Donation agreement

1. Concept, characteristics and meaning of the gift agreement. A gift agreement is an agreement under which one party - the donor - intentionally provides property benefits at his own expense to the other party - the donee with the consent of the latter.

Donation agreement:

- always gratuitous (non-equivalent);

- may be real;

- may be consensual.

In everyday life, gift giving to relatives, friends, and colleagues is widespread; Moreover, the value of the property donated can be very high. At the same time, contract law in general is characterized by the regulation of remunerative relations, as evidenced by the presumption of remuneration of the contract (clause 3 of Article 423 of the Civil Code). Therefore, the main qualifying feature of a gift agreement is its gratuitousness. Both parties must clearly understand that the transfer of property benefits to the donee is carried out without an equivalent or any consideration. An agreement according to which the donee, in turn, provides any property benefits to the donor will not be recognized as a gift - equivalence is seen here and the agreement will be qualified according to the design of a paid contract (purchase and sale, exchange or an unnamed paid contract).

The problem of the legal regulation of the gift agreement (Articles 572–582 of the Civil Code) is that it is necessary to take into account the moral preconditions for the emergence of gift relationships, as well as the fact that the gift agreement is based on the personal relations of the parties. This explains the features of the gift agreement, which are clearly manifested, for example, in issues of responsibility of the parties, refusal of the gift, cancellation of the gift.

2. The subject of the gift agreement is understood very broadly and is not limited to the traditional gift of material things or money.

The donor in accordance with paragraph 1 of Art. 572 Civil Code:

- transfers or undertakes to transfer his property to the donee;

- transfers or undertakes to transfer to the donee the obligatory right of claim against himself. This is either the establishment of the donor’s obligation to the donee (for example, the obligation to perform work for the donee free of charge), or the transfer by the donor of an already existing right of claim to himself (but in the latter case, the right of claim to himself is a debt to a third party, accordingly, the right of claim to himself is transferred in the order of transfer of debt);

- transfers or undertakes to transfer to the donee his obligatory right of claim against a third party. In this case, the donor assigns the right of claim to a third party under any obligation in favor of the donee (for example, a third party who is the donor’s debtor under a loan agreement will have to return the loan amount to the donee);

- releases or undertakes to release the donee from his obligation to himself. This is debt forgiveness in accordance with Art. 415 Civil Code;

- releases or undertakes to release the donee from his obligation to a third party. In this case, the model of fulfillment of the obligation by a third party under Art. 313 of the Civil Code (for example, when the donor repaid a loan issued by the bank to the donee) or the debt transfer model (when the obligations to repay the loan are transferred from the donee to the donor with the consent of the bank).

In Art. 572 of the Civil Code does not directly indicate the transfer as a gift of what is in Art. 128 of the Civil Code is covered by the concept of “other property”, which is not the object of property rights and does not quite fall under the category of “own obligatory right of claim against a third party” (including non-cash money, uncertificated securities, exclusive intellectual right, share in the authorized capital of LLC ). However, a systematic analysis of the legislation shows that there are no restrictions on the gratuitous alienation of “other property”; therefore, it can be the subject of a gift agreement.

In any case, the subject of a donation can only be specific property, therefore an agreement that promises the donation of all property or its non-individualized part is void.

3. Features of the legal structure. A gift agreement can be real (this is indicated in the law by the words “the donor transfers ...”) and consensual (this is indicated in the law by the words “the donor undertakes to transfer ...”, “promise of donation in the future”).

In theory, such a division gives rise to numerous discussions.

Thus, it is believed that a real gift agreement is an example of a special type of property agreement - before its conclusion, the rights and obligations of the parties cannot arise, and by the transfer of property (transfer of the real right to a gift), the relations of the parties are exhausted after the fulfillment of the rights and obligations of the parties does not arise) . As for the consensual gift agreement, according to the current point of view, it is difficult to characterize it as bilaterally binding (bilateral). The donee has no obligation to accept the gift - he is only required to agree to accept the gift; all his rights under the contract paradoxically consist in refusing the gift. Perhaps in a gift agreement we are dealing with a combination of two counter unilateral transactions: actions to provide property benefits on the part of the donor and consent to accept the gift on the part of the donee. This design optimally explains the features of the gift agreement, in particular the features of its termination.

Due to the peculiarities of the legal structure, it is difficult to unambiguously characterize a gift agreement either only as unilaterally binding (if only because there are no obligations in the real gift agreement), or only as bilaterally binding (the donee has some obligations regarding the proper attitude towards the gift, but they arise after the execution of the donation agreement and rather represent some encumbrances on the property donated).

4. Form of gift agreement. The form of a real gift agreement, due to its nature (“a real agreement” accompanied by the transfer of a gift), can only be oral (which does not exclude the possibility of a written agreement).

Simple written form requirement:

a) the form of the consensual donation agreement (“promise of donation in the future”) must certainly be written. If the simple written form is not observed, the promise of donation “is not recognized as a gift agreement and does not bind the promisee” (clause 2 of Article 572 of the Civil Code), i.e. the contract is considered not concluded;

b) the written form is established for the donation of real estate. State registration of a real estate donation agreement has been canceled since March 1, 2013. Only the transfer of ownership of real estate is subject to state registration. The consequences of failure to comply with the written form are not directly established by law, but, based on the legislation on state registration of rights to real estate, the absence of a document-contract in this case will be an obstacle to state registration of the transfer of rights to donated real estate;

c) in writing, regardless of whether the contract is real or consensual, an agreement must be concluded in which the donor is a legal entity, and the value of the gift exceeds 3,000 rubles. Failure to comply with the written form in this case entails the nullity of the gift agreement;

d) the grant of exclusive rights to the results of intellectual activity and means of individualization equivalent to them is subject to the norms of Part Four of the Civil Code. Such agreements must be concluded in writing, and if the object is subject to state registration with Rospatent (invention, utility model, industrial design, trademark and some others), then the transfer of the exclusive right is subject to state registration;

e) in other cases established by law (for example, donation of uncertificated securities).

All of the above cases of mandatory written form make it possible to give the gift agreement a notarial form if the parties agree on this.

There is only one case when the notarial form of a gift agreement is prescribed by law. A mandatory notarial form is established for transactions aimed at alienating a share or part of a share in the authorized capital of a limited liability company.

Failure to comply with the notarial form entails the invalidity of this transaction (clause 11 of the Law on Limited Liability Companies). This rule applies to agreements for the donation of a share (part of a share) in the authorized capital of an LLC, since the gratuitous alienation of a share (part of a share) is a donation.

According to family law, a notarized consent of the spouse is required if transactions for the disposal of real estate and transactions requiring notarization and (or) registration in the manner prescribed by law (including donation) are carried out by one of the spouses (clause 3 of article 35 of the Family Code). This rule also applies to donation agreements for real estate and other property.

5. Subjects of the gift agreement. Prohibitions and restrictions on donation. The donor must be the owner of the thing or the holder of the right at the time of donation. There is a large group of cases of gift prohibitions depending on the subject composition (these prohibitions do not apply to ordinary gifts worth up to 3,000 rubles).

Donations on behalf of minors and citizens declared legally incompetent by a court are not permitted.

In practice, there are cases where a gift conceals the extortion of a bribe, therefore state and municipal employees cannot be recipients in connection with their official position or in connection with the performance of their official duties. For the same reason, but partly for moral reasons, it is prohibited to give gifts to employees of social institutions by citizens who are in these institutions for treatment, maintenance or education, and by the relatives of these citizens.

Donations between commercial organizations are prohibited, since the purpose of their activities is to make a profit, not charity (donation agreements in which one of the parties is a citizen or a non-profit organization are permitted).

Based on the legislation on privatization, donation of state or municipal property is not allowed.

Gift restrictions exist for cases where consent is required to complete a transaction. Thus, donation restrictions exist for property that belongs to a legal entity with the right of economic management or operational management (the consent of the owner of the property is required, except in cases of giving “ordinary gifts of small value”), and for property that is in common joint ownership (the consent of all is required). participants in joint ownership, regardless of the value of the gift).

6. Contents of the legal relationship regarding gifting. In a consensual agreement, the donor is obliged to take actions to transfer the gift to the donee. In a real contract, the transfer of a gift is carried out by the delivery of a thing or its symbolic transfer (for example, the delivery of car keys) or the delivery of title documents (for cases of transfer of rights).

Unless otherwise provided by the contract, the obligations of the donor are transferred, but the rights of the donee are not inherited.

Responsibility of the donor. Gratuitous contracts, compared to paid ones, initially imply a reduced liability of the debtor. The rules regarding liability for defects in the gift (due to low quality, incompleteness, etc.) do not apply to the donor.

But still, the donor is responsible for damage caused to the life, health or property of the recipient as a result of defects in the donated item (when, for example, the brakes of the donated car are faulty), about which he did not warn the recipient.

Refusal of the gift. Until the transfer of the gift, the donee has the right to refuse the gift. Consequently, in a gift agreement according to the model of a real agreement, the agreement is considered concluded (and the right to the object of the donation is transferred) through the implied actions of the donee. Active actions to refuse a gift in this situation mean a refusal to conclude a contract and are in the sphere of pre-contractual relations. If the gift agreement is concluded in writing (consensual gift agreement), the refusal of the gift must also be made in writing. If the transfer of the gift has already taken place, there is no need to terminate the contract - the donee, as the owner or legal holder, has all the powers to dispose of the property, including those related to the renunciation of ownership of the thing, the refusal to exercise the right of claim transferred to him, etc.

Cancellation of a donation and refusal of the donor to fulfill the contract. Cancellation of a donation occurs in cases where the donation has already taken place. Depending on the situation, the donor himself, his heirs and simply interested parties can cancel the donation.

The donor may cancel the donation for the following reasons:

a) related to the personality of the donee:

- in the event that the donee dies before the donor (thereby removing the subject of the gift agreement from the estate),

- in connection with a changed attitude towards the personality of the donee (the donee intentionally caused bodily harm to the donor or made an attempt on the life of the donor or one of his family members or close relatives);

b) related to the subject of the donation agreement (an item that provides the donor with great non-property value): if the recipient’s handling of the donated item creates a threat of its irretrievable loss. This limits the right of ownership of the donee to dispose of the gift.

When canceling a donation, depending on the subject of the agreement:

- the obligations of the donee from which he was released are restored;

- the rights of claim with which the donee was endowed are terminated;

- The donee has an obligation to return the donated item that has been preserved in kind.

If it is impossible to restore obligations, terminate the right or return the item, the donee is obliged to compensate the cost of the gift in accordance with the rules on unjust enrichment.

Refusal to execute a gift agreement is possible in cases where the donor’s obligation to transfer the gift in the future has not yet been fulfilled:

- the donor and his heirs have the right to refuse the contract in connection with the occurrence of the grounds for the cancellation of the donation;

- the donor has the right to refuse the contract if, after the conclusion of the contract, circumstances arise indicating that the execution of the contract under the new conditions will lead to a significant decrease in the donor’s standard of living.

7. Donation as a type of gift. In addition to donation as such, there is a donation - the donation of a thing or right for generally beneficial purposes. It is the donation that most fully meets the goals of charity. Therefore, the recipients can, as a rule, be medical, educational, scientific and other institutions, but there is no prohibition on donations to any other subjects of civil law. When making a donation, the consent or permission of third parties to accept the gift is not required. A donation is a more strict design compared to a simple donation - a donation can be canceled only if the donated property is used not in accordance with the purpose specified by the donor.

It can be especially difficult to distinguish a donation from a donation in cases where the recipient is a citizen, therefore property is considered not as a gift, but as donated to a citizen only when the donor stipulates the intended use of the gift.

8. Distinguishing donation from similar legal relations.

Donation and inheritance. An agreement providing for the transfer of a gift to the donee after the death of the donor is void. However, if such an agreement in form and content meets the requirements for a will (Chapter 62 of the Civil Code), it can be qualified as a will, and as such will give rise to a legal relationship of inheritance.

Giving and forgiveness of debt. The relationship between the creditor and the debtor for debt forgiveness can be qualified as a gift only if the intention of the creditor is established to relieve the debtor from the obligation to pay the debt as a gift. Therefore, in particular, refusal to collect a penalty or even part of a debt does not qualify as a gift if it is due to a sober calculation regarding the judicial prospects for collecting the entire amount of the debt.

Features of donating a property

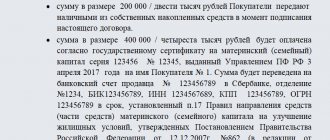

Mandatory notarization of the real estate donation agreement is not required, but it must be registered with the Federal Registration Service of Cadastre and Cartography. State registration of rights to real estate is carried out in accordance with the recommendations of Order of the Ministry of Justice of the Russian Federation dated July 1, 2002 N 184. To do this, the following documents must be submitted:

- Donation agreement in three copies;

- Copies of passports of the parties to the gift agreement;

- BTI documents (cadastral passport, explication and floor plan);

- Application for state registration of transfer of rights to real estate;

- Certificate of state registration of the donor's ownership of the gift;

- Documents for land, if real estate is donated along with a land plot;

- An extract from the house register, no more than a month old;

- Notarized consent of the spouse or a document confirming that the property is not jointly owned by the spouses.

The state fee for registering a gift agreement is 1,000 rubles for each party; in addition, the donee pays a state fee of 2,000 rubles for registering the transfer of ownership. The registration period is 10 working days, after which the recipient receives an extract from the Unified State Register or a certificate of ownership of the property.

Please note: if the donor and recipient under a real estate donation agreement are close relatives (spouses, parents, children, adoptive parents and adopted children, grandparents, grandchildren, brothers and sisters), then they do not have the obligation to pay personal income tax. In all other situations, the donee must pay a tax of 13% of the value of the property.

Lawyer's answers to frequently asked questions

Is it possible to draw up a contract of promise to donate an apartment with a mortgage?

Any transactions with mortgaged property before the debt is repaid without the consent of the lender are prohibited. Try to get permission from the bank. An alternative option is to issue a deed of gift, the execution of which will begin after the mortgage debt is closed.

I took out a loan secured by real estate, now I want to give it to my son. Can I draw up a contract of promise to donate a collateralized apartment?

No, alienation of mortgaged housing without the consent of the bank is prohibited. He can challenge the deal in court, and the judge will most likely take his side.

Is it necessary to draw up a deed of transfer and acceptance when donating real estate?

Not necessary, but if necessary, you can draw it up, indicating all the details: what is the condition of the housing, are there any defects, etc.

Is it possible to draw up a contract of promise of gift to a legal entity?

Yes, with the exception of donations between commercial organizations - this is prohibited by clause 4, clause 1 of Art. 575 of the Civil Code of the Russian Federation.

Is it possible to give money for a wedding under a promise agreement, and how to do it?

The contract is drawn up in writing, the amount is indicated, because a document without a description of the item (gift) is invalid. Draw up a deed of gift, give the second copy to the recipient and wait until the wedding, and then hand over the bills.

Responsibility of the parties

Having received a DD item (real estate, valuable thing) as a gift, the donor undertakes to treat it with care. It is important to take into account the provisions of Art. 580 of the Civil Code of the Russian Federation, according to which the donee has the right to demand from the donor compensation for damage caused as a result of donating a gift with defects.

This is possible if the defects were invisible at the time of the transaction, but the donor knew about them and did not inform the other party.

The donee is also responsible for:

- losses caused by refusal to accept a gift;

- poor handling of the gift (having discovered this, the donor has the right to cancel the transaction).

When concluding a donation agreement, the recipient is responsible for using the gift for its intended purpose in order to avoid cancellation of the transaction.

Briefly: the object of the donation is a gift, and the donor undertakes to notify the recipient of his shortcomings, and the other party undertakes to handle him with care.

Arbitrage practice

Most often, the courts refuse to satisfy the claims, but there are also cases in which the plaintiffs managed to get the donation canceled and the contract declared invalid:

- Decision No. 2-6177/2014 2-6177/2014~M-5866/2014 M-5866/2014 dated September 19, 2014 in case No. 2-6177/2014;

- Decision No. M-1752/2013 2-70/14 2-1548/2013 2-70/2014(2-1548/2013;)~M-1752/2013 2-70/2014 dated January 20, 2014;

- Decision No. 2-679/13 2-679/2013 2-679/2013~M-736/2013 M-736/2013 dated July 16, 2013

As a result of the proceedings, the contracts were declared invalid by the courts. Registration entries in the Unified State Register were cancelled, and property rights were returned to the donors.