A serviceman who has sent a package of documents to the Rosvoenipoteka Federal State Institution for the purchase of housing on a military mortgage needs prompt information about the fate of the submitted application. The topic of this article is the official website of Rosvoenipoteka and tracking documents with its help.

Website rosvoenipoteka.ru

The official website of the Federal State Institution "Rosvoenipoteka", located on the Internet at www.rosvoenipoteka.ru, contains the necessary legal information for current and future participants in the savings and mortgage system (NIS), through which Russian military personnel are provided with living space.

In an accessible form, using infographics and FAQ (“Question and Answer”), site visitors are informed:

- procedure for obtaining an NIS participant certificate;

- procedure for inclusion in the NIS;

- mechanism for exclusion from the NIS register and repayment of the housing loan (targeted housing loan);

- a list of available loan programs and detailed information about each of them;

- location of new buildings available for purchasing an apartment on the primary market with a military mortgage, as well as special offers from developers;

- information about insurance programs (insurance is a mandatory condition for participation in the military mortgage program);

- other useful information.

The contact details of the Federal State Institution “Rosvoenipoteka” are also posted on the website - telephone numbers, postal and email addresses, work schedule of the institution’s specialists.

What the Law Offers

It provides ample opportunities for military personnel to obtain home ownership through a mortgage. More specifically, to take advantage of this opportunity after a three-year accumulation process in NIS. That is, without waiting for the end of service in the Russian Armed Forces.

The Federal State Institution “Federal Administration of the Accumulative Housing System for Military Personnel” is in dynamic development. This year, good news regarding the reduction of interest rates on preferential mortgage loans received public discussion on the Internet and specialized sources of information. The list of banking structures that provide mortgage loans to military personnel includes:

- RNKB (PJSC),

- VTB24 (PJSC),

- Sberbank,

- JSCB "Svyaz-Bank" and others.

Thus, Rosvoenipoteka took a significant step in the cluster of national material care for the defenders of the Fatherland. The information appeared on the official Internet resource.

Who can take part in the program

The main condition for participation in the program is official registration with NIS. Control of this body is carried out by Rosvoenipoteka. A special register contains detailed information about the project participants, as well as who is a volunteer and who takes part under mandatory conditions.

- The following categories of citizens can be classified as mandatory participants: Graduates of specialized educational institutions who have signed an agreement or contract since 2005, or received an officer rank.

- Officers who signed the contract on a voluntary basis.

- Warrant officers, midshipmen who signed the agreement in 2005 or later. In this case, the following condition must be met: the service life is at least three years.

- Military personnel who did not receive the rank of officer, however, earned this rank no earlier than in 2008.

The following categories of volunteers may include:

- Warrant officers, officers who signed the first contract back in 2005.

- If sailors, soldiers, sergeants signed the agreement after 2005.

To join the program on a voluntary basis, you will need to send a completed application for consideration to Rosvoenipoteka.

Business card

The official Internet resource contains the necessary information that military personnel who want to obtain mortgage loans for construction and purchase of their homes are interested in receiving. You can easily access his bookmarks at rosvoenipoteka ru.

A user registered on the site is greeted with a lot of interesting and useful things when he enters his account. A simple interface allows you to navigate from option to option in an uncomplicated manner. Military personnel call the site a calling card on the way to their dream of owning a modern home of their own.

Available banks and insurance companies

As was said, Rosvoenipoteka compiles for you a list of recommended insurance companies and banks with which you can conclude a deal.

At the moment, the following banks are available to military personnel:

- Sberbank;

- Bank of Russia;

- VTB 24;

- Gazprombank;

- RNKB;

- Rosselkhozbank;

- Zenith;

- Bank opening;

- House of the Russian Federation.

Leading banks in Russia that offer favorable conditions for military mortgages There

are not many approved lenders, but the advantage is that you can choose one of the programs that is exactly suitable for your case. These banks have many offers, and all available services can be found on the official website of Rosvoenipoteka.

But we can highlight credit products that a serviceman can use in these banks:

- Mortgage on a plot with a finished house;

- Mortgage on a building plot;

- Mortgage for a secondary apartment;

- Consumer loan (but only for the purpose of purchasing a home);

- On-lending.

Since all of the above banks support compulsory insurance when drawing up a loan agreement, ordinary people have to look for an insurer. But a participant in the Rosvoenipoteka program will not need to find a decent insurance company.

Recommended viewing:

You will already be offered this list, from which you can select the appropriate organization:

- Nasko;

- Alpha Insurance;

- Sogaz;

- Rosselkhozbank Insurance;

- VSK;

- Ingosstrakh;

- VTB Insurance;

- Rosgosstrakh;

- Energy guarantor.

What can the site tell you?

It is worth remembering that the Federal State Public Institution Rosvoenipoteka has an official website and has a link ending in ru. On it you can find out not only the latest news, but also prompt, reliable mortgage information .

In a word, everything that the site prints is true. This is easy to understand from the first pages of the Internet resource, since the link to it contains ru at the end. How the site is practically useful for military personnel

Military personnel who are members of the NIS spend more time at training grounds, train soldiers, and perform other important government tasks. They are given the opportunity to receive preferential funds, but under the conditions established by laws and other regulations of the Russian Federation. Military personnel do not have time to visit financial institutions that issued mortgage loans to learn about changes in mortgage lending policies.

Today, when such an electronic resource has been created on the Internet, Rosvoenipoteka has become closer to people in military uniform. It allows you to learn about events online:

- in the barracks,

- at the training ground,

- in the caponier,

- in exercises and so on.

To do this, it is enough to have a smartphone, tablet, or music book. A registered user will need little time to log into his account and obtain the information he is interested in. And continue to serve.

Where else, besides Moscow, is Rosvoenipoteka organized?

Federal State Institution "Rosvoenipoteka" is registered and located in Moscow. However, for the purpose of better implementation of the NIS program, its branches have been created in the regions.

There are fourteen of them in total. On the main page of the site you can find their names and addresses. It also provides information about which regions the activities of a particular branch cover.

The “Establishment” tab also provides information on each of the branches. Here you can see his contacts, full name of the manager, working hours, as well as the names of those credit institutions that operate in the relevant regions.

Wide, useful information base of the resource

The site can provide users not only with information about the status of savings accounts, but also provide information of a general informational nature . For example, that banks annually accrue funds to accounts without taking into account the quantitative family composition of an NIS participant. That this process is not affected by rank, territorial location of service, educational or scientific qualifications.

Rosvoenipoteka considers mortgage funds as an element of ordinary allowance, equated to a clothing, monetary analogue.

conclusions

For persons undergoing military service, a special mortgage program has been in effect since 2004. With the help of the mortgage savings system, many military personnel have already managed to solve their housing problems.

The implementation of this program is carried out by institutions of Rosvoenipoteka. On the website of the head office in Moscow you can find complete information about all the conditions and features of this program.

You can watch an educational film about the implementation of the right of military personnel to housing in this video:

See also Telephone numbers for consultation Oct 27, 2021 kasjanenko 494

Share this post

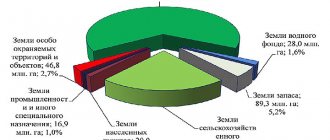

Sources of accumulation of mortgage sums

Rosvoenipoteka accumulates funds from two main sources .

Every year the accounts receive funds allocated from the country's budget. Government contributions are subject to upward adjustment once a year. FGKU receives its second source from investment projects. That is, from investments in profitable projects. These may be additional savings coming from the acquisition of funds located in income accounts from money invested in the development of reliable companies that are recommended by the Federal State Public Institution.

Warrant officers and officers who have become members of the savings mortgage system are eager to find out how the process of replenishing their accounts is going. The answer can be found on the website . For the first 36 months, a serviceman cannot purchase housing, despite the fact that amounts begin to accumulate in his account. After the specified period, the moment of truth comes - you are allowed to buy an apartment or house.

Where an officer or warrant officer can view savings

To do this, you need to visit the Internet resource Rosvoenipoteka . This is easy to do from any personal electronic network device. Go to your office. If you don’t have communication tools at hand, then pick up a regular calculator and calculate the funds.

There are times when users doubt the “honesty” of computer data. This is easy to check. You can send a request on the Rosvoenipoteka resource. The latest current result will be sent to your email in a few days.

How much money is given for a military mortgage loan per month?

The annual state contribution for military mortgages in 2021 is 260,241 rubles. or 21,678 rub. per month. In 2021, this amount was 20,490 rubles. The federal law on the federal budget provides for a monthly contribution (payment) for a military mortgage in 2019 at the rate of 22,372 rubles. or 268,465.6 rubles. in year. Initially, with the introduction of the NIS, the amount of annual contributions was much lower.

Let us consider, as an example, the volume of savings of a military member participating in the NIS as of , if he joined the system in January 2010.

Table of the amount of savings of an NIS participant on a military mortgage.

In addition, the amount of savings of each military personnel is subject to increase due to investment income.

According to official data from Rosvoenipoteka, the return on investing funds of NIS participants averages about 8-9%. The numbers are quite logical, given that 90% of all amounts are invested in bank deposits, and only 10% are invested in higher-yielding securities. This was done to avoid losses from investing at the end of the year. Stocks and bonds do not guarantee returns and carry many risks. For example, 2009 turned out to be unprofitable from an investment point of view due to risky transactions.

If we take an average return of 9%, then the approximate amount (size) of income from investing savings before using a military mortgage from our example would be:

So, from the point of view of purchasing housing, the amount turned out to be quite a decent amount of 2.5 million rubles.

Opening a personal account

An officer or warrant officer visits a financial institution where a loan to purchase a home will be issued. So, it will be better, although you can open a personal account in any bank.

You must understand that the money to your personal account will come from the budget of the Russian Federation.

After 36 months from the date of opening the account, the officer can use the funds for a down payment on a targeted loan. If he does not buy anything, then the savings in the account will continue to grow.

How to open an account

A citizen who has been officially registered with NIS does not have to worry about opening an account to which the required savings will be transferred. It opens automatically by the system upon registration. For the voluntary category, you will need to send an official report addressed to the senior military unit. Next, a complete list of required papers and documents is compiled, on the basis of which the military man becomes a full participant in the program. The list includes the following papers:

- Copy of Russian passport (first page).

- Copies of contracts (first, second).

- Report (a copy is possible).

Document package tracking

Hotline number “ubrir”, how to write to the support service

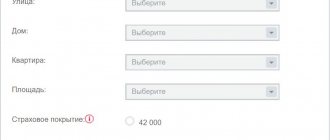

After successful completion of the registration procedure, the account owner has the opportunity to check the status of consideration of documents on Rosvoenipoteka that were previously submitted to the organization. For this purpose, a corresponding form is provided, which is located on the left side of the site. To get up-to-date information, just dial the number of the Rosvoenipoteka participant certificate. After that, click on the “Find out” button.

Note! After sending a request, the system will process it within several hours. In exceptional cases the waiting period will be 2-3 days

There are several possible answers:

- The documents are approved and submitted to the manager for signature. This response indicates that the test was successful. In the absence of this record, the NIS participant must be prepared for the fact that it will take a long time to understand the reasons for the refusal. In addition, it is necessary to spend a lot of effort to eliminate mistakes made by employees of a government agency (if any, respectively).

- Documents have been received and submitted for review. This status makes it clear that the documentation sent earlier has already reached the territory of the institution.

- The documents have been submitted for legal examination. In accordance with legal requirements, legal department employees can review the submitted package of documents within five working days. If the department is currently suffering from high workload, you will have to wait another 1-2 days. Representatives reserve the right to refuse to process documents for obtaining a mortgage. In such circumstances, the reason for the refusal is indicated.

- The documents were sent by Courier Service. It is mandatory to indicate the name of the service, the number of the shipment, as well as information about the website where you can check the current location of the parcel. You just need to wait until the package of documents appears in the customer’s city at a pre-agreed warehouse.

All documentation is processed through internal departments within a month. Thus, a person taking part in the NIS must first be patient, even when the documents are perfectly prepared and there are no grounds for refusal.

Loan programs: information section

Toll-free hotline of the Russian Mortgage Bank

The Russian Mortgage Bank operates two hotlines: for residents of Moscow and the Moscow region, and for free calls within the Russian Federation.

- 8-800-555-25-05 – For calls within Russia;

- 8-495-684-11-11 – Moscow.

In addition, clients can use official email

Do you use your personal account?Always use62%Never use9.42%Not registered yet28.58%Voted: 5816Sources used:

- https://ipotekarosvoen.ru/

- https://ucabinet.ru/internet-banking/rosvoenipoteka/

- https://prizivniku.com/raznoe/lichnyy-kabinet-voennosluzhashchego-rosvoenipoteke

- https://v-lichnyj-kabinet.ru/gosudarstvennye-sluzhby/rosvoenipoteka/

- https://banks-cabinet.ru/russipoteka.html