Foreigners and their statuses affecting the calculation of contributions

Foreigners are persons who are not citizens of the Russian Federation, but either have confirmation of citizenship of another state or are unable to confirm such citizenship.

They can be in the Russian Federation for three reasons (Clause 1, Article 2 of the Law “On the Legal Status of Foreign...” dated July 25, 2002 No. 115-FZ):

- permanent residence, which requires a residence permit;

- temporary residence, during which a document permitting residence is issued;

- temporary stay when a person enters the Russian Federation with or without a visa, receiving a migration card and issuing a document giving the right to work.

Read more about these reasons in our material .

Foreigners can engage in labor activities:

- under an employment or civil contract agreement;

- as an individual entrepreneur.

To temporarily carry out activities, a foreigner must have a work permit (if he arrived on a visa) or a patent (if a visa is not required). The period of temporary stay in Russia will determine the validity period of the corresponding document. This period may be extended.

Does not make exceptions regarding the compulsory nature of insurance and, accordingly, with regard to the calculation of insurance premiums from foreigners in 2020–2021:

1. Neither paragraph 1 of Art. 7 of the Law “On Compulsory Pension...” dated December 15, 2001 No. 167-FZ, establishing the need for compulsory pension insurance (OPS) for all persons working both under contracts (labor or GPC) and as individual entrepreneurs, except those temporarily in the Russian Federation highly qualified specialists.

2. Neither paragraph 1 of Art. 2 of the Law “On Mandatory Social...” dated December 29, 2006 No. 255-FZ, obliging the implementation of compulsory social insurance (OSI) for disability and maternity of individuals working under employment contracts, except for highly qualified foreign specialists temporarily staying in the Russian Federation. But this law exempts individual entrepreneurs (and, accordingly, foreigners) from OSS (clause 3 of Article 2).

3. Neither art. 10 of the Law “On Compulsory Medical...” dated November 29, 2010 No. 326-FZ, which determines the need to obtain compulsory medical insurance (CHI) for persons working under contracts (labor or GPC) or who are individual entrepreneurs, but who are not classified as highly qualified foreign specialists or foreigners temporarily staying in the Russian Federation.

4. Neither the Law “On Mandatory Social...” of July 24, 1998 No. 125-FZ (clause 2 of Article 5), which extends the obligation for employers to make contributions for injuries and the income of foreigners. These contributions will be accrued in any case, regardless of the status of a foreigner working in the Russian Federation.

That is, insurance premiums for payments to foreigners must be calculated. But these charges have their own nuances, depending on the category of the contribution payer, the basis for the foreigner’s stay in Russia and the qualifications of the foreign specialist.

Chapter 2 “Procedure for issuing invitations to enter the Russian Federation”

As the title suggests, the entire second chapter of the document talks about issuing invitations for foreigners to enter Russia. Article 16 includes general information:

- tells what data is included in the invitation;

- determines the circle of persons entitled to issue an invitation;

- establishes the obligations of the receiving party in relation to the foreigner.

The following two articles are devoted to certain types of invitations: Article 17 - an invitation to study at a Russian university, Article 18 - an invitation to carry out work activities.

Article 18.1 talks about the regulation of the labor market for foreign workers, namely the establishment of quotas for issuing work permits for visa foreigners. Article 19 lists state migration services for which a fee is charged.

Contributions for foreigners residing (permanently or temporarily)

According to the provisions of the laws on compulsory insurance, foreigners living (permanently or temporarily) in the Russian Federation are subject to such types of insurance as:

- OPS, regardless of how they work (under an employment or GPC contract or as an individual entrepreneur);

- OSS for disability and maternity when performing work under an employment or GPC contract, but not in a situation where the foreigner is an individual entrepreneur;

- Compulsory medical insurance, regardless of how they work (under an employment or civil employment contract or as an individual entrepreneur), but not when the foreign specialist is highly qualified;

- OSS on injuries when performing work under an employment or civil employment contract.

That is, on the income of foreigners registered under an employment or civil employment contract, you will have to pay all contributions according to the same rules as on the income of citizens of the Russian Federation, if the foreigners do not belong to the category of highly qualified specialists. In relation to a highly qualified specialist, accruals for OPS and OSS will be mandatory.

Read about the rules for paying contributions from payments of highly qualified foreign specialists in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Typical Situation. It's free.

A foreign individual entrepreneur will be the payer of contributions for compulsory medical insurance and compulsory medical insurance.

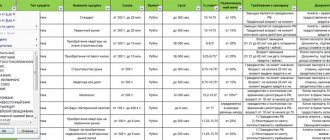

Generally established tariffs for contributions in 2020–2021 from the salaries of foreigners from the EAEU working under a labor or civil service agreement will be (Article 426 of the Tax Code of the Russian Federation):

- on OPS - 22% from income not exceeding 1,465,000 rubles. (in 2021), and 10% of income above this amount;

- OSS for disability and maternity - 2.9% on income not exceeding 966,000 rubles. (in 2021), contributions will not be accrued above this income;

- Compulsory medical insurance - 5.1% of the entire amount of income.

ATTENTION! Calculate contributions to VNIM for temporarily staying foreign workers at a rate of 1.8%, and do not accrue compulsory medical insurance. Calculate all contributions for refugees, just like for Russians (Letter of the Ministry of Labor dated December 19, 2014 N 17-3/B-620). But make sure they actually have refugee status.

In addition, the fee payer may also experience:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee (Articles 428, 429 of the Tax Code of the Russian Federation);

- the possibility of using reduced tariffs in accordance with Art. 427 Tax Code of the Russian Federation.

If the employer is included in the list of SMEs, then on the income of a foreign worker exceeding the minimum wage, he has the right to pay contributions at reduced rates.

Read more about reduced contributions in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Insurance premium rates for foreigners in 2020–2021 for injuries will depend on the type of activity carried out by the employer.

For foreign individual entrepreneurs, the amount of contributions due for payment will be determined in the same way as for individual entrepreneurs who are citizens of the Russian Federation (clause 1 of Article 430 of the Tax Code of the Russian Federation):

1. Annual payment for compulsory pension insurance for income not exceeding 300,000 rubles. for the year, will be equal to 32,448 rubles. in 2021. If the income turns out to be more than 300,000 rubles, an additional 1% will be charged on the amount exceeding 300,000 rubles. The total amount of payments cannot be more than 8 times the fixed annual payment 32,448 × 8 = 259,584 rubles. in 2021.

2. The annual payment for compulsory medical insurance will be determined as a specific amount - 8,426 rubles. in 2021.

To learn about the amount of contributions for injuries, read the article “The rates of contributions for compulsory social insurance against industrial accidents and occupational diseases depend on the type of economic activity .

Employment of citizens of EAEU member countries

Workers with citizenship of Armenia, Belarus, Kyrgyzstan and Kazakhstan are registered for work in the same way as Russians. They do not need to obtain patents or permits.

A voluntary health insurance policy may be added to the standard package of documents when hiring a foreigner. But if the employer himself concludes an agreement with the insurance company, this is not necessary, because the employee will have compulsory health insurance.

| Important! Starting from September 2021, restrictions on quotas for videoconferencing have changed. The full list of exceptions is in the Appendix to the Order of the Ministry of Labor No. 490n dated 07/05/2019. |

Temporarily staying foreign citizens: features of contributions

The imposition of contributions on foreigners temporarily staying in the Russian Federation has its own rules, primarily because among them are highly qualified specialists, whose income under a contract (labor or civil service agreement) is not subject to any contributions, except for contributions for injuries.

The income of other foreign workers registered under the contract will not be subject to contributions to compulsory health insurance, but will be subject to payments to compulsory health insurance and compulsory health insurance. Tariffs for them will generally be equal (Article 426 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2017 No. 03-15-06/11189):

- on OPS - 22% from income not exceeding 1,465,000 rubles. (in 2021), and 10% of income above this amount;

- for OSS for disability and maternity - 1.8% from income not exceeding 966,000 rubles. (in 2021), contributions will not be accrued above this income.

At the same time, situations may arise for the contribution payer when he has:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee (Articles 428, 429 of the Tax Code of the Russian Federation);

- the possibility of using reduced tariffs in accordance with Art. 427 Tax Code of the Russian Federation.

Contribution rates for injuries will depend on the type of activity carried out by the employer.

For individual foreigners with a temporary stay, insurance payments will be determined in the same way as for individual entrepreneurs who are citizens of the Russian Federation and individual entrepreneurs who live (temporarily or permanently) in Russia.

Procedure for calculating personal income tax

Situation 1

Category of citizens : temporarily staying foreign citizens from countries with a visa-free regime (except for the EAEU).

Patent : must be obtained.

At what rates should personal income tax be calculated?

- at a rate of 13% from income up to 5 million rubles. for the tax period, regardless of whether citizens are tax residents of the Russian Federation (clause 3 of Article 224 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated June 13, 2017 No. 03-04-05/36673)

- 650 thousand rubles. plus at a rate of 15% on the amount of income exceeding 5 million rubles, if the amount of the corresponding income for the tax period is more than 5 million rubles (clause 3.1 of Article 224 of the Tax Code of the Russian Federation).

Situation 2

Category of citizens: foreign citizens with temporary residence permit.

Patent: no need to obtain.

At what rates to calculate personal income tax : depends on whether citizens are tax residents of the Russian Federation:

- 13% or 15% - standard tax rates for residents

- 30% is the tax rate for non-resident citizens, with the exception of income listed in paragraph 3 of Art. 224 Tax Code of the Russian Federation.

Art. 207 of the Tax Code of the Russian Federation establishes that foreign citizens who are actually in the Russian Federation for at least 183 calendar days within 12 consecutive months, which may fall on different calendar years, are recognized as tax residents. The Ministry of Finance of the Russian Federation, in letter No. 03-04-05/3343 dated January 22, 2020, notes that the status of tax residents of the Russian Federation is determined for each date they receive income.

Some specific situations regarding contributions from the income of foreigners

Art. 420 of the Tax Code of the Russian Federation, defining the object of taxation of insurance premiums, makes an exception regarding payments to foreigners, in which such contributions will not be charged:

- when a foreigner, under an employment or GPC contract, works in a structural unit of a separate nature, located outside the territory of the Russian Federation (clause 5).

The norm specified in paragraph 5 of Art. 420 of the Tax Code of the Russian Federation, allows not to impose contributions on income accrued to foreigners located outside the territory of the Russian Federation and performing work under a civil process agreement remotely (letter of the Federal Tax Service of Russia dated 02/03/2017 No. BS-4-11 / [email protected] ).

However, if income from a foreign company is received by a foreign employee who is temporarily in Russia, working in the representative office of this employer on the territory of the Russian Federation and who is not a highly qualified specialist, then his income must be paid contributions to OPS and OSS for disability and maternity (letter from the Ministry of Finance of Russia dated 02/06/2017 No. 03-15-05/6079).

From the income of a foreigner temporarily staying in the Russian Federation who has received refugee status, unlike other foreigners with a temporary stay, additional deductions will be made for compulsory medical insurance using the usual tariff for the Russian Federation of 5.1% (letter of the Ministry of Labor of Russia dated February 17, 2016 No. 17-3/OOG- 229).

To learn whether to charge contributions if a citizen of the Russian Federation works abroad, read the material “Distance worker abroad: we pay contributions, but we don’t pay personal income tax .

All details of the calculation and payment of insurance premiums, including against accidents, for payments to foreign employees are discussed in detail in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

Results

Foreigners can be in the Russian Federation in the status of residents (temporarily or permanently) or temporarily staying. For the first group, insurance premiums will be calculated in the same manner as for citizens of the Russian Federation. That is, at generally established, additional or reduced tariffs, if the foreigner is registered under a contract (labor or civil process agreement). An exception will be highly qualified specialists, from whose income they will not have to make contributions to compulsory medical insurance.

No accruals will be made on the income of highly qualified specialists temporarily located in the Russian Federation and working under a contract (labor or civil employment contract), except for contributions for injuries. And the income of other foreign workers temporarily staying in the Russian Federation and working under a contract must be subject to contributions to compulsory health insurance and compulsory social insurance, applying a special rate for compulsory social security for disability and maternity.

Contributions from the income of foreign individual entrepreneurs will be calculated according to the algorithm for calculating payments for individual entrepreneurs in force in the Russian Federation, regardless of their status.

Sources:

- Federal Law of July 25, 2002 N 115-FZ “On the legal status of foreign citizens in the Russian Federation”

- Federal Law of December 15, 2001 N 167-FZ “On Compulsory Pension Insurance in the Russian Federation”

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Federal Law of November 29, 2010 N 326-FZ “On Compulsory Health Insurance in the Russian Federation”

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.