance period is the time interval between the date of payment of the advance and the moment of conclusion of the transaction (signing of the purchase and sale agreement).

For how long should the advance payment be made? The parties must resolve this issue individually.

The timing depends on the readiness of the apartment for sale, as well as on the speed of paperwork. If the Buyer has the required amount of money on hand, and the Seller has all the documentation ready, the advance payment period can be two weeks. It’s another matter if the Buyer plans to purchase an apartment using mortgage funds. In this situation, even a month may not be enough.

It is in the interests of the Buyer to prescribe longer periods. Therefore, even if at first glance it seems that two weeks is enough for registration, there is no need to rush - it is better to indicate the deadline with a margin. This is because if the Buyer does not sign the sales contract within the stipulated time, he will lose the entire down payment amount.

In an alternative transaction, the Buyer must make sure that the Seller will have time to find a suitable option within the agreed period. If an “alternative” is not found, the deal may fall through.

Ideally, the Seller should find several suitable apartments before receiving an advance.

Advance with return

Realtors and sales consultants themselves advise the buyer, to be sure that the product he likes will not “go away,” to conclude a preliminary purchase and sale agreement and pay a certain amount as a deposit. What if in the end the purchase did not take place? Problems with the return of deposits, according to judicial statistics, are a very common topic of controversy.

Therefore, the explanation of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation about who, to whom, when and on the basis of what laws should return the deposit for a failed acquisition can help many current and future buyers.

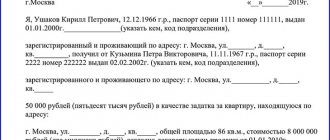

In our case, in 2021, a resident of the Moscow region approached the city court with a claim against a certain citizen for the return of money. The lawsuit calls the amount—almost $162,000—“unjust enrichment.” In addition, the plaintiff also asked for interest on the use of this money for seven years. Here it turned out to be more than 82 thousand dollars.

The history of the claim is as follows. One citizen decided to buy part of a residential building from its owner. The seller and buyer entered into a preliminary agreement. This agreement stated that citizens assumed the obligation to conclude a full-fledged purchase and sale agreement within a year from the date of signing the preliminary agreement. “In fulfillment of its obligations,” the plaintiff paid the defendant almost 162 thousand dollars. But the purchase of the home never took place, the preliminary agreement was terminated, but the seller did not return the deposit.

In the city court, the owner of the unsold property explained his refusal to return the money simply: the statute of limitations (three years) for such a claim had passed. In general, earlier it was necessary to demand money, but now time is lost. But the court satisfied the claims of the failed buyer. The regional court agreed with this decision, although it reduced the amount of interest collected by almost half.

The defendant did not agree with this decision and went further and higher - to the Supreme Court of the Russian Federation. There, the case was requested, studied and all decisions taken on the dispute about the return of the deposit were canceled. According to the Supreme Court, local courts “committed violations.”

From the case materials it is clear that the parties signed the preliminary purchase and sale agreement back in 2010. And during 2011 they had to sign the main agreement. Part of the house for sale was valued at $192,000. According to the preliminary agreement, the buyer paid the equivalent of 162 thousand dollars.

The first instance decided: since the obligations under the preliminary agreement were not fulfilled and the main agreement was never signed, then the deposit must be returned. The appeal, reducing the interest for “using someone else’s money,” considered: since the citizen filed a claim in 2016, he should only be refunded the interest for the previous three years.

The Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation stated that it does not agree with such decisions.

And that's why. According to the Civil Code (Article 1102), if a person, without legal acts or transactions, acquired property at the expense of another person, who was called the victim, then this property was “unreasonably acquired.” And it must be returned. From the case materials it is clear that the money paid under the preliminary agreement is a deposit.

Article 308 of the Civil Code states that the deposit “is recognized as a sum of money given by one of the contracting parties in payment of payments due to it under the contract and as evidence of the conclusion of the contract to secure its execution.”

The next article of the Civil Code (381) states that if obligations are terminated before the start of execution of the contract by agreement of the parties or if it is impossible to fulfill (Article 416), the deposit must be returned. But if the party who gave the deposit is responsible for the failure to fulfill the contract, then it remains with the one to whom it was given. But in the case where the party who received the deposit is responsible for failure to fulfill the contract, she is obliged to return it in double amount. This is also stated in the agreement that the parties signed.

If the transaction does not take place due to the fault of the buyer, then the deposit will not be returned to him

According to the Supreme Court of the Russian Federation, local courts, when starting to consider the dispute, had to establish who is responsible for the fact that the main purchase and sale agreement was not concluded within the agreed period. For some reason, neither the city nor the regional courts did this.

In addition, the courts of first and appellate instances, in violation of the law, did not evaluate the seller’s arguments and evidence that the main contract was not concluded due to the buyer’s fault. Back in 2011, the home seller sent the buyer a notice that it was necessary to conclude the main contract. But the buyer not only did not react to this, he tried to terminate the preliminary agreement.

As a result, the case regarding the return of the deposit will be reconsidered.

Advance amount for the apartment

The seller will always demand more. In cases where the selling party believes that the advance amount is too small, the Buyer must confidently justify its decision. The law does not establish the exact amount of the advance payment. But in practice it does not exceed 1-2% of the cost of the apartment.

It is important to remember that the Buyer’s intentions are confirmed not by the amount of the advance payment, but by the very fact of making an advance payment.

Similarities and differences between them

The table shows the ratio of deposit and advance payment (general features).

| Similar features | Prepaid expense | Deposit |

| Transfer moment | Before fulfillment of the main obligation | Before fulfillment of the main obligation |

| Accounting for the total amount of the contract | Taken into account | Taken into account |

| Calculation method | Cash | Cash |

There are few similarities, but the difference between an advance and a deposit is significant. This is easily explained by the nature of the payments in question. The difference is not noticeable when the deal is concluded, since the main differences between them are the consequences of failure to fulfill the main obligation.

It is clear what is the difference between an advance, a deposit and an advance payment:

Who should I make an advance payment when buying an apartment?

The advance payment, regardless of its type, is transferred only to the owner of the apartment. This means that before transferring the agreed amount of money to the counterparty, it is necessary to make sure that he is the owner of this property.

In order to find out who owns the ownership of an apartment, it is worth ordering an Extract from the Unified State Register of Real Estate (USRN). Next, you should check the data from the extract with the Seller’s passport data.

Only after the information has been verified, the Buyer can sign a preliminary purchase and sale agreement, a deposit agreement with the Seller and transfer money to him.

It often happens that several people are the owners of an apartment. In such a situation, the deposit agreement is signed by all the people indicated in the extract from the Unified State Register of Real Estate.

If one of the owners is a person under 14 years of age, parents or legal representatives will act in his interests. This means that a minor child may not be present when the transaction is completed and when the advance payment is transferred.

It is also possible for all owners to delegate the authority to sell the apartment to one person. With this option, a power of attorney must be issued to him on behalf of the remaining co-owners.

There are often cases when a realtor is involved in the sale of an apartment. Is it possible to give him an advance payment? Can. However, in such a situation, you need to make sure that the real estate agent has a power of attorney not only to represent interests, but also to receive funds.

The Realtor to whom the advance payment is transferred must provide the Buyer with an agency agreement with the owner of the apartment. The buyer needs to carefully study the terms of the preliminary contract, which are often imposed by agencies.

What else does the Buyer need to do when transferring money to the realtor:

- Check the agent's passport details.

- Write them down in the text of the deposit agreement.

- Keep a copy of the agency agreement with the owner (this document will be proof of the transfer of money to an outsider).

You should not count on the fact that if the transaction fails due to the fault of the Seller or realtor, the real estate agency will bear financial responsibility to the Buyer. The maximum you can claim is a refund of the advance.

How does a deposit differ from an advance?

Security function of deposit and advance payment

The deposit, in addition to the above payment and evidentiary functions, also performs a security function.

The deposit must be returned only in the event of termination of the secured obligation before the start of its performance by agreement of the parties or due to the impossibility of performance (Article 416 of the Civil Code of the Russian Federation).

Unlike a deposit, an advance does not perform a security function - regardless of the reasons for failure to fulfill obligations, the party who received the corresponding amount is obliged to return it.

Purpose of the deposit and advance payment

The main purpose of the deposit is to prevent non-fulfillment of the contract (Article 329 of the Civil Code of the Russian Federation). After all, the negative consequences of violating the obligation secured by the deposit are the loss of the deposit or its return in double amount. These financial consequences encourage civil society participants to behave in good faith.

Such a goal is not pursued when making an advance payment, the payment of which occurs for the main purpose - prepayment of goods, services, or work.

Therefore, if a dispute arises, it is necessary to establish whether the parties to the contract pursued precisely the goal of ensuring the fulfillment of a contractual obligation by issuing a sum of money and accepting it.

Changes to prepayment

On July 1, 2021, amendments to the law on the contract system, introduced by Federal Law 124-FZ of April 24, 2021, came into force, which simplified the government procurement procedure for enterprises and changed the procedure for conducting them. If the advance is provided with treasury support, the OIC is calculated based on the initial maximum contract price (IMCP). In this case, the NMCC is reduced by the amount of the advance.

According to the new rules in bidding for small and medium-sized businesses, the contract price in the case of an advance payment is reduced by the amount of the advance payment (clause 1, part 1, article 30 of Federal Law No. 44-FZ).

In addition, innovations made it possible to change the essential condition on advance payment of work. In its letter dated May 19, 2020 No. 09-04-05/41434, the Ministry of Finance explained in what cases this is permitted.

To change the conditions of advance payment, the following conditions must be simultaneously met:

- the new advance amount should not exceed the maximum limit established by law for this type of work;

- the advance payment condition is specified in the text of the contract;

- changes in the conditions of advance payment occur at the initiative of the contractor, adjustments are agreed upon with the customer.

How advances under 44-FZ are regulated by law

The customer sets the condition for advance payment of the contract at his own discretion - advance payment is not a mandatory part of the contract, the law allows you to decide on this issue yourself.

If an advance payment was provided for in the contract, the customer is obliged to transfer it to the supplier.

In accordance with Art. 487, 711, 781 of the Civil Code of the Russian Federation, prepayment is paid in full or in parts. The advance amount can range from 50 to 100 percent of the NMCC. When paying a full advance, the customer makes 100% prepayment under 44-FZ before the supplier begins to fulfill the agreements under the contract. If the prepayment is partial, the contractor receives the first payment from the customer before fulfilling contractual obligations, and the last payment after he has successfully fulfilled all the terms of the contract under 44-FZ (delivery of goods, performance of work, provision of services).