Current legislation obliges homeowners in apartment buildings to pay contributions for major repairs of premises that are in common ownership. At the moment, there are disputes regarding the legality of collecting these contributions, and therefore many apartment owners are in no hurry to pay bills for major repairs. Today we will talk in the article about liability for late payment of contributions: are there penalties for major repairs, what formula are they calculated by, is it possible to resolve the dispute over the payment of contributions in court.

Contributions for major repairs: general provisions

In 2012, the Government of the Russian Federation adopted a law according to which responsibility for carrying out major repairs in apartment buildings falls on the shoulders of home owners. This law came into force on 01/01/14, in connection with which home owners are required to make contributions for major repairs. Legislative norms provide for the following scheme for carrying out repairs at the expense of the owners:

- Homeowners pay monthly fees for major repairs. The amounts of funds are accumulated by the Capital Repair Fund (CRF).

- FKR undertakes the obligation to carry out repairs at the expense of the owners. In this regard, the FKR is holding a tender among contractors wishing to carry out repair work in a particular region.

- The contractor who wins the tender carries out major repairs of common areas (roof, façade, foundation, etc.), intra-house systems and utilities, installs communal heat and gas meters, etc. The contractor is paid by the FKR using contributions from homeowners.

Contributions paid by homeowners are accumulated in the Fund of a specific region (depending on the location of the property). Also, regional FKRs search for contractors, hold a tender and approve a list of companies that will carry out repairs in a given region.

Procedure and deadlines for paying fees for major repairs

Since the payment of contributions for major repairs is made to the Regional Operator Fund, it is the regional legislation that regulates the timing and procedure for making payments for major repairs. In general, contributions must be paid “monthly” (payment for March is made in March).

Where to pay for major repairs without commission

Where to pay for major repairs of an apartment building? In the vast majority of constituent entities, the procedure for contributions for major repairs is similar to payment for rent and housing and communal services and is carried out:

Since the procedure for paying contributions for major repairs at this stage differs from the usual procedure for paying utility bills, you can read the instructions for making payments through the Sberbank-Online service on the bank’s official website by following the link www.sberbank.ru/samara/ru /promo/sbol/oplata_zhkkh/

Penalty for violation of payment deadlines

For persons who have paid contributions late and/or incompletely, liability is provided in accordance with Art. 155 Housing Code of the Russian Federation. In accordance with the norms of the Housing Code, the debtor is obliged not only to repay the arrears of contributions for major repairs, but also to pay interest in the prescribed manner (Part 14 of Article 155 of the Housing Code of the Russian Federation). Many call the accrued interest penalties, because in fact, debtors who violated the procedure for paying contributions are required to make this payment.

At the same time, according to the clarifications of the FKR, interest for non-payment is not a penalty or penalty. The amount of interest is collected from debtors in order to replenish the financial reserves of the Fund. Like the fees themselves, late interest paid can only be used for major repairs of common property in apartment buildings.

On the suspension of the collection of penalties (fines, penalties) in the housing and communal services sector until January 1, 2021

The Government of the Russian Federation, by Decree No. 424 dated 04/02/2020 “On the specifics of providing utility services to owners and users of premises in apartment buildings and residential buildings” (hereinafter Resolution No. 424), suspended the collection of penalties until January 1, 2021:

- in case of untimely and (or) not paid in full payment for residential premises and utilities and contributions for major repairs, i.e. exempted apartment owners from collecting penalties ;

- for untimely and (or) incomplete fulfillment by persons engaged in the management of apartment buildings of obligations to pay for utility resources (gas supply, electricity, heat supply, water supply and sewerage, solid municipal waste), i.e. HOAs, management companies, etc. were exempted from collecting penalties.

These prohibitions are formulated as follows:

- suspension of the provisions (containing the right to collect penalties) of the Rules for the provision of utility services to owners and users of premises in apartment buildings and residential buildings, approved by Decree of the Government of the Russian Federation of May 6, 2011 No. 354 “On the provision of utility services to owners and users of premises in apartment buildings and residential buildings" (clause 1);

- a ban on the application of provisions of contracts for the provision of utility services that contradict this resolution (Government Decree No. 424) - i.e., it is obvious that it is implied that if such an agreement has the right to collect a penalty, then this provision now contradicts the ban on the collection of a penalty (clause 2 and clause 3);

- a ban on the application of the provisions of management agreements for apartment buildings establishing the right to collect penalties for late and (or) incomplete payment of payment for residential premises (clause 4);

- suspension of the collection of penalties in case of untimely and (or) incomplete payments for residential premises and utilities and contributions for major repairs (clause 5).

The Government of the Russian Federation has the right to introduce such restrictions. On March 31, 2020, the State Duma adopted Federal Law No. 98-FZ dated January 1, 2020 “On Amendments to Certain Legislative Acts of the Russian Federation on the Prevention and Response to Emergency Situations” (hereinafter referred to as Law No. 98-FZ). This law introduced changes to some regulatory legal acts, including the Federal Law of December 21, 1994 No. 68-FZ “On the protection of the population and territories from natural and man-made emergencies.”

Previously, as follows from Art. 1 of the Federal Law of December 21, 1994 No. 68-FZ “On the protection of the population and territories from emergencies of a natural and man-made nature”, an emergency situation was considered to be a situation in a certain territory resulting from an accident, a dangerous natural phenomenon, a catastrophe, a natural or other disaster, which may result or have resulted in human casualties, damage to human health or the environment, significant material losses and disruption of people's living conditions.

Now the provision of the article in question has been supplemented with the concept of “the spread of a disease that poses a danger to others.” In view of this, the legislator has now provided for the possibility of adopting amendments in the face of the threat of the spread of coronavirus infection (COVID-19).

In accordance with Art. 18 of Law No. 98-FZ The Government of the Russian Federation, among other things, may establish specifics for the calculation and payment of penalties in the event of untimely and (or) incomplete payment of payments for residential premises and utilities. The same applies to the collection of penalties (fines, penalties) for untimely and (or) incompletely fulfilled obligations by legal entities to pay for services provided on the basis of contracts in accordance with the legislation of the Russian Federation on gas supply, electric power, heat supply, water supply and sanitation.

In development of the above article of Law No. 98-FZ, the Government of the Russian Federation adopted Resolution No. 424.

However, the main normative acts establishing the right to collect the corresponding penalty are the Civil Code of the Russian Federation, the Housing Code of the Russian Federation and other laws, which Government Resolution No. 424 did not dare to “swing” and which it left without attention. In particular, as provided for in Art. 15 of the Law on Heat Supply dated July 27, 2010 No. 190-FZ, parts of Art. 13 of the Law on water supply and sanitation dated December 7, 2011 No. 416-FZ, art. 37 of the Law on Electric Power Industry No. 35-FZ, Art. 25 of the Law on Gas Supply No. 69-FZ, consumers of energy resources are obliged to pay a legal penalty to the resource supplying organization in case of late and (or) incomplete payment for energy, and in accordance with paragraphs. 14 t 14.1 st. 155 of the Housing Code of the Russian Federation, persons who have lately and (or) not fully paid for residential premises and utilities, contributions for major repairs, are required to pay penalties.

But despite the absence of changes in the above articles of laws, in accordance with Art. 422 of the Civil Code of the Russian Federation, the provisions of contracts in this part must comply with the rules established by law and other legal acts, which in the case under consideration is Resolution No. 424. As a consequence, the provisions established by Resolution No. 424 apply to both legal and contractual penalties.

The Resolution itself comes into force from the date of its official publication - i.e. from 04/06/2020. But it does not follow from the text of the document that its effect extends to legal relations that arose before its entry into force; it does not contain retrospective clauses. This measure represents a temporary moratorium on the assessment of penalties for late fulfillment of obligations.

At the same time, the normative act does not contain specifics in the part of paragraph 5, which deals specifically with the collection of penalties in court . The legislator also did not provide detailed comments or explanations. Let's take a closer look here.

Paragraph 5 of Resolution No. 424 reads as follows: “Suspend until January 1, 2021 the collection of penalties (fines, penalties) in the case of untimely and (or) incomplete payments for residential premises and utilities and contributions for major repairs.”

Most comments suggest that the Government has prohibited from April 6 to January 1, 2021 the collection of penalties (fines, penalties) in cases where payments for housing and utilities are paid late and (or) incompletely. During this period, management organizations will not be able to demand penalties from residents who are late in paying utility bills. In turn, management organizations were also protected from penalties for failure to fulfill obligations to suppliers of utility resources.

That is, delving into the meaning of the text of the fifth paragraph, without having the legislator’s comments, one can perceive the double meaning of this:

1. it is impossible to collect a penalty accrued in the period from 04/06/2020 to 01/01/2021, but accrued for delays incurred before April 6, 2021 can be collected now, after April 6;

2. it is impossible to collect a penalty during the specified period in principle, including those accrued for the period of delay until April 6, 2020.

Arbitrage practice

Analyzing the judicial practice of arbitration courts that has already developed in a short period of time, we can conclude that the courts evaluate the fifth paragraph of Resolution No. 424 as follows: it is impossible to recover a penalty accrued during the period from 04/06/2020 to 01/01/2021.

For example, in the decision of the Arbitration Court of the Amur Region dated April 14, 2020 in case No. A04-1390/2020, the court stated:

<…> At the same time, in accordance with the Decree of the Government of the Russian Federation dated 04/02/2020 No. 424, in the period from 04/06/2020 to 01/01/2021, the collection of penalties (fine, penalties) in case of untimely and (or) not paid in full amount is suspended payments for housing and utilities.)

Thus, the accrual of penalties in this case is carried out from 03/17/2020 to 04/05/2020 and then the accrual is suspended from 04/06/2020 to 01/01/2021.

In the operative part of the decision of the Arbitration Court of the Vologda Region dated April 21, 2020 in case No. A13-1686/2020, the court stated in more detail about the moratorium period:

Collect from <…> 14,064 rubles. 73 kopecks penalties for late fulfillment of a monetary obligation in the period from September to December 2019, calculated for the period from 10/22/2019 to 04/06/2020, as well as 7,038 rubles. to reimburse the costs of paying the state duty.

In case of failure to pay the debt by 01/01/2021, a penalty will be charged from the amount not paid on time in the amount of 187,824 rubles. 58 kopecks from 01/01/2021 to the day of actual payment of the debt.

In this decision, the court clearly stated that if the debtor does not pay the principal amount before 01/01/2021, then the accrual of penalties after this date will continue until the actual payment.

There are also judicial acts in which the court’s position regarding the application of Resolution No. 424 is not clearly defined, but the claims are satisfied in full. So, for example, in the operative part of the decision of the Arbitration Court of the Khabarovsk Territory dated April 17, 2020 in case No. A73-2440/2020, the court stated the following:

Collect <…> penalties in accordance with clause 6.4 of Article 13 of the Federal Law of December 7, 2011 No. 416-FZ “On Water Supply and Sanitation” for the period from March 18, 2020 to the day of actual payment of the debt amount in the amount of 713,697 rubles. 24 kopecks (taking into account the Decree of the Government of the Russian Federation dated 04/02/2020 N 424 “On the specifics of providing utility services to owners and users of premises in apartment buildings and residential buildings”).

How the said judicial act will be executed will become known only at the stage of enforcement proceedings.

Arbitration courts make decisions containing similar conclusions every day. The courts believe that the provisions of Resolution No. 424 apply to the collection of penalties (fines, penalties) only for obligations that arose during the period from 04/06/2020 to 01/01/2021, while resource supply organizations have the right to bring claims for the collection of penalties for periods of delay in fulfilling obligations, arising from 04/06/2020 not earlier than the date indicated in the Resolution - 01/01/2021.

Within the framework of writ proceedings provided for in Chapter 29.1 of the Arbitration Procedure Code of the Russian Federation, things are more complicated. And here the courts take a different position, returning applications for a court order if the application contains a requirement to collect a penalty for any period.

For example, in the ruling of the Arbitration Court of the Perm Territory dated 04/22/2020 in case No. A50-7940/2020, the court concluded that if, after 04/06/2020, the debtor filed an application with the court for a court order, in which, in addition to the demand for debt collection contains a demand for the collection of a penalty, the collection of which has been suspended, the court returns such a statement to the collector.

And in the ruling of the Arbitration Court of the Kurgan Region dated April 15, 2020 in case No. A34-3208/2020, the court came to the conclusion that there was a dispute about the law, in accordance with the adopted Resolution No. 424, and also refused to accept the application for the issuance of a court order.

In conclusion, we can conclude that due to the lack of clarification, each party - a participant in legal relations - will interpret the law in its own favor. So far, the prevailing opinion is that the provisions of Resolution No. 424 apply specifically to the demand (collection) of penalties (fines, penalties) only for obligations arising in the period from 04/06/2020 to 01/01/2021. At the same time, there is no clear understanding whether resource supplying and management organizations have the right to continue accrual and subsequently (after 01/01/2021) demand a penalty for moratorium periods, since after this period the ban on its collection in court is lifted.

Update: On April 30, 2021, the Presidium of the Supreme Court of the Russian Federation approved “Review No. 2 on certain issues of judicial practice related to the application of legislation and measures to counter the spread of the new coronavirus infection (COVID-19) in the Russian Federation ,” paragraph 7 of which explains , for which periods of delay in 2021 a penalty is not subject to accrual.

The Presidium indicated that the said moratorium applies to penalties (penalties, fines) subject to accrual for the period of delay from April 6, 2021 to January 1, 2021, regardless of the billing period (month) for the supply of a utility resource (provision of utility services), payment for which there is a delay, including if the amount of the principal debt was formed before April 6, 2021, unless a different deadline for the end of the moratorium is established by law or legal act.

If the decision to collect the corresponding penalty is made by the court before January 1, 2021 (or, if changes are made, another end date of the moratorium on the collection of penalties), then in the operative part of the decision the court indicates the amount of the penalty calculated for the period until April 6, 2021. B The court rejects part of the claims for the collection of a penalty until the actual fulfillment of the obligation on the basis of Article 10 of Law No. 98-FZ, paragraphs 3-5 of Resolution No. 424, as filed prematurely. At the same time, the court explains to the applicant the right to make such a claim in relation to the days of delay that will occur after the end of the moratorium.

How to calculate interest on arrears: step-by-step instructions

Let's say you received a notice from the regional Federal Financial Markets Fund about accrued interest for violating the procedure for paying contributions for major repairs. In order to verify the legality of the accrued amounts, you can independently calculate the amount of the penalty. To carry out the calculation, proceed according to the algorithm:

- Check the due date for payment of fees in your region. To do this, contact your regional FKR.

- Determine the date of actual payment of contributions for the period. You can obtain this information in payment documents (date of bank statement, payment order, receipt).

- Calculate the number of days overdue. The first day will be the day following the established payment deadline, the last day will be the date of the actual transfer of funds.

- Determine the amount of arrears. If you paid the fee late, the entire amount of the fee is considered arrears. If the payment of the contribution is made on time, but not in full, then the amount of the underpayment is recognized as arrears.

- Find out the Central Bank refinancing rate on the date of receipt of the notification. You can obtain this information on the Central Bank website.

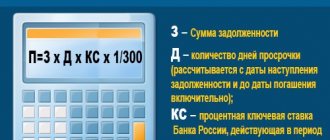

- Calculate the amount of interest (penalty) using the formula:

P = Week * StRef / 300

Compare the result obtained with the indicator specified in the received notification. If the amount in the notification does not correspond to the calculated amount, contact the regional Federal Financial Markets Fund for clarification.

Example No. 1. Resident of Ryazan Nalimov K.D. is the owner of an apartment with a total area of 52 sq. m. The contribution rate for major repairs for Nalimov is 6 rubles/sq.m. m. Thus, the amount of monthly payment for Nalimov is 312 rubles. (52 sq. m. * 6 rub.). Nalimov is obliged to pay fees by the 10th of the next month.

Nalimov made payment of fees for September and October 2021 on 12/18/16. Due to violation of payment deadlines, Nalimov was accrued interest on contributions (penalty). The amount of the penalty and its calculation is shown in the table below:

| Period | Payment deadline | Date of actual payment | Number of days overdue | Amount of arrears | Calculation of interest (penalties) | Amount of interest (penalty) |

| September 2016 | 10.10.16 | 18.12.16 | 69 days | 312 rub. | 312 rub. * 69 days * 10% / 300 | 7.18 rub. |

| October 2016 | 10.11.16 | 18.12.16 | 38 days | 624 rub. | 624 rub. * 38 days * 10% / 300 | 7.90 rub. |

| TOTAL | 15.08 rub. | |||||

Is it possible to pay only the amount of debt for major repairs without penalties?

Is it possible to pay only the amount of the debt without penalty? Those. Will I be able to contact them in writing (none of the phone numbers listed on their website answer - I was unable to clarify this issue) to “write off” the amount of the penalty by paying only the principal debt?

Is it possible to pay only the amount of the debt without penalty? Those. Will I be able to contact them in writing (none of the phone numbers listed on their website answer - I was unable to clarify this issue) to “write off” the amount of the penalty by paying only the principal debt?

Is it possible not to pay fees and penalties: judicial practice

The topic of calculating contributions for major repairs and collecting interest from defaulters causes a lot of controversy and disagreement. Opponents of paying contributions explain their position with the following arguments:

- Russian legislation does not provide for payment for utility services that are not considered completed;

- The collection of contributions for major repairs and the accrual of penalties for defaulters are not prescribed in the Tax Code of the Russian Federation.

Adherents of this position refuse to pay contributions on the basis of the lack of cost estimates and a certificate of completion of work.

In 2021, State Duma deputies appealed to the Constitutional Court demanding confirmation of the legality of fees for major repairs. In April 2016, the Constitutional Court approved the validity of contributions to the Overhaul Fund. At the same time, the court made the following clarification: home owners can independently undertake obligations to raise funds for major repairs and their implementation.

If residents have not accepted the appropriate obligations within the prescribed period, the right to collect contributions rests with the local municipality. In a situation where the regional operator of the Fund collects contributions without the consent of residents, the owners have the right to go to court. That is, if there is an appropriate court decision, residents have the right to refuse contributions to the FKR and collect funds independently. However, judicial practice in recent years shows that it will take you at least a year to withdraw from the Fund.

Thus, taking into account the decision of the Constitutional Court, we can conclude: the homeowner does not have the right to completely refuse to pay contributions and penalties to the FKR. When filing a claim against a defaulter, the court will in any case side with the plaintiff.

The Transbaikalia Overhaul Fund will write off penalties for everyone who paid the debt from October 1 to December 31

A comment will be rejected if it contains calls for breaking laws, overthrowing government, revolution, mass unrest, violating the territorial integrity of the state, inciting national hatred, contains signs of religious or linguistic superiority, contains personal data or may damage business reputation.

I went to this almshouse and asked when the renovation of our house was planned. We barely found it. They said in 22, on the condition that 50% of the amount would be collected. If not, then the repairs will be postponed indefinitely. Pay and wait for the weather from the sea, naive people.

Are penalties for major repairs legal in 2019?

The mechanism for calculating rent has already become more or less clear to ordinary people, as well as control over the funds transferred to the management company’s account. But capital contributions, expressed in considerable amounts, are not familiar to every co-owner of the Moscow Railway. According to the law, accumulated funds can be spent on the following types of work:

- Complete replacement of the roof or its main parts (beams, rafters, mauerlats).

- Repair of the facade of the Moscow Railway.

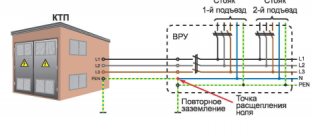

- Replacement of utilities related to general building systems.

- Installation of resource metering devices at home.

- VPR of entrances.

- Replacement of elevator equipment and any in-house engineering.

The list is not exhaustive and can be supplemented with other nominations depending on the need and will of the residents of the house.

In practice, only a few wait for capital work to be completed, and in most cases, the quality of the services provided does not correspond to the funds spent. According to the law, representatives of the management company, the regional representative of the FKR and the initiative group of residents must monitor the implementation of actions. As a rule, co-owners do not have access to decisions on major repairs, and what is ultimately issued for the work performed makes people wonder whether it is worth making these deductions at all.

A penalty will be charged for late payment for major repairs.

Ignoring submitted payments leads to the fact that each subsequent receipt will arrive with a higher total figure. It consists of debt and accrued penalties. These special additional charges are called penalties. Based on the approach to the implementation of capital repairs in many regions, the question arises whether people have the right to charge penalties for capital repairs.

According to the legislation, namely the Housing Code of the Russian Federation, the imposition of sanctions is enshrined in Article 155 of this standard and has no exceptions to the mechanism of its implementation. Also, in any other legislative act there are no measures that would protect citizens from these exactions, which, in fact, do not bring practical benefit to residents. Perhaps a decision will be made at the state level that there are precedents when penalties for major repairs are illegal.

Attention! To minimize the risks of non-payment of fees on time, many banks offer, which at a set time debits a fixed amount of money and transfers it to a specified account. Sberbank offers such a service.