Benefit amount

Until today, the benefit was assigned in the amount of 50% of the regional subsistence minimum per child.

This year, if, when paying this benefit, the average per capita family income does not reach the regional subsistence level, then the benefit will be assigned in the amount of 75% of the subsistence minimum.

If, with an increase in the payment, the average per capita income in the family does not rise to the level of the subsistence minimum, then the benefit will be assigned in the amount of 100% of the subsistence minimum.

How to account for bonuses and rewards?

When determining average earnings, bonuses and rewards actually accrued for the billing period, take into account the following:

- monthly bonuses and rewards - no more than one payment for the same indicators for each month of the billing period;

- bonuses and remunerations for a period of work exceeding one month - no more than one payment for the same indicators in the amount of the monthly part for each month of the billing period;

- remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the previous calendar year - in the amount of one twelfth for each month of the billing period, regardless of the time the remuneration was accrued.

For whom benefits will become more accessible?

It was decided to take into account the needs of students when calculating.

If the eldest child under the age of 23 (unmarried) is a full-time student, he will be taken into account as part of the family when calculating average per capita income. As part of the family, when assessing need, children under guardianship will be taken into account, that is, families will be able to receive benefits for children under guardianship.

It was also decided not to take into account the compensation payment in the amount of 10 thousand rubles, which parents caring for children with disabilities receive as income. That is, it will not be included in the parents’ income. This decision will make payments for children from 3 to 7 years of age more accessible to families raising a disabled child.

What income is taken into account?

To calculate need, social security authorities use information about the income received by the family for the year preceding 4 months before the payment is assigned.

That is, if a family applies in April 2021, then its income will be assessed from December 2021 to November 2021 inclusive. When assigning payments, the following income for this period is taken into account:

- income from labor or creative activity (wages, royalties, payments under civil contracts)

- income from business activities, including income of self-employed

- pensions

- scholarships

- interest on deposits

- alimony and social payments.

Calculation features and exceptions

There are exceptions to every rule, and the calculation of average wages also has its own characteristics. There are two main exceptions specified in the Resolution of the Russian Federation.

- Calculation period.

- Employee income.

In the first case, the billing period changes. For example, if in the 12 months before the calculation the employee did not work a single day, then the calculation is made based on the 12 months preceding them. This exception is always used when calculating payments if an employee goes on maternity leave for the second time in a row.

The second point relates to the employee's income. Thus, there are cases when calculations are made on the basis of a “bare” salary or tariff rate. For example:

- wages for the last two years were not accrued for one reason or another;

- the employee has not worked a single day for a period of two years;

- the employee did not work a single day in the month for which payroll is calculated.

With a flexible work schedule, hourly time calculation is used: not the daily duration of time is calculated, but the total number of hours worked. In this case, hourly earnings are calculated. Further, if you need to show the average daily or monthly earnings, the hourly indicator is multiplied by the amount of hours worked for the corresponding period.

Loan “Secured by real estate” Norvik Bank (Vyatka Bank), Lic. No. 902

from 8.8%

per annum

up to 20 million

up to 20 years

Get a loan

Property criteria

The new rules also provide for new criteria of need.

Now we are not talking only about family income. Her property will also be taken into account. In particular, the payment can be received by families with an average per capita income below the subsistence level and with the following property and savings:

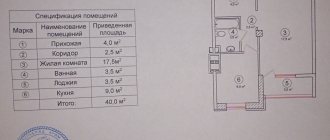

- one apartment of any size or several apartments if the area for each family member is less than 24 sq.m. Moreover, if the premises were found unsuitable for habitation, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by the applicant and (or) a member of his family suffering from a severe form of chronic disease, in which it is impossible for citizens to live together in the same premises, and residential premises provided to a large family as a support measure. Shares constituting 1/3 or less of the total area are not taken into account;

- one house of any size or several houses, if the area for each family member is less than 40 sq.m. Moreover, if the premises were found unsuitable for habitation, it is not taken into account when assessing need. Also not taken into account are residential premises occupied by the applicant and (or) a member of his family suffering from a severe form of chronic disease, in which it is impossible for citizens to live together in the same premises. Shares constituting 1/3 or less of the total area are not taken into account;

- one dacha;

- one garage, a parking space, or two, if the family has many children, the family has a disabled citizen, or the family has been issued a motor vehicle or motor vehicle as part of social support measures;

- land plots with a total area of no more than 0.25 hectares in urban settlements or no more than 1 hectare if the plots are located in rural settlements or inter-settlement areas. At the same time, land plots provided as a measure of support for large families, as well as a Far Eastern hectare, are not taken into account when calculating need;

- one non-residential premises. Outbuildings located on land plots intended for individual housing construction, personal subsidiary plots or garden plots, as well as property that is common property in an apartment building (basements) or common property of a gardening or vegetable gardening non-profit partnership are not taken into account;

- one car (except for cars under 5 years old with an engine more powerful than 250 hp, with the exception of families with 4 or more children, if the car has more than 5 seats), or two, if the family has many children, a family member has a disability, or the car was received in as a measure of social support;

- one motorcycle, or two, if the family has many children, a family member has a disability, or the motorcycle was received as a measure of support;

- one unit of self-propelled equipment under 5 years old (these are tractors, combines and other pieces of agricultural equipment). Self-propelled vehicles older than 5 years are not taken into account when assessing need, regardless of their number;

- one boat or motor boat under 5 years old. Small vessels older than 5 years are not taken into account when assessing need, regardless of their number;

- savings, annual interest income for which does not exceed the subsistence level per capita in Russia as a whole (i.e., on average, these are deposits worth about 250 thousand rubles).

What does it consist of

Income

This is the salary of all working family members. This also includes interest on deposits, odd jobs and freelancing, gifts for holidays, pensions, social benefits and any other additional injections.

Expenses

Spending by all family members. This part of the budget consists of several categories.

- General expenses . Food, apartment bills, communication services, travel on public transport, car maintenance (if everyone uses it), family vacations, loans.

- Unexpected expenses . Breakdown of plumbing or gadgets, medical care or other expenses that cannot be planned in advance.

- Personal expenses . They are prescribed for each separately. This includes buying clothes and shoes, having fun with friends, scheduled visits to the doctor, getting an education, buying gifts, paying for classes and clubs for the child, and spending on pets.

Before the start of the month, write down approximate limits in each category so that you don’t accidentally spend more than you received.

Savings

Illustration: Fizkes / Shutterstock

Funds that remain after spending money on expenses. Savings may include:

- Airbag . Everyone needs it! These are funds that will save you in any financial difficulties: they will help you cover expensive treatment, survive dismissal, or repair a stalled car. The size of the airbag should be at least three salaries: to accumulate it painlessly, you can save 10% of your income every month.

- Money for large purchases . For example, a vacation, a car or a new home.

- Assets and valuable property . Investments, car, real estate - any options for values. Such savings have bonuses - for example, investments can grow due to interest and become sources of passive income.

Owning your own home gives you a sense of stability and reduces your monthly expenses—you don’t have to pay a landlord. It is profitable to purchase an apartment in a new building in any region of Russia before July 1, 2022 with a preferential mortgage lending program. The rate for the entire term will be 7% or even less. The program allows you to choose an apartment both in housing under construction and in already completed housing. The only condition is that it must be the primary real estate market. The maximum loan amount is 3 million rubles, and the down payment amount is 15%.

Find out more

Zero income rule

This new rule assumes that benefits are assigned if adult family members have earnings (scholarships, income from labor or business activities, or pensions) or the lack of income is justified by objective life circumstances.

The reasons for lack of income may be:

- child care, if this is one of the parents in a large family (i.e. one of the parents in a large family may have zero income for all 12 months, and the second parent must have income from labor, entrepreneurial, creative activities or pensions, scholarship)

- child care if we are talking about a single parent (i.e. the child officially has only one parent, the second parent has died, is not listed on the birth certificate or is missing)

- caring for a child until he reaches the age of three

- caring for a disabled citizen or an elderly person over 80 years of age

- Full-time education for family members under 23 years of age

- compulsory military service and a 3-month period after demobilization

- undergoing treatment lasting 3 months or more

- unemployment (confirmation of official registration as unemployed at the employment center is required, up to 6 months of being in this status are taken into account)

- serving the sentence and a 3-month period after release from prison.

However, if in total the parents had no income for an objective reason for no more than 10 months out of 12, then the benefit will be assigned despite the “zero income”.

The “zero income rule” does not apply to single parents—that is, to those families where the second parent is dead, missing, or not listed on the birth certificate.

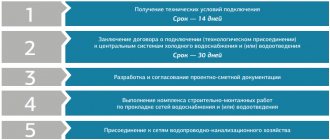

How to make a payment

To receive a payment, one of the parents must submit an application for all children aged 3 to 7 years inclusive.

This can be done online - through the federal or regional (if the subject has one) portal of State Services or in person - through the social security department or MFC. In some cases, it may be necessary to document the information specified in the application, but in the vast majority of situations, all data will be obtained from government information systems. You can receive benefits on a card of any payment system until June 1, 2021, and from June 1, 2021 - only on a card of the national payment system MIR.

For what period of payment is the payment established?

When applying for payment, it is established immediately for 12 months or until the child reaches the age of 8 years.

If the family applied within 6 months of reaching the age of 3, then the benefit is accrued from the age of 3. If later - from the date of application.

Example No. 1. A family with a child who turned 3 years old in January applies for benefits in May. If a family is recognized as low-income and has the right to payment, then the benefit will be accrued from January, and assigned immediately for 12 months, i.e. until May 2022.

Example No. 2. A family with a child who turned 4 years old in January applied for benefits in May. If a family is recognized as low-income and has the right to payment, then the benefit will be assigned for 12 months from the date of application - from May 2021 to May 2022.

Example No. 3 . A family with a child who turned 7 years old in January applied for payment in May. If the family is eligible for payment, then the benefit will be assigned from the moment of application - from May - until the child reaches 8 years of age, that is, until January 2022.

What you shouldn't save on

The task of the family budget is to optimize income and expenses, and not to keep as much money as possible untouched. Therefore, you should not deny yourself everything, in particular, do something from this list:

- Sparing money on health . The disease can progress over time, and treatment can only become more expensive.

- Don't pay bills . It’s not scary to miss one month, but then interest will start to accrue, and if you delay too much, the water or electricity may be turned off.

- Buy cheap clothes and shoes just because of the price . If an item is of poor quality, doesn’t fit into your wardrobe, or you don’t like it at all, it will quickly go to a landfill or gather dust in the closet. It's better to pay extra for quality right away.

- Deprive yourself of all entertainment . Skimping on vacation can lead to accumulated fatigue. And in this state it is very difficult to preserve the resource. In addition, there is a risk at some point that you will break down and spend all your savings on entertainment.

How to get an increased benefit for those who already receive it at the old rate

You need to resubmit the application on the State Services portal (federal or regional portal) or in person at the MFC or social security authorities.

Families who had previously been assigned a monthly payment for 12 months can apply for its assignment in a new amount starting from April 1, 2021 until the end of 2021.

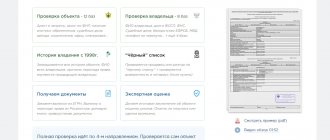

Social security authorities will check information about income and property, and if the family is low-income, the required amount of payment will be calculated. In addition, the family will receive an additional payment for the first 3 months of 2021.

How to manage a family budget

The first step is to objectively assess your financial situation . To do this, record your income and every ruble spent in a spreadsheet or notebook for a month: note the exact amount and what it was spent on.

Then add up your expenses and compare them to your income. This way you can analyze how rationally the budget is spent, mark items that exceed the desired indicators, and see where you can save.

Then start creating a family budget . To do this, you can make a pivot table yourself in Excel or use ready-made tools in any mobile application for monitoring finances, for example, “Zen Money”, Toshl, “Home Accounting”. Try to predict the required amount of expenses for the next month and set the limits. Then enter real data regularly. During the first couple of months, the numbers may not add up - don’t worry, it takes time to get used to it.

Here are some useful rules that will make it easier to control your budget.

- Appoint a chief . Even if the budget is separate, the line of total expenses remains. To ensure that the refrigerator is not empty and bills are paid on time, it is better that the most responsible family member monitors this.

- Set up an account for general expenses . This way, the funds needed to pay for utilities will not go unnoticed on taxi trips, movies, or anything else.

- Make a budget for a long time ahead . For a quarter, six months or a year. This is important for large purchases: you will have an idea of how much money you need to set aside in order to save up for what you planned.

What income is not taken into account when assigning payments?

Not included in income:

- payments for children from 3 to 7 years old that were received in previous periods for this child.

- monthly payments for children under 3 years of age, if this benefit was assigned to a child who was already 3 years old by the time the application was submitted.

- one-time financial assistance and insurance payments.

- funds provided under a social contract.

- the amount of benefits and other similar payments, as well as alimony for a child who, on the day of filing the application, has reached the age of 18 years (23 years - in cases provided for by the legislation of the constituent entities of the Russian Federation)

- compensation payments for caring for a disabled child (10 thousand rubles).

Calculation of average earnings with summarized accounting

When determining the average earnings of an employee for whom a summarized recording of working time is established, the average hourly earnings are used.

Average hourly earnings are calculated by dividing the amount of wages actually accrued for the pay period by the number of hours actually worked during this period.

Average employee earnings = average hourly earnings x

the average monthly number of working hours in the billing period, depending on the established length of the working week.