Subsidies for pensioners have remained in place in 2021. They are for people who:

- have a status based on age;

- on disability;

- have the status of a labor veteran;

- belong to the category of low-income population.

The federal figure is 22% of total family income. Legislation allows reducing this threshold at the regional level, for example:

- for Muscovites it is 10%;

- for residents of St. Petersburg – 15%;

- for pensioners of the Rostov region - 20%.

What subsidies are available to pensioners?

There are two types of payments:

- Federal - the same for citizens of any region who are allocated from the state budget.

- Regional - may differ by region and are paid from the local fund.

All categories of citizens have the right to receive information about the benefits due to them, guaranteed by the state. To do this, you need to contact the social protection authorities or the Pension Fund, where they are required to provide it.

Subsidies for pensioners to pay for housing and communal services

Retired military personnel, heroes of the USSR and Russia can receive it. In the latter case, the amount of compensation reaches 100%. Covers in full the payment of housing and communal services and subsidies for persons over 80 years of age. For other elderly people it reaches 50%.

Loan "Pension Plus" Sovcombank, Lic. No. 963

from 6.9%

per annum

up to 300 thousand

up to 5 years

Get a loan

Subsidy conditions

The accrual of subsidies for housing payments to pensioners is suspended if there is arrears in paying utility bills for more than two months. However, it is always provided only for a certain period, since the family’s income, its social status and other parameters that affect the amount of compensation may change. To receive compensation, you must also not change your place of residence.

Low-income citizens can receive a subsidy. This category includes not only single pensioners, but also families with several pensioners. The condition is that the person applying for compensation must be:

Loan "Pension" Asian-Pacific Bank, Person. No. 1810

from 5.5%

per annum

up to 1 million

up to 5 years

Get a loan

- user of the premises from the state fund;

- owner;

- member of the residential complex and housing cooperative.

The main condition is the level of income. If one of the immediate relatives living with the pensioner works or the family income is above the established minimum, then it will be more difficult to receive monetary compensation.

Apartment subsidies for pensioners will not be awarded if:

- a person occupies space under a free user agreement;

- a sublease agreement has been drawn up;

- an annuity agreement has been entered into with the dependent who owns the property.

One of the types of social protection of citizens for paying for housing and communal services is the provision of social support measures in the form of benefits for paying for residential premises and utilities.

Measures of social support for citizens in paying for housing and utilities (hereinafter referred to as housing and communal services) are provided to certain categories of citizens in accordance with the legislative and legal acts of the Russian Federation and the city of Moscow.

In accordance with the Decree of the Moscow Government dated December 7, 2004 No. 850-PP “On the procedure and conditions for providing measures of social support for citizens in paying for housing and utilities,” in Moscow more than 50 categories of citizens are entitled to benefits in paying for housing and communal services, which is significantly more than provided for by federal legislation in other regions of the Russian Federation. Certain categories of beneficiaries are provided with a discount on housing and communal services payments together with members of their families.

Compensation for benefits from the city budget is provided for veterans of labor and military service, repressed persons, donors and other categories of citizens who enjoy benefits in accordance with the regulations of the city of Moscow.

Measures of social support for citizens in paying for housing and communal services are based on the declarative principle and are carried out when citizens provide documents confirming their inclusion in the appropriate preferential category to the organization that calculates payments for these services.

Social support measures for paying for housing and communal services are provided to citizens in the form of a discount on payment (preferential discounts) when calculating their payments for housing and communal services.

Preferential discounts are provided to citizens for no more than one apartment (residential premises) based on rates, prices and tariffs established by the Moscow Government.

Citizens who pay for maintenance and repair services of residential premises at prices established by the Moscow Government receive preferential discounts on payment for these services are calculated at the prices at which payments are calculated.

From July 1, 2015, those citizens who use social support measures to pay for the maintenance of residential premises in a private housing stock are provided with the same social support measures to pay contributions for major repairs.

By Decree of the Moscow Government dated December 29, 2014. No. 833-PP for certain categories of citizens who are not entitled to benefits in paying for housing in a private housing stock (disabled people, honorary donors, large families, etc.), additional social support measures have been established for paying contributions for major repairs.

In addition, additional social support measures for paying the contribution for major repairs are established by the Decree of the Moscow Government dated 04/05/2016. No. 161-PP for non-working owners of residential premises who have reached the age of 70 and 80 years (living alone, as well as living as part of a family consisting only of non-working citizens of retirement age living together).

In cases where, in accordance with the law, social support measures for paying for residential premises are provided within the social norm for the area of residential premises (the standard for the standard area of living premises used to calculate the subsidy), preferential discounts are calculated from a total area not exceeding:

• for a citizen living alone – 33 sq.m;

• for a family of 2 people – 42 sq.m;

• for a family of 3 or more people – 18 sq.m. for each family member.

If legal acts establish that social support measures for paying for utility services are provided within the limits of their consumption standards, then when calculating preferential discounts, the standards for the consumption of utility services established by resolutions of the Moscow Government are taken into account:

• dated January 11, 1994 No. 41 – heating, gas;

• dated July 28, 1998 No. 566 – cold and hot water, drainage;

• dated December 20, 1994 No. 1161 – power supply.

In the case where a citizen has the right to social support measures for paying housing and communal services on two or more grounds, preferential discounts are awarded on one of the grounds at the citizen’s choice. In this case, for each type of payment, different preferential discounts can be applied (for example, discounts for payment for residential premises can be provided on one basis, and for payment of utilities - on another basis; for different utility services, discounts can be provided on different grounds).

If there are several citizens in a family who are entitled to social support measures for paying housing and communal services, each of them has the right to take advantage of their own right to preferential discounts or use the benefit as a member of the family of a citizen entitled to social support measures to pay for housing and communal services. In this case, for each unit of service volume consumed (cubic meters, Gcal, etc.), only one preferential discount can be provided.

Family members of a citizen entitled to social support measures for paying housing and communal services include his spouse, parents and children living with him, unless otherwise specified in the legislative document providing these social support measures. Other persons living together with a citizen entitled to social support measures for paying for housing and communal services can be recognized as members of his family upon presentation of a document confirming their classification as members of the same family (for example, a social tenancy agreement, a court decision, etc.).

If a citizen wishes to take advantage of preferential discounts on payment for housing and communal services not at the place of permanent residence (registration at the place of residence), but at the place of actual residence, he must, in addition to documents confirming the right to social support measures, submit a certificate to the organization that calculates payments for housing and communal services, a certificate that at the place of permanent residence, payments for housing and communal services are accrued to him without taking into account preferential discounts.

Compensation for lost income of housing and other organizations from providing citizens with benefits for paying for housing and utilities, communication services (radio broadcasting and television antenna), i.e. payment of compensation is made on the basis of an agreement concluded between the City Center for Housing Subsidies and the organization receiving budget funds. The procedure for compensation of lost income is regulated by Decree of the Moscow Government dated June 4, 2002 No. 411-PP.

Detailed information about the provision of benefits is available on the website of the City Center for Housing Subsidies.

At what pension level do they provide subsidies for utilities?

The mere fact that a person is a pensioner is not enough for him to be eligible to receive a subsidy. The size of the pension does not always matter. For example, rehabilitated citizens and honorary donors are provided with benefits; the size of the pension for this type of subsidy does not matter.

And labor veterans at the regional level will have to show the size of their pension. For example, in the Nizhny Novgorod region they can receive a subsidy only if their income does not exceed 22 thousand rubles.

If there are no rights to special benefits (veterans, home front workers, families with many children), then you can claim the right to a subsidy due to the large sums spent on utilities. To do this, the total family income is summed up and compared with monthly utility bills. The maximum that is set is 22%, but in the regions authorities often reduce this figure.

For example, in a family only the father works, the mother and two children are on maternity leave. He earns 30,000 rubles, of which 7,000 rubles are spent on utilities every month, this is more than 23%. Let's say they live in the Rostov region, where the threshold value is 10%. This means that the family can contact local authorities, provide a certificate of salary and the amount of paid utilities. And they will receive a subsidy.

There is only one condition - there should be no debts to pay for utilities. You can’t come and ask for a subsidy when a person owes about 20-50 thousand rubles for gas.

Use your right to a subsidy

If there is no preferential status, a pensioner can take advantage of a subsidy to pay for housing and communal services.

The level of income of him and his family members living with him is of fundamental importance here. Each region has its own threshold value for the share of utility bills in total family income.

The permissible maximum is 22%, but regions have the right to reduce it for their territory. One of the lowest threshold values in Moscow is 10%.

It is important that in order to receive a subsidy, the law has one condition: the absence of rent debts, otherwise the accrual of the subsidy is suspended.

But the Supreme Court of the Russian Federation has more than once drawn attention to the fact that the subsidy cannot be “removed” if the debt arose for a good reason.

Last year, several decisions were made when the rent subsidy was restored to pensioners and even compensation for moral damage was recovered from social security (for example, the Armed Forces of the Russian Federation, case No. 16-KG19-2).

Subsidies for working pensioners

Pensioners in this category have all the rights of working citizens of the Russian Federation and small benefits based on age restrictions. If a man after 60 years or a woman after 55 continues to work, then they are not limited in receiving all the benefits that are due to people who have retired.

Thus, a working pensioner has the right to additional unpaid leave upon request, without explaining the reasons, which is guaranteed in Labor Code Art. 128:

- WWII participants - 35 days;

- disabled people - 60;

- the rest - 14;

If an employee wishes to resign, he is not obliged to work for a two-week period, at the same time, the employer does not have the right to fire him due to retirement age.

For those working in the field of education, additional payments to pensions are provided based on titles, Ph.D. degrees, etc.

Additional payment up to the subsistence level for non-working pensioners

If the pension amount does not reach the subsistence level, you will be paid additional funds that do not reach the subsistence level. The amount of additional payments depends on the regional level. The federal minimum standard of living is 10,022 rubles. In the region it depends on the price level. If the federal subsistence level is higher in the region, the pension will be increased to it; if the regional one is higher, then by the subject’s allowance.

Additional payment is assigned at the request of the pensioner. To do this, you need to contact the MFC or the territorial branch of the Pension Fund.

Bankiros.ru

Payments to pensioners with dependents

Additional payments to pensions are provided to citizens who have disabled relatives as dependents:

- minor children;

- full-time students under 23 years of age;

- elderly parents or spouse;

- relatives with disabilities.

The amount of the additional payment is one third of the fixed payment of the insurance pension - 2014 rubles. In this case, no more than three additional payments are possible for three dependents, respectively.

To receive payments, you must contact the territorial office of the Pension Fund and fill out an application. Supporting documents must be attached to it, for example, a certificate of the student’s studies at a university or documents on guardianship of minor grandchildren.

Payments to rural residents

Increased pensions are granted to citizens who have worked in rural areas for more than 30 years. The surcharge is a quarter of the fixed payment from the insurance pension. In 2021 it is 1,511 rubles. The additional payment is assigned automatically according to the data of the pension department.

Increases to pensions of citizens over 80 years of age and disabled people

The supplement is given to pensioners over 80 years of age, as well as disabled people of the first group. The amount of payments is equal to double the size of the fixed payment from the insurance pension - 6,044 rubles. The additional payment is calculated automatically based on the data of the Pension Fund of the Russian Federation.

Allowances for residents of the Far North

Increased pensions are paid to residents of the Far North or equivalent territories, as well as to citizens who have worked there for a long time. An important condition for the bonuses is the total insurance period: 25 years for men and 20 for women. The period of work in harsh climatic areas should be from 15 years in the Far North or 20 years in areas equivalent to it.

The fixed insurance pension is increased by half for workers of the Far North - 3022 rubles and by 30% for areas equated to it - 2014 rubles. It does not matter whether the pensioner has changed his place of residence, the additional payment is mandatory.

The pensioner chooses the additional payment for residents of the Far North himself. Payments are possible due to the regional coefficient or additional payments for preferential length of service. In case of relocation, the right to additional payment is retained only if the pensioner has the necessary northern experience in reserve.

Compensation for travel of pensioners of the Far North to domestic resorts

Pensioners living in the Far North or areas equivalent to it have the right to compensation for the cost of tickets to a vacation spot every two years. Important. so that the vacation spot is located within Russia.

You can get to the holiday destination:

- reserved seat carriage;

- economy class aircraft;

- intercity bus;

- river or sea vessels of the third – fifth category.

To receive compensation, you must contact the territorial office of the Pension Fund or MFC. Travel tickets must be attached to the application.

If you are just planning a vacation, you can get free tickets. To do this, also contact the Pension Fund or MFC. Fill out an application for tickets and attach documents about your upcoming vacation, for example, a hotel reservation or a voucher to a sanatorium.

Payments to crew members and coal mining workers

To receive the bonus, specialists in flight crews and the coal mining industry must have a work experience of at least 25 years for men and 20 years for women.

The amount of payments is calculated individually. It depends on the average salary in the Russian Federation, the average salary of a specialist, and length of service. Last year, the average bonus was 7,470 rubles for pilots and 3,845 rubles for miners. The amount of payments is adjusted every three months.

Payments for special merits

Special surcharges are intended for:

- Heroes of the USSR and Russia;

- Heroes of labor;

- Awarded the Order of Merit for the Fatherland, Labor Glory, and for Service to the Motherland;

- laureates of state awards of the USSR and Russia;

- champions of the Olympic and Paralympic Games.

The amount of additional payments depends on the above category: 250, 330 and 415% of the social pension. The minimum allowance exceeds 12 thousand rubles. Olympic champions receive it.

Payments are of a declarative nature. To receive it, you must contact the Pension Fund of the Russian Federation or the MFC and provide documents confirming your right to payments.

Termination of subsidies

Payment is terminated for the following reasons:

- if within 2 months without good reason payment for residential premises is not made or the terms of the concluded agreement to pay debts for housing and communal services are not met,

- if the pensioner changes his place of residence,

- if the composition of the family, or the financial situation of the family or pensioner changes,

- if it is revealed that false information was provided to receive a subsidy.

Transport benefit for pensioners

Please note that federal benefits have been cancelled. But there are regional ones, according to which pensioners can use public transport for free or at a discount.

The difficulty is that the state obliges the regions, and there they introduce not only budgetary, but also commercial routes, where the benefit does not apply. Pensioners have to wait for transport.

To find out if there is a benefit for free travel in this region, you need to contact the social security authority or check on the State Services portal.

For example, in Moscow, a pensioner can receive a social benefits card, and with it the opportunity to use public transport for free. For those pensioners who do not use transport, monetary compensation is provided.

What benefits in the housing and communal services sector have been introduced to support the population?

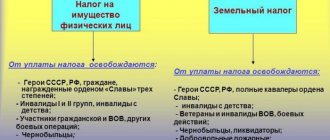

Disabled people, disabled children, war and labor veterans have the right to housing compensation. The state partially compensates for housing fees for military personnel, families of fallen and deceased military personnel, Chernobyl survivors, Heroes of the Russian Federation and the USSR, Heroes of Labor, holders of the Order of Glory, teachers, doctors working in rural areas and workers' settlements, and so on.

In addition to these citizens and families, the disadvantaged segments of the population also have the right to benefits in the field of housing and communal services. The latter receive subsidies in accordance with Decree of the Government of the Russian Federation No. 761 of December 14, 2005. The pandemic forced the authorities to adjust the procedure for paying for housing and communal services.

The subsidy was automatically extended

The subsidy for low-income families and citizens when paying for housing and communal services is issued for 6 months. However, if the subsidy payment ends between April 1 and October 1, 2021, then this compensation is extended automatically and in the same amount for six months (Government Decree No. 420 of April 2, 2020). That is, the subsidy is not assigned, but rather, it is extended. During this period of time, persons receiving compensation to pay for housing do not need to collect papers, fill out an application and knock on the threshold of the authorized body. The authorities will do everything themselves.

But the subsidy calculated without application may turn out to be lower than actually allocated. For example, if the average per capita family income decreased, but documents about this were not provided, because the subsidy was automatically extended. In this case, a recalculation will be made and the person will be reimbursed for the missing amount.

Conversely, if the recipient of compensation by the time the subsidy expires, the income situation has become better and he is entitled to payments in a smaller amount than before the extension, then the excess amounts paid for the period for which the state assigned the subsidy without application will not be refunded. This money will remain with citizens and will not have to be returned.

Suspension of collection of fines, penalties and interest

Until January 1, 2021, the Government deprived resource supply organizations (RSOs), MSW handling operators and management companies of the right to demand that citizens pay penalties, penalties and fines (Government Decree No. 424 of 04/02/2020).

Accordingly, the provisions of contracts for the provision of utility services containing clauses on the payment of penalties, fines and penalties do not apply until the end of this year. In addition, the federal authorities suspended until January 1, 2021 the collection of penalties for late or incomplete payment of housing, utilities and contributions for major repairs.

Temporary cancellation of verification of metering devices

If the meter verification period expires before January 1, 2021, the device will be operated without verification until this date. At the same time, the Ministry of Construction of the Russian Federation prohibited the application of increasing coefficients to the consumption standards for housing and communal services in such cases (Letter of the Ministry of Construction No. 18848-OL/04 dated May 19, 2020).

In other words, the Government has increased the meter verification interval. Therefore, the planned verification will take place at the beginning of 2021. RSO and CC are required to accept readings from all instruments with expired verification periods. Moreover, even those whose terms had expired on the day of adoption of Resolution No. 424.

Prohibition on disconnection from housing and communal services

Again, until January 1, 2021, the Government prohibited utility companies, distribution centers and MSW operators from suspending the provision of utility services if the owners do not pay in full for these services. Please note that in this case we are talking specifically about incomplete or partial non-payment. It turns out that if payment is not made in full, RSO and housing and communal services still have the right not to provide the service, despite the pandemic.

Tax benefits when buying an apartment

Property taxes are required to be paid, but not at the time of purchase. It is paid once a year for the entire year of ownership of the property, and then upon sale.

After the purchase, you can take advantage of the property deduction if this is the first home that a person receives. Any owner can submit documents for a personal income tax deduction if he is officially employed and pays taxes to the budget at a rate of 13%.

The opportunity to take advantage of the property deduction arises only once in a lifetime and subject to a limit of 2,000,000 rubles. Housing may cost more, then only this amount will be deducted. In other words, the maximum deduction will be 260,000 rubles. You can also return interest if the house or apartment was purchased with a mortgage. In this case, you can return 320,000 rubles.

How to get a deduction

To receive a deduction, you need to collect a package of documents (we will indicate which ones below) and take them to the tax office.

There are nuances:

- if a single man bought an apartment, he can receive a deduction of up to 260,000 rubles;

- if he bought it with a mortgage, he can also receive interest in the amount of 320,000 rubles;

- if a family buys an apartment, then by default it is jointly acquired property; both husband and wife can receive deductions, each up to 2 million.

What documents will be needed

You need to prepare:

- an extract from the Unified State Register of Real Estate (a certificate of ownership is possible, but they have not been issued for several years), an agreement for participation in shared construction;

- confirmation of payment - checks, receipts, orders, receipts (if the house is on a mortgage, then you can simply bring a certificate from the bank stating that the funds have been transferred);

- certificate of income in form 2-NDFL for each year for which the deduction is claimed;

- applications from spouses if they both apply for deductions;

- marriage registration certificate.

You need to make copies of all the originals, since the tax office will take the copies, but they will compare them with the originals, so you will also have to take them with you.

To return the tax, the taxpayer himself will have to calculate it. The tax office will check him.

There is a nuance - maternity capital or other subsidies must be deducted from the cost of housing. Home owners are only entitled to that portion of the cost that was their expense.

If you have questions, you can ask them at the tax office.

Subsidies for major repairs

All home owners are required to pay contributions for major repairs. But some categories of people can apply for a subsidy and not pay. Let's figure it out.

Who may not pay at all:

- if the house is in disrepair and will soon be demolished;

- if the owner is over 80 years old.

Who is eligible for the subsidy?

Those who are not exempt from paying contributions can apply for a subsidy. Who is entitled to a subsidy of 50% of the cost:

- disabled people of groups 1 and 2;

- owners, disabled children and their parents;

- heroes of the country and holders of the Order of Glory;

- WWII participants and their families;

- people who suffered as a result of the Chernobyl accident, as well as members of their families;

- citizens who suffered as a result of the accident at the Mayak production site;

- single owners over 70 years of age;

- non-working owners over 70 years old, if in their family there are only non-working pensioners or disabled people of groups 1-2.

In addition, it is worth going to a special section on the State Services portal. It lists all the benefits and subsidies to which the owner is entitled in a particular region. It's worth checking out this section.

In some regions, people may receive compensation for payments for major repairs or may not pay it if the utilities amount exceeds 10-20% of the total family income.

How did indexation affect the size of the pension?

The Pension Fund of the Russian Federation has approved a list of one-time and monthly additional payments to pensioners in 2021. In January, insurance pensions of non-working pensioners were indexed - 6.3%. The basic part of payments has been increased to six thousand rubles.

In April, the state will index social pensions and state security payments. Their value is proportional to the cost of living of a pensioner in the region of residence.

The Pension Fund of the Russian Federation predicts an increase in the average size of the insurance pension to 16,2452 rubles, and the social pension to 10,122 rubles. The average amount of additional payment to a pensioner whose income is below the subsistence level will be on average 2,196 rubles. The actual pension may be lower. It depends on the pensioner’s work experience, working conditions and the veracity of the employer’s information. If the pension does not reach the subsistence level, the Pension Fund will compensate for the missing part.

Monthly additional payments for disabled people, combat veterans, and participants in the liquidation of the Chernobyl accident will be indexed to the inflation rate until the end of February. Additional payments are assigned automatically.

Payments for additional material support for disabled people, veteran prisoners, widows of war participants will not be affected by indexation yet.