When might a power of attorney for donation be needed?

A power of attorney is a document according to which one citizen (principal) authorizes a second citizen (attorney) to represent interests before a third party.

It may also be needed when donating in several situations:

- The donor cannot be present at the transaction in person: he is sick, is abroad, etc.;

- The donor is a legal entity, and the founder or director cannot formalize the deed of gift personally. The document appoints a legal representative.

The form of the power of attorney depends on the type of transaction. According to Art. 574 of the Civil Code of the Russian Federation, a gift agreement (hereinafter referred to as DD) is drawn up in writing if real estate is being donated, the donor is an organization and the value of the gift exceeds 3,000 rubles, or the citizen promises to give a gift in the future. In other cases, an oral transfer of the gift is sufficient.

Important! If the DD requires notarization, then the power of attorney must also be certified by a notary. A power of attorney agreement without a certificate is signed only in a notary office.

Legal Advice: Even if the law does not require a notarial form, it is better to contact a notary. The presence of his signature will significantly reduce the likelihood of challenging the transaction and protect the interests of both parties - the donor and the donee.

Disadvantages of a gift agreement

The main disadvantage of donation is the obligation of the recipient of the gift to pay income tax in the amount of 13% of the value of the property, if he is not a close relative .

There are also other disadvantages:

- It is impossible to specify counterclaims to the recipient, for example, to establish a lifelong ban on eviction from the donated housing.

- The contract can only be challenged in court proceedings and under the following conditions: Attempt on the life of the donor.

- If the handling of the donated item can lead to its irretrievable loss, and for the donor it has great non-material significance.

- If the health or property status of the donor has changed so much that the fulfillment of the obligation under the contract will lead to a significant deterioration in his living conditions (applicable to the promise of a gift in the future).

What can you give by proxy?

Citizens and legal entities can draw up deeds of gift for different types of gifts that belong to them as property:

| What is given | Peculiarities |

| Real estate |

|

| Movable property (car, money, jewelry, etc.) | Oral donation is possible. When drawing up a DD on paper, a simple written power of attorney is sufficient. |

| Property owned by an organization under the right of operational management or economic management | The consent of the actual owner for the transaction will be required |

| Right to claim debt | The debtor's consent is not necessary, but written notice of the transfer of the right of claim is required |

| Fulfillment of debt obligations of the donee | The deal is agreed upon with the lender |

Features of donating movable property

Is a gift agreement valid after the death of the donor?

Deadlines

In general, the process takes 2-3 weeks . Most of the time is spent on preparing related documents.

Taxes

Essentially, the process of gifting results in the recipient receiving an economic benefit, and although the house is not cash, it is recognized as income. It is believed that there is a saving of finances that could have been spent by the recipient of the property on purchasing a share. The value of the property received is subject to taxation.

There is a category of citizens who are not required to pay personal income tax . According to the Tax Code of the Russian Federation, the list includes:

- Family members and close relatives . This does not apply to distant relatives. According to the law, relatives are only spouses, parents, children (including adopted children), grandparents, grandchildren, full and half brothers and sisters (Clause 18.1 of Article 217 of the Tax Code of the Russian Federation).

- Consular employees and members of their families (Article 49 of the Vienna Convention on Consular Relations of April 24, 1963).

The rest of the family - nephews, cousins, sisters and others - are required to pay personal income tax.

Benefits do not apply to people who lived together with the donor, were dependent on him or were in close relationships.

Not falling into the preferential category, the new owner is required to pay tax in the amount of:

- 13% of the value of the property, if the payer is a resident of the Russian Federation, that is, lives in the Russian Federation for at least 183 days ;

- 30% of the cost of the share if the recipient is not a resident .

Non-residents are not only foreigners, but also citizens of the Russian Federation who permanently reside abroad. If stateless persons or people who have received a residence permit permanently reside in the Russian Federation, they pay 13% tax, being residents.

The tax amount is calculated from the value of the property, established by an independent appraiser, recorded in inventory reports and cadastral documents.

There are no tax deductions when paying taxes on donated real estate.

The deadline for filing a tax return is April 30 of the year following the year the gift was received (Article 229 of the Tax Code of the Russian Federation).

According to paragraph 4 of Art. 229 of the Tax Code of the Russian Federation, the calculated tax must be paid no later than July 15 of the year following the year of donation.

There are a number of sanctions for late payment of taxes. Filing a declaration later than the month specified in the law faces a fine of 5% of the tax amount for each overdue month (but within 30%). Therefore, it is recommended to follow the letter of the law and comply with the deadlines for filing the declaration.

Subtleties of design

Any issues related to the need to prepare legal documents have a number of nuances. Here are some of them.

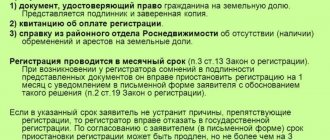

Donation of land

Having donated a house, the owners forget about transferring the land on which it is located. Subsequently, for example, upon the death of the previous owner, the house will remain to the recipient, but the land can be divided among the heirs.

It is possible to donate land if it is owned, land surveying has been carried out, and the owner has a cadastral passport. Otherwise, you will have to deal with the design of the site.

Donating a share of a house to a child

The intention to transfer a share of the house to children often arises from parents, grandparents, godparents and other close people. Some nuances should be taken into account:

- Children cannot sign an agreement themselves or decide to accept real estate as a gift due to incapacity. The agreement is signed by the parent, adoptive parent, guardian or trustee. If a child has reached the age of 14 , he can independently accept a gift only with the written consent of his legal representative. In this regard, information about the representative is indicated in the gift agreement.

- Property of children under 14 years of age cannot be donated by their legal representatives.

- If the child is not a relative of the donor, he must pay tax on the income. In the absence of funds, the tax is paid by the child’s legal representative (Clause 2 of Article 27 of the Tax Code of the Russian Federation).

Compliance with the above conditions is mandatory for the transaction to be recognized as valid.

Gift with condition

Often, when promising a gift, the concept of gratuitousness is lost. If, for example, a father promises to give his son a part of a house after he reaches 20 years of age, this is a donation, but if at the same time the son has to give his sister a car, the meaning of the “donation” is lost, the contract is not valid.

Features of donation by power of attorney

The main rule regarding the power of attorney is established in paragraph 5 of Art. 576 of the Civil Code of the Russian Federation. According to it, the document must contain information about the donee and the subject of the donation (gift). Without such information, the power of attorney is void, and it is impossible to draw up a DD using it. For example, it will not be accepted when registering a transfer of ownership in Rosreestr, and in general the transaction will be easier to challenge.

There are other rules:

- The donor's representative does not have the right to make transactions in relation to himself and act as the donee (clause 3 of Article 182 of the Civil Code of the Russian Federation);

- Powers of attorney on behalf of citizens in prison, in military service, in stationary social organizations, with the signature of an authorized leader, are equivalent to notarial ones. He certifies the document, because a person does not have the opportunity to come to a notary’s office;

- To transfer a gift from a legal entity, a power of attorney is issued by the head or other authorized citizen in accordance with the constituent documents and legislation (Article 185.1 of the Civil Code of the Russian Federation).

Note! If an attorney acts on behalf of the company when donating by proxy, you will need not only the signature of the manager, but also a seal.

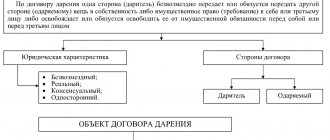

Subject and features of the deed of gift

The first criterion for a gift is the mandatory presence of the necessary legal characteristics that are inherent in such an agreement and established in accordance with current legislation. Namely:

- Free transaction.

This is a mandatory condition, according to which the donor, when transferring an object into ownership to the donee, does not have the right to demand any compensation from him (this rule also applies to services). But this does not mean at all that donation is not made for selfish purposes. At the same time, everything that relates to the interpersonal relations of the parties to the method of alienation of property under consideration is outside the jurisdiction of the law.

- The recipient's consent to accept the gift.

If a person refuses to accept an apartment, house, car or any other property, he has the legal right not to accept the terms of the transaction.

- Property sign.

That is, when concluding a gift agreement, the donor’s property decreases, while the donee’s property increases. This feature is considered quite controversial today, due to innovations in legislation and due to the development of the industry.

ARTICLE RECOMMENDED FOR YOU:

Do I need to submit 3-NDFL when donating real estate?

Thus, if a transaction meets all the criteria listed above, it can be considered legal and “clean”. At the same time, there remains one more rule, failure to comply with which can lead to challenging the deed of gift, namely, the compliance of the subject of the agreement.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

According to Article 572 of the Civil Code of the Russian Federation, not only material things, but also certain obligations or services can be the object of donation.

Today, as a rule, small transactions are concluded orally, and for large ones, written documentation is required. The most common objects of gifting in 2021 are:

- equipment and jewelry;

- loans and money;

- a share in an LLC, as well as part of an apartment, residential building, dacha and other real estate;

- car, as well as other vehicles;

- garage, apartment, house and land.

Types of powers of attorney and their differences

The Civil Code of the Russian Federation provides for several types of powers of attorney: one-time, special, general.

According to their form, they are divided into two subtypes: simple written and notarial. There are also distinctions based on the validity period: urgent, issued for a specific period, and unlimited - drawn up for an indefinite period of time: it is canceled strictly in certain cases. Powers of attorney are also divided according to the number of parties to the transaction: unilateral, where the interests of one donor are represented by one attorney, and multilateral, involving several principals and attorneys.

For donations, powers of attorney are of greatest importance in terms of the scope of powers. Let's look at them in detail.

One-time power of attorney

A one-time ticket is issued for a representative to perform one specific action. When donating, you can indicate that the citizen is only authorized to sign the DD or submit documents for registration.

Legal advice: a one-time power of attorney is the best option for giving. It strictly limits the rights and capabilities of the representative, thereby reducing the risks of the principal.

Special power of attorney

A special one is issued for performing similar actions during a certain period. According to it, the representative has the right to sign the DD or submit documents for registration several times. This option is not very suitable for donation if you need to issue only one deed of gift.

General power of attorney

The most dangerous option for the donor is a general power of attorney. It does not limit the attorney’s powers, and he will be able to use it to perform any actions with property: donate, exchange, sell.

Legal advice: even if you completely trust a person, it is recommended not to issue a general power of attorney for him. It is better to limit yourself to a one-time or special one in order to preserve relationships and property.

Gift taxes

A donation is a transfer of property without payment. This means that the donor cannot demand or receive anything in return. Therefore, he has no obligation to pay any taxes. As mentioned above, the recipient must pay income tax after receiving property as a gift, but only when he and the donor are not close relatives. Who belongs to the category of close relatives is widely covered in special articles devoted to the problems of inheritance.

For example, if you accepted an apartment as a gift, and it belonged to your cousin (although she is a relative by blood, she is not legally included in the list of close relatives), then you must pay income tax, the amount of which is 12% according to the following formula: (for example, the cost of an apartment (according to expert estimates) is 40,000 rubles) multiplied by 12% and we get the amount of income tax.

How to donate real estate by power of attorney: step-by-step instructions

The procedure is similar to an independent donation by the parties, but there is one step in it - the execution of a power of attorney for the representative. Both the donor and the donee have the right to do this if they cannot be present at the transaction in person.

Important! The agreement can be signed in person, and a power of attorney can be issued to an attorney to register the transfer of ownership, because the presence of all participants in the transaction is required. If it is not possible to sign the DD, a representative has the right to do so.

Step 1: agreement with the donee

First, you need to agree on the deal with the recipient of the gift: tell him what property is being transferred to him, when and where to sign the deed of gift. This step is important because... he can refuse the deal (Article 573 of the Civil Code of the Russian Federation).

Step 2: execution of a power of attorney

It is necessary to find a person to represent your interests. It can be a relative, acquaintance, friend - the choice is left to the principal. If the attorney agrees, you need to issue a power of attorney with a notary.

Contents of the power of attorney

The power of attorney is drawn up in writing and must contain the following information:

- The nature, range and scope of powers of the attorney;

- Full name, passport details of the principal and representative;

- Duration of powers;

- Description of the subject of the transaction: address of the property, area, number of floors, number of rooms, etc.;

- Information about the donee;

- Possibility or impossibility of transfer of trust;

- Details of title documents for real estate;

- Signature of the principal;

- Signature and seal of a notary.

If the principal is a legal entity, the organization's seal will be required.

Sample of a one-time power of attorney for donating a share in an apartment: alt:

Validity

According to Art. 186 of the Civil Code of the Russian Federation, a power of attorney that does not indicate its validity period remains valid for 12 months from the date of signing. If the date is not specified, the document is considered void. The maximum period is 3 years.

If a notarized power of attorney is intended for transactions abroad and does not contain information about the validity period, it is valid until canceled by the principal.

Documentation

To issue a power of attorney you will need:

- Passports of the principal and attorney;

- Certificate of ownership or extract from the Unified State Register for housing;

- The principal's title documents for real estate: purchase and sale agreement, exchange, etc.

State duty

According to Art. 333.24 of the Tax Code of the Russian Federation, the state duty is 200 rubles. If a notary's assistance is required in preparing a document, this is paid separately. On average, prices for additional services start from 2,000 rubles. and depend on the region.

Step 3: registration of deed of gift

When the power of attorney is issued, you need to sign the DD. An attorney does this on behalf of the principal (donor), and the donee signs independently.

Important! If the DD requires certification, it must be signed directly by a notary.

Documentation

The list of documents is almost the same as when drawing up a power of attorney:

- Passports of the parties;

- Power of attorney;

- Deed of gift (if drawn up independently and not from a notary);

- Real estate documents.

Step 4: registration of the transaction in Rosreestr

After signing the DD, the representative and the donee need to come to the MFC or Rosreestr to submit documents for re-registration of ownership. If a contract of promise of gift has been drawn up, the application is submitted only from the moment its execution begins - the date is indicated in the document.

For registration, the list presented above is provided, but in addition to it you will need a deed of gift.

Note! If the gift is not real estate, but, for example, a car, registration is not required. All you need to do is make changes to the title and register the vehicle with the new owner.

State duty

Individuals pay 2,000 rubles for re-registration of real estate, organizations – 22,000 rubles.

Who can you donate a share to?

By law, a deed of gift can be issued to almost anyone. You can transfer a share in an apartment free of charge to a relative, friend, good acquaintance or a complete stranger. There are no obstacles to this, even if there is a minor co-owner.

The transaction has its own characteristics when it comes to a gift to a minor. Until the age of 14, a child will not be able to sign a donation agreement for a share of the apartment; his parents must do this for him. And from 14 to 18 years old, children sign themselves, but with the permission of their legal representatives. Otherwise, the transaction will be considered illegal.

And yet, the legislation has provided a list of persons to whom it is prohibited to give shares in apartments in order to combat corruption:

- Employees of educational, medical and social institutions, if the donor is their client or a relative of the client;

- Employees in state, municipal bodies, state banks, if the gift is somehow related to the performance of their official duties.

Termination of power of attorney

According to Art. 188 of the Civil Code of the Russian Federation, a power of attorney is revoked for one of several reasons:

- The expiration date specified in the document occurs;

- Cancellation of a power of attorney by the principal;

- Refusal of the attorney's authority;

- Death of the principal or representative;

- Bankruptcy of an attorney or representative in an arbitration court if he loses the right to issue powers of attorney.

To terminate powers, a consent to refuse is drawn up. The parties have the right to draw it up at any time and contact a notary.

Risks of giving by proxy

There are several risk factors when making a gift by proxy. If a general agreement is drawn up, the attorney will be able to dispose of the principal’s property at his own discretion: not give it to the donee, but transfer everything to himself or sell it to other people. It’s better to make a one-time deal, for a specific transaction.

There is another point: if another person wants to challenge the DD, in court he can refer to the fact that the principal did not understand the consequences when drawing up the power of attorney. That is why it is recommended to have the document certified by a notary: this way the chances of the transaction being canceled will be reduced. Notaries always explain the rights, obligations and consequences for the parties. If it is determined that the owner is in poor condition and does not understand the consequences of the gift, the certification will be refused.

Apartment as a gift for your child

In the case when an apartment is given to a minor who has not reached the age of fourteen years (that is, a minor), the transaction can be completed by his legal representative on his behalf (one of the parents, adoptive parent or guardian). To make a gift transaction in favor of a minor over 14 years of age but under 18 years of age, the written consent of the same list of persons as in the previous case is required. They also dispose of the donated property (except for the right of alienation) until the recipient reaches 18 years of age.

Arbitrage practice

Often, interested parties turn to the courts to invalidate DDs and powers of attorney, justifying this with the above reasons or a violation of their interests.

Here are some examples of decisions where claims were satisfied:

- Decision No. 2-3/2019 2-3/2019(2-517/2018;)~M-466/2018 2-517/2018 M-466/2018 dated January 22, 2021 in case No. 2-3/2019 ;

- Decision No. 2-17/2019 2-17/2019(2-2093/2018;)~M-1268/2018 2-2093/2018 M-1268/2018 dated January 15, 2021 in case No. 2-17/2019 ;

- Decision No. 2-335/2018 2-335/2018(2-5440/2017;)~M-3301/2017 2-5440/2017 M-3301/2017 dated September 28, 2021 in case No. 2-335/2018 .

Lawyer's answers to frequently asked questions

Is it possible to transfer a power of attorney for donation?

Yes, if this is provided for in the initial power of attorney from the donor or donee.

Is the presence of the donee required when drawing up a power of attorney?

No, his data is enough.

What is the validity period of a power of attorney?

The validity period cannot exceed the period specified in the first power of attorney.

A general power of attorney has been issued for the son to dispose of property. Can he use it to draw up a deed of gift for the apartment and give it to himself?

No you can not. The same person does not have the right to represent the interests of both parties.

Is it possible to call a notary to your home if a person is paralyzed?

It is possible, but transportation costs and services are paid separately from the state duty. The cost is set by regional notary chambers.

Heirs of the donated apartment

After registration of the donation and legal registration of ownership of the recipient, he becomes the full owner of real estate - an apartment and acquires the right to dispose of it as he wishes. One of the parties has the right to challenge such a transaction. This right is also granted to third parties who have had their rights infringed as a result of its conclusion. For example, the following situation may happen: a citizen donated his apartment, and after a while he died. However, his closest relatives are convinced that their rights were violated by these actions and that they lay claim to the inheritance. In this case, they may try to challenge the already completed gift agreement. In such situations, much will depend on the circumstances in which the donor was: could he be aware of his actions? Did any relatives or acquaintances put pressure on him? In addition, it is worth considering such a moment as deception of the donor. The latter has the right to annul the donation if the recipient has taken action to attempt his life or attempted the life of his relatives, as well as when he maliciously inflicted bodily harm on the donor.

Heirs have the right to demand in court the cancellation of the donation if the recipient maliciously killed the donor.

Interesting point. A gift agreement may include a condition that if the recipient dies before the donor himself, then the latter receives the gifted item back.

In addition, the legislation regulates cases in which donation is prohibited altogether. It is not allowed to give an apartment: - on behalf of persons who have not reached 14 years of age (young children) and citizens who are recognized as legally incompetent; - employees of medical and educational institutions, social protection authorities and similar institutions - people who are treated, kept or educated there, as well as their husband (wife) or relatives.