Property tax is calculated taking into account the cadastral value of real estate. Depending on the type of real estate (land, private house, apartment, garage, etc.), there are rules for calculating tax based on the cadastral value.

In this article we will briefly and step-by-step analyze examples of calculating tax based on cadastral value in 2021. To do this, we will consider all the components of the tax calculation formula taking into account the types of real estate.

Do I need to pay tax for a country house?

The institution of taxation is quite developed in the Russian Federation. Citizens are required to bear the burden of paying various taxes by law. Personal property tax is no exception.

All objects owned by a citizen and recorded in the Unified State Register of Real Estate (USRN) are subject to registration.

Contrary to this, there is an opinion among the population that country houses are not subject to property tax for individuals. What causes such a widespread and erroneous judgment?

The fact is that the Federal Tax Service of Russia (hereinafter referred to as the FTS) and its territorial divisions in the regions do not have on their staff people with special expert knowledge who would go to the location of the garden plot and the house located on it to carry out a cadastral valuation of real estate .

This is why citizens can easily hide a built house from tax inspectors.

The Federal Tax Service Inspectorate (IFTS) receives information about the cadastral value of real estate from a specialized body - Rosreestr.

If the owner of a country house has not received a cadastral passport for it, that is, has not declared his ownership right for further registration with the authorized body, then the Federal Tax Service has no information that there is real estate somewhere that is not taken into account when taxing all other objects .

Since 2021, registration of property rights and cadastral registration takes place simultaneously. Until this time, an object could be registered without registering property rights.

An unfavorable picture may arise for a citizen if he deliberately hides property in order not to pay tax, but such data will still reach the Tax Inspectorate (for example, when applying to another authorized body to receive any government service). In accordance with current legislation, the Federal Tax Service has the right to calculate tax for the three previous periods, as well as charge penalties for late payment of property tax for individuals.

The best option would be to contact the territorial tax authority and report the unaccounted object. If a citizen manages to implement such an appeal before 2021, then the Federal Tax Service will not impose an additional burden of responsibility on him, and the tax will be calculated only from the moment the government body learns about the existence of the property.

Note that for country houses the rule for calculating the tax minus 50 square meters applies. m. of the total area of the house. If the house has a total area of fifty square meters or less, then you will not have to pay tax.

Note! Based on the provisions of Article 407 of the Tax Code of the Russian Federation, the payer may be in the category of beneficiaries, so we recommend contacting the territorial body of the Federal Tax Service to clarify all the circumstances.

Taxable base

In accordance with the current Tax Code, the object in respect of which the owner has an obligation to make contributions to the treasury is not the dacha as a whole, but individual items of property:

- a plot of land used for living, growing vegetables, fruits, and ornamental plants;

- buildings located on the site.

According to Part 1 of Article 389 of the Tax Code (in the future, all references will refer to this document), any plot that is not excluded from the land use lists and not classified as state resources will be taxed.

The land issued to summer residents meets this criterion; therefore, both “six acres” and a huge plot are equally included in the taxable base.

The same applies to buildings erected on the site. As follows from Article 401, the requirements of the Federal Tax Service apply to:

- private houses, both the main ones and others included in the complex (parts 1, 2);

- garages;

- outbuildings, including chicken coops and barns.

Key caveat: the structure for which the owner pays tax must be officially registered.

The importance of this point will be discussed in the next section.

How to calculate the amount

To calculate property tax for individuals, in particular for a country house, it is necessary to take into account the following criteria, which form the final amount payable:

- taxable base – inventory or cadastral value of the object;

- tax rate - in accordance with the Tax Code of the Russian Federation and regulations at the regional and local levels;

- coefficients that help adjust the tax amount.

The tax rate is always directly dependent on the value of the object of taxation.

How can I calculate property tax for individuals?

- by personally contacting the territorial tax authority, where the inspector will explain how the calculation is made in the corresponding tax period;

- on the official website of the Federal Tax Service of Russia, where a calculator is presented with which you can perform calculations online. To do this, you will need to select the desired type of tax, select your region of residence, and also set the required parameters (cost of the object, area). The user can find the cost on the Public Cadastral Map by entering the object number;

- refer to the current legislation and independently make the calculation, taking into account the cost and area of the object, tax rate, coefficient and formula.

Article 406 of the Tax Code establishes all-Russian tax rates depending on the inventory or cadastral value of a real estate property.

| Inventory value | Tax rate |

| Up to 300 thousand rubles. | Up to 0.1% |

| From 300 to 500 thousand rubles. | More than 0.1%, but up to 0.3% |

| More than 500 thousand rubles. | More than 0.3%, but up to 2% |

As for the calculation of the cadastral value, the rate will be 0.1%, provided that the area of the object is no more than fifty square meters. In this case, the house must be located on the plots of SNT, individual housing construction, private household plots. In other cases, a rate of 0.5% will be taken into account.

At the regional level, property tax for individuals can be either reduced or increased, but not more than three times.

On a note! If a citizen owns a country house, located geographically on a SNT land plot, and the area does not reach 50 square meters. m., then the tax amount will be zero. However, we should not forget that this has nothing to do with the calculation of land tax.

Real estate gift tax.

What to do if you haven’t received a tax notice to pay your tax, read here.

How to reduce property taxes for individuals, read the link:

Tax deduction for purchasing a summer house

According to the provisions of the law, when purchasing real estate, including a summer house, a tax deduction is provided. When purchasing a summer house, it can also be provided at the buyer’s request. Its size is thirteen percent of the cost, but not more than 260,000 rubles. This deduction is an income tax refund. You can only use this opportunity once.

To receive a deduction, you need to contact your local tax office with a declaration, agreement, and payment documents.

What conclusions will we draw?! Tax on garden plots and country houses is mandatory. However, benefits are established by law for certain persons. You can find out more about the availability of benefits and the amount of tax at the inspection offices of your city.

How to calculate tax on a country house: example

For clarity, we will give an example of calculating property tax for individuals in relation to a country house located on the territory of SNT. Let us take into account that the cadastral value has been applied in this region since 2021.

Ivan Ivanov owns a country house, the area of which is 150 square meters. m. Previously, the inventory value of the object was equal to 100,000 rubles. Then the real estate was assessed according to the new rules, and the cadastral value became 400,000 rubles. The tax rate in this region is 0.1%.

The Tax Code of the Russian Federation provides a special formula for calculating tax according to the new rules during the transition period (clause 8 of Article 408). Therefore, initially we will calculate the amount of tax based on the inventory value of the object, that is, as it was before: 100,000 rubles * 0.1%, which turns out to be 100 rubles.

Types of real estate for paying tax at cadastral value

Taxes are imposed only on those properties that are registered in the cadastral register. Registered real estate is assessed by the state and each property has its own cadastral value.

Taxes are paid based on the cadastral value and taking into account tax rates and benefits. Let's look at how taxes are paid based on the cadastral value of the following types of real estate:

- land plot

- residential (private) house

- garden house

- apartment (room)

- other real estate objects

Let us briefly consider the procedure for paying tax at cadastral value in 2021 for each type of real estate separately.

Tax on non-residential dacha buildings

Real estate objects - apartments, houses, garages and others - that have a foundation are subject to taxation. However, the tax authority, if there is no information about the object in the Unified State Register, will in no way be able to guess about its existence.

At least, this will last until the citizen needs to contact government agencies, the reason for which will be inextricably linked with the unaccounted for object. If the Federal Tax Service finds out about hidden real estate, then the tax for the last three periods will be calculated, as well as penalties for late payment.

Article 407 of the Tax Code of the Russian Federation indicates a list of beneficiaries for the payment of property tax for individuals. These include citizens who own garden houses, houses for economic activities, gardening, etc., if the object has an area of no more than 50 square meters. m.

If the property has a large area, then the tax will be calculated for payment. However, this does not mean that a citizen cannot be included in the preferential category of payers for other reasons. For example, being a pensioner, a war veteran, etc.

The legislator also exempted from paying property tax for individuals who are the owners of objects with any area, but the purpose of the buildings is designated as an atelier, workshop, etc. If you do not want to pay the tax, you can try to change the category of the property.

If a person does not qualify on any of the preferential grounds, then the tax for a non-residential dacha building will be calculated in the generally accepted manner, based on the cost, the rate for a non-residential building and the coefficient.

Principles of the building tax system

Buildings with a foundation, interconnected with the ground without the possibility of their movement, are real estate (Article 130 of the Civil Code of Russia). Each owner of a plot with real estate and capital adjacent buildings is required to pay tax. The fee amounts are not the same; its exact amount will be notified after registration of the object.

Buildings without a foundation are considered temporary – they are movable property. The fee is not charged due to the lack of a strong connection between the buildings and the land. To confirm this fact, a certificate from the cadastral authority or BTI is required.

The fee is calculated for the previous calendar year. Payment is made before December 1st of the next tax period.

The tax on lands for horticultural and agricultural purposes is calculated at the cadastral price with a rate approved by the municipality. In 2021, the draft changes to this tax are being tested.

How and when to pay dacha tax

From January 1, 2021, individuals have the opportunity to pay taxes in one payment. If previously it was necessary to wait for a tax notice with the calculation amount for each type of tax, now, in accordance with Article 45.1 of the Tax Code of the Russian Federation, a taxpayer or other person has the opportunity to transfer a certain amount to the budget.

The funds will be distributed by the official to repay the calculated amount of tax on the corresponding date (for 2018 - on the date 02.12.2019 in accordance with clause 7 of article 6.1 of the Tax Code of the Russian Federation). However, in the event of an existing tax arrears, funds transferred without reference to a specific BMR (not based on notification) will be counted towards the repayment of tax debt.

Since 2015, taxpayers have the opportunity to receive notifications electronically through their Personal Account. Payment can be made by using the service or through the official website of the State Services after user confirmation.

If the tax payment does not reach the budget before December 1, and in 2021 - until December 2 according to the rules for transferring non-working days, then the tax authority will inevitably begin to calculate penalties for the property tax of individuals for the tax period from 01/01/2018 to 12/31/2018 already from December 3, 2021.

Next, the Federal Tax Service sends demands (not to be confused with notifications) to unscrupulous taxpayers for the payment of overdue taxes and penalties. When the amount of all claims reaches 3,000 rubles, the inspection has the right to apply to the Justices of the Peace for issuing a court order to forcibly collect the arrears.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

To prevent this from happening, it is necessary to pay all taxes due on time.

You can do this:

- through the payer’s personal account;

- official website of the Federal Tax Service of Russia;

- through ATMs (Sberbank);

- through the use of Sberbank Online;

- on the official website of Gosuslugi;

- by other means (electronic wallets).

Note! When using some services for payment, an additional commission may be charged by the intermediary of the money transfer service.

Payment deadlines

Both taxes, both on land and on registered buildings, must be transferred to the budget before December 1 of the year following the “paid” one.

For example, if a citizen purchased a dacha in March 2019, he will have to make a contribution for the first time before the end of November 2020.

An important point: since both filing a declaration and transferring funds can be done online, there are no deferments for taxpayers, even in connection with the pandemic and the “self-isolation” introduced in Russia.

Theoretically, the owner of a dacha can, referring to Article 64 in the latest edition, demand a deferment of tax requirements. It should be borne in mind that:

- The article is for the most part intended not for individuals, but for entrepreneurs;

- the applicant will have to provide compelling evidence of the impossibility of paying on time.

This right, like others related to benefits, applies to applications: the owner of the dacha will have to independently prepare documents and send them to the Federal Tax Service.

The period of legitimate delay in payment, upon receipt of approval, can be up to three years.

Do pensioners pay tax on a country house?

Starting from 2015, pensioners have the right to be exempt from paying property tax for individuals for one property among similar ones. That is, if a pensioner has two country houses, then he may not pay tax for one of them, but only after submitting an appropriate application to the territorial tax authority.

Typically, exemption is given for the object for which the tax is calculated in a larger amount, but the citizen is not deprived of the right to choose. Please note that the application for the benefit must be submitted before November 1 of the current year in order to receive an exemption from payment for the previous tax period.

The application is free in nature, no documents are attached to it, but details of a passport, pension certificate, etc. are indicated. A person can submit an application through their Personal Account in order not to visit the inspection.

Do not forget! The country house is located on a plot of land, which is also subject to taxation. From 2021, pensioners do not pay land tax, provided that the plot has an area of no more than 600 square meters. m.

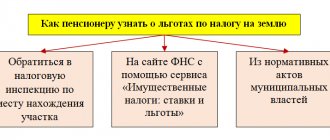

More information about tax benefits for pensioners can be found on the official website of the Federal Tax Service of Russia. For this you need:

- on the Internet resource of the Federal Tax Service, go to the “Taxation” section;

- select the “current taxes and fees” subsection;

- go to the “local taxes” section, select the type of interest;

- scroll the page to the point where benefits are described;

- select “local benefits”;

- set the required search parameters;

- after this, the service will issue a regulatory act of local government bodies, which must be carefully studied in order to have an idea of the benefits available to various categories of citizens.

Frequently asked questions

Is it possible to refuse to build a house on a plot for individual housing construction?

No one, including the tax office, can force the owner to start building a mansion. The lack of construction is not a basis for confiscation of land - but the Federal Tax Service, after several warnings, will almost certainly double the tax rate.

Will the tax amount be recalculated if a balcony, porch, or gallery is added to the cottage?

No. The amount of deductions depends only on the cadastral value of the object, and not on individual design changes.

Is it possible not to pay tax while in SNT?

The procedure for owning roads, common real estate, and land must be approved by all members of the partnership without exception. A citizen who has not given such consent is not required to pay anything.

Your rating of the article

Tax on an unfinished house on a summer cottage

Unfinished properties are also subject to tax. For this to happen, the citizen is obliged to notify the government agency of the fact of construction. However, in practice this rarely happens. If the Federal Tax Service finds out that construction took place before the registration of property rights, it will calculate tax and penalties for the three previous periods.

Unregistered objects being built on land plots for individual housing construction will be subject to double land taxation in ten years until they are registered with Rosreestr.

Was there registration?

The tax service does not have the right to register ownership on its own initiative.

Consequently, until the owner himself applies to Rosreestr, the object remains unregistered and is not included in the taxable base.

The legislation does not yet provide for either forced registration or punishment for the owner who does not want to register the building.

In the worst case, the Federal Tax Service will send notices about the need to include the building in the Unified State Register of Real Estate - until the next law or amendment is adopted.

The owner can appeal the unlawful inclusion of an object in the register in court.

Preferential categories of citizens

Taxpayer benefits are provided at two levels: federal and regional. Official information is presented on the website of the Federal Tax Service of Russia.

Important! The legislator provides for the following categories of citizens who are entitled to tax benefits:

- heroes of the USSR and the Russian Federation;

- disabled people of the first, second categories and childhood;

- WWII veterans and combatants during the existence of the USSR;

- officials at headquarters from the SA and Navy;

- participants in actions during global disasters (Chernobyl nuclear power plant, etc.);

- military personnel with twenty or more years of service;

- families who have lost their breadwinner who is a military serviceman;

- nuclear test participants;

- participants in the war in Afghanistan;

- pensioners;

- parents, spouses of a deceased military personnel or civil servant at the time of performance of immediate duties;

- citizens engaged in creative activities;

- citizens who own a house with the category “economic purpose” and an area of no more than 50 square meters. m.;

- other benefits in accordance with local legislation.

If a citizen belongs to any of the above categories, then he must personally appear at the tax authority to submit an application for a tax benefit or submit the document electronically.

For your information! Please note that tax exemption will apply to only one homogeneous object. To change the selected object, you must submit a new application before November 1. After this, you will have to wait for a new tax period.

Country house

Payments are calculated according to the generally accepted scheme. Owners of rural houses often do not register their homes. It is impossible for the owners of newly erected buildings and those who have started construction to evade registration of real estate. The authorities strictly control new buildings.

Pensioners are exempt from payments for the house in which they live, and additionally for one building with an area not exceeding 50 m². Rural houses are valued relatively inexpensively by the cadastral authority due to their distance from social institutions.

What to do if you obviously have a permanent greenhouse?

It should be registered. Let us remind you that according to the law, cadastral registration and registration of rights are of a declarative nature. This means that registration is possible only at the request of the owners. This also applies to greenhouses.

To register, you need to collect a package of documents (all information is on the Rosreestr website). Documents can be submitted: 1) through the website by filling out special forms; 2) by personal contact at MFC offices throughout Russia.

As soon as the object is registered in the Unified State Register of Real Estate, and, accordingly, information about them is provided to the tax office and the BTI, you will be charged tax.

Specific examples

1. There is a bathhouse on the site, standing on a solid foundation and connected to communications - such an object will be considered real estate, it is subject to registration and taxation.

There is a barrel sauna on the site, installed on wooden legs, operating autonomously - such an object will not be considered real estate, it does not need to be registered, and no tax will be charged.

2. A barn made of gas blocks was built on a poured foundation - you will have to pay a tax for it.

A frame shed for storing agricultural implements is mounted on supports made of metal poles - it does not need to be registered and is not subject to taxation.