Category and type of permitted use of land in settlements

The types of permitted use of land in settlements are stipulated by the Town Planning Code of the Russian Federation. In accordance with the norms of the current legislation, urban planning regulations are established. With their help, the development of a particular settlement is regulated.

The following areas are classified as agricultural lands:

- Intended for agricultural use (growing plants, raising livestock).

- Intended for agricultural production.

The above categories are fundamentally different from each other.

The Land Code states that agricultural lands include areas located outside the boundaries of a populated area.

IF THE SITE IS NOT USED FOR ITS PURPOSE, THE RATE WILL INCREASE.

In accordance with Art. 389 of the Tax Code of the Russian Federation, land plots, in particular for agricultural purposes, are subject to land tax. But different tax rates are established for plots of different categories (Article 394 of the Tax Code of the Russian Federation).

In general, a rate of 1.5% is applied, but for some categories of land plots it is equal to 0.3%, including for land plots classified as agricultural lands or lands within agricultural use zones in populated areas and used for agricultural production[1]>.

According to Art. 77 of the Land Code of the Russian Federation, agricultural lands are considered to be lands located outside the boundaries of a populated area and provided for agricultural needs, as well as those intended for these purposes.

Agricultural lands include agricultural lands, lands occupied by on-farm roads, communications, forest plantations intended to protect lands from negative impacts, water bodies (including ponds formed by water-retaining structures on watercourses and used for the purpose of pond aquaculture) , as well as buildings and structures used for the production, storage and primary processing of agricultural products.

Owners of land plots and persons who are not owners of land plots are obliged to use land plots in accordance with their intended purpose in ways that should not harm the environment, in particular the land as a natural object (Article 42 of the Land Code of the Russian Federation).

From paragraph 3 of Art. 6 of the Federal Law of July 24, 2002 No. 101-FZ “On the turnover of agricultural land” it follows that the fact of non-use of a land plot for farming or other activities related to agricultural production is established by the state land supervision body.

Before a decision on the forced seizure of such a land plot from its owner is made in court at the request of the said body, at least three years are given, during which this owner can still begin to use the plot for its intended purpose.

For your information:

Signs of non-use of land plots for agricultural production or other activities related to agricultural production are given in the List approved by Decree of the Government of the Russian Federation of April 23, 2012 No. 369 (one of them is sufficient to recognize non-use):

- no work on cultivating crops or cultivating the soil is carried out on the arable land;

- There is no haymaking on the hayfields;

- on cultivated hayfields, the content of weeds in the structure of the grass stand exceeds 30% of the area of the land plot;

- there is no grazing of livestock on pastures;

- In perennial plantings, no maintenance or harvesting work is carried out on perennial plantings and no uprooting of decommissioned perennial plantings is carried out.

- forest and (or) bush cover on arable land exceeds 15% of the land area;

- forest cover and (or) bush cover on other types of agricultural land is over 30%;

- Tussocks and (or) waterlogging account for over 20% of the land area.

The Letter of the Ministry of Finance of Russia dated July 16, 2014 No. 03-05-04-02/34879 [2]> states that if a land plot is recognized by the authorized body as unused for agricultural production, taxation in respect of this entire plot should be carried out at the tax rate established representative body of the municipality in relation to other lands and not exceeding 1.5%, starting from the tax period in which the decision on the identified violation was made, until the beginning of the tax period in which the violation was eliminated (see also Letter of the Ministry of Finance of Russia dated 06/03/2015 No. 03‑05‑04‑02/32131).

According to paragraph 1 of Art. 393 of the Tax Code of the Russian Federation, the tax period for land tax is a calendar year.

Example.

In August 2021, the fact was revealed that the owner of the land plot was not using it for agricultural purposes in accordance with this purpose. In September 2021, it was recognized that this violation had been eliminated.

According to the clarification of the Ministry of Finance, for all reporting periods in 2021, including for the first, second and third quarters, the owner must pay land tax at a rate of 1.5% as for other lands.

For all reporting periods in 2021, land tax is paid at a rate of 0.3% as for agricultural land.

For the reporting periods that passed before either decision was made, updated declarations should be submitted.

Features of such lands

The lands of settlements mean the territory intended exclusively for expanding the area of cities and urban-type settlements. Such areas are divided into several zones:

- Residential.

- Recreational.

- Infrastructure.

- Social and business.

- Production.

- Agricultural.

The division of land in settlements is carried out into 35 zones. Only the most common ones are listed above. Less common are golf courses and horseback riding, as well as areas for natural and educational tourism. Each type of plot has its own special purpose code, which can be found in Order of the Ministry of Economic Development of the Russian Federation No. 709 and Article 85 of the Land Code of the Russian Federation.

Agricultural lands include a complex of the following zones:

- Haymaking.

- Areas with plantings.

- Pastures.

- Arable lands.

- Facilities for various types of farming.

Agricultural lands are used for appropriate purposes until the general design of the settlement is changed, according to which the type of land changes depending on the needs of the settlement. The act of changing the type of site is approved by local authorities.

When the purpose of land changes, buildings and residential buildings can be erected in its place. A change in type is a necessity for the priority development and growth of a settlement.

Local authorities have the right to manage agricultural plots that are located within the boundaries of the settlement. The ability to dispose is limited within the competence of the governing body. The right of management also applies to differentiated lands.

If the land is located within the settlement, this does not prevent the site from being used for agricultural purposes. The territory is under the control of several persons, which is why there is a mixed order of legal regulation.

Categories

Groups and classes of agricultural land are very diverse , and it’s worth saying right away that there are two categories of such land that differ significantly from each other:

- Land for agricultural use.

- Agricultural production land.

But based on the Land Code of the Russian Federation, these types belong to one category of land - agricultural.

The first subcategory may include lands of other categories, for example:

- forest fund;

- industry;

- settlements.

This is documented by the following definition: “Category of land – settlements, permitted use – for peasant farming.” Such permitted use is temporary - the land is transferred to legal entities or citizens for certain purposes, for example, the organization of agricultural enterprises.

This includes:

- administrative buildings;

- warehouses;

- roads;

- various infrastructure facilities.

In general, everything that can ensure a high-quality production process of agricultural products for the population.

If we rely on Article 77 of the Land Code of the Russian Federation, then it says that agricultural lands are considered to be areas that are located outside the populated area .

But there are cases when such lands are located within the boundaries of populated areas. Moreover, they have a special name - for agricultural use.

Lands of this category, located within the boundaries of settlements, have the following legal status: “land for dacha construction” or “for individual housing development”, since these lands fall under articles part 10 and part 3 of the Civil Code of the Russian Federation.

At the moment, the following categories of land can be changed by including plots within the boundaries of a settlement or by joining them to a dacha non-profit partnership, or a gardening non-profit partnership, if there is a fact of their contact:

- agricultural production;

- Peasant farm (peasant farm);

- Private household plot (personal subsidiary plot).

What you are allowed to do

What agricultural activities are allowed?

Legislative acts establish that agricultural areas can be used for the following purposes:

- Production of raw materials and agricultural products.

- Personal farming.

- Gardening device.

- Fish farming.

- Creation of a farm.

Legislative acts do not regulate issues regarding the construction of any buildings on agricultural land. But to run a full-fledged economy, some facilities will be necessary. Therefore, the following may be found in the area:

- Cowsheds.

- Chicken coops.

- Roads.

- Garages.

- Warehouses.

- Sheds.

Construction of a residential building is a complex but possible process. In order for a house or cottage to be built absolutely legally, certain conditions will need to be met.

Is it permissible to build houses or other buildings?

Legislation allows the construction of only the following buildings on agricultural land:

- Warehouses or cellars for storing crops or preparations.

- A house for personal use or for housekeeping.

- Country summer house.

- Outbuildings.

- Single-family cottage with less than three floors.

Construction is allowed only on territories that are the property of an individual. Only after receiving ownership of the land can you proceed to the procedure for obtaining a special construction permit, which will be based on a pre-developed building design. Only with such permission can the building be registered after completion of construction work.

Stock

What not to do

According to current legislation, it is strictly prohibited to conduct any commercial activities on agricultural lands.

For example, if you build a residential building on the site and equip it into a hostel, you will have to pay a large fine.

If the land belongs to the agricultural category, then it is subject to several restrictions, violation of which will lead to liability. The amount of the fine will be determined in accordance with the Code of Administrative Offenses:

- physical person - 0.5–1%, but the amount cannot exceed 10,000 rubles;

- official - 1–1.5%, but the amount cannot exceed 20,000 rubles;

- legal entity - 1.5–2%, but the amount cannot exceed 100,000 rubles.

There is also a maximum penalty amount. This applies to cases where inappropriate use of a site harms the environment.

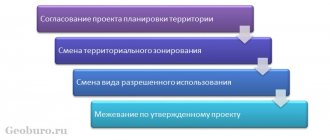

Changing land category

Changing the type of permitted use of agricultural land is possible if the owner of the site wants to build a residential building. It is worth noting that the applicant can only be the owner.

There are two ways to transfer agricultural land to individual housing construction:

- In accordance with land legislation, transfer the territory to the boundaries of the settlement. In this case, it must be taken into account that the owner will need to reimburse a certain amount of money, namely, the difference between the cost of agricultural land and individual housing construction.

- Expanding the boundaries of the site. In this case, transferring the land to individual housing construction is not necessary. According to current legislation, the owner can build a private house within the boundaries of the settlement.

To change the category of a site, you will need to adhere to the following algorithm of actions:

- Contact your local government office in person.

- Apply.

- Attach a passport to the paper, as well as other necessary documents confirming ownership of the plot.

It may take about two months to review the submitted documentation. If the owner receives the go-ahead, he will be issued a corresponding resolution. If the refusal was received unreasonably, then you can go to court with a statement of claim.

To obtain the status of a residential building on the territory for summer cottage construction, it is necessary to have an appropriate resolution. To do this, simply contact your local authority with the required documentation.

If the plot is intended for gardening, then it is impossible to obtain individual housing construction. Therefore, if you are going to buy land, you must take into account the type of permitted use.

The Supreme Court summarized the practice of providing land to peasant farms and agricultural organizations

On December 23, 2021, the Presidium of the Supreme Court approved a Review of judicial practice in cases related to the provision of land plots to agricultural organizations and peasant (farmer) farms for agricultural production, which includes 12 clarifications.

Lawyer of the Central Branch of the city of Chita of the Chamber of Lawyers of the Trans-Baikal Territory Vitaly Volozhanin noted that clarification of issues of judicial practice based on its study and generalization are of great practical importance, especially in the area related to land legal relations. “First of all, this is due to the dynamics of improving the basic laws governing relations on the provision of land plots. The review of the Supreme Court under consideration is a significant document in law enforcement practice, as it allows courts to ensure uniform application of practice in cases related to the provision of land plots to agricultural producers,” he believes.

In his opinion, such an analysis and generalization of law enforcement practice will allow subjects of agricultural production, when resolving issues related to the conclusion of a land lease agreement for their production activities, to avoid unfounded claims to declare it invalid and to apply the consequences of the invalidity of the transaction.

Contents of the document

In the preamble, in particular, it is noted that the current land legislation establishes the general rule on the provision of state or municipal land for ownership or lease at auction. At the same time, the provisions of the law are mentioned, according to which it is possible to conclude agreements on the provision of land for agricultural production for ownership or lease without holding a tender.

As follows from clause 1 of the Review, the provision of land for agricultural production on the basis of clause 8 of Art. 10 of the Law on the circulation of agricultural land without tendering is permissible only in the absence of applications for the provision of this plot from other peasant farms or agricultural organizations. In order to identify such persons, the authorized body publishes a notice of the provision of a land plot in the manner prescribed by Art. 39.18 Land Code of the Russian Federation.

In paragraph 2 of the document it is noted that the tenant of a land plot intended for agricultural production has the right to conclude a lease agreement for a new term without holding a tender. In this case, the publication of a notice of provision of a land plot, provided for in Art. 39.18 of the Land Code of the Russian Federation, not required.

Vitaly Volozhanin noted that the current land legislation establishes the general rule on the provision of a land plot in state or municipal ownership for ownership or lease at auction. “At the same time, there are cases when agreements on the provision of land for agricultural production for ownership or lease are concluded without holding a tender. And here the most interesting is the clarification of cases when agreements on the provision of land for agricultural production for ownership or lease are concluded without holding a tender, which, of course, simplifies the procedure for obtaining land by agricultural producers,” he believes.

According to clause 3, if the tenant continues to use the land plot provided in the prescribed manner without bidding for agricultural production before March 1, 2015, after the expiration of the contract, in the absence of objections from the lessor, the contract is considered renewed on the same terms for an indefinite period. In this case, the tenant has the right to apply for a new lease agreement.

“The possibility of a tenant concluding the right to lease a land plot intended for agricultural production for a new period also has great practical value,” noted Vitaly Volozhanin.

Clause 4 explains the procedure for resolving the issue of sale without tendering in the case specified in sub-clause. 9 paragraph 2 art. 39.3 of the Land Code of the Russian Federation, land plots that are in state or municipal ownership and intended for agricultural production, to persons renting these plots for more than three years. To calculate the three-year lease term, not only the last valid lease agreement can be taken into account, but also previous, successively concluded lease agreements for a land plot with one tenant.

In paragraph 5 of the Review, it is noted that the three-year lease period of a land plot provided for agricultural production, established by the above norm, in the event of the sale of the plot to its tenant without bidding, is calculated from the moment the lease agreement is concluded, provided that the authorized body does not have information about identified and not eliminated during this period, violations of the legislation of the Russian Federation when using a plot of land.

Based on clause 6 of the document, the area of a land plot of agricultural land that can be purchased by the tenant in accordance with clause 9 paragraph 2 art. 39.3 of the Land Code of the Russian Federation, is determined taking into account the legislative requirements for the formation of land plots and is not limited to the area required for the use of real estate legally located on such a plot.

Clause 7 explains that a tenant who has re-registered the right to permanent (perpetual) use of an agricultural land plot has the right to acquire ownership of it, regardless of the period of use of the plot under a lease agreement on the terms provided for in clause 3.2 of Art. 3 of the Law on the entry into force of the Land Code of the Russian Federation.

The next paragraph notes that a land plot intended for agricultural production as part of the lands of settlements cannot be purchased on the basis of sub-clause. 9 paragraph 2 art. 39.3 of the Land Code of the Russian Federation after changing its type of permitted use in accordance with the rules of land use and development.

Legal director Alexey Silivanov noted that many land owners perceive the inclusion of their plots in the land of settlements and their classification as business development as a benefit, because this expands the possibilities for commercial use of real estate and increases its value. “The Land Code of the Russian Federation establishes that tenants can purchase plots for agricultural production without holding a tender after three years from the date of conclusion of the lease agreement. The review of the practice of the Supreme Court examined a situation in which a tenant tried to buy an agricultural plot without bidding as part of the lands of settlements after it had been classified as a public and business development zone. The court recognized that as a result of this, agricultural production on the site is impossible, and this excludes the possibility of granting ownership of the site without holding a tender in accordance with subsection. 9 paragraph 2 art. 39.3 of the Land Code of the Russian Federation,” he explained.

As follows from clause 9, the existence of conditions for the provision of a municipal land plot, formed on account of unclaimed land shares, to an agricultural organization or peasant farm for ownership or lease without holding a tender on the basis of clause 5.1 of Art. 10 of the Law on the Turnover of Agricultural Land may be confirmed by any relevant, admissible and reliable evidence

In paragraph 10 it is noted that only a plot of land formed on account of unclaimed land shares, the ownership of which is recognized by the municipality, and not the land shares themselves (land share) can be put up for auction.

According to clause 11 of the document, the allocation of a land plot on account of unclaimed land shares and the registration of municipal property rights to it do not terminate the lease agreement for an agricultural plot, concluded by the participants in shared ownership before the recognition of ownership of the unclaimed shares by the municipality.

The last paragraph of the Review notes that a plot of land for agricultural production is provided to a Cossack society for rent without bidding within the territories established by the law of a constituent entity of the Russian Federation, solely for the purpose of preserving and developing the traditional way of life and management, taking into account the need of such a society for a plot of land.