We do not pay gift tax from a close relative How to calculate gift tax When is the gift tax due?

When accepting a gift from a relative, we rarely consider whether tax law considers the gift to be income and whether we must pay tax on it. After all, a gift from relatives is a gift within the family, when no one has lost and no one has gained. But is this so, and what does the Tax Code say about this?

First, let's clarify: gifts, except for real estate, vehicles, stocks, shares and shares, are not taxed. No matter who gives it to you, and whatever it is, including giving money. Read our Gift Tax article for more details.

Therefore, in the article below we will tell you the rules for calculating tax if a relative gave you an apartment, a car, shares, a share or a share.

Is a gift tax return required?

According to Art. 80 of the Tax Code of the Russian Federation, the declaration is a written or electronic application of the taxpayer. It reflects information about income received for calculating personal income tax.

The amount of personal income tax depends on the status of the payer:

- Resident - a citizen who has stayed in the Russian Federation for at least 183 days over the past 12 months;

- A non-resident is a person who has been in Russia for up to 183 days over the past year.

For residents, the rate is set at 13%, for non-residents – 30% (Article 224 of the Tax Code of the Russian Federation). Regardless of their location, military personnel performing military service abroad, as well as employees of state and municipal authorities residing in the territory of a foreign state are recognized as residents.

When making a gift, the declaration is submitted to the Federal Tax Service at the payer’s place of residence if he receives real estate, a vehicle, shares, shares or units as a gift.

When is it not necessary to provide a tax return for a gift?

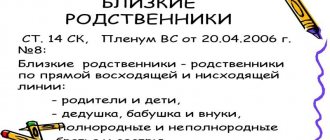

Paying personal income tax and submitting a declaration is the responsibility of the donee: they receive income in the form of property. According to Art. 217 of the Tax Code of the Russian Federation, close relatives of donors are exempt from taxation: parents, children, full and half brothers and sisters, grandchildren, granddaughters. Even if they receive housing or a car through a free transaction, personal income tax is not paid.

Also, taxation does not apply when receiving money or a gift in kind under a gift agreement (hereinafter referred to as DD), regardless of the degree of relationship between the donor and the donee.

In the above cases, the declaration is not submitted and the tax is not paid. But if necessary, the document will be required if the Federal Tax Service suspects a citizen of intentional tax evasion. In addition to this, you will have to provide documents confirming your relationship with the donor. Such cases are extremely rare.

Determining the value of property received under a donation transaction

As you know, the value of the property received by the donee as a gift is of particular importance when calculating the amount subject to income tax, since it is his actual income - economic benefit. At the same time, based on the Information Letter of the Ministry of Finance of the Russian Federation, No. 03-04-05/3074 dated January 28, 2015, it is the market value (Article 7 of the Federal Law No. 135) of the subject of donation that is subject to determination for income tax purposes (Chapter 23 of the Tax Code), on the date of conclusion of the agreement under which this item was alienated.

Determination of the market value of the subject of donation is based on the market value of similar property benefits existing on the date of donation. Determining the specific size of the market value of a specific item of donation for the purpose of using this value for taxation can only be carried out by an authorized appraiser , acting on the basis of Federal Law No. 135 of July 29, 1998.

For your information

According to Art. 11 Federal Law No. 135, the final document containing the specific market value on the day of donation, determined in the order of assessment by the appraiser, will be a report drawn up in written or electronic form . It is from the value determined by the specified report that the donee should determine the amount of income tax to be paid.

At the same time, if the subject of the donation is a real estate object, for tax purposes the cadastral value of this object specified in the agreement can be used, but only if it corresponds to the market value (Letter of the Ministry of Finance No. 03-04-05/21903). If the tax authority discovers a discrepancy between this value and the market value by more than 20% , it will assess additional tax and impose a penalty, which will be completely legal, based on the Determination of the Armed Forces of the Russian Federation No. 34-KG14-3.

Example

Citizen Lopukhov, according to a gift agreement concluded between him and citizen Akhmetov, received an apartment in a multi-storey building free of charge. Due to the fact that there were no family ties between him and the donor, Lopukhov was obliged to pay income tax to the state treasury, amounting to 13% of the cost of the housing he received. When filling out a tax return, the donee used the cadastral value of the specified property as a tax base - 1.5 million rubles, which was indicated in the certificate from the BTI and in the gift agreement concluded by the parties. Accordingly, 195 thousand rubles were subject to payment as personal income tax. Some time after submitting the declaration, Lopukhov received by mail a receipt for personal income tax payment, which he paid at the nearest bank branch. After some time, Lopukhov received a notice of a desk tax audit carried out against him. This audit identified some discrepancies in the amount of income he received in kind and in the amount subject to taxation. Thus, according to tax inspectorate employees, Lopukhov was obliged to calculate the amount of income tax based on the market, and not the cadastral value of the property received as a gift, which at the time of the donation was 2 million rubles. Lopukhov’s incorrect application of legislative norms, according to tax authorities, led to an understatement of the tax base by more than 20%, as a result of which they intend to recover from citizen Lopukhov the under-withheld amounts of income tax.

At the court hearing, a representative of the tax authority argued that, according to Art. 41 of the Tax Code, the specified property received by Lopukhov as a gift is his income in kind, which is an economic benefit. Such economic benefit is subject to taxation based on its market value, not its cadastral value. Such conclusions are based on the fact that the cadastral value does not indicate a real assessment of the value of the property based on the fact that it does not take into account all the characteristics required to determine it: the cost of other real estate, the demand for such objects in a particular region and other significant circumstances that determine real economic benefit received by Lopukhov at the time of donation.

Moreover, as evidence, a representative of the tax authorities presented to the court a report on the assessment of the said apartment, carried out by appraiser K. at the request of the tax authorities. According to it, the market value of the apartment at the time of donation was 2 million rubles, which proved that the tax base was underestimated by 25%, due to which the amount of tax paid should have been 260 thousand rubles, and the budget did not receive 65 thousand rubles.

After listening to the arguments of the representative of the tax authority, the court satisfied his demands and ordered the donee Lopukhov to pay additional amounts of personal income tax that were not withheld, and also ordered him to pay a penalty and a fine.

How to determine the value of a gift to fill out a declaration and calculate taxes?

Form 3-NDFL indicates the value of the donated object, it depends on the type of gift:

- Housing, commercial real estate, land, garage, other real estate. The cadastral value is used for calculation;

- Vehicle. If a price is indicated in the deed of gift, the contractual value is used. If not available, the tax is calculated based on the market price;

- Share in LLC. The actual value at the time of the transaction is applied.

Important! The payer calculates personal income tax independently and indicates all amounts in the declaration. If the tax office has questions, clarification may be required.

Do I have to pay gift taxes? Who is exempt from personal income tax?

How to draw up a gift agreement for a stranger?

Features of paying tax on a gift of land if the donor is a legal entity

Russian legislation directly prohibits the execution of contracts

donation of land between commercial structures. Only an individual can act as a recipient of a gift from a legal entity.

Today, large organizations often practice the transfer of ownership of a site in gratitude for dedicated work. Who pays taxes on such transactions?

For legal entities, concluding gratuitous transactions does not carry any tax consequences: neither in terms of payment of VAT nor income tax. There is no basis for their calculation.

Whereas an individual will have to declare the received plot of land in the general manner and pay a tax of 13%. There will be no benefits in this case, since family ties with a legal entity are impossible.

Find out all the information you need about renting a plot of land with subsequent purchase from the administration. What awaits you if you do not pay your utility debts, you will find out here. You can learn how to correctly calculate the cost of renting land for agriculture from our article.

Procedure for filing a tax return for a gift

The declaration is submitted during a personal visit to the Federal Tax Service, by registered mail with acknowledgment of receipt, through the MFC or personal account on the tax authority’s website, through “State Services” if you have a confirmed account.

The step-by-step order looks like this:

- Collecting documents and submitting a declaration to the Federal Tax Service.

- Conducting a desk audit by employees of the Federal Tax Service. The maximum period is 3 months.

- Sending a tax notice and payment document to the payer.

Payment of personal income tax according to the details of the payment document is made within the established time frame.

Legal advice: if you plan to submit a declaration in person to the MFC or the Federal Tax Service, it is better to make an appointment in advance through the website. This will avoid long waits in line.

Form and content of tax return 3-NDFL for donation

Form 3-NDFL was approved by Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected] The payer fills it out independently; information will be required:

- Full name, date of birth, registration address, passport details of the citizen;

- Taxpayer status code;

- Phone number;

- Number of sheets;

- KBK, OKTMO, amount of tax payable;

- The total amount of income received as a gift;

- Amount of tax to be paid;

- TIN;

- Cadastral value of real estate.

All sheets are signed with a transcript.

Tax return (3-NDFL) for donation:

General rules for filling out the declaration

When registering 3-NDFL, you must adhere to general recommendations, otherwise the Federal Tax Service may refuse to accept the document:

- Corrections and errors are not allowed.

- If the declaration is stapled, the barcodes must not be deformed.

- Rubles are used to calculate income.

- The fields are filled in from left to right.

- If there are free cells left when filling out the OKTMO code, they are filled in with dashes.

- At the bottom of each page, the completeness and accuracy of the information is confirmed by the taxpayer’s signature with a transcript.

- Information in the document is entered in capital letters and in legible handwriting.

Legal advice: if possible, it is better to use the “Declarations” program to fill out form 3-NDFL. It can be downloaded from the official website of the tax service. This will significantly simplify the registration procedure.

Tax return filing deadlines

The declaration is submitted to the Federal Tax Service by April 30 of the year following the date of registration of the deed of gift. After reconciliation, the tax is paid by July 15. If the specified dates fall on weekends or holidays, the deadline will be moved to the next weekday.

Documentation

Along with the declaration, a passport and a gift agreement are provided to the Federal Tax Service. No other documents are required.

When do you need to file a 3-NDFL declaration in 2021?

To pay income tax on gifted real estate to the new owner, simply provide the appropriate declaration (3-NDFL). However, he needs to do this no later than April 30 of the year following the year of the transaction. For example, if a citizen took ownership in February 2021, then he must submit a tax return by April 40, 2021.

We remind our readers once again that when registering a gift the subject of which is a house, apartment or other real estate - the donee becomes the owner not at the time of signing the gift agreement, but after the state registration established by the legislator with the bodies of Rosreestr. Thus, the calculation of the tax period begins from the moment the donated property passes into the ownership of the donee, after he receives an extract from the Unified State Register of Real Estate.

Example from a lawyer

The donor completed the transfer of the house on December 13, 2021, after which the parties to the transaction went to the registration authority to transfer the package of necessary documents for re-registration of ownership. At the same time, the registration process was completed only by mid-January of the following year. According to the current tax legislation of the Russian Federation, a new home owner must file a 3-NDFL declaration in 2021.

Responsibility for late submission of a tax return

According to Art.

119 of the Tax Code of the Russian Federation, if the deadline for submitting the declaration is violated, the payer is held accountable. He is charged a fine of 5% of the unpaid amount for each month of delay. The minimum fine is 1,000 rubles, the maximum is 30% of funds not transferred to the budget. Case study:

The citizen received an apartment as a donation, the cadastral value is 2,000,000 rubles. The amount of personal income tax payable is 260,000 rubles. at a rate of 13%. He was 1 month late in paying his taxes, for which he was held accountable and ordered to pay a fine of 5%. The total amount was 13,000 rubles.

Due to missing the deadline, instead of 260,000 rubles. he had to pay 273,000 rubles.

Important! For failure to provide a document, there is also administrative liability under Art. 15.5 Code of Administrative Offenses of the Russian Federation. Sanctions include a warning or a fine of up to 500 rubles.

How to prepare a declaration

The declaration form changes every year, so when filling it out you need to make sure that it is up to date .

Basically, the procedure for filling out the declaration is as follows:

- All codes are indicated on the initial page (their meaning can be found in specialized code directories or in the Federal Tax Service department).

- All personal information of the taxpayer is indicated.

- Section 1 provides information about the amount of tax and the source of income received.

- In section 2, the tax is calculated - the data of the gift agreement is indicated.

- Sheets E and D display the information that must be filled in when receiving a tax deduction (it is not available for donations).

- The last section contains information about all calculated amounts.

2021 Tax Return Form

Lawyer's answers to frequently asked questions

Is it possible to submit 3-NDFL through another person if it is not possible to do it yourself or via the Internet?

Yes. You need to draw up a power of attorney, it is provided along with the declaration. Information about it is indicated in the document itself.

Who files a declaration and pays tax when making a gift from a legal entity to an employee?

Employer. Gifts with a total value of up to 4,000 rubles. per year are not subject to tax.

Is there a tax deduction for gifts?

No, the donor does not receive income or pay taxes, and the recipient does not spend the money.

I was given a share in the apartment, the contract was certified by a notary. Will the Federal Tax Service find out about the transaction if I do not file a declaration?

Yes, he will. Information to the Federal Tax Service on all certified transactions with citizens' property is transmitted by notaries.

How to determine the market value of a car for tax purposes?

You need to indicate it in the deed of gift, based on the average prices for a car in the region, or order an independent assessment.

Legislation

If the procedure and requirements for drawing up a gift agreement are contained in the Civil Code, then the tax rules are regulated by Tax legislation.

According to it, a plot of land received as a gift is the income of a citizen.

That is why upon receipt of such property you must pay

tax to the budget and report on the received property.

The donor does not have to pay any taxes and file a declaration. So, if the land were transferred into the ownership of another person through a purchase and sale agreement, then it would be the donor who would be responsible for paying personal income tax. In the case of a deed of gift, he does not receive taxable income.

Attached documents

The payer must attach documents to the tax return that will confirm the validity of the payments.

These include:

- Initiator's passport. It is required as an identification document. A copy of it from the pages with biographical data and information about the place of registration is also suitable.

- Identification number of the person paying taxes. It can be obtained from the Federal Tax Service at your place of residence. The number is issued in the form of a certificate.

- Apartment donation agreement.

- Documents that relate to the transferred real estate - a certificate of ownership or an extract from the Unified State Register, as well as a technical passport for the apartment, indicating its location and total area.

What is it and how is it regulated?

Until 2006, the law “On the tax on property transferred by inheritance or gift” was in force.

They determined the amount of payments in such cases. The tax rate depended on the value of the property .

The minimum size was 10% of it, the maximum was 502 minimum wages and another 40% of the price.

Benefits were provided only for children and parents. They had to pay from 3% to 176.1 minimum wage and 15% of the cost.

This law is not currently applied. Taxation of gifts and inheritances is determined by the Tax Code .

Land plots are not subject to inheritance and gift taxes.

Examples of personal income tax calculation

Example 1:

The plot worth 167 thousand rubles was donated to the citizen of the Russian Federation by his uncle. In this case, he must pay personal income tax at the rate of 13%. This will amount to 21 thousand 710 rubles.

Example 2:

Another plot, the cadastral value of which is 231 thousand rubles, was donated to a non-relative. The income tax rate will also be 13%. That is, you will have to pay 30 thousand 30 rubles.

Example 3:

The plot was donated to a non-citizen of the Russian Federation who spent less than 183 days in Russia in the year it was received. The cadastral value of the plot is 270 thousand rubles. He must pay 30%, that is, 81 thousand rubles.

Our experts have prepared a lot of useful material on the topic of donating land, as well as donating land with a house. From individual publications you can learn:

- How much can registration cost?

- Documents for a deed of gift for a land plot and a house, including if the transaction is carried out between relatives.

- Is it possible to donate a plot of land without a house built on it?

- Registration of a transaction for the share of the storage unit.