0

Posted by: Moscow Lawyers Construction, investments, repairs, redevelopment, demolition 12/02/2019

All owners must pay contributions for major repairs! This has already been proven, and there is no point in arguing. But the fact that you have to pay for all previous owners from the moment the new building is put into operation is, of course, amazing news for everyone...

By the end of July, most happy homeowners are expecting “chain letters” from the Federal Tax Service with the calculation of property taxes. This year, many owners of new buildings for the first time were doubly happy: the Capital Repair Fund (hereinafter referred to as the Fund) also issued bills to them.

Let us remind you that there are two ways to collect contributions: to the account of a regional operator or to a special account. The method is chosen by the owners at a general meeting (Article 170 of the Housing Code of the Russian Federation (hereinafter referred to as the Housing Code of the Russian Federation)).

In the vast majority of cases, contributions are collected by the regional operator, whose legal status is regulated by Art. 178 Housing Code of the Russian Federation. To avoid confusion, the Fund will be identified as the fundraiser.

Everything would be fine with the new accounts if it were not for the exorbitant amounts of contributions in the amount of several thousand rubles. At the same time, the current payment itself is small, but the main amount of the required payment is... DEBT!

The investigation with representatives of the Foundation reveals something surprising. It turns out that only this year Rosreestr transferred information on real estate to the Overhaul Fund, which took and accrued contributions for the entire period from the moment it was included in the overhaul program (sometimes the Fund is disingenuous, issuing charges from the moment the house was put into operation, and not included in the program) .

“Where does the debt come from?” asks the “happy” owner of the new building. “After all, the Overhaul Fund (hereinafter referred to as the Fund) has never made any payments! I didn’t open any personal accounts! And in general, it seems, according to the law, for the first five years after the house is put into operation, contributions for major repairs are not charged...”

Moreover, many of the owners are not the original owners of the new building, but bought apartments on the secondary market. This is quite common. At first, those who participated in the DDU registered the commissioned real estate for themselves, and then sold it. That is, this is rightfully considered to be housing purchased on the secondary market. And even recognizing the debt that suddenly arose all at once and in a large amount, such owners, of course, refuse to pay for the previous owners of the apartment. And they think they are right.

Surprisingly, according to the law, the new owner... inherits the debts for major repairs. It is also noteworthy that Rosreestr’s transfer of data on new buildings to the Fund with a “delay” of several years does not in any way protect the interests of the current (today’s) owner.

But let's look at the issue in more detail.

WHO SHOULD PAY CONTRIBUTIONS FOR OVERHAUL REPAIRS?

1. The owner of premises in an apartment building is obliged to bear the costs of maintaining the premises belonging to him, as well as to participate in the costs of maintaining common property in an apartment building in proportion to his share in the right of common ownership of this property by paying fees for the maintenance of residential premises, contributions for major repairs (Part 1 of Article 158 of the Housing Code of the Russian Federation).

On the legality of this requirement, see Resolution of the Constitutional Court of the Russian Federation dated January 29, 2018 N 5-P.

Owners of premises in an apartment building are required to pay monthly contributions for major repairs of common property in an apartment building (Part 1 of Article 169 of the Housing Code of the Russian Federation).

Exceptions are expressly listed in the law. Exempt from paying contributions for major repairs:

- owners of housing in a house recognized in accordance with the procedure established by the Government of the Russian Federation as unsafe and subject to demolition;

- owners of premises in a house located on a land plot in respect of which an executive body of state power or a local government body has made a decision to confiscate for state or municipal needs the land plot on which this apartment building is located, and to confiscate each residential premises in this apartment building ;

- if the owners have already paid and “accumulated” the minimum amount of the capital repair fund and made a decision at the general meeting to suspend the obligation to pay contributions for capital repairs, with the exception of owners who are in arrears in paying these contributions (Part 8 of Article 170 of the Housing Code of the Russian Federation ).

- if the repair (including partially) was carried out earlier than the deadline established by the regional program, and contributions are offset against future periods in the manner prescribed by Part 5 of Art. 181 Housing Code of the Russian Federation.

Major repairs in buildings built less than five years ago

There is a common misconception that if the house is new, then it is too early to think about repairs. However, the phenomenon of wear and tear must be taken into account. And this indicator depends on the type of structures and building materials. For example, the service life of an elevator is 25 years. Even if after this period the structure continues to function properly, it still needs to be thoroughly diagnosed by replacing worn parts.

The service life of facade cladding, cold and hot water supply systems is 10-15 years. If we are talking about a seam or soft roof with a bitumen layer, then such a covering must be changed every 5 years.

Thus, after 15-20 years, most of the building’s structures will become unusable. And to replace all worn out parts, a considerable amount will be required. That's why owners start saving money in advance. If the tenant refuses to pay the contribution, he violates the provisions of Article 168 of the Housing Code of the Russian Federation.

WHAT IS THE SIZE OF THE FEE? HOW IS IT INSTALLED?

The contribution must be paid either in the minimum amount or in an amount greater than the minimum. The second option is applicable to cases when the corresponding decision is made by the general meeting of owners of premises in an apartment building (Part 8.1 of Article 156 of the Housing Code of the Russian Federation).

In other cases (and they are the majority, since Part 7 of Article 170 of the Housing Code of the Russian Federation is most often implemented), contributions are paid in the minimum amount. The minimum amount of contribution for major repairs is established by the regulatory legal act of the constituent entity of the Russian Federation.

Currently, to calculate the minimum contribution, the Methodological Recommendations for Establishing the Minimum Amount of Contribution for Major Repairs, approved. By Order of the Ministry of Construction of Russia dated June 27, 2016 N 454/pr.

Many factors are taken into account to determine the minimum contribution amount. And when calculated for each owner, the amount of this contribution is calculated based on the occupied total area of the premises in an apartment building, owned by the owner of such premises.

In fact, the amount of the contribution is set per square meter of the apartment and multiplied by the number of square meters of a particular apartment.

Calculation example:

The amount of the contribution for major repairs is set in the region in the amount of 6.23 rubles/1 sq. m.

The area of the apartment is 70 sq. m. m.

6.23 x 70 = 436 rub.

In total, the owner of a 70-meter apartment will have to pay a monthly contribution to the Overhaul Fund in the amount of 436 rubles per month.

If there are several owners of one apartment (for example, shared ownership of an apartment purchased using maternity capital funds), then contributions for major repairs are distributed according to the number of square meters owned by each family member. Accordingly, to record the contributions paid for major repairs, the Fund opens a personal account for each co-owner.

Please note that according to Part 2.1 of Art. 169 of the Housing Code of the Russian Federation, the law of a subject of the Russian Federation may provide for the provision of compensation for the costs of paying a contribution for major repairs. That is, in some regions, certain categories of owners (most often low-income) can count on compensation. Unless, of course, it is provided for by regional law.

Conclusions and useful video

Families who do not own real estate and residents of dilapidated houses may not pay for future work to restore the house to its previous condition. The acquisition of treasured square meters in a recently erected building does not relieve the need to form a fund.

More detailed information can be found in the following video.

The addition of the concept of “new building” to housing legislation did not protect owners from the obligation to pay receipts for major repairs, but allowed them to count on receiving a deferment after approval of the application by the housing inspectorate.

The developer's warranty obligations to eliminate all deficiencies identified within 5 years from the date of putting the residential building into operation should not be taken as an exemption from paying for major repairs. Dues are part of your housing payments, so ignoring receipts and deadlines can make matters worse. Citizens belonging to one of the preferential categories can apply to the MFC for compensation.

INHERITANCE OF DEBT IS MANDATORY AT THE LEGISLATIVE LEVEL!

According to the same norm - Part 3 of Art. 158 of the Housing Code of the Russian Federation - “... when the ownership of premises in an apartment building is transferred to the new owner, the obligation of the previous owner to pay for the costs of major repairs of common property in the apartment building, including the obligation not fulfilled by the previous owner to pay contributions for major repairs, for with the exception of such an obligation not fulfilled by the Russian Federation, a subject of the Russian Federation or a municipal entity that is the previous owner of the premises in an apartment building..."

That is, it is legally established that debts of owners for major repairs, contrary to the common practice of the emergence of rights and obligations, are “inherited” by law.

It is noteworthy that the Housing Code of the Russian Federation in the original edition of December 29, 2004 N 188-FZ did not contain a direct provision on such an inheritance, but only spoke about the transfer, along with the right of ownership, of the obligation to pay contributions for major repairs. Which, in general, only meant the automatic occurrence of an obligation to pay contributions. But not the inheritance of debts on them.

However, this norm was supplemented by the phrase about “inheritance” by Federal Law No. 271-FZ of December 25, 2012 on the transition “... including the obligation not fulfilled by the previous owner to pay contributions for major repairs.”

It is obvious that with the purchase of an apartment, the owner becomes obligated to pay for housing and communal services, housing maintenance fees, and taxes from the moment of registration of the transfer of ownership. Why did the legislator make such a dizzying exception regarding contributions for major repairs?

Obviously, to facilitate the possibility of collecting it? For unconditional replenishment of accounts of regional operators? And it doesn’t matter that such a provision directly contradicts the Civil Code of the Russian Federation, the Housing Code of the Russian Federation and generally accepted norms.

The obligation to pay the debts of the previous owner has been adopted and fixed at the legislative level! I'm glad that so far only for contributions for major repairs. Bye…

How to pay for major repairs in a new building

At least three months before the start of fundraising, apartment owners at a general meeting must determine the method of forming the fund. The following organizational issues are also resolved:

- fund size;

- amount of contributions;

- list of secondary and priority works.

Each subject of the Russian Federation sets a minimum tariff. For example, in Moscow it is about 20 rubles per m2, and in Yekaterinburg it is half as much. Owners have the right to increase the amount of monthly payments if they are saving for a certain type of work.

SO IS THERE A 5-YEAR DELAY ON CONTRIBUTIONS OR NOT?

Despite the “revelation” of the amazing fact of inheritance regarding the payment of contributions, the would-be owners still have hope that, perhaps, they do not owe for the entire period of the apartment’s existence.

According to Part 3 of Art. 169 of the Housing Code of the Russian Federation, the obligation to pay contributions for major repairs arises for the owners of premises in an apartment building after the expiration of the period established by the law of the constituent entity of the Russian Federation, which is at least three and no more than eight calendar months, starting from the month following the month in which the approved document was officially published regional capital repair program, which includes this apartment building, with the exception of the case established by Part 5.1 of Art. 170 Housing Code of the Russian Federation.

And according to Part 5.1 of Art. 170 of the Housing Code of the Russian Federation, the obligation to pay contributions for major repairs from the owners of premises in an apartment building put into operation after the approval of the regional capital repair program and included in the regional capital repair program when it is updated arises after the expiration of the period established by the state authority of the constituent entity of the Russian Federation, but no later than within five years from the date of inclusion of this apartment building in the regional capital repair program. The decision to determine the method of forming a capital repair fund must be made and implemented by the owners of premises in a given apartment building no later than three months before the obligation to pay contributions for capital repairs arises.

In fact, citizens do not quite correctly understand this norm.

In theory, it talks about pretrial periods during which the government authority of a constituent entity of the Russian Federation may not collect contributions for major repairs from owners of apartments in new buildings, securing this deferment period at the legislative level.

However, there can be no question of any MANDATORY deferment.

Considering that regional authorities more often only use the right to tighten or increase, almost no one uses the above-mentioned right to a five-year deferment of exemption from contributions. Why, if you can start replenishing your account with a regional operator almost immediately as soon as the house is handed over? On the contrary, modern houses are trying to be included in the regional capital repair program as quickly as possible in order to collect contributions as early as possible, providing a “deferment” of no more than 3 months.

The situation is typical: theoretically, a benefit or benefit can be given. But in fact there are none.

Taking into account the established part 5 of Art. 168 of the Housing Code of the Russian Federation, the timing of updating regional capital repair programs (at least once a year) in most cases, all newly commissioned houses for the current year are included in the regional program at the end of the same year.

Thus, owners of new buildings almost immediately begin to be charged fees for major repairs after the house is completed, without providing any five-year exemption period from paying these fees. This is not in the interests of either the regional operator or the authorities. After all, during the period of such a “deferment” you can collect decent amounts from each new home!

Calculation example.

The building has 180 apartments. Each 70 sq. m (the data is taken uniform solely to simplify the calculations). The contribution amount is 6.23 rubles per 1 sq. m.

In total, a fee of 436 rubles is charged per month for 1 apartment. (RUB 6.23 x 70 sq. m).

For 180 apartments per month, 78,480 rubles are charged (436 rubles x 180 units).

5 years = 60 months.

Over 5 years (60 months) the entire house will pay 4,708,800 rubles to the Fund. (four million seven hundred eight thousand eight hundred rubles)!

RUB 26,160 each. from every apartment!

Why deprive the Fund of such a sum?

Which houses are considered new buildings

An apartment building can be called a new building if the document allowing the use of the premises was signed later than July 1, 2021. The construction contractor provides the owners with a 5-year warranty. If any breakdown occurs, defects made during construction appear, the elevator or communication system fails, the developer will eliminate the problem against the warranty.

Important: at least 3 months before the obligation to pay receipts occurs, apartment owners must decide at a meeting in which account the funds will be accumulated. If residents transfer more than is established in the regulatory act, then the difference can be used to pay for work not specified in the federal standard.

The house is under the guarantee of a construction company, and the need to make savings in case of serious damage or to restore the structure is not a common concept. Under certain circumstances, the Housing Code exempts from paying for major repairs or provides compensation. Owners of square meters in high-rise buildings are required to pay fees if the house is included in the regional program. The deferral of charging the fee differs in the regions, since the condition is set by the administration.

WHAT IF ROSRESTR IS STRONGLY LATE WITH DATA TRANSMISSION?

Fortunately, the owner does not have to calculate the amount of the contribution on his own. Yes, he cannot actually pay it until the Fund issues him the appropriate payment document (or the contribution amount is not included in the general bill for housing and communal services) - depending on the chosen method of forming the capital repair fund.

In the case of the formation of a capital repair fund on the account of a regional operator (and this scenario is the most popular), the owners of residential premises in an apartment building pay contributions for major repairs on the basis of payment documents submitted by the regional operator, within the deadlines established for payment for residential premises and utilities , unless otherwise established by the law of the subject of the Russian Federation (Part 1 of Article 171 of the RF Housing Code).

A similar payment procedure is established for cases of forming a capital repair fund in a special account (Part 2 of Article 171 of the Housing Code of the Russian Federation).

But, unfortunately, the Fund can calculate and charge contributions only on the basis of data not only on houses commissioned, but also on the basis of data from specific owners and the size of the area of their apartments. And Rosreestr, which is obliged to transmit this data, unfortunately, transmits it with a delay of... several years!

Thus, it is quite common for Rosreestr to transfer data to the Fund only in the middle of 2019 for houses commissioned at the end of 2014 and included in the regional overhaul program at the end of 2015!

The fund, accordingly, immediately accrues contributions both for the current month and for previous periods.

It is noteworthy that the law does not contain any reservations regarding the fact that contributions are not accrued for the previous period from the moment the house is included in the capital repair program until the Fund receives information for the correct calculation of contributions for capital repairs.

And therefore a paradox arises: the owner at the current moment in time for the first time receives a payment document confirming the payment of contributions for major repairs of an apartment in a newly built building with the already indicated amount of debt for all previous years! Accordingly, the amount of debt turns out to be quite impressive.

Calculation example.

The contribution amount for a 70-meter apartment is 436 rubles. per month.

For the year it turns out to be 5,232 rubles.

However, the Fund retroactively accrued contributions for the three previous years, presenting a “sudden” debt in the amount of 15,696 rubles.

Total due for payment: 436 rubles. (current contribution) + 15,696 rub. = 16,132 rub.

And the owner will have to pay this entire amount at once, along with payments for housing and communal services. Otherwise, he may begin to accrue penalties.

Neither Rosreestr nor the Fund bears any liability to the owner for such late accruals.

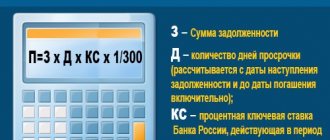

On the contrary, the owner has the responsibility to make timely contributions. Based on the established payment deadlines, the owner must pay the entire amount (the current contribution and the “suddenly” arising debt) within the deadlines established for paying for residential premises and utilities. If the payment of contributions is late, the owner will be subject to a penalty (Parts 2 and 4 of Article 181, Part 14.1 of Article 155 of the Housing Code of the Russian Federation). And, again, the law does not offer any concessions or installment plans in a situation of “sudden” formation of debt on contributions.

By the way, the Fund has the right to submit a payment document containing a calculation of the amount of contribution for major repairs for the upcoming calendar year, once during the first billing period of such year. The owner of non-residential premises has the right to pay such a payment document at a time in the month following the month in which it is presented, or in monthly equal installments during the calendar year within the time limits established for payment for residential premises and utilities, unless otherwise established by the law of the constituent entity of the Russian Federation (Part 3 of Article 171 of the RF Housing Code).

When do they start asking owners to pay for major repairs?

Here a lot depends on the region of residence. If the delay is a year, then it is 12 months after the facility is put into operation that residents will have to collect money. However, in this case, you need to take into account the warranty period from the developer.

For example, a construction company commissioned a house, establishing a 5-year warranty period. And if during this time a third-party company interferes with engineering systems or building structures, then the warranty is simply void. In this case, apartment owners have the right to write a request for a deferment. It doesn’t matter whether it is installed in the region or not.

The corresponding decision is made during the general meeting of residents. Then a collective statement is written, which must be sent to the regional administration. In this document, owners must indicate the reason for the delay.

Next, the housing commission must assess the condition of the house and make a final decision. If the application is rejected, you will have to pay.

The opportunity to receive a deferment is present only if the house was put into operation less than 5 years ago. Residents of older high-rise buildings cannot take advantage of this opportunity, even if the warranty period from the developer is 10 years, and the building is in excellent technical condition.

WHAT ABOUT THE LIMITATION TERMS?

Lawyers and those who have ever dealt with lawsuits will immediately come up with a brilliant idea about the statute of limitations.

What if you pay only part of this sudden debt? Or, for example, only for the period when you yourself are the owner of the apartment? And don’t pay for the previous owner! After all, while the point is, the statute of limitations for previous periods will pass, which in the event of a legal dispute can be declared in court!

Let us recall that the general limitation period is three years (clause 1 of Article 196 of the Civil Code of the Russian Federation).

However, it begins to flow from the day determined in accordance with Art. 200 of the Civil Code of the Russian Federation, that is, “... from the day when the person learned or should have learned about the violation of his right and who is the proper defendant in the claim for the protection of this right.”

And since the Fund received data on an apartment in a new building with a delay of 3 years, the period for claims for payment of contributions accrued for previous periods of ownership by this or a previous owner begins from the day the relevant information was received.

This creates a paradoxical situation: the Fund is only now learning about the violation of its right to receive contributions; it can charge contributions for all earlier periods of the existence of an object included in the regional capital repair program.

At the same time, the owner’s application to apply the consequences of missing the limitation period will not be satisfied by the court, since this period has just begun to run from the moment the Fund received information on real estate from Rosreestr.

Privileges

Some categories of citizens may receive benefits or be completely exempt from paying contributions for major repairs. We are talking about the following persons:

- Chernobyl victims;

- disabled people of groups 1 and 2;

- rehabilitated victims of repression;

- large and low-income families;

- veterans of the Great Patriotic War;

- labor veterans;

- families raising a child with disabilities;

- people of retirement age (persons over 70 years of age receive a 50% discount, and those over 80 are exempt from payment).

Benefits do not imply complete exemption from paying contributions. In this case, the state covers part of the expenses for the person. Moreover, each region has its own rules in this regard.

How beneficiaries can receive compensation

To receive benefits, you must contact the local administration, the social protection department. The applicant must have the following documents with him:

- identification;

- disability certificate, pension certificate or other documents confirming the status of a beneficiary;

- certificate of family composition;

- payment receipt;

- certificate of absence of debts for housing and communal services.

When calculating benefits, the following restrictions are taken into account:

- there should be no more than 36 m2 of living space per person;

- per family – no more than 56 m2.

DEBT COLLECTION IS A QUICK AND HOPELESS PROCEDURE FOR THE DEBTOR...

Surprisingly, collecting dues for major repairs is quick and easy. The Fund collects debts in accordance with Art. 122 of the Code of Civil Procedure of the Russian Federation, receiving a court order. Let us remind you that a court order is issued if a demand is made for the collection of debts for payment of housing and utilities, as well as telephone services.

Of course, the dispute may then result in a real legal battle, considered through litigation, but the fact remains that the contributions will be collected from the owner.

But it is unlikely that it will be possible to collect paid debts on contributions from the previous owner. Due to the direct indication in the law of the rule of “inheritance” of debts, “including the part of the obligation not fulfilled by the previous owner to pay contributions for major repairs,” excludes for the present owner the hope of collecting debts from the previous owner in court. There will be no regression!

Current and major repairs

Receipts for housing and communal services may contain payment not only for major repairs, but also for current repairs of the building. The latter includes the following types of work:

- sanitation;

- preparation for the heating season;

- carrying out minor and cosmetic repairs (for example, painting walls in the entrance);

- emergency work;

- preventive maintenance of engineering systems;

- landscaping.

For example, a broken window in the entrance will be replaced as part of ongoing repairs. In turn, major repairs may involve replacing windows in all entrances of the house. Current repairs - replacing a broken step, major repairs - replacing the floor in the corridors. Thus, to ensure the normal functioning of all systems, both types of work are necessary.