Mortgage refinancing from 7.65%

Tired of overpaying? Refinance!

additional amount for personal needs

Up to 90% of the value of the collateral real estate

To learn more

The law says that you can reissue a mortgage with the consent of the bank to a relative or third party. Financial institutions do not receive any benefits from this procedure, but are willing to accommodate clients halfway.

The process is regulated by Article 77 of the Federal Law “On Mortgage”. The bank can approve two types of transactions:

- re-issuing a loan to another person;

- refinancing, in which a loan is issued to a new financial institution.

If the mortgage is reissued as part of the divorce process, the Family Code and the interests of both spouses and children are also taken into account.

Grounds for re-registration of property

Before we talk about re-registration of property, let us establish what ownership means. Civil legislation defines this as the right to use, as well as own and dispose of property. Thus, a person can do whatever he wants with his property - sell, donate, exchange, or even destroy, of course, if this does not cause damage to surrounding people and nature. Section 2 of the Civil Code (hereinafter referred to as the Civil Code of the Russian Federation) is devoted to this right.

Based on the provisions of the mentioned law, re-registration of ownership is nothing more than the transfer to another person of the right to dispose, own, use real estate or other property.

You may be interested in: what are the features of registering ownership of an apartment.

Sometimes it is enough to simply transfer the item to the new owner, and sometimes it is necessary to additionally draw up a written agreement. The latter is relevant for the transfer of ownership of an apartment. Based on the Civil Code of the Russian Federation, the Housing Code, laws regulating property relations, as well as the practice of lawyers, there are five ways to transfer an apartment to another person:

- Purchase and sale - the owner transfers the apartment to another person for a fee (Articles 549 - 558 of the Civil Code of the Russian Federation).

- Donation is a gratuitous transfer of property (Articles 572 – 582).

- Rent - a person undertakes obligations for the care and maintenance of the owner of the apartment or pays a certain amount during the period established by the agreement, and as a result receives it into ownership after the expiration of a certain time or the death of the owner (Articles 589 - 605).

- Exchange - in such a transaction, owners exchange property among themselves (Articles 567 - 571).

- Will - with this method, the apartment is transferred to the new owner after the death of the former owner and inheritance on the basis of a written order certified by a notary or a person specified in the law (Articles 1110 to 1175 of the Civil Code).

What to choose from

A purchase and sale agreement is not the best option. The only advantage of such a deal is the speed of registration.

Important! It will not be possible to obtain a tax deduction when documents are drawn up between close relatives. Therefore, it makes sense to pay attention to other methods.

If the apartment has been owned for less than three years, then you will also have to pay tax. A purchase and sale agreement is most often just a way to transfer property. In reality, relatives do not pay each other anything, so there is a basis for recognizing the agreement as void. And such consequences are undesirable for both parties.

There are two more alternative options for transferring housing to a relative: donation and will.

Re-registration procedure

Documents required for re-registration of an apartment:

- Passport;

- a document confirming the emergence of ownership rights (DCT, rent agreement, etc.);

- consent of the spouse, confirmed by a notary.

To re-register, you need to submit these documents to Rosreestr and write a corresponding application. Order of the Ministry of Economic Development of Russia dated November 26, 2015 No. 883 established that the collected package can be sent by Russian Post, through a representative, the online portal of State Services or the website of Rosreestr, MFC, or submitted in person to the branch of the registration authority. The applicant also needs to pay a state fee - 2,000 rubles.

After submitting the application, within 12 days the specialist will make a decision on registration or refusal (for example, due to an error in the execution of the contract), which can be appealed in court.

Thus, to re-register an apartment, it is necessary not only to draw up a written agreement, but also to prepare a package of documents and register the acquired property. Below we will look step by step at re-registering an apartment in different ways.

There is nothing complicated in the instructions provided, however, certain knowledge is required so that all actions and executed documents have legal force.

Alternative options

There are also alternative options for transferring real estate. You can apply for an annuity, provided that the elderly person needs care. Indeed, in life it often happens that relatives take care of a grandmother or grandfather, and after receiving real estate as a gift, they stop doing this. In this case, a life annuity is a more suitable option.

If the spouses are divorced, then an agreement on the division of property will do.

Purchase and sale

You can sell an apartment to absolutely any person or organization. To find a buyer, you can place an ad online or contact a real estate agent. Next, we presented instructions for independently conducting a transaction for a private apartment.

Step 1. Appraisal of the apartment.

Since the apartment lease transaction is of a paid nature, it is necessary to realistically assess its value. When selling, you can rely on the results of a cadastral valuation, but they do not always satisfy the owners or buyers of real estate. Therefore, it is worth contacting specialists to conduct an independent assessment of the apartment and determine its market value specifically for the period of sale.

Don't agree with the cadastral value of your property? Fill out the form to the right and our highly qualified attorney will tell you how to challenge the results of a government assessment.

Step 2. Prepare documents.

When buying an apartment with a registered child, the new owner takes on a big risk. Since he will not be able to discharge him without providing similar housing.

These documents are collected directly by the owner. The future owner should carefully study all the documents, and pay special attention to the USRN extract.

The buyer will only need a passport and the consent of the spouse.

Step 3. Draw up a policy statement.

This agreement is drawn up in simple written form, but in compliance with certain requirements. He contains:

- details of the seller, buyer;

- information about the apartment: address, location in the house, area, number of rooms;

- transaction price;

- payment method (cash, non-cash);

- payment method (one-time payment, installments);

- conditions for re-registration of ownership (after payment of the entire amount, after the first installment);

- rights, obligations of the parties to the contract;

- liability for breach of contract;

- additional conditions.

It is also necessary to draw up a transfer deed, which will be an annex to the agreement.

For the agreement, you will additionally need the buyer’s passport and the consent of the spouse (if he has one).

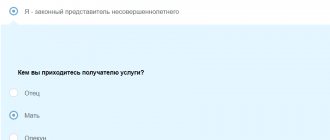

You can draw up this agreement yourself; notarized confirmation is not required, except in cases where one of the parties to the transaction is a minor child, incapacitated, the documents will be sent by mail, or when a share in the apartment is being sold.

Step 4. Register ownership.

Possible risks

There is a risk that other applicants will be able to challenge the deed of gift. This scenario is possible if the plaintiff proves that the transaction was made with the aim of depriving the obligatory heirs of the share due to them.

A will can also be contested. The reason for challenging will be violation of the order of registration or drawing up of a document under pressure from other persons.

Donation

You can transfer an apartment under a gift agreement to any persons, in particular, those who are not relatives. The deed of gift is gratuitous, so a real estate appraisal is not required; you can start immediately by preparing the necessary papers.

Step 1. Prepare documents.

To draw up a deed of gift, you will need the same list of papers as for the DCT.

Step 2. Draw up a deed of gift.

This act of will must be drawn up only in writing. There are no special requirements for the structure. But the deed of gift must contain:

- details of the parties;

- information about the apartment;

- rights, obligations of the donor and the donee;

- liability for breach of contract.

The need for notarization arises in the same situations as with DCT.

Step 3. Rewrite the apartment.

When does it become necessary to transfer a mortgage to another person?

Let's take a closer look at the reasons for changing the borrower and how the loan is transferred in various cases:

- Deterioration of material condition. The financial situation in a family can change for the better or for the worse over the course of several years. In the latter case, the bank will offer loan refinancing in order to reduce the burden on the family budget by extending the loan term. You can also renew the loan agreement with a solvent relative.

- Change of marital status. The need to reissue a mortgage loan arises in connection with a divorce and the need to transfer loan obligations to one of the spouses. The bank will approve the transaction if the applicant confirms financial solvency.

- Change of credit institution. If you find a more profitable program with a comfortable payment schedule, you can reissue the mortgage even without the bank’s consent. The borrower enters into another agreement and repays the old loan. How beneficial such a change will be needs to be considered. When re-registering, they may charge a commission for the transaction itself and insurance.

- Death of the borrower. In this situation, the deceased is excluded from the transaction, and his credit obligations are transferred to the heir of the property. In some cases, a court decision is required to determine which party will receive the inheritance.

Rent

The legislation allows for the transfer of ownership under a rent agreement for a fee or free of charge. In the first option, the agreement specifies a condition for the periodic transfer of funds to the owner during his life (lifetime annuity) or indefinitely (permanent). And in the second there is a condition on the provision of services and the fulfillment of certain obligations - lifelong maintenance with dependents.

Does the rent recipient continue to live in the re-registered apartment? Write to our legal adviser by filling out the form on the right, and he will definitely help you solve the problem.

If the agreement contains a condition for payment, then the rules of the monetary contract apply to it, and if the transfer of property is free, the gift agreement applies. However, annuity is not one of these contracts.

You may be interested in the apartment rental agreement and its features.

Step 1. Prepare documents.

The package of documents for an annuity agreement does not differ from the DCP.

Step 2. Draw up an agreement.

The rent must also be drawn up only in writing and must be certified by a notary. Otherwise, the agreement will not have legal force. It includes:

- data of the parties;

- information about the apartment;

- rights, duties, responsibilities;

- additional conditions.

Step 3. Rewrite the apartment.

Basic moments

At first it may seem that transferring the apartment by deed of gift is the most suitable option.

But not everything is so simple. You may also have to pay tax on the deed of gift. Only close relatives are exempt from obligations. The rest of the citizens will have to share money with the state. Therefore, in 2021, the solution to the issue depends on the costs associated with completing the transaction.

Exchange

In practice, apartment exchanges often occur within the same city, region or even country. It can be either without additional payment or with additional payment.

Step 1. Prepare documents.

For exchange, both parties to the transaction collect a package of documents for each subject of the contract, as in the case of purchase and sale.

Step 2. Draw up an agreement.

The peculiarity of this agreement is that the parties to the transaction act as a seller and a buyer at the same time. The agreement contains the same conditions as the above agreements. Notarization is not necessary; the contract can be certified at the request of the parties.

Step 3. Rewrite the apartment.

How to renew a mortgage: requirements, collecting documents, submitting an application

Each bank has a list of requirements for a new borrower and restrictions on transferring a home loan. In general terms, the criteria look like this:

- age within 21-65 years;

- Russian citizenship;

- having a permanent job and stable income;

- temporary or permanent registration in the city where the bank operates;

- full legal capacity;

- sufficient solvency.

In each case, the bank individually decides whether the mortgage can be reissued to another borrower, based on its compliance with general and its own internal requirements. The lending institution has the right to refuse a candidate if at least one criterion is not met.

The list of documents that will be needed to transfer the loan includes:

- Russian passport;

- work book or contract;

- income certificate;

- application form.

You may also need documents about marital status, SNILS, TIN of the new borrower, a foreign passport, information about the availability of property, and a military ID.

The borrower who transfers loan obligations must provide only an application and a passport.

How to renew a mortgage - step by step:

- contact the bank and explain the reasons for the decision - after familiarizing yourself with the situation, the credit institution will provide advice and offer options for action;

- collect and prepare documents - the new borrower deals with the necessary paperwork for obtaining a loan;

- continue to make mortgage payments while the bank reviews the application to avoid default;

- obtain a report from an independent appraiser - the credit institution may ask the new borrower to prepare a report;

- wait for the application to change the client to be submitted to the Credit Committee;

- execute a transaction for the transfer of loan obligations.

At the final stage, the previous owner writes an application for early repayment of debt using a loan from a new client, after which he receives a statement confirming the closure of the loan and the absence of debt to the bank. The credit institution enters into a mortgage agreement with the new borrower, which specifies the payment schedule and other conditions. The fact of mortgage of housing must be registered with the Registration Chamber or the MFC.

The process can take anywhere from 2 to 8 weeks, just like applying for a regular mortgage.

Will

The peculiarity of a testamentary disposition is that it comes into force only after the death of the owner. It also has an advantage over inheritance by law.

Step 1. Prepare documents.

To draw up a will, it is enough for the owner of the apartment to provide a passport and title documents for the apartment.

Step 2. Make a will.

To draw up a will, you must contact a notary or other authorized person. For example, if a person is in a hospital, then the head physician can certify the “last will”.

When receiving an apartment under a will, the heir acts as follows:

- Collects documents.

To receive an inheritance you must provide:

- heir's passport;

- testator's passport;

- original will;

- certificate of ownership in the name of the testator;

- extract from the Unified State Register of Real Estate.

- Presents documents to the notary.

To re-register the apartment in his name, the heir needs to obtain a certificate of inheritance. To do this, the documents indicated above are transferred to the notary for examination.

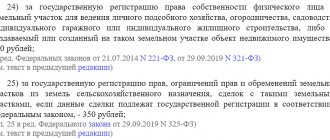

- Pays the state fee.

After reviewing the documents, the heir receives a payment order to pay the state fee. For children, spouse and parents of the testator, the payment amount is 0.3% of the value of the inherited property, and for other categories - 0.6%.

- Receives a certificate.

Having paid the fee, the heir receives a certificate of the right to inheritance - the basis for re-registration of the apartment.

- Registers property rights.

You may also be interested in: how to challenge a will for an apartment.

Summary

The specific option for re-registration of the transferred or received apartment in all cases should be chosen depending on the goals pursued by the parties to the transaction. It is better to come to a decision based on consensus. The maker of the will, and legally this is a one-sided transaction, can ignore the wishes of the heirs and act at his own discretion. In some cases, such a decision may lead to the will being contested in court.

Sources

- https://prokvartiru.com/prodazha/kak-pereoformit-kvartiru

- https://FB.ru/article/283928/pereoformlenie-kvartiryi—poshagovaya-instruktsiya

- https://kvartira3.com/kak-pereoformit-na-drugogo-cheloveka/

- https://pravoved.ru/journal/pereoformlenie-kvartiry-na-drugogo-sobstvennika/

- https://yuristznaet.ru/kvartira/pereoformlenie-kvartiry-na-drugogo-sobstvennika.html

- https://PravoNedv.ru/kvartira/oformlenie/na-drugogo-cheloveka.html

- https://mirzoev.pro/information/sposoby-pereoformleniya-nedvizhimosti-na-drugogo-sobstvennika/

Price

The cost of registration includes:

- state registration fee;

- production of cadastral document;

- notarial services;

- income tax – 13% of the sale agreement amount;

- the purchase price of the apartment - when re-registering rights to oneself.

Notary costs depend on how many services you need. For a simple certification of a power of attorney for a representative, a lot of money will not be required, but the cost of checking the encumbrances of the living space and certifying the agreement is much more expensive.

The price also varies depending on the region where the service is received.

To reduce tax costs when re-registering rights to a relative, you should draw up a gift agreement , and ordering the necessary documents and certificates through the State Services will save up to 30% of the cost of state duty.

How taxation works

Here are some examples:

Example No. 1. Ledentsova I.M. gave her niece an apartment in the Moscow region. The cost of the property is 4,000,000 rubles.

A niece and an aunt are relatives, but they are not close relatives.

Tax calculation: 4,000,000 * 13% = 520,000 rub.

Example No. 2. Starovoitova N.A. gave her two daughters an apartment. The cost of the property is 3,200,000 rubles. The daughters will not have to pay anything to the state budget. After all, mother and daughter are closely related. Therefore, they receive an exemption from paying the fee.

Is it possible to avoid paying the fee?

There are two ways to do this:

- Issue a deed of gift twice to make a gift through a close relative. For example, an uncle wants to give a house to his nephew. To avoid paying a fee, you can first donate housing to your brother. The nephew will receive the house through a deed of gift from his father. Then you won't have to pay tax. But paying the state fee for registering ownership rights will not be avoided.

- Sign a fictitious purchase and sale agreement. You will not have to pay the fee if the citizen has owned the property for more than three years. And under this condition, you can issue a deduction.

In this case, the costs will be even less than with a gift. There are no clear instructions on how to avoid paying the fee. Therefore, people use available methods of tax evasion.