Comments

In this article, we will look at how legal it is to charge penalties for late payment for housing and communal services, and how the penalty itself is calculated in the presence of debt for housing and communal services and major repairs.

Not everyone and it is not always possible to pay for housing and communal services within the time limits established by law, as a result of which late payments occur.

Penalties for late payment for housing and communal services

In accordance with current legislation, payment for housing and communal services must be made before the 10th day of the month following the billing period , unless a different payment period for these services is established by the management agreement or the general meeting of members of the homeowners association or cooperative.

This norm is provided for in paragraph 1 of Article 155 of the Housing Code of the Russian Federation (hereinafter referred to as the Housing Code of the Russian Federation).

If there is a delay in payment for housing and communal services, performers for specific services have the right to charge penalties on the amount of the debt on the basis of paragraph 14 of Article 155 of the Housing Code of the Russian Federation.

Who should count the penalties?

The tax office charges penalties to companies that paid taxes, advance payments or insurance premiums late (Article of the Tax Code of the Russian Federation). To pay the penalty, wait for the Federal Tax Service's request. The tax office itself must indicate late payment and calculate penalties.

If you find an arrears and want to close them, calculate the penalties yourself, pay the arrears and penalties, and then submit an updated declaration. This is the only way to avoid a fine (Article of the Tax Code of the Russian Federation). If you first submit an update and then pay the tax and penalties, the inspectorate will impose a fine.

How to calculate penalties

The calculation procedure depends on the date on which the arrears arose and for what period the delay lasted.

The debt arose no earlier than December 28, 2021

Penalties are accrued from the date the debt arose until the date of repayment, inclusive. For the calculation, each calendar day of delay is taken into account, including holidays, weekends and non-working days.

Example . In 2021, Yabloko LLC was overdue for the advance payment of income tax. It was due to be paid on July 28, 2021, but the organization transferred the payment on August 5. Penalties will be accrued for 8 calendar days - from July 29 to August 5 inclusive.

Entrepreneurs and individuals pay penalties for the entire period of delay at a rate of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. For organizations, the rate changes depending on the period of delay (Article of the Tax Code of the Russian Federation, Article 13 of the Federal Law of November 30, 2016 No. 401-FZ):

- From the 1st to the 30th day - 1/300 of the refinancing rate for the period of delay.

Penalties for late payments up to 30 days = Amount of debt × Calendar days of delay × 1/300 of the refinancing rate

- From the 31st day - 1/150 of the refinancing rate that was in effect from the 31st day.

Late fees from the 31st day = Amount of debt × Calendar days of delay from the 31st day × 1/150 of the refinancing rate

Important! The amount of penalties cannot exceed the amount of debt. If the penalties turned out to be higher, you need to pay a penalty to the budget in the amount of the unpaid or late paid contribution, tax, advance payment, but not more than the amount of the debt (Clause 3 of Article of the Tax Code of the Russian Federation).

The debt arose from October 1, 2021 to December 27, 2018

Penalties are accrued from the day following the deadline for payment until the date of repayment of the arrears, excluding this day (letter of the Federal Tax Service dated December 6, 2017 No. ZN-3-22/7995).

The procedure for calculating penalties is similar to the previous one. For individual entrepreneurs the rate is 1/300 for the entire period; for organizations it increases:

- From the 1st to the 30th day - 1/300 of the refinancing rate for the period of delay.

- From the 31st day - 1/150 of the refinancing rate that was in effect from the 31st day.

Important! There are no restrictions on arrears that arose before December 28, 2021. The amount of penalties cannot exceed the amount of debt.

The debt arose before October 1, 2021

The procedure for calculating penalties is almost identical to that in force during the period from October 1, 2021 to December 27, 2021. The amount of penalties is not limited and the dates that are accepted for calculation are the same.

The only difference is in the calculation formula. The key refinancing rate is taken at 1/300 for the entire period of delay. There are no exceptions.

Calculation of penalties in the program

In the 1C program: Accounting in housing and communal services management companies, homeowners' associations and housing cooperatives

You can remove the accrual of penalties in accordance with Resolution No. 424. To do this, you need to open the Housing and Communal Services Accounting Policy - the Penalties tab.

Using the example of a personal account with debts for April, November and December, we show how to calculate penalties during the moratorium period.

Calculation of penalties in January 2021

On January 2, the moratorium period ended. Let's see how the program calculates penalties.

No penalties are charged in January: January 1 is still a moratorium period. For April and November debt

: January 2 is the first day of delay, penalties will be accrued from the thirty-first day, that is, from February.

For December debt

: the December accrual must be paid before January 11, January 12 is the first day of delay, penalties will be accrued from the 31st day.

Calculation of penalties in February 2021

Now let's see how penalties for February 2021 were calculated

For April and November debt

: From February 1, penalties begin to accrue; this is the thirty-first day of delay.

For December debt

: the accrual of penalties will begin on February 11. Therefore, in February we charge penalties only for 18 days.

From the thirty-first to the ninetieth day of delay, penalties are charged at 1/300 of the Central Bank rate. Central Bank key rate - 4.25% 1/300 key rate - 0.141667%

Calculation of penalties in March 2021

On March 22, 2021, the Central Bank key rate changed: it increased to 4.5% 1/300 of the Central Bank key rate 4.50 = 0.0150000. Therefore, from March 22, penalties are accrued at a rate of 0.015%

For April, November, December debt

: in March 2021, the debt period is less than 90 days, so the penalty rate is the same for everyone - 1/300. But from March 22 it will be slightly higher due to the increase in the Central Bank’s key rate.

If you are accruing penalties incorrectly or have problems with contracts, look at the large article about mutual settlements in 1C: Accounting in housing and communal services management companies, homeowners' associations, housing cooperatives.

In the article about calculating penalties, we show the mechanism in detail: with examples, tables and formulas.

How to pay penalties

The procedure for paying penalties is similar for insurance premiums and taxes. Pay them together with the amount of arrears or after paying the entire amount of tax or contribution (clauses 5, 7 of Article 2 of the Tax Code of the Russian Federation, clause 7 of Article 26.11 of Law No. 125-FZ).

To pay penalties, issue a separate payment order. In its field 104, reflect the BCC for penalties for the corresponding tax or contribution. In field 24, indicate that you are paying penalties, for what period and details of the tax claim, if any.

In field 106, enter the payment basis code. For example, voluntarily (VD), at the request of the tax office (TR), according to a tax audit report (TA). Depending on the code, fields 107-109 are filled in. For penalties on contributions for injuries, enter “0” in fields 106-109.

As it was before January 1, 2021

Until January 1, 2021, residents who paid for housing and utilities late or incompletely were required to pay penalties in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation in effect at the time of payment.

If the refinancing rate changed, the amount of penalties also changed.

Thus, in the period from September 14, 2012 to December 31, 2015, the refinancing rate established by the Central Bank of the Russian Federation was 8.25%.

Example:

according to the receipt for January 2015, you need to pay 3581.29 rubles.

On 02/08/2015, an amount of 3,100 rubles was deposited.

Thus, a debt in the amount of 481.29 rubles has arisen on the Subscriber’s personal account. (RUB 3,581.29 - RUB 3,100.00) for the period from 02/11/2015 to 02/21/2015 (the date the receipt for February was generated).

Penalties were accrued as follows: RUB 481.29. (amount of debt) x 11 days (number of days of overdue debt, i.e. from 02/11/2015 to 02/21/2015) x 0.00028 = 1.48 rubles.

How are penalties calculated now - from January 1, 2021

Federal Law No. 307-FZ* dated November 3, 2015 (hereinafter referred to as Federal Law No. 307) amended the article of the Housing Code regulating the procedure for calculating the amount of penalties. These changes came into force on 01/01/2016.

Now, in case of violation of the deadline for payment for residential premises and utilities or payment is not made in full, penalties are accrued in the following amounts:

- from 1 to 30 days - not credited.

— from 31 days to 90 days of delay in the amount of 1/300 of the refinancing rate;

- from 91 days onwards, the debtor is charged an increased amount of penalties - 1/130 of the refinancing rate.

Examples:

| 1. Calculation of the amount of penalties for debt arising from January 1, 2021 (before January 1 there was no debt, no penalties were accrued) |

| The payment deadline is January 10, 2021; as of January 10, 2021, payment has not been made. From January 11, 2021, 30 days are counted (during this period from January 11 to February 9, 2021 inclusive, no penalties are accrued). From February 10, 2021 (from the 31st day to the 90th day), penalties are accrued in the amount of 1/300 of the refinancing rate (penalties in the specified amount are accrued from February 10 to April 9, 2021 inclusive). From April 10, 2021 (from the 91st day) and subsequent days until the day of actual payment, penalties are accrued in the amount of 1/130 of the refinancing rate. |

| 2. Calculation of the amount of penalties for debt arising from September 11, 2015 (and earlier) |

| The payment deadline is September 10, 2015; as of September 10, 2015, payment has not been made (payment has not been made after January 1, 2016). From September 11 to December 31, 2015, penalties are charged in the amount of 1/300 of the refinancing rate (in accordance with Part 14 of Article 155 of the RF Housing Code as amended at that time). From January 1, 2021 to the day of actual payment, penalties are charged in the amount of 1/130 of the refinancing rate (in accordance with Part 14 of Article 155 of the RF Housing Code as amended by Federal Law No. 307, effective from January 1, 2021), since by January 1, 2021 the period of delay exceeds 90 days from the date of payment. |

| 3. Calculation of the amount of penalties for debt incurred since October 11, 2015 |

| The payment deadline is October 10, 2015; as of October 10, 2015, payment has not been made (payment has not been made after January 1, 2016). From October 11 to December 31, 2015, penalties are charged in the amount of 1/300 of the refinancing rate (in accordance with Part 14 of Article 155 of the RF Housing Code as amended at that time). From January 1 to January 8, 2021, penalties in the amount of 1/300 of the refinancing rate continue to be accrued (in accordance with Part 14 of Article 155 of the Housing Code of the Russian Federation as amended by Federal Law No. 307, effective from January 1, 2021), since by January 1, 2021 the period of delay exceeds 30 days, but does not exceed 90 days from the date of payment. From January 9, 2021 (91st day after the payment is due), penalties are charged in the amount of 1/130 of the refinancing rate on the day of actual payment. |

| 4. Calculation of the amount of penalties for debt incurred since November 11, 2015 |

| The payment deadline is November 10, 2015; as of November 10, 2015, payment has not been made (payment has not been made after January 1, 2016). From November 11 to December 31, 2015, penalties are charged in the amount of 1/300 of the refinancing rate (in accordance with Part 14 of Article 155 of the Housing Code of the Russian Federation as amended at that time). From January 1 to February 8, 2021, penalties in the amount of 1/300 of the refinancing rate continue to be accrued (in accordance with Part 14 of Article 155 of the RF Housing Code as amended by Federal Law No. 307, effective from January 1, 2021), since by January 1, 2021 the period of delay exceeds 30 days, but does not exceed 90 days from the date of payment. From February 9, 2021 (91st day after the payment is due), penalties are charged in the amount of 1/130 of the refinancing rate on the day of actual payment. |

| 5. Calculation of the amount of penalties for debt incurred since December 11, 2015 |

| The payment deadline is December 10, 2015; as of December 10, 2015, payment was not made (payment was not made after January 1, 2016). From December 11 to December 31, 2015 (21 days), penalties are charged in the amount of 1/300 of the refinancing rate (in accordance with Part 14 of Article 155 of the Housing Code of the Russian Federation as amended during this period). From January 1 to January 9, 2021 (9 days), penalties are not accrued (in accordance with Part 14 of Article 155 of the RF Housing Code as amended by Federal Law No. 307, effective from January 1, 2016 - penalties are not accrued within 30 days from the date of maturity payment). From January 10, 2021 (the 31st day from the date of payment) to March 9, 2021 (from the 31st to the 90th day), penalties in the amount of 1/300 of the refinancing rate continue to be charged. From March 10, 2021 (91st day after missing the payment deadline), penalties are charged in the amount of 1/130 of the refinancing rate on the day of actual payment. |

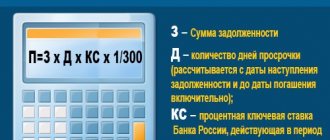

Major renovation

The Housing Code of the Russian Federation defines a separate procedure for calculating penalties for contributions for major repairs. By analogy with utilities, penalties are accrued not from the first day of non-payment or incomplete payment of charges for major repairs, but from the thirty-first day. In this case, for each subsequent day of non-payment, penalties are charged in the amount of 1/300 of the refinancing rate of the Central Bank, regardless of the term of the debt.

In accordance with the instructions of the Bank of Russia**, from January 1, 2016, the value of the refinancing rate is equal to the value of the Bank of Russia key rate determined on the corresponding date

.

Accrual of penalties in accordance with Part 14. Part 14.1 Art. 155 of the Housing Code of the Russian Federation is carried out based on the size of the key rate of the Bank of Russia, which currently amounts to 10%

.

* Federal Law No. 307-FZ dated November 3, 2015 “On amendments to certain legislative acts of the Russian Federation in connection with strengthening the payment discipline of consumers of energy resources.”

** Directive of the Bank of Russia dated December 11, 2015 No. 3894-U “On the refinancing rate of the Bank of Russia and the key rate of the Bank of Russia.”

Penalty calculator