A peasant farm is one of the organizational and legal forms that is registered by agricultural producers and processors. A peasant farm unites individuals related by relationship or property, but it can be created by one person. How to register a peasant farm and what features does this form of business have?

Peasant farm - what is it?

To understand what a peasant farm is, let us turn to the Federal Law of June 11, 2003 N 74-FZ (as amended on June 23, 2014) “On Peasant (Farm) Farming”:

- Article 1. The concept of a peasant (farm) economy - A peasant (farm) economy (hereinafter also referred to as a farm) is an association of citizens related by kinship and (or) property, having property in common ownership and jointly carrying out production and other economic activities (production , processing, storage, transportation and sale of agricultural products) based on their personal participation.

- Article 3. A farm carries out entrepreneurial activities without forming a legal entity. The entrepreneurial activities of a farm carried out without the formation of a legal entity are subject to the rules of civil legislation that regulate the activities of legal entities that are commercial organizations, unless otherwise follows from federal law, other regulatory legal acts of the Russian Federation or the essence of legal relations.

In other words, a collective farming enterprise is a duly registered association of citizens who:

I am ready to advise you free of charge by phone (24 hours a day, 7 days a week)

The call is free for all regions of the Russian Federation

- are related;

- have common property (land, buildings, poultry, livestock, equipment, machinery, inventory, etc.);

- take personal part in joint economic activities, the subject of which is agricultural products.

Peasant farms can be established by:

- Russian citizens;

- Foreigners;

- stateless persons.

All members of a collective farming enterprise must have legal capacity. The law imposes some restrictions on the composition of peasant farm members:

- spouses can only involve their parents, grandparents, as well as children, grandchildren, sisters and brothers who have reached the age of sixteen to participate in the business;

- the household cannot contain representatives of more than three families;

- as an exception, it is allowed to involve in participation in activities persons who are not related to the head of the peasant farm. There can be no more than five such citizens.

The composition is not constant. A citizen who meets the requirements of the law can be accepted as a member of a collective farming enterprise by mutual consent of its founders. To leave a peasant farm, it is enough to submit a written application to its head.

What can a peasant farm do?

The subject of activity is agricultural products. The farm has the right to produce, process, store, transport and sell it at its own discretion. Peasant farm enterprises can engage in:

- livestock farming;

- agriculture;

- field farming;

- forestry, etc.

Collective farming has the right to use motor transport. It can transport cargo necessary for business activities. The law does not prohibit transporting: feed; fertilizers; seeds; raw materials; manufactured products; fuels and lubricants; equipment and spare parts; other goods needed for the household.

General accounting points

One way or another, farm accounting revolves around inventory. Specialists monitor data on receipt and use of materials. Particular attention is paid to the costs of receiving products and determining costs. The specific nature of the activities of peasant farms requires taking into account the natural loss of raw materials or agricultural products when reflecting accounting data.

Primary data, as a rule, is reflected in accounting in quantitative terms. Determining the cost of manufactured products has a number of features. In this case, crop production, livestock farming, and raw material processing have their own nuances.

How to register a peasant farm

A collective farming enterprise is considered open from the date of state registration. Only after tax registration does it acquire legal personality and can carry out economic and other legal activities. The legal system allows the registration of a peasant farm in the form of a legal entity, but most often its head is registered as an individual entrepreneur.

To complete the registration steps, you will need to collect a package of documents. The head of a peasant farm can personally submit papers to the tax office at his place of registration. This will avoid the cost of notarizing signatures.

The list of documents required for registration includes:

- application form p21002;

- agreement on the creation of a collective farm;

- receipt (check) for payment of state duty;

- a copy of the passport of the head of the peasant farm and the original for verification;

- notification of the transition to the selected tax regime (if necessary).

Attention should be paid to drawing up the constituent agreement. It needs to spell out in detail all the main issues regarding the functioning of the future business entity. According to current legislation, this document must contain provisions defining:

- members and head of the peasant farm;

- management procedure and powers of the head;

- rights and obligations of members;

- the procedure for the formation of a property fund, as well as legal relations of property;

- rules for accepting new members and leaving the collective farm;

- the procedure for distributing income and products received in the process of activity.

The agreement must contain information about the date and place of conclusion. At the end of the document, all founders put their signatures.

Registration takes no more than three working days. After this period, you will be able to pick up the following documents:

- certificate of state registration;

- certificate of registration with the tax authority;

- extract from the state register.

You should definitely open a bank account. It will be needed for non-cash payments, including for making mandatory payments to budgets and extra-budgetary funds. Registration of peasant farms with the Pension Fund of Russia and the Social Insurance Fund occurs automatically. Relevant notifications are sent by mail to the address of the head of the household.

What is the price

The question about the cost of a peasant farm should be divided into two sub-questions: How much does it cost to register a peasant farm, and how much does it cost to open a peasant farm “from scratch”.

Let’s dwell on the question “how much does it cost to register”:

- state registration fee 800 rub.

- Certificate from a notary, form P21002 - 1500 rub.

- Notarized power of attorney from 2000 rub.

- Notarized copy of the applicant's passport within 1000 rubles.

Notary costs are required if the applicant will not submit the documents himself.

How to get subsidies for peasant farms

The state implements various programs to develop agricultural business. Measures aimed at supporting farmers are being taken at both the federal and regional levels. After opening a peasant farm, you can apply for assistance from the state.

In the regions, competitions are often held to distribute financial resources among farms. Those wishing to participate in them submit applications to the competition commissions in advance. The rules generally provide for the subsequent filing of reports on the expenditure of government assets.

In order to improve solvency in the agricultural sector, the state provides subsidies to repay obligations on investment loans. The selection of winners is also carried out on a competitive basis after consideration of submitted applications.

I am ready to advise you free of charge by phone (24 hours a day, 7 days a week)

The call is free for all regions of the Russian Federation

The implementation of projects to provide financial support to farmers is entrusted to relevant government agencies. Limit levels, types of assistance and rules for participation in programs change annually. You can keep up with the latest information on the websites of government agencies working with business in the field of agriculture.

Inventory on farms

Keeping records on farms is difficult due to the constant movement of assets, changes in value, and natural loss. To obtain reliable data on the condition of property and current assets, peasant farms regularly conduct inventories. The frequency and list of inspected objects and assets is determined by the peasant farm depending on the individual characteristics of the business.

Peasant farms monitor the status of:

- Property included in fixed or current assets.

- Composition, number of livestock taken into account in the main herd and young animals.

- Materials intended for sowing and ongoing use.

- Settlements with external counterparties.

- Other farm assets.

The inventory procedure is carried out by a commission approved by the head of the farm. The data identified during the event is recorded in the inventory list.

Where to get a plot of land for a peasant farm

The most suitable options:

- buy a plot of land from a private person;

- rent private land;

- lease a plot of land that is municipally owned.

The last option is most suitable for newly opened peasant farms. Renting municipal land is sometimes much more profitable than private land. And it’s not even that it’s expensive, it’s just that it’s very difficult to find a suitable plot of land for sale. Local governments have the right to allocate plots of agricultural land to collective farms. Such territory can only be used for its intended purpose (for crops, pastures, etc.). Land for settlements is allocated for the construction of buildings and structures.

The practice of leasing land plots for farming varies by region. All land plots for farming, regardless of which category of land they belong to - agricultural or to the redistribution fund, are provided by the local administration. To obtain a plot of land and organize a farm on it, you need to contact the local administration with an application. After reviewing the application, information about the location of the land provided will be provided. (At the same time, in the application you can also indicate the specific formed area).

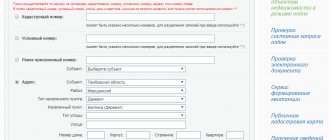

If it is not formed, then it will be necessary to carry out land surveying, topographic survey, draw up a plan and accurately measure the site. Register the land plot with cadastral registration and obtain a cadastral passport. Then receive a copy of the cadastral plan and an extract from the cadastral passport. All documents should be submitted to the administration for a resolution on the transfer of the site (Article 77 of the Land Code of the Russian Federation).

You will need:

- passport;

- application to the administration;

- cadastral passport;

- an extract from the cadastral passport and a copy of the cadastral plan;

- administration resolution;

- payment receipt for the plot;

- registration payment receipt;

- registration of property or lease.

A peasant farm can obtain a land plot for rent without bidding in cases established by a special law on the turnover of agricultural land (subclause 12, clause 2, article 39.6 of the Land Code of the Russian Federation). A land plot from among municipal lands can be provided to a peasant farm in a non-competitive manner if it is already used by the peasant farm and subject to certain terms of circulation (Clause 5.1, Article 10 of the Federal Law of July 24, 2002 No. 101-FZ “On the turnover of agricultural land "). In all other cases, the peasant farm must participate in tenders on general terms.

The procedure is as follows:

- You can try to start right away with an application for the allocation of land on behalf of the head of the peasant farm, without preparing and approving the layout of the land plot. The application indicates: the goal is to conduct or expand farming activities; estimated rental period; business plan with reasonable calculations; address and area of the requested site.

- The application is accompanied by a document on state registration of the peasant farm.

- Next, the village council must provide the applicant with a diagram of the site on the cadastral plan. But if they suddenly refuse you, don’t be lazy to prepare a layout diagram for the storage unit yourself - it’s faster and cheaper than dealing with the municipality.

- The applicant ensures the implementation of land surveying and cadastral works. The executive body, within 14 days after receiving the cadastral passport, makes a decision on granting a lease for the land. Documents are drawn up within 7 days from the date of the decision.

What taxes will you have to pay for peasant farms?

Various tax regimes provided for by law are available to peasant farms. The most popular are:

- general tax system;

- single agricultural tax (USAT);

- simplified taxation system (STS).

If the tax office does not receive a notification about the transition to one of the special tax regimes within a month after registration of the peasant farm, then the general procedure applies. The tax system can be changed once a year. The selected regime will be applied from the beginning of the next calendar year.

A collective farming enterprise that uses a common taxation system separately pays all established taxes and fees and submits appropriate reports. The use of the Unified Agricultural Tax and the simplified tax system provides for exemption from payment of:

- corporate income tax or personal income tax;

- property tax;

- VAT.

Other taxes, fees and insurance premiums are paid on a general basis. The Unified Agricultural Tax regime was developed specifically for peasant farms. It provides significant relaxations and benefits for agricultural producers, so it is reasonable for a farmer to choose this particular tax system.

Peasant farm insurance premiums and reporting frequency

Amounts of accrued wages to farm personnel are subject to insurance contributions transferred to the funds. The rate of each type of contribution is determined depending on the chosen taxation system. Contributions and reporting on them came under the administration of the Federal Tax Service. In the Social Insurance Fund, control is carried out only on deductions for injuries and occupational diseases, for which an abbreviated report must be submitted.

| Reporting | Where to introduce yourself |

| Final calculation in the Social Insurance Fund for 2021 | FSS |

| Calculation in the Social Insurance Fund from 2021 | Social Insurance Fund regarding contributions for injuries |

| Final calculation of RSV-1 for 2021 | Pension Fund |

| Form SZV-M starting in 2017 | Pension Fund monthly |

Starting from 2021, reporting on contributions to the funds will be submitted to the Federal Tax Service. The reporting form will be submitted quarterly and will combine data on contributions to all funds.

conclusions

- I believe that collective farming is a very convenient form of organizing a small business for people who are accustomed to working on the land and living from their labor.

- After registering a peasant farm, you can count on financial assistance from the state. Preferential loans are available for the purchase of equipment, equipment, agricultural raw materials, etc.

- There is a special tax regime with a low rate and no paperwork.

What can be built on a plot for a peasant farm?

How to register a private subsidiary plot and start earning money from scratch