When buying real estate, the transaction must be registered. Until recently, for this you had to stand in line at Rosreestr, and there, as a rule, the matter was not resolved in one day - they issued a coupon for a specific day. Now this procedure has been simplified and transaction registration can be done via the Internet. So far, this service is provided only by some banking organizations, but their number is steadily growing. But electronic registration of real estate transactions through Sberbank is available today.

The essence of electronic transaction registration

The initiator of this idea was Rosreestr. Now submitting an application has become much easier, and the terms for concluding a purchase and sale agreement have been significantly reduced. Today this service is in great demand among Sberbank clients. It is also used by other banking organizations, but Sberbank is the undisputed leader in this direction.

Rosreestr managers say that now, after filling out an application and submitting all the necessary documents, it will be possible to register a real estate transaction within 24 hours. But statements are statements, but in fact the procedure can take up to a month. Experts explain this by the “dullness” of the system.

What is the service for?

As the name suggests, this service provides security for settlements between parties to a contract when buying and selling real estate . Payment for the transaction takes place in cashless form.

In the first year of the Service’s operation, not all bank employees understood the nuances of the procedure, and therefore could not explain them to their clients. In addition, the deadlines for payment and verification of documents were delayed. But at the moment, in almost all Sberbank branches this service operates normally.

Why is electronic registration necessary?

Today, the tools for issuing mortgage loans are constantly being modernized. The mortgage business continues to improve its technical equipment. Electronic transaction became a natural extension of this process. Often transactions are carried out in different regions. For example, a family lives and works in the Far North, and their children enter educational institutions in Moscow or Novosibirsk. In this case, parents will have to incur considerable travel costs, but electronic registration solves this problem.

As a rule, a mortgage transaction also requires significant time investment. Even the increased Northern holiday will not be enough. In order to increase the mortgage portfolio at the expense of such clients, Rosreestr initiated the electronic registration procedure. Sberbank was one of the first to support this initiative, and this bank controls more than 50% of the entire mortgage market. It is this banking organization that invests huge amounts of money in Internet banking.

Now the debtor can carry out the transaction in his region. The client will have to come to the bank branch one day to record his consent to the transaction. After this, he can return home without worrying about the legal side of the issue, since the bank takes care of registration with the justice authorities. Thus, the client saves not only money, but also time that he would have to spend on confidentially processing the transaction. When implementing it, you do not need to go to a notary to make a power of attorney, but this action can be very difficult if a person needs to leave for some time.

What can you buy?

An interesting asset was found on the RAD site in St. Petersburg. This is a non-residential premises located either in the basement or in the basement of the building

. With an area of 51.5 sq.m. the cost of the object is 1.764 million rubles.

Probably suitable for some kind of business, but you will have to invest heavily in repairs and furnishings. But the photographs are high quality, and the description is comprehensive.

But “Portal DA” compares favorably with outdated competitors. Convenient interface, comfortable search, login using Sber ID. To register, you need to confirm your mobile phone number. How interesting are the offers?

Electronic registration of a transaction in Sberbank

Sberbank was among the first to decide to conduct mortgage loan transactions electronically. By the way, in addition to mortgage clients, this procedure is also carried out for other debtors. Sberbank willingly cooperated with Rosreestr and signed all the documents necessary for this.

This procedure is paid, and it costs from 7,900 to 10,900 rubles (depending on the type of housing and the region of registration of the transaction). But this price also includes the cost of state duty. For finished housing, the procedure for registering it will cost 8,000 rubles. After the transaction is certified by the owner in the Unified State Register of Real Estate, a corresponding entry will appear in Rosreestr. This procedure has its undoubted advantages, the main one of which is the absence of the need to stand in endless queues. The client will only have to wait until all the documents are provided to him by email.

The cost of the service includes the following:

- Payment of the state fee for registering the transfer of ownership.

- Issuance of an enhanced qualified signature for all parties to the transaction.

- Sending documents electronically to Rosreestr.

- Interaction with Rosreestr and registration support.

- Transaction support by a personal manager.

Stages of the transaction:

- The Bank manager or developer will send the documents to Rosreestr electronically.

- Rosreestr receives documents online and begins registration.

- The purchase and sale agreement and an extract from the Unified State Register with an electronic mark on state registration will be sent to your email.

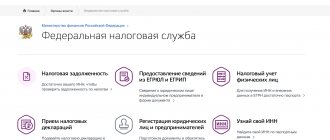

Important! The client will not have physical documentation in hand. All documentation will be submitted electronically. The validity of the agreement can be checked on the official website of Rosreestr. This can be done after registering on the company’s resource by visiting your personal area.

What are the processing times and costs for borrowers?

The processing time is far from the primary problem for borrowers who are more interested in the question of how much this option costs. Based on the information posted on the official website of Sberbank and the Dom Click service, the applicant will have to pay no less than 7,900 and no more than 10,900 rubles for electronic registration of a transaction.

The total amount will vary depending on the region of residence and the type of registered real estate. The same tariff includes the amount of the state duty, and the remainder of the total amount covers Sberbank’s expenses included in the maintenance of the service.

It might be interesting!

Is it possible to register in a mortgaged apartment and how to do it

What will you have to provide to the bank to register your application?

The following documents will have to be provided regardless of whether the apartment was purchased with a mortgage or with cash:

- real estate purchase and sale agreement (apartment)

- consent of a family member, if necessary;

- an application for a transaction completed on the website.

The above documents must be provided to the registrar in full. If at least one of them is missing, registration may be denied.

Who can use the service?

The service is provided to Russian citizens. Legal entities registered in the Russian Federation can act as sellers of real estate. Only direct transactions can be carried out through SBR without the participation of intermediaries. It is allowed to have no more than 2 recipients of funds under the agreement.

For mortgage lending, the SBR service can be provided when purchasing real estate under the “Ready Housing” and “Housing Under Construction” programs. Real estate objects can be apartments from the primary or secondary market, their shares, new garage spaces, commercial properties, rooms. If a transaction for the acquisition of land plots or plots with houses is carried out without borrowed funds from Sberbank, then it can also be carried out through SBR. For programs that provide special conditions for issuance, the SBR rules do not apply.

Conditions for submitting documents

In fact, there are few conditions, but they must be observed, because the applicant will receive title documents only if they fully comply. The list of necessary conditions and documentation is as follows:

- The real estate purchase and sale agreement is the main document.

- The transaction can only be carried out with an individual.

- If equity participation in the ownership of real estate is envisaged, contacting Rosreestr is a necessary condition.

- An application to Rosreestr will also be required if there are minor children in the family.

- Powers of attorney and similar documents are not considered.

- Military mortgage registration is not carried out.

- The agreement stipulates a certain number of persons participating in the procedure, usually 2 people. If the number of sellers or buyers is increased, the transaction will be refused.

Nominal account of the Sberbank Real Estate Center

Transactions for the purchase/sale of real estate passing through the central nervous system are carried out using a nominal account. The nature of the NS makes it possible for one person to open it and another person to receive the money.

The parties to the SBR are:

- The buyer is the account holder. He signs an order to transfer money to the seller after registering the transaction with Rosreestr;

- The seller is the beneficiary;

- Sberbank - money is stored in its account, it controls the process of registering a transaction.

Carrying out the procedure

Already at the very beginning of the procedure, you should indicate to the manager that the entire procedure will be completed electronically. Then the debtor will have to pay for the procedure, after which a specific date for the transaction will be set. Then the bank manager will send all the documents provided by the client to Rosreestr via a secure channel. Further, the transaction will be carried out or it will be refused - this depends on the quality of the information provided by the client. After this, the documents will be sent to the applicant’s email, and he will become the rightful owner of the declared property.

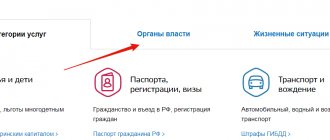

Important! If you have any doubts regarding the transaction being carried out, the authenticity of the signature can be checked on the State Services portal.

Carrying out the procedure for processing documents via the Internet does not mean that the client will not be able to receive all documents in physical form. Electronic documents are fully capable of confirming the right to own real estate. By the way, when the client receives all the documents necessary to own real estate, he no longer needs to have them notarized.

This service was developed by Sberbank to relieve clients from the need to perform additional steps that lead to a waste of personal time. The maximum period for its implementation is 5 working days. During this time, bank managers must process all documents provided by the applicant. The bank manager may refuse the applicant on the basis of the lack of certain documents, but he is obliged to provide a justification for the refusal.

Disadvantages of electronic registration

The main disadvantages of this system include the fact that only citizens of the Russian Federation can use it. Without Russian citizenship, the transaction cannot be carried out. And with electronic registration, the rate increases by 10%. Only adult citizens can participate in the event. Disabled people cannot participate in the event.

Another disadvantage of electronic registration is its price. It can reach up to 10,000 rubles; of course, it all depends on the region in which the applicant lives.

Is there a benefit and how to track the procedure?

Of course, there is a benefit, because when carrying out this procedure there is no need to visit the office of the credit company, everything is done remotely. And here there is no need to prepare the necessary documents; in the case of electronic registration, this will be handled by the managers of the credit company.

After reviewing the contract, all necessary documentation about it will be sent to the applicant’s email. This service is available not only to “mortgage holders,” but also to those who purchased housing under some other program or simply for cash. All clients have access to the service of a manager who will provide comprehensive information on any issue. Managers can be contacted either by e-mail or by telephone, which are mandatory indicated on the websites of credit institutions.

FAQ

Users have a lot of questions related to the use of SBR. Here are the answers to the most popular ones.

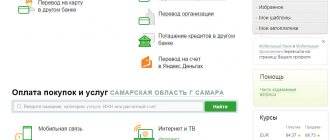

How to view TS in Sberbank Online?

The account number is indicated in the service agreement; if necessary, information can be obtained from bank employees.

The functionality of the Sberbank online personal account does not provide the ability to provide information about the nominal account number. This is due to the lack of need and possibility of performing transactions via the Internet.

How to withdraw money from my account?

Money can be withdrawn from the account only if both parties change their minds about entering into a transaction. In this case, the contract for the provision of SRB services is terminated and the money is transferred to the buyer.

If it is not possible to provide an agreement on termination of the contract signed by the buyer and the seller, it is necessary to provide written confirmation of the fact that the parties to the transaction did not sign the Agreement.

The period for returning funds to the buyer will be 10 working days.

How much does it cost to open an account for a buyer or seller?

The cost of the service is on average 2900 rubles. It is paid according to an agreement between the seller and the buyer. The exact cost depends on the region where it is carried out and the parameters of the transaction. You can find out the cost of opening an account from the SBR manager.

The bank does not charge any further commissions.

How is it different from a safe deposit box?

Using a safe deposit box involves concluding a tripartite agreement between the seller, buyer and bank. In this case, both the seller and the buyer must be present when depositing funds. The issuance of funds is possible only after receiving documents on the transfer of ownership. The cost of an individual bank safe starts from 75 rubles. per day, for a period of up to 30 days. In addition, more than 2,000 rubles will be charged. for access control.

Distinctive features of using SBR are:

- Application of non-cash payments. The buyer will not need to withdraw cash from the account to deposit it into a safe deposit box and pay an additional commission for this.

- The service independently requests Rosreestr to complete the registration procedure.

Who pays

When deciding on payment for services, you need to keep in mind that there are two concepts - state registration of a purchase and sale agreement and state registration of a mortgage (transfer of purchased housing as collateral to the bank). When an object purchased on credit is registered, the bank includes in the cost of its services a state duty in the amount of 1000 rubles in accordance with the Tax Code of the Russian Federation.

Important: Payment for the Savings Bank online registration service is made by the mortgagor (borrower).

The applicant has the right to agree with the person selling the apartment to divide the amount to be paid in half. But, as a rule, the seller does not agree, and the entire burden falls on the buyer. This is due to the fact that the service is important to the borrower, since as a result he receives a reduction in the interest rate. The seller has no benefit in this situation.

Reference: When the parties to the purchase and sale agreement apply to the bank for electronic state registration without borrowed capital, the parties themselves must agree on the terms of payment. For a credit institution, it does not matter who pays for the service. The main thing is that it is paid in full and on time.

Advantages and disadvantages

The considered option of conducting state registration of the transfer of property rights from one person to another, like all other methods, has advantages and disadvantages. The advantages include:

- the ability to register a transaction remotely (outside the locality where the property is located). In the usual format, state registration is carried out at the location of the apartment when the parties personally contact the registration authority. This method is not always convenient, especially if the buyer lives in another city;

- convenience of submitting an application and related documentation due to longer working hours at Sberbank branches compared to registration institutions;

- the parties resolve several issues during one visit to the banking department - conduct a transaction, make payments and submit documents for state registration;

- no need to visit the registration office. Banking specialists will send all necessary scanned copies of documents through their own communication channels. In this case, clients save significant time;

- the service can be used not only by mortgage borrowers, but also by citizens who decide to purchase housing without borrowing capital;

- no need to pay a separate fee. The amount is included in the total cost of the banking service;

- each client receives a personal manager who will provide consultation on any issue and fully support state registration;

- reduction in mortgage rates by 0.1%.