Basic rules for deposit

If a receipt is simply drawn up, in the event of a problematic situation the court recognizes the transfer of funds in advance, the document loses its properties. The advance is a security measure for two parties - the buyer confirms his intentions to buy, the seller confirms his intentions to sell. The deposit performs the same functions, but also confirms the completed transaction. The money is paid according to the preliminary purchase and sale agreement, but not the whole amount is paid, but a part of it.

The situation is acceptable if the buyer does not have the entire amount at the time of the transaction, he undertakes to pay it within a certain time. Therefore, in addition to the receipt, a deposit agreement and a preliminary purchase and sale agreement are drawn up. In case of refusal of the transaction with a receipt, the seller pays the money to the buyer in double amount. If the court recognizes the fact of transfer of funds in advance, the seller gives only the amount he received.

The content of the document on receipt of the deposit is arbitrary, but the following information must be indicated:

- surname, first name and patronymic of the parties in full;

- passport details, including place and date of birth;

- residential address, registration;

- designation of the fact of transfer of funds as a “deposit”;

- indicating the amount in numbers, words;

- reference to the agreement to which the receipt is attached.

The document is written by the seller in his own hand, signed and numbered. Drawed up in two copies. A printed version is also allowed; it must be drawn up in the presence of a notary and certified by a specialist. If the receipt is written in person, it is recommended that there be disinterested witnesses who also sign the document. The text must be clear, with a detailed description of the place and time of transfer of funds.

Where can a receipt be used?

The main purpose of the document in question is to confirm the creditor’s right to receive money from the debtor. The receipt becomes decisive evidence of the provision of the loan and the occurrence of monetary obligations of the borrower.

Having a document allows the creditor to go to court. To do this, a statement of claim is drawn up, to which is attached a receipt, a receipt for payment of the state duty, and other documentation confirming the position of the plaintiff. Judicial practice clearly shows: with the correct execution of documents, especially receipts, the likelihood of a positive court decision is extremely high.

Types of deposit receipts

The Civil Code of the Russian Federation provides for the preparation of a receipt if the amount of funds exceeds 10,000 rubles, otherwise the document is declared invalid and has no legal force.

The legislation does not have precise definitions of the types of receipts, but in fact they exist:

- Subject. The purpose of the transfer of money and the subject of purchase and sale are indicated.

- Pointless. There is no clear wording, money is borrowed.

The person receiving the funds writes a receipt stating that the money has been received, the transferring party writes a receipt indicating that they have transferred the funds. Both documents are certified by the signatures of both parties.

In addition, receipts are divided according to the subject of the purchase and sale agreement: car, apartment, land, garage, other major acquisition.

Why do you need a receipt?

A receipt is a document that confirms that money was transferred from one individual or legal entity to another person as a loan or for other reasons.

The receipt contains information about how much money was given, under what conditions, and in what period it should be returned to the lender.

In cases where disagreements arise between the creditor and the debtor and one of them decides to go to court, it is the receipt that becomes the official document that proves the fact of the transfer of money, and also shows the conditions for their use and the time frame within which they should have been received given back.

A receipt is not one of the mandatory documents that must accompany the transfer of cash (by the way, in relations between citizens there are no such documents at all), but it is recommended.

Receipt for deposit for apartment

It is issued in the event that the entire amount of funds specified in the purchase and sale agreement is not enough. The receipt is written in any form indicating all important information.

Approximate sample

RECEIPT

about receiving a deposit

St. Petersburg "__"_______2019

I, Dmitriev Maxim Petrovich, born December 14, 1967, passport series 1111 number 111111, issued on January 1, 2000 _______________ (specify by whom, unit code), registered and residing at the address: St. Petersburg, _______ , d._____, apt._________, received from Pavel Viktorovich Kondratyev, born 09/11/1965, passport series 2222 number 222222 issued 02/02/2002. (specify by whom, division code), registered and residing at the address: St. Petersburg, st.__________, no._____, apt._____ 70,000 rubles (seventy thousand rubles) as a deposit for an apartment located at the address: Moscow, ________ st., no.____, apt._____, total area 89 sq. m., worth 3,000,000 rubles (three million rubles), according to the purchase and sale agreement dated 01/01/2019.

Signature__________ Date___________

When making a deposit, a preliminary purchase and sale agreement must be drawn up, which indicates the method of payment: the first part in the form of a deposit, the second - the remaining amount.

Basic Rules:

- If there are several owners, the funds transferred in the form of a deposit are divided equally, and everyone writes a receipt.

- The document must strictly indicate the amount, date, time, and place of transfer of money. There should be no crossing outs or corrections.

- If the seller is a minor, parents or official guardians write a receipt for him, but the presence of the child when transferring money is required.

- It is recommended to give a deposit and draw up the document in the presence of disinterested witnesses, who also sign the receipt.

Lawyers do not recommend making a deposit of more than 30% of the cost of the apartment. You should also be wary of a transaction if the seller quickly agrees to receive a symbolic amount. Issuing a receipt from a notary will help avoid fraudulent actions on the part of the seller, but is not a 100% guarantee. It is necessary to carefully check the documents before transferring funds.

How to write a receipt correctly

“Write a receipt”, “only against signature”, “give a receipt, and no problems” - how often do we hear these words. But we don’t always realize that it’s not enough just to give or receive a receipt. It still needs to be compiled correctly.

A few words about the receipt, its originator and recipient

The term “receipt” is familiar to many people. However, the legislation does not contain its official definition. The dictionary interprets the concept of “receipt” in the following meanings:

- a document with a signature certifying the receipt of something, confirming that the person who issued it received something as a loan;

— a safe receipt indicating that some value has been accepted for storage, etc.;

- a written act by which the creditor confirms the fulfillment of the obligation assumed by the debtor.

Usually a receipt is given to confirm:

- receiving something, for example, a deposit, borrowed money, alimony for a certain period, property for use.

Note! By giving or borrowing money, you are entering into a loan agreement. If its amount is 10 BV or more, the loan agreement must be drawn up in writing. In this case, the receipt is a confirmation of the loan agreement and its terms <*>.

Reference information The size of the BV is 27 bel. rub. <*>. Accordingly, the tenfold size of the BV will be 270 bel. rub. (27 x 10);

- acceptance of any thing for storage;

— fulfillment of an obligation assumed by another person.

As a rule, the receipt is written by the one who takes money, property, or confirms the fulfillment of an obligation assumed by someone. This person is the originator of the receipt.

The originator transfers the receipt to the person who gives him money, transfers property, etc., that is, to the recipient of the receipt.

The recipient of the receipt accepts it and keeps it for safekeeping until the originator of the receipt fulfills the accepted obligation (for example, repayment of a debt).

Example Situation 1. A neighbor borrowed your laptop. To protect yourself from unnecessary worries, you asked him to write a receipt and indicate in it that he undertakes to return the laptop to you in two weeks. He did this and then gave the receipt to you for safekeeping. In this situation, the neighbor is the originator of the receipt, and you are its recipient. Situation 2. A friend asked you to take a TV and refrigerator for storage while his apartment is being renovated. You did him a favor and agreed. True, an acquaintance, just in case, asked you to write a receipt about what things and in what condition you accepted from him. In this case, you are the originator of the receipt, and your friend is its recipient.

Contents of the receipt

The receipt is usually drawn up in any form. It is recommended to include the following information:

- document's name;

Example “Receipt for receipt of deposit”, “Receipt for acceptance of valuables for safekeeping”

— date and place of drawing up the receipt;

Example “February 11, 2021, Grodno”

— Full name, date of birth, passport details, place of registration and place of actual residence of the originator of the receipt, its recipient, as well as witnesses (if any).

Note! The passport must be valid at the time of writing the receipt;

- the fact of accepting money or other things. So, if the maker of the receipt borrows money, receives a deposit, etc., a certain amount of money (in numbers and in words) and the type of currency should be indicated. For example, 100 (one hundred) US dollars.

Note : It is advisable that the receipt read “received an amount in the amount of...”, “borrowed an amount in the amount of... the money was received by me in full.” Otherwise, it will be almost impossible to prove that the money was transferred to the originator of the receipt. Especially if he states that the recipient of the receipt promised to give them to him on another day, but did not keep his word.

If the originator of the receipt accepts the storage or temporary use of any property, this fact should also be recorded. In this case, it is desirable that the receipt describes the item being accepted, i.e. its brand, model, color, dimensions, presence or absence of defects are indicated;

Example Situation 1. A recent acquaintance borrowed an expensive camera from you while traveling abroad. You asked him to write a receipt about this. However, the receipt did not indicate the model of the camera or its condition. Upon returning from a trip, an acquaintance returned your camera with a broken lens, saying: “You gave me this.” It will be difficult to prove that you gave him the item in good condition and he ruined it. Situation 2. You are planning a long trip and need a laptop for work. However, yours is under repair. You borrowed a laptop from a colleague, made a receipt for it, but did not indicate that there was a large crack on the lid of the laptop. When you return it, your colleague may accuse you of damaging his property and demand that you repair the laptop at your expense or even buy a new one because you broke this one.

- the obligation of the maker of the receipt to return a certain amount of money, a specific thing, if something was transferred to him on credit, for use, or for storage. If a receipt confirms the fulfillment of an obligation assumed by another person, it is advisable to indicate in it the extent to which the obligation was fulfilled and its result (if possible);

- deadline for return of money and property;

- the amount of interest for the use of money and the period for their payment, if they are provided (when transferring money as a loan);

- place to return money and items. Especially if the originator of the receipt lives in another locality;

- the signature of the originator of the receipt and its transcript, as well as the signatures of witnesses (if any).

An example of the wording of a receipt for debt repayment: “Receipt February 11, 2021, Minsk, Petrov Petrovich, born May 18, 1986, passport: series MR 1000001, issued May 29, 2016 by the Leninsky District Department of Internal Affairs of Minsk, registered and residing at the address: Minsk, st. Sinaya, 6, apt. 12, borrowed from Nikolay Nikolaevich Nikolaev, born on August 22, 1950, passport: series MR 1000002, issued on August 24, 1995 by the Oktyabrsky District Department of Internal Affairs of Minsk, living at the address: Minsk, st. Sokola, 12, apt. 97, the amount of money in the amount of 210 (two hundred ten) Belarusian rubles. I received the money in full. I undertake to return the specified amount in full no later than May 1, 2021. Signature /P.P.Petrov/"

Recommendations for drawing up a receipt

The legislation does not contain requirements for drawing up a receipt. However, the recipient of the receipt to adhere to the following recommendations:

- Be sure to make sure that the receipt is signed by its originator.

Note: It is advisable to compare the originator’s signature on the receipt with the signature indicated in his passport;

— it is desirable that the receipt be written by the originator in his own hand. Then it will be difficult for him to challenge the fact that he wrote a receipt.

Example from judicial practice The defendant at the court hearing challenged the fact that funds were transferred to her and that she wrote a receipt. The court ordered a handwriting examination, according to the conclusion of which the handwritten text of the receipt and the signature on it on behalf of the plaintiff were made by the plaintiff herself. District Court decision dated August 17, 2015

Note : A receipt prepared in printed form (for example, typed on a computer and printed), with only the handwritten signature of the originator, will also be valid. However, if he subsequently decides to challenge the authenticity of the signature on it, conducting a handwriting examination based on the signature alone will cause difficulties;

— check that the text of the receipt is written clearly and legibly, preferably with a ballpoint or ink pen. If the text contains strikethroughs, blots, corrections with the note “believe the corrected” and a signature, ask the receipt to be rewritten.

Note: Store the receipt in a place that not only ensures its safety, but also protects the paper and ink from fading;

— when transferring money or any valuable thing, it is advisable to invite witnesses. Ask them to write at the bottom of the receipt that they indicate the transfer of a certain amount or thing, after which they put their signatures, and also indicate their full name, address, passport details and date.

Note! If the amount of the loan agreement is equal to or exceeds 10 BV, and you have not drawn up the agreement, you can only confirm the existence of the debt with a receipt, but not with testimony <*>;

— make sure that the passport details of both the receipt maker and yours are indicated and that they do not contain errors. After all, the opposite can lead to unpleasant consequences. For example, if an error is made in your passport data or they are not indicated at all, the person who prepared the receipt may claim that he did not take anything from you, that the money was given to him by a completely different person (your full namesake and namesake), and now he has given everything to him returned. The same applies to the originator’s passport data. In such a situation, he can declare that he personally did not take anything from you or anyone else;

— when lending money, be sure to check that the type of currency is indicated.

Example Indicating only the words “in dollars” in a receipt may lead to a dispute that the amount was transferred not in US dollars, but, for example, in dollars of Canada, Australia, New Zealand, Singapore, etc.

Note! You can lend or deposit an amount in foreign currency only if you and the other party are citizens of the Republic of Belarus, foreign citizens and stateless persons who have a residence permit in the Republic of Belarus, that is, residents <*>.

If you are writer , we recommend that you consider the following key points:

— you do not have to draw up a receipt in the presence of its recipient. The main thing is that he familiarize himself with its contents and take it for safekeeping;

- write the receipt clearly, using wording that does not allow for discrepancies, so that the text of the receipt cannot be interpreted differently;

— place your signature immediately below the text of the receipt so that there is no space left where you can enter some information. If there are still empty spaces on the receipt, add dashes.

Note: When returning a receipt by its recipient, we recommend asking him to indicate on the receipt that the obligation stated in it has been fulfilled by you, and to put the date and signature.

Receipt for deposit for car

You can confirm the fact of transfer of funds in the store with a cash receipt, power of attorney, invoice, and other documents. When purchasing a used car, the supporting document is a properly executed receipt. A receipt is written when receiving money if:

- the amount is paid partially in the form of a deposit;

- the transport was purchased by proxy, the documents were not reissued, the seller is a third party;

- the car has not been deregistered;

- the buyer asks to pay an amount in excess of that specified in the contract.

The fact of receipt and transfer of money is documented in any form indicating important information.

Approximate sample

RECEIPT

in receiving money to pay for a car

I, Petrov Ivan Sidorovich, passport (number, series, date of issue, name of the authority that issued the document, date of birth), residing at the address (actual address, registration), inn 1111111111,

received from

Sergeev Sergey Sergeevich, passport (number, series, date of issue, name of the authority that issued the document, date of birth), residing at the address (actual address, registration), inn 1111111111,

money in the amount of 370,000 (three hundred seventy thousand) rubles as payment for a car (identification number, make, model, type, color), registration certificate (series, number, issued by, date),

under the car purchase and sale agreement concluded by the parties on September 02, 2021.

I undertake to perform all actions necessary to transfer ownership of the car to the buyer within the period specified by me in the power of attorney issued in the name of the buyer.

Payment has been made in full.

Date of receipt of money and receipt: ___________ Signature:___________

Advantages and disadvantages for both sides

Having paper is beneficial for both parties to the transaction.

For the buyer, it is a guarantee of concluding a secure transaction with the seller, and for the selling party, it is a guarantee of receiving money. Having a receipt in hand, the parties will protect themselves from possible claims against each other . The disadvantage is that it has a limited validity period (3 years).

In case of possible violations, you can go to court within the specified period. After the expiration of the limitation period, the receipt is considered invalid.

Receipt for deposit for land plot

The document is issued for the following reasons:

- confirmation of expenses for the purchase of real estate with the intention of receiving a tax deduction;

- confirmation of receipt of funds;

- personal concerns;

- old age, serious illness of the seller of the land plot.

The requirements for filling out a receipt for the deposit are standard, but you will have to write a little more. The document must indicate:

- Name;

- date, place of filling;

- passport data of the buyer, seller;

- amount paid in figures and words;

- address;

- cadastral number of the plot, area;

- list of buildings included in the documentation;

- link to the purchase and sale agreement;

- seller's signature.

It is recommended to fill out the document in the presence of witnesses who are disinterested persons. Signatures are provided by all those present.

Approximate sample

RECEIPT

Ryazan 02/03/2018

I, Borisenko Andrey Stepanovich, born 10/12/1956, place of birth: Ryazan, passport series 1111 number 111111, issued by the Federal Migration Service of Ryazan on 04/01/2008, registered at the address: s. Orlovskoye, Petrovsky district, Ryazan region, no. 2, received from Tatyana Ivanovna Karpenko, born on June 17, 1983, place of birth: Ryazan, passport series 1111 number 111111, issued by the Federal Migration Service of Ryazan on November 12, 2011, registered at the address: Ryazan, st. Shakhova, 2, apt. the amount of 1,000,000 (One million) rubles for the land plot I sold, located at the address: s. Orlovskoye, Petrovsky district, Ryazan region, plot 2, area 11 acres, cadastral number 20:20:100200:20-10; one-story log residential house with an area of 50 sq. m, cadastral number 20:20:100200:20-10 and outbuildings - a bathhouse and a barn - according to the “Agreement for the sale and purchase of a land plot and a residential building” dated 03/01/2017, drawn up in simple written form. The calculation has been completed in full. I have no complaints against the buyer. Full name, signature

Why is it necessary when buying or selling?

Receipt for receipt of funds for a land plot is a document showing when, where and for what reason payment was made and received. Is a confirmation of the transfer of money.

There are several reasons for writing a paper:

- insufficient reliability of the seller;

- the likelihood of denying the fact of receiving money;

- the need to confirm the costs of purchasing memory.

A receipt will be needed if a citizen plans to return income tax funds. It is compiled at the time of transfer of money and stored with the main package of documentation for the purchased plot.

The paper is a legally significant document - if the owner’s rights are violated, it can be taken to court.

Note! The document is drawn up by the person accepting the money - the seller. If a citizen does not have the opportunity to personally accept finances, a representative does this for him. In this case, the document indicates that the money was received by proxy. Its details must be written down: date, place of issue.

Receipt for deposit for residential premises, house

A correctly drawn up document is official proof of the payment of money for the house as a deposit. A receipt is also required for a refund of 13% property tax after a sale transaction has been completed. The document is drawn up in any form indicating all important information.

Approximate sample

RECEIPT

St. Petersburg 12.02.2021

I, Maxim Fedorovich Dmitriev, born on March 26, 1982, passport data: (series and number, date of issue, where and by whom it was issued, address of last registration on the passport) received from Alexander Petrovich Karnaukh, born on March 23, 1965, passport data: ( series and number, date of issue, where and by whom it was issued, address of last registration in the passport) deposit for the house I am selling, which is located at: (full address) in the amount of 5,000,000 rubles (Five million) under the sales contract dated 10.02 .2019

Signature

A document drawn up correctly acquires legal force. If one of the parties refuses the transaction, the injured person is entitled to compensation for losses.

Sample receipt for receiving a deposit when purchasing an apartment

Any real estate purchase and sale transaction, especially intermediate stages such as transfer of a deposit, advance payment or collateral, are associated with numerous risks and problems. During a free consultation, experienced specialists will point out the most important points. They are ready to accompany the entire procedure of purchasing a home, thanks to which any fraudulent schemes can be eliminated.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

4

How to get deceived when buying an apartment

Fraud when buying an apartment occurs, if not constantly, then very...

17

How does the purchase and sale of an apartment through a safe deposit box work?

The purchase and sale transaction of an apartment involves many risks, one of which is...

62

What expenses do the buyer and seller bear when buying or selling an apartment?

Purchasing an apartment is associated with high costs. The lion's share of the buyer's expenses...

2

Buying an apartment with a mortgage encumbrance

When applying for a mortgage loan, the bank requests collateral. They can perform...

10

Termination of the preliminary agreement for the purchase and sale of an apartment

In case of expropriation of an apartment for compensation, the Seller and the Buyer may not…

4

What you need to know when buying an apartment through a real estate agency

Real estate agencies actively advertise their services, promising to find housing much more...

How to properly fill out a deposit

Before you start generating a receipt, you need to make sure that the transferred funds are not perceived as an advance payment. These terms have different legal meanings. If the transaction fails due to the fault of the seller, he is obliged to return the deposit in double amount. If the transferred amount is considered an advance, 100% is returned.

The document is drawn up in the presence of all interested parties and filled out with a ballpoint pen. Information from other documents is copied; abbreviations are not allowed if they are not in the source. The receipt indicates all owners of the subject of sale. The amount is divided in equal shares, signatures confirming receipt of funds are placed at the end of the document. We should not forget that the receipt is an addition to the contract; in the absence of the latter, the transferred amount is regarded as an advance.

Standard Requirements:

- the document is written with a ballpoint pen with blue or black ink;

- the presence of witnesses is not mandatory, but desirable;

- The sample should be prepared in advance, but it must be filled out only in the presence of other interested parties, during the direct transfer of the deposit.

A document acquires legal force if properly executed. Before writing a receipt or transferring money, you should draw up a deposit agreement, which lists the information of all participants in the process, information about the subject of the transaction, conditions, and market price. The transfer of the specified amount occurs after the subject of the agreement is deregistered, the sale and purchase agreement is completed, and ownership is transferred through re-registration.

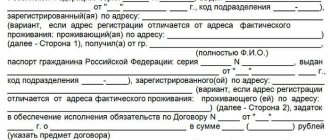

Sample deposit agreement

Full name, citizen of the Russian Federation, _________ year of birth, gender __________, passport No.______________issued on _________ by department ___________, department code __________, registration and residence address: _____________________, hereinafter referred to as the Seller, and

Full name, citizen of the Russian Federation, _________ year of birth, gender __________, passport No.______________issued on _________ by department ___________, department code __________, registration and place of residence: _____________________, hereinafter referred to as the Buyer, on the other hand, have entered into this agreement as follows:

The parties hereby agree that the Seller undertakes to sell (transfer ownership), and the Buyer undertakes to buy (acquire ownership) in the future, within _____________ years, an apartment located at the address: ________________________________ at the price of __________________ (____________) rubles.

2. The specified apartment consists of _______ living room. The total area of the apartment excluding the area of loggias (balconies) is _____ (in words ______________) sq. m., located on the _________ floor of a residential building. Cadastral No. _________________. We describe the entire apartment! Even if the share is sold.

3. To ensure the fulfillment of its obligations, the Buyer makes a deposit to the Seller for the purchased apartment in the amount of ____________ (_____________) rubles.

4. The buyer and seller undertake to conclude a Purchase and Sale Agreement for the specified apartment within _____________ years. Or you can specify the conditions after the occurrence of which the parties, within ______ business days, undertake to conclude a Purchase and Sale Agreement for the specified apartment (for example, after the execution of inheritance documents).

5. The cost of the apartment in the amount of ______________ rubles is final and cannot be changed.

6. The parties are aware that in accordance with Art. 380 and 381 of the Civil Code of the Russian Federation, they are responsible for failure to fulfill their obligations. Namely: if the purchase and sale agreement is not concluded due to the fault of the Seller (documents are not ready or refusal to conclude, price increase, indicate possible reasons, etc.), then he undertakes to return to the buyer the amount of the deposit and a fine in the amount deposit amount up to ____________ year. If the purchase and sale agreement is not concluded due to the fault of the Buyer (personal documents are not ready or refusal to conclude, change in price), then he loses the right to return the deposit amount. The parties are released from liability (specified in Article 380.381 of the Civil Code of the Russian Federation) if ____________________ (you must indicate, for example, the delay in documents is due to the suspension of work of government agencies or errors of government agencies, illness of one of the parties, etc.).

7. This agreement is drawn up in two copies, one of which is handed over to the Buyer, the second to the Seller.

Receipt for real estate transactions

In transactions involving the transfer of property or acceptance of it for storage, the receipt acts as a guarantee link. However, in larger real estate transactions, a slightly different rule comes into play.

Everyone will agree that the most important and largest purchases in every person’s life are the purchase of a plot of land, an apartment, a car or a cottage. Such large commodity exchange operations require large investments of funds that are not often at hand. In order not to miss out on the desired home or car, many try to provide a strong promise that the purchase will be completed and the seller will receive the amount collected. Then the deposit comes into play.

Thus, the buyer can give the earnest money to the seller as a guarantee that the transaction will be completed. The deposit is a reliable fixer of the transaction, since it is not returned to the buyer if the purchase is cancelled. It is possible to achieve the return of the deposit, and in double the amount, only by proving that the sale failed due to the fault of the seller.

At this moment, a receipt appears at the scene of action.

The amount of the deposit can be absolutely any. The receipt can indicate either a fixed amount or a percentage of the purchase price.

Sample receipt for transfer of deposit and purchase of real estate

A receipt for receipt of money (deposit) for an apartment or house is drawn up in any form. When preparing this document, you can use the following sample.

However, in real estate transactions, there are some requirements that must be met before you can hand over the earnest money.

- Before writing a receipt, it is necessary to draw up a preliminary purchase and sale agreement.

- If several people act as owners of the property being sold, then everyone must write a receipt, and the deposit should be divided equally among themselves.

- The receipt must be “clean”, without blots, cross-outs or errors.

- If the owner is a minor child, then the receipt is written for him by his parents, guardians or adoptive parents.

- The receipt is not drawn up in advance, but on the spot, in the presence of the citizens participating in the transaction, as well as spouses, if any.

- The receipt can be handwritten or printed. The second option involves having the document certified by a notary. Otherwise, lines such as details of the seller and buyer, as well as the cost of the transaction, are also written by hand.

- A sample receipt for receipt of a deposit for a land plot should be drawn up after personal inspection and verification with the cadastral plan.

- When drawing up a sample receipt when purchasing a garage, you should study all the reasons why the land is the property of the seller, since the construction of a garage on the site may be prohibited.

Sample receipt for renting an apartment

A receipt may also appear in transactions such as renting an apartment, house or room. It will help protect not only the landlord, but also the tenant from fraud. However, as in the case of the purchase of real estate, it cannot act as an independent document.

Make sure all conditions are met:

- It is necessary to pre-conclude a rental agreement for residential premises, since the receipt only supplements it.

- Drawing up a receipt must be a voluntary act.

The receipt for payment for rental housing also does not have clear regulations.

A receipt is a good reason for resolving conflicts. It has a lot of advantages, so don’t neglect its design.

Benefits of a receipt

- It is a guarantee of completing a transaction and receiving funds.

- Acts as insurance against unforeseen situations.

- It is the primary evidence in court during legal proceedings.

- Protects against losses not only monetary, but also psychological.

- Provides reliability and confidence in transactions with large amounts and strangers.

- Does not require mandatory notarization, like other official and legal documents.

It never hurts to draw up a small “piece of paper” in serious transactions in order to protect yourself and your property.

Earnest money agreement - document structure

Since the receipt is drawn up in any form, there are no clear rules for its preparation, but in order for the document to acquire legal significance, all important information must be written down in it.

Receipt structure:

- preamble;

- details of the parties, their signatures;

- date and place of conclusion of the document;

- the subject of the agreement, which indicates that a pledge is being drawn up, not an advance;

- exact amount in numbers, in words;

- a detailed description of the process of transferring funds - who, to whom, when, where, for what;

- liability of the parties if the transaction does not take place;

- duration of the agreement, possibility of termination.

A correctly drawn up document allows you to quickly resolve a controversial situation, return legitimate money with compensation for damages for wasted time.

Receipt for deposit for tax office

A tax deduction is provided for the amount of expenses for the purchase of residential premises - apartment, house, room. A receipt for the tax office is drawn up in any form indicating all important information; notarization is not required, but is encouraged.

Mandatory requirements:

- The receipt must indicate the personal data of the seller, buyer, and passport details.

- The document must be individual. If there are several owners, each one writes a receipt indicating the amount received.

- There must be a link to the purchase and sale agreement. The information on the basis of which the receipt was written is indicated. If the contract does not have a number, the date of preparation is indicated.

- All information must be reliable, errors and corrections are not allowed.

- If the payment was made by another person on behalf of the buyer, a power of attorney must be attached to the receipt.

Experts do not recommend handing over the original to tax officials to avoid losing the main document. If you plan to contact the tax service, you should draw up the document in two copies.

If you cannot choose a full tax deduction for the transaction, you still have the opportunity to get the required amount when making the next transaction to purchase a home.

Extract from the Unified State Register of Real Estate

An extract from the Unified State Register of Real Estate is proof of ownership of the property. A certificate of registration of rights is a conditional document that requires confirmation. Before transferring the deposit or drawing up a receipt, you must verify the rights of the owners. A fresh extract from the Unified State Register of Real Estate will allow you to clarify information about the owners of real estate, the absence of encumbrances, and arrests. You can order an extract online via the Internet. The price of the service is 250 rubles. At the same time, you should not trust the electronic statement provided by the buyer, since it is possible to edit the data and enter false information.