Pre-trial compensation for damage caused by flooding of an apartment

Despite the fact that the law does not provide for a mandatory pre-trial procedure for resolving such disputes, before going to court, you should send a claim to the guilty party demanding compensation for damage after the apartment was flooded. A pre-trial demand allows the victim to indicate the seriousness of his intentions to receive compensation for the damage caused, and also encourages the other party to seek a resolution to the current situation. The claim must indicate:

- recipient of the claim;

- sender of the claim;

- date and time of flooding of the apartment, exact address, alleged cause of flooding and the person responsible;

- requirements for the perpetrator, including the procedure for obtaining compensation;

- date of preparation of the pre-trial demand.

The claim is signed by the victim, after which it is handed over personally or sent by registered mail with a list of the contents addressed to the recipient. No matter how the claim is sent, the main thing is that you have documents on hand confirming the fact that it was sent.

It is worth noting that the court always positively perceives the party’s intentions to resolve the conflict peacefully. In addition, the presence of an unanswered claim in the case may indicate dishonest behavior of the defendant and is used by the plaintiff to prove his case.

USEFUL : read how you can make a claim profitably through us, and also watch a video with additional tips on filing it

Sample complaint to neighbors who flooded the apartment

You need to start writing a claim after you understand who is responsible for the flood.

To whom should the complaint be addressed?

If the culprits are neighbors, then the claim for flooding of the apartment due to the fault of the neighbors should be addressed to the owner of the property, and not to other persons living there on a commercial or free basis (for example, a tenant under a commercial lease agreement). If we are talking about a citizen who lives on social rent, then he will be responsible for the flood, i.e. the claim must be sent to him.

You can find out who the owner is through the management organization. If for some reason this is not possible, Rosreestr has reliable information about this. On the department’s website you can order an online extract from the Unified State Register (USRN is a paid service).

If the management company is at fault, then the claim is sent to the address of its location, or transferred to one of the employees against signature.

Contents of the claim

Here is an approximate structure of a claim addressed to neighbors:

- Document header. It consists of the full name, address and contacts of the owner of the affected apartment, as well as the full name and address of the owner of the apartment from which the flooding occurred, or data from the management organization if the flood occurred through its fault.

- Main part. It sets out the facts with supporting documents, as well as legal norms justifying the requirements. Thus, the obligation of the culprit to compensate for the damage caused to the property of a citizen is provided for in paragraph 1 of Art. 1064 of the Civil Code of the Russian Federation.

- The pleading part. Here you should set out specific requirements for the culprit.

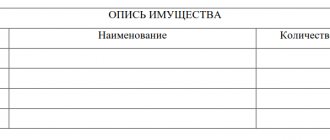

- List of documents attached to the claim. These are documents that substantiate the requirements: photographs, a flood report, an assessment report, checks, receipts, etc.

- The writing is completed by affixing the signature of the owner of the affected apartment and the date of drawing up the document.

A deadline for responding to a complaint should also be set, and it should be reasonable (for example, 10 calendar days). If the claim is written to the management organization, it should be taken into account that the deadline for reviewing the document may be established by the management agreement - then this is what is indicated.

Determining the amount of compensation for flooding an apartment

In accordance with Art. 1064 of the Civil Code of the Russian Federation, damage caused to a person or property is subject to compensation in full. After flooding the apartment, the parties have the right to agree on an amount that will compensate for the damage caused. To do this, the injured party should record the damage (in a photo or video) and invite witnesses who will be able to confirm the visible damage in the future. It is permissible to compile the amount of compensation with a reasonable degree of reliability in the form of a table, after which, transfer the documents to the culprit of the flood so that he can express his position.

If the parties were unable to agree on the amount of compensation on their own, then they should contact a specialized organization engaged in the assessment of damaged property, building materials and apartment decoration. If there are disagreements after involving a third-party appraiser, to resolve the conflict, you will need to go to court with a statement of claim.

The damage assessment previously carried out by an independent appraiser will be a weighty argument in determining the amount of compensation. In addition, if any of the parties disagrees with the results of the assessment, the court, on its own initiative or at the request of a party, may order a forensic examination, therefore it is not recommended to carry out repairs on the premises until all issues regarding compensation for damage caused have been resolved.

Collection of the insured amount in connection with the flooding of residential premises

We offer for your information judicial practice in a civil case, in which lawyer Zaporozhets V.M. represented the interests of citizen K.A.V. according to the claim of K.A.V. to the limited liability company "Rosgosstrakh" for compensation for material damage, recovery of penalties and compensation for moral damage, in connection with the flooding of K.A.V.'s apartment.

After many attempts to obtain the insurance amount in connection with the flooding of the apartment, K.A.V. was forced to turn to lawyers for help.

During the study of documents in the case and after consultation with lawyer Zaporozhets V.M. citizen K.A.V. it was decided to go to court.

Lawyer Zaporozhets V.M. prepared the corresponding statement of claim and represented the interests of the plaintiff K.A.V.

The court found that the property of K.A.V. There is an apartment at the address: <address>. DD.MM.YYYY between her and the branch of Rosgosstrakh LLC a voluntary insurance agreement was concluded for an apartment of series No. <... > on the basis of the Rules for voluntary insurance of buildings, apartments, household and other property, civil liability of property owners (owners) No. <... >.

During the contract period, an insured event occurred (the house was flooded to a level of two meters from the floor), the next day K.A.V. I contacted the insurance company with a corresponding application and within a few days submitted all the necessary documents.

The apartment was inspected DD.MM.YYYY, insurance compensation was paid DD.MM.YYYY, but with the amount paid gr. K.A.V. I do not agree (since it is unreasonably underestimated) and are asking to recover the difference between the amount of insurance compensation paid for damage to the apartment and the cost of restoration repairs in the amount of <... > rubles <... >, in addition, the insurance compensation should have been paid within 10 days (not counting weekends and holidays), that is, DD.MM.YYYY, the defendant was 66 days late (from DD.MM.YYYY).

The calculation of the delay amounted to <... > rubles <... > days, the specified amount is asked to be recovered from the defendant, as well as moral damages in the amount of <... > rubles for moral suffering caused by the unlawful actions of the defendant, who delayed payment, to recover the costs of paying a lawyer for drawing up the claim applications and representation of interests in court, as well as for conducting an examination in the amount of <...> rubles.

K.S.I. was brought in to participate in the case as a third party who does not make independent claims on the plaintiff’s side, who supported the claims in full at the court hearing.

Representative of the defendant by proxy V.M.Yu. did not appear at the court hearing, asked to be considered without his participation, sent a response according to which he objects to the claims, believes that an independent examination confirms the amount of damage paid by the insurance company, believed that the defendant made payment on time and in full, grounds for collecting compensation there is no moral damage or penalties, the plaintiff provided all the necessary documents only DD.MM.YYYY.

Having studied the case materials and listened to the explanations of the persons involved in the case, the court comes to the following conclusion.

The apartment with a total area of <... > square meters, located at <address>, is in the common joint ownership of K.A.V., K.S.I., which is confirmed by a certificate of state registration of rights of the series <... > No. <... > issued by the Office of the Federal Registration Service DD.MM.YYYY.

At the court hearing it was established that DD.MM.YYYY between K.A.V. and Rosgosstrakh LLC entered into an insurance contract <address>, which is confirmed by the insurance policy series <... > No. <... > The beneficiary under the contract is not specified.

The validity period of the agreement is DD.MM.YYYY. Under the contract, the following were insured: interior decoration and engineering equipment of the apartment in the amount of <... > rubles, household property in the amount of <... > rubles, (including furniture <... > rubles, audio-video equipment, household appliances and electronics... rubles, clothing , shoes, underwear - <... > rubles, other - <... > rubles).

In accordance with Art. 943 of the Civil Code of the Russian Federation, the conditions under which an insurance contract is concluded can be determined in the standard rules of insurance of the corresponding type, adopted, approved or approved by the insurer or an association of insurers (insurance rules). Conditions contained in the insurance rules and not included in the text of the insurance contract (insurance policy) are mandatory for the insured (beneficiary), if the contract (insurance policy) directly indicates the application of such rules and the rules themselves are set out in one document with the contract (insurance policy) ) either on its reverse side or attached to it.

In the latter case, delivery of the insurance rules to the policyholder upon conclusion of the contract must be certified by an entry in the contract. When concluding an insurance contract, the policyholder and the insurer may agree to amend or exclude certain provisions of the insurance rules and to supplement the rules. The insured (beneficiary) has the right to refer, in defense of his interests, to the rules of insurance of the relevant type, which are referred to in the insurance contract (insurance policy), even if these rules are not binding for him by virtue of this article.

The conditions under which the insurance contract was concluded between the parties are defined in the Rules for voluntary insurance of buildings, apartments, household and other property, civil liability of property owners (owners) (Standard (Unified)) No. 167.

As follows from the insurance contract concluded between the parties, the contract was concluded according to option No. 1 of the Rules, that is, the property is insured against accidents, natural disasters, including floods and floods.

In accordance with Part 1 1 and 2 tbsp. 947 of the Civil Code of the Russian Federation, the amount within which the insurer undertakes to pay insurance compensation under a property insurance contract or which he undertakes to pay under a personal insurance contract (insurance amount) is determined by an agreement between the policyholder and the insurer in accordance with the rules provided for by this article. When insuring property, unless otherwise provided by the insurance contract, the insured amount should not exceed their actual value (insurance value). This value is considered to be the actual value of the property at its location on the day of concluding the insurance contract.

Similar provisions regarding the determination of the insured amount are contained in clause 4.2 of the Rules. According to paragraphs. 4.3.1 and 4.3.2 of the Rules, the actual (insurable) value of the insurance object when insuring buildings means the cost of construction (construction) of the insurance object, taking into account wear and tear (in the case of apartment insurance - market value) and/or repair (restoration) costs, including the cost of finishing materials and equipment (including wear and tear) and work performed at the time of concluding the insurance contract.

The insured amounts under the insurance contract are determined in the amount of <... > rubles in relation to household property, <... > rubles in relation to the apartment (without interior decoration and engineering equipment) and <... > rubles in relation to the interior decoration and engineering equipment of the apartment, taking into account 10% depreciation .

In accordance with clauses 7.15, 7.15.1 of the Rules, an insurance contract for buildings (apartments), interior decoration, equipment of buildings (apartments) can be concluded with the condition of reimbursement of expenses for restoration (repair) of the insurance object in case of damage to property “taking into account wear and tear”.

In this case, it is precisely this condition that is included in the insurance contract concluded between the parties.

In accordance with section 12 of the Rules, interior decoration and engineering equipment - all types of internal plastering work, painting, glass, wallpaper, tiling work, floor coverings, door structures (entrance and interior), including the door itself, door frame, excluding external decoration of the entrance apartment doors, window units, including glazing, etc.

In this case, the object of insurance was the apartment itself (without interior decoration and engineering equipment) and the interior decoration of the apartment and engineering equipment of the apartment.

Resolution of the district administration dated DD.MM.YYYY No. 130 “On the introduction of an emergency situation” in connection with a sharp rise in water level on the S. River due to a congestion at the village <address> and flooding of the housing stock in the amount of five houses at <address > from 19.00 DD.MM.YYYY a state of emergency was introduced on the administrative territory of the municipality.

From the certificate of the district administration No. <...>, issued by DD.MM.YYYY gr. K.A.V., living at <address>, it follows that DD.MM.YYYY with a sudden rise in the water level in the river. N. up to 950 cm, (and with a water hammer at 00 hours 40 minutes DD.MM.YYYY more than 10 meters), the house was flooded to a level of two meters from the floor, as a result of which all existing property was damaged, furniture was lost, walls and floors were damaged , damaged gas equipment, electrical wiring, electrical appliances, household electrical appliances, home decoration; The water hammer damaged the bathhouse and woodshed.

DD.MM.YYYY plaintiff K.A.V. appealed to the defendant with a statement about the insured event.

The procedure for determining the amount of damage and making insurance payments is provided for in Section 9 of the Rules.

DD.MM.YYYY, the expert of CJSC <...> issued an act on the destruction, damage or loss of buildings (apartments), household and/or other property belonging to K.A.V., according to which a list of household property destroyed and damaged as a result was drawn up natural disaster, as well as information about damage to the interior decoration of the house and engineering equipment, which are signed by K.A.V., objections by K.A.V. The specified lists do not contain the relative amount of household property and its value, the nature and extent of damage to interior decoration and engineering equipment.

Based on the drawn up act, LLC <...> assessed the damaged and destroyed household property, as well as the cost of restoration and repair work on the interior decoration and engineering equipment of the apartment.

The amount of insurance payment by the expert for destruction and damage to common property is determined in the amount of ... rubles, for restoration work on interior decoration and engineering equipment is determined - < ... > rubles, including walls 30% - < ... > rubles, floor 20% - < ... > rubles, household property in the amount of <... > rubles. In total, the total amount of insurance payment was <...> rubles.

Insurance company DD.MM.YYYY K.A.V. Insurance payments in the amount of <...> rubles were transferred to personal account No. <...> in the additional office of the Bank's branch <...>.

Beneficiary K.A.V. DD.MM.YYYY contacted the insurance company with a request to recalculate the insurance payment and reimbursement of penalties for late insurance payment.

In meeting the requirements of K.A.V. the insurance company refused, citing the fact that there were no grounds for revising the amount of insurance compensation.

With payments made to K.A.V. did not agree, went to court, asked to recover from the insurance company the difference between the amount of insurance compensation paid for damage to the apartment and the cost of restoration in the amount of <... > rubles, arguing that in fact more damage was caused as a result of the flood. He substantiates his demands for the recovery of a larger insurance payment with an expert opinion drawn up by appraiser S.A.V.

By court ruling dated DD.MM.YYYY, an expert examination was appointed in the case to determine the amount of damage caused as a result of damage to the apartment. According to the expert opinion on substantiating the cost of restoration repairs and damage after flooding of the apartment, compiled by appraiser S.A.V., the cost of restoration repairs of the apartment as of DD.MM.YYYY < ... > rubles, the cost of damage as a result of damage to the apartment is < ... > ruble <... > kopecks.

When conducting the examination, the act dated May 22, 2013 of JSC <...> on the destruction, damage or loss of buildings (apartments), household and/or other property was used, the local estimate was compiled using territorial unit prices and estimated prices for materials in base prices 2010 year with recalculation to current prices on DD.MM.YYYY.

Taking into account the circumstances of the case, the court considers it possible to base the decision on the opinion of an independent expert, whom the court has no reason not to trust, and to recover from the insurance company in favor of K.A.V. the difference between the amount of insurance compensation paid for damage to the apartment and the cost of restoration repairs, which, according to the court’s calculations, amounts to the amount of <... > rubles <... > kopecks.

The estimated cost of repair and restoration of the apartment, according to the examination, is ... rubles, the cost of materials, excluding 10% of wear and tear, is < ... > rubles, the defendant paid an insurance payment for damage to interior decoration - ... rubles, therefore, the amount to be recovered is - < … > rubles < … > kopecks < … >.

Plaintiff K.A.V. demands to recover from the defendant a penalty for untimely payment of insurance compensation for 66 days for the period from DD.MM.YYYY in the amount of <... > rubles <... > kopecks.

According to paragraphs. 8.1.2, 8.1.3 of the Rules, the insurer is obliged, after receiving all the necessary documents, to make a decision within five days on recognition or non-recognition of the event as an insured event and on insurance payment or refusal of insurance payment, in the event of a decision to recognize an event that has signs of an insured event, insured event, within five days (not counting weekends and holidays) after the day the corresponding decision was made, make an insurance payment, and in case of refusal of an insurance payment, notify the policyholder in writing about the decision within the same period.

Plaintiff K.A.V. claims that the application with all the necessary documents was sent by DD.MM.YYYY, no demands were made that she did not provide all the documents, the insurance payment was made by DD.MM.YYYY, the defendant’s arguments that they were not provided all the documents are not supported by anything, which gives the court grounds to conclude that the defendant paid the insurance compensation in violation of the deadlines established by law.

Taking into account the circumstances of the case, the fact that the defendant made the insurance payment in violation of the deadlines, taking into account that civil law provides for a penalty as a way to ensure the fulfillment of obligations and a measure of property liability for their fulfillment, the court came to the conclusion that the claims in this parts are subject to satisfaction, however, taking into account the requirements of reasonableness and fairness, the proportionality of the violation committed under the obligation that has arisen, the court considers it possible to determine the amount of the penalty in the amount of <... > rubles, there are no grounds for collecting it in a larger amount.

Plaintiff K.A.V. claims were also filed for compensation for moral damage caused to her in the amount of <...> rubles.

In accordance with the Preamble of the Federal Law "On the Protection of Consumer Rights", this Law regulates the relations arising between consumers and manufacturers, performers, importers, sellers when selling goods (performing work, providing services), establishes the rights of consumers to purchase goods (work, services) ) of appropriate quality and safe for life, health, property of consumers and the environment, obtaining information about goods (works, services) and their manufacturers (performers, sellers), education, state and public protection of their interests, and also determines the mechanism for implementing these right

Consumer is a citizen who intends to order or purchase, or who orders, purchases or uses goods (work, services) exclusively for personal, family, household and other needs not related to business activities. Contractor - an organization, regardless of its organizational and legal form, as well as an individual entrepreneur, performing work or providing services to consumers under a paid contract; lack of goods (work, service) - non-compliance of the goods (work, service) or the mandatory requirements provided for by law or in the established according to the order, or the terms of the contract (in their absence or incompleteness of the conditions usually presented to the requirements), or the purposes for which a product (work, service) of this kind is usually used, or the purposes of which the seller (performer) was informed by the consumer at the conclusion contract, or sample and (or) description when selling goods according to the sample and (or) description.

From the legal relations of the parties it follows that the defendant is the provider of the voluntary property insurance service, and the plaintiff is the consumer of this service.

The disadvantage of the service in this case is a significant violation of the deadlines for making insurance payments, defined in paragraphs. 8.1.2 and 8.1.3 Regulations. The defendant did not provide evidence to the court that these deadlines were violated through no fault of his own.

In accordance with Art. 15 of the Law, moral damage caused to the consumer as a result of violation by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) of consumer rights provided for by the laws and legal acts of the Russian Federation regulating relations in the field of consumer rights protection, is subject to compensation by the causer of harm, if any his guilt. The amount of compensation for moral damage is determined by the court and does not depend on the amount of compensation for property damage. Compensation for moral damage is carried out regardless of compensation for property damage and losses incurred by the consumer.

Since K.A.V. is right to receive insurance payment on time and in full by the defendant is guilty of violation, compensation for moral damage is subject to recovery from the defendant in favor of the plaintiff.

In accordance with Art. 151 of the Civil Code of the Russian Federation, if a citizen has suffered moral harm (physical or moral suffering) by actions that violate his personal non-property rights or encroach on other intangible benefits belonging to the citizen, as well as in other cases provided for by law, the court may impose on the violator the obligation of monetary compensation for the specified harm.

When determining the amount of compensation for moral damage, the court takes into account the degree of guilt of the offender and other circumstances worthy of attention. The court must also take into account the degree of physical and mental suffering associated with the individual characteristics of the person who suffered harm.

When determining the amount of compensation for moral damage, the court accepts the plaintiff’s arguments about the moral suffering experienced due to repeated requests to the defendant for payment of insurance compensation, and the defendant’s failure to pay insurance compensation in full for a long period of time.

Taking into account the degree of reasonableness and fairness, it considers it possible to recover from the defendant compensation for moral damage in the amount of <...> rubles.

Clause 6 of Art. 13 of the Law “On the Protection of Consumer Rights” establishes that when the court satisfies the consumer’s requirements established by law, the court collects from the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) for failure to voluntarily satisfy the consumer’s requirements a fine of fifty percent of the amount awarded by the court in favor of the consumer.

Considering that the defendant was charged the difference between the paid amount of insurance compensation for damage to the apartment and the cost of restoration in the amount of <... > rubles <... > kopecks, a penalty in the amount of <... > rubles, the court considers it possible to collect a fine in the amount of <... > rubles < ... > kopecks.

According to Part 1 p. 98 of the Code of Civil Procedure of the Russian Federation, the court awards the party in whose favor the court decision is made to reimburse the other party for all legal expenses incurred in the case. In accordance with the requirement of Part 1 of Art. 100 of the Code of Civil Procedure of the Russian Federation, to the party in whose favor the court decision was made, at its written request, the court awards, on the other hand, the costs of paying for the services of a representative within reasonable limits.

Taking into account the circumstances of the case, the court considers it possible to recover in favor of the plaintiff the costs of paying for the examination in the amount of <... > rubles, the costs of paying for the services of a representative in the amount of ... rubles, which were expressed in drawing up a statement of claim, participation in court hearings, these costs correspond to the complexity cases are not overly inflated.

In accordance with Art. 61.1, 61.2 of the Budget Code of the Russian Federation, the defendant is subject to the collection of a state duty for local budget revenue in the amount of <... > rubles <... > kopecks.

Guided by Art. Art. 194-198 Code of Civil Procedure of the Russian Federation, the court decided the claims of K.A.V. partially satisfy.

The court recovered from the limited liability company Rosgosstrakh in favor of K.A.V. material damage in the amount of < … > rubles < … > kopecks, including the difference between the amount of insurance compensation paid for damage to the apartment and the cost of restoration in the amount of < … > rubles < … > kopecks, a penalty for late transfer of insurance payment in the amount of … rubles , compensation for moral damage in the amount of ... rubles, legal expenses in the amount of <... > rubles, the rest of the claims are refused.

A fine in the amount of <...> rubles <...> kopecks was also collected. from the limited liability company "Rosgosstrakh" in favor of K.A.V. and state duty for local budget revenue in the amount of <... > rubles <... > kopecks.

Documents to court in case of flooding of an apartment

The statement of claim for compensation for damage caused by flooding of the apartment, in addition to the claim itself, includes the following documents:

- information about the plaintiff and defendant in the future lawsuit . We are talking about passports for individuals or extracts from the Unified State Register of Legal Entities for legal entities. The plaintiff also needs to confirm his ownership of the apartment and the defendant's ownership. If the fault for flooding the apartment is related to the actions (inactions) of the management company or developer, then an agreement will be required, the terms of which, apparently, were violated by these legal entities;

- documents confirming the circumstances of the case . To record damage and establish the amount of compensation, a conclusion from an independent appraiser is required;

- a receipt confirming payment of the state fee or a request for deferred payment;

- notification of delivery of a copy of the claim with attachments to the defendant or confirming the fact of sending the application to him;

- other documents recommended by a specialist from the Law Office “Katsailidi and Partners”. These may include: a copy of the claim previously sent to the defendant, a power of attorney from the plaintiff’s representative, and others.

Steps to take before filing a flood claim

If the flooding is not confirmed by documents, recovery of damages will be difficult and sometimes impossible. Before filing a claim, it is necessary to collect evidence.

Evidence needed:

- The fact of the flood, the occurrence of damage and guilt in the incident. To do this, immediately after flooding is detected, representatives of the organization managing the house (management company or HOA) are called, a flood report is drawn up indicating its cause and the culprit, and detailed photographs of the damage are taken.

- Amount of damage. It can be confirmed by an independent assessment.

- The fact of incurring additional costs in connection with the bay, as well as their size. Confirmation will be contracts, receipts, checks, etc.

Even if the fact of the flood was not discovered immediately (for example, the owner was absent from home for a long time), it is still necessary to call representatives of the management organization to draw up a report. There is no statute of limitations for the situation described.

How does the apartment bay trial work?

This category of cases, depending on the amount of claims, is considered by magistrates or district courts. A civil case must be considered within two months from the date of receipt of the claim in court, but in reality it may take a longer period to consider the case.

After accepting the claim for proceedings, the court determines the date for the preliminary hearing in the case. In the ruling on preparing the case for trial, the court indicates to the parties what is required of them in addition to the previously presented materials. You must be fully prepared for the preliminary court hearing, since in cases involving flooding of an apartment, in the absence of objections from the parties, the court can proceed to the main hearing immediately after the preliminary hearing and consider the case on the merits.

The consideration of the case consists in the fact that the plaintiff substantiates his claims against the culprit of the flood in the apartment, and the defendant either accepts the claims or expresses his disagreement with them. If there is a dispute about the amount of damage, the parties have the right to request the appointment of a forensic examination to determine its amount.

After studying all the circumstances of the case, judicial arguments, remarks and studying materials, the court retires to the deliberation room to make a decision. The court decision comes into force after a month from the date of its production in final form, unless it has been appealed.

How to win a claim for damages after a flood?

Litigation always involves some risk. In some processes the risk is higher, in others it is lower, but it still exists. This is due to the fact that it is impossible to predict the actions of one’s opponent, and no one can know in advance all the documents that will be presented by the parties during the trial. You can minimize the risk of becoming a losing party in a court case by following the following basic rules:

- identify the defendant in the case . A claim filed against an improper defendant will be denied, so the proper culprit for the flooding must be identified before the trial. The alleged culprits could be neighbors, the developer, a management company or another organization that manages the house. If the owner of the apartment is unknown, then you can find him out at the territorial office of Rosreestr;

- prepare carefully for the trial . It is necessary to collect as much useful material as possible for the trial. The main evidence will be an assessment of the damage caused and recording the fact of flooding by a specific person;

- comply with all procedural formalities . These include both advance payment of state fees and support of your position directly at the meeting;

- seek help from a professional lawyer . If you doubt your success, we recommend that you seek help from a specialist in this category of cases. The assistance of a lawyer can play a key role in achieving a positive result in a case for compensation for damage caused by an apartment flood.

What can be demanded from the culprit of the flood?

The owner of an apartment damaged by the flood may demand compensation for:

- Material damage. This will be the amount indicated in the appraisal report as the cost of repair and restoration work.

- Costs of conducting an independent assessment. Costs must be confirmed by an agreement for the provision of appraisal services and a payment document (receipt, check, etc.).

- Costs for legal services (drawing up a claim). The evidence here is an agreement on the provision of relevant services and a payment document.

- Other expenses. For example, to notify the culprit about the upcoming assessment or to prepare a technical plan, floor plan and explication (if this was required for the assessment). All such expenses must also be supported by proof of payment.

A claim for flooding of an apartment, if it is addressed to the management organization, can include a claim for compensation for moral damage. In relations with the owner, he acts as a consumer, whose right to such compensation is provided for in Art. 15 ZPPP. In other cases, you should not count on compensation, no matter how great the damage to property. Courts usually refuse to collect it in this category of cases.