Why am I now paying for utilities through Tinkoff Bank?

Everyone needs to pay utility bills every month. For example, in Moscow I need to pay for an apartment at the Housing and Communal Services Moscow EIRC, and for electricity at Mosenergosbyt. If you pay through Sberbank online on the website or through the application, the commission will be 0.5% for housing and communal services and 1% for electricity. I need to pay for 2 apartments, which is about 14,000 rubles, and giving Sberbank 140 rubles every month is definitely not my option.

Payment for housing and communal services with a Tinkoff card in Sberbank and other options

Some are interested in whether there are alternative options for paying for housing and communal services, for example, whether it is possible to pay for utilities with a Tinkoff credit card at Sberbank. This depends on the functionality of the operator through which you plan to complete the transaction.

For example, you cannot make payments to Sberbank online from cards of other banks - only from your own.

However, there are other options:

- payment services and electronic wallets - Yandex.Money, Qiwi, Webmoney, MTS.Pay;

- remote payment terminals – CyberPlat, Eleksnet, Qiwi, etc.;

- Post office;

- ATMs of Russian banks;

- mobile operators;

- partner replenishment points - for example, Euroset or Svyaznoy.

In all these cases, payment can be made both from Tinkoff cards and from other banks - the same Sberbank or VTB, as well as in cash.

You cannot pay for housing and communal services with a Tinkoff card at Sberbank online, but you can, if necessary, use other alternative methods

However, paying utility bills without commission at Tinkoff is only possible when using the online account. In other cases, you will have to pay the provider an additional fee.

The size of commissions and limits on replenishment are set by the intermediary himself. They need to be recognized on the spot

. The transfer time also depends on it - sometimes payment through third-party services can take up to 3-5 days.

Advantages and disadvantages of this system

Undoubtedly, paying for utilities using the Internet, including through the Tinkoff Bank website, has a lot of undeniable advantages. Let's try to reveal them:

- there is no need to stand in long and tedious queues, or waste time on the road to the bank;

- instant payment (this is especially true in cases where payment must be made as soon as possible);

- low amount of commission charged for payment;

This circumstance is very attractive for many users;

- payment can be made from anywhere in the country;

- eliminates the possibility of making mistakes when transferring funds;

- you can choose the most convenient payment option: through your personal account on the website or using a mobile application;

- the ability to pay utility bills at any time of the day;

- It is possible to save a payment template, which in the future significantly simplifies the entire payment procedure.

- dependence on Internet connection;

- the possibility of failures in the operation of the site cannot be excluded;

- there is a possibility of encountering scammers.

However, as you know, every medal has its other side. So, payment through the Tinkoff Bank website has a number of its negative aspects:

For these purposes, clone sites are often created that are visually identical to the official website of the bank. A person who pays housing and communal services on such a resource directly transfers money to the swindler and, accordingly, loses it.

Payment for housing and communal services through Tinkoff Bank without commission

When Tinkoff first began distributing credit cards, the functionality of its Internet banking was limited, and it was possible to pay utility bills only with certain operators. There are currently no such restrictions

. Regular clients of the bank do not even have a question about whether it is possible to pay for utilities with a Tinkoff card. It's possible.

Advantages of the method:

- there is no need to stand in line at the bank, all transactions are made online;

- You can make payments at any time, even at night;

- at Tinkoff, payment for housing and communal services without commission - neither the bank nor the service provider charges additional commissions;

- operator errors are excluded, since you control every step and check the necessary information on the receipt;

Tinkoff promptly transfers money to the utility service provider - the funds will arrive within 24 hours, and you will be credited for the payment.

Payment of utilities through Tinkoff Bank

From the card through your personal account

The easiest way to pay for housing and communal services through Tinkoff is to use the bank’s official website.

The procedure is as follows:

- log in to your online account;

- select the Payments section (if necessary, change the region of presence);

- click on the housing and communal services logo (house icon);

- find the required management company in the list (you can use the search bar);

- enter your personal account number;

- select the payment period;

- in the Additional information line, indicate additional information, for example, counter indicators;

- indicate the name of the payer;

- enter the amount in rubles;

- indicate the details of the card with which you plan to pay for utilities through Tinkoff, or select the one you have.

Step 1Step 2Step 3

Then all that remains is to confirm the transaction in the manner provided by the bank that issued the card. Payment is allowed from absolutely any card issued by any Russian banking organization, including credit, virtual and non-embossed.

After the operation is successfully completed, you can save it as a template so that you do not have to go through the entire procedure again each time. Or set up automatic payment with the required frequency of checking the invoice.

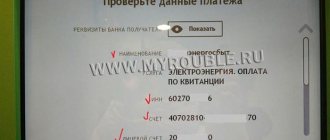

By details - TIN and personal account number

The second option, how to pay for housing and communal services with a Tinkoff card, is used if you cannot find the name of the utility service provider in the list of proposed ones. This is relevant for small towns and newly formed management companies that have not yet transferred their payment details to Tinkoff.

However, functionality has been implemented on how to pay for housing and communal services through Tinkoff using the details.

To do this you need:

- Using the algorithm described above, go to the Payments – Housing and Public Utilities section;

- enter the organization's TIN in the search bar;

- click on the option that appears;

- check the matching details in the right column;

- make a payment using the following algorithm.

You can pay for utilities at Tinkoff using the details, for example, TIN of the supplier company

If the desired option is not found, then you should return to the Payments - All Categories section and search for the organization there by TIN. Perhaps it was classified into a different category - for example, Other

. But this is unlikely.

In case of difficulties, it makes sense to contact the live chat - the operator will help you make the payment.

In the Tinkoff mobile bank you can also pay for housing and communal services using the QR code found on the receipt.

Using AutoPay

The bank provides a convenient function - auto payment. The system will automatically check once a month on a given day whether the management company has issued an invoice

. If yes, then an automatic payment will be generated for the required amount.

An SMS will be sent to the bank client with details of the planned operation and a cancellation code. If everything suits you, then you don’t need to do anything.

. Otherwise, you must enter a special code and the operation will be frozen. Subsequently, you can manually make a payment.

Read more about payment options with a Tinkoff card.

Tinkoff Housing and Communal Services: what services are accepted for payment?

In fact, you can pay for anything. The service has a system for searching organizations by TIN. Therefore, you can simply enter the TIN number from the receipt, and the system itself will find the utility service and pull up its details.

In general, the following items are located in the “Payments” category of Tinkoff Bank:

- mobile communications, home telephony. You can pay for the services of any operators in Russia and the CIS countries, as well as put money on a tourist SIM card. To pay, you just need to enter the number, the system will determine the operator itself;

- Housing and communal services. A large section containing data from hundreds, if not thousands, of utility service providers throughout Russia. If you enter your city, you will see all operators. But it’s better not to search for what you need manually; it’s easier to enter the TIN number or the name of the required utility company into the search field;

- Internet. It is also home to dozens of service providers for all cities and regions of the country;

- network marketing. In this section you can pay for Faberlic, Oriflame, Ivon, Amway, etc. via the Internet;

- government services. We are talking about paying traffic police fines, taxes, payments to bailiffs, to Rosreestr, etc.;

- replenishment of electronic wallets Qiwi, WebMoney, Yandex, etc.;

- payment of loans from any banks and microfinance organizations. The payer does not need to enter all the details; they are already entered into the program. To pay, simply indicate the loan agreement number;

- payment for services of educational organizations.

This is not a complete list of what can be paid online through the Tinkoff Bank service. As you can see, this is not only housing and communal services, the service is provided as comprehensively as possible. You can pay for anything online through this bank - it’s convenient. You can immediately pay for utilities, telephone, and Internet, and immediately pay the state fee. All at once and in one place.

Payment is accepted only from bank cards. The servicing bank does not matter. It could be Tinkoff or any other.

Is cashback awarded for paying for housing and communal services at Tinkoff?

Despite the fact that formally payment for housing and communal services is not considered a cash-out transaction, cashback is not awarded for it. The fact is that, in accordance with clause 3.2 of the Loyalty Program, the bank does not award bonuses for expense transactions related to payment for goods and services in the Payments section. The only exception is made for the Transport category.

Thus, neither cashback for Tinkoff housing and communal services, nor Bravo points when paying with a credit card are awarded to the bank client.

There are also no bonuses when paying for similar services through third-party operators - for example, Qiwi terminals or the Yandex.Money system.

Limits and commissions

Payers are interested in whether Tinkoff Bank offers payment for housing and communal services without commission. In accordance with the terms of service for a debit card, every transaction made using a bank transfer (including remote payment for services) is free of charge. Consequently, the bank does not charge a commission for paying for utility services, including electricity, gas, telephony, intercom, Internet, etc.

You can pay for housing and communal services at Tinkoff without commission; there are also no limits on this operation.

Tinkoff does not set a transfer limit. Moreover, if the payer does not have enough funds to pay for housing and communal services, then he can activate an overdraft and pay off the utility debt at the bank’s expense

.

If the overdraft amount does not exceed 2022 rubles, then no overdraft fee will be charged

. If this threshold is exceeded, the rate is calculated individually. You must activate an overdraft in advance in your online account.

It is also possible to pay for housing and communal services through Tinkoff without commission and with a credit card. There are no restrictions on the maximum payment amount - with the exception of the limit of the card itself. The operation is not equivalent to cash withdrawal

. The user will receive all the benefits of the product: a grace period of up to 55 days and a standard loan rate after its expiration.

Smartphone application from Tinkoff

Owners of smartphones and other gadgets (for example, laptops or tablets) will be able to transfer funds to their accounts using a special mobile application. To start using the service, individuals need to install special software on their gadgets. Go to PlayMerket or AppleStore and install this application there.

After its activation, smartphone users will be able to make money transfers or various payments for goods, works or services around the clock. At any time they will be able to check the status of their account and find out about the current debt on the loan.

Is it possible to pay utility bills with a Tinkoff credit card?

First, you need to top up your card account with the required amount. If you don’t have a Tinkoff debit card, then both a credit card and a savings account will do.

. That is, you can pay for utilities with a Tinkoff credit card, and there will also be no commission for this.

In addition, there will be a grace period of up to 55 days, during which you will be able to top up your credit card back, avoiding interest charges.

How to pay using your personal account details?

Debit card from Tinkoff Up to 30% cashback Up to 6% per annum Free service Read more →

If the name of the supplier is not in the list of organizations, you can resort to the second payment method. Usually residents of small towns and villages turn to him for help, since their service companies are little known and not common in other localities.

Commission for payment of housing and communal services in Tinkoff Bank

The commission depends on how you pay for housing and communal services and which organization the transfer is made to:

- For utility bills without registering on the website, the system charges 2% of the total amount.

- At Tinkoff, payments for housing and communal services from a personal account are made without commission.

- More often than not, large service providers do not impose fees on consumer payments, but there are exceptions. Before paying, check whether a commission is charged, and if so, what interest is charged by the system when paying

. The information is in the generated receipt, which indicates the amounts and transfer fees. The fee rarely exceeds 0.5%.

Despite the fact that credit card users cannot always take advantage of the grace period and cashback, the Tinkoff service is the most convenient and simplest option for paying utility bills using the Internet.

Advantages of Tinkoff Bank for paying for housing and communal services

Many financial institutions offer to make housing and communal services payments, but there are a number of reasons to take advantage of the offer from Tinkoff:

- Low fee. In most cases, you can pay utility bills in full without a fee.

- Remote payment for housing and communal services. You can deposit funds through your personal account, which eliminates the need to stand in long lines.

- You can withdraw funds from your account, credit card (Black, Platinum, etc.) or debit card.

- If the payer does not have data, do not worry. The Tinkoff system has already entered the basic details for rent. You don’t have to waste time filling out payment forms and worry that due to an error in one digit, funds are transferred to someone else’s account. When paying, you only need to enter basic information: personal account and payer information, the rest is entered automatically.

- At Tinkoff, payment of utility bills is quick. Short enrollment periods eliminate the formation of debts.

- There is no need to keep a bunch of receipts. Housing and communal services payments are saved in history, and if necessary, they can be printed at any time

.

To do this, you can use an ATM or a regular printer

.

In the first case, you need to insert the card, find the required payment in the history and click the “Print” button

. In the second, go to your personal account, open the history, find the organization’s receipt and also perform the “Print” action. - If you use a credit card to pay for housing and communal services, it is possible to maintain a grace period. It all depends on the organization's MCC code, so it is better to check it in advance and make sure that the interest-free payment will continue to apply.

With the service from Tinkoff “Payment of utilities” you will save a lot of time and nerves.

Tatiana Shevtsova

Expert advice

Ask a Question

Tinkoff has been providing housing and communal services payment services since 2022, and as reviews show, during this time there have not been a single serious complaints from clients. The administration resolves problems and technical failures on an emergency basis.

Paying for housing and communal services using autopayment

This organization has a very convenient auto-payment function , with the help of which the user saves himself from the need to check his monthly account and balance; these actions are performed for him by a system that is completely mechanized and brought to perfection.

The client of the financial institution will be sent messages with a confirmation code. If something happens, he can always cancel the task and stop sending money, so this process is as safe as possible.

How to pay for utilities at Tinkoff Bank?

In order to pay for housing and communal services, you must have an account on the website. It can be created by clients who have any Tikoff banking product: credit or debit card, account

.

After authorization or registration in the system, follow the instructions:

- Tinkoff does not include rent in the list of basic services, so you need to look for the tab for transfers at the bottom of the page - scroll to the end, and under the “Bank” section, find the line “Payments”.

- Then there are two ways - enter the details manually (by contract number) or find the required organization in the list of companies. In the first case, do not forget to check “VAT included”. The second method is much easier, because in this case you will only have to enter the basic data of the payer

. In order to do this, first check whether the system has correctly identified your location. You can change the city if you are in another locality or country, or simply want to pay for out-of-town housing and communal services for your loved ones. - The tab that opens will contain a list of companies providing paid services in your city. You can find the desired organization by name or TIN of the recipient

. The corresponding search bar will be located at the top of the page. - As soon as you select an institution, the following field will open in which you need to enter basic data about the payer and payment: personal account number, period, payment amount and the card from which the funds will be debited. First make sure that there is a sufficient amount on the card.

- Check the correctness of the payments in the receipt, which is generated automatically and appears on the screen.

- If you make a payment without registering in the system, you must enter a password and login to enter your personal account. This will confirm the debit or credit card activity and serves to prevent fraudulent activity.

- Additionally, the bank may require you to confirm the payment via SMS with a verification code, which Tinkoff sends to the mobile phone to which the card is linked upon activation.

Taking into account the subtleties, the process will take no more than 10 minutes. Saving time is the main advantage of the payment service at Tinkoff Housing and Communal Services.

You can pay for housing and communal services without authorization using a card from another bank, but then you will have to pay a fee.

Another remote way to pay for utilities is a mobile application. In 2022, Tinkoff Bank released a large-scale update for individuals who use smartphones on iOS and Android platforms, and made it possible to pay for housing and communal services using a QR code

.

You just need to bring the corresponding field on the receipt to the gadget’s camera, and after the code is read, the system will automatically fill out the receipt

. This method is even faster, and you can pay for utilities in a couple of minutes.

Tatiana Shevtsova

Author of the article

Ask a Question

If you use a credit card with a bonus program, please note that cashback is not awarded for payments. Payment is not considered a purchase, but is equivalent to a transfer to the organization’s account.

Payments through an ATM and personal account are made instantly. In extreme cases, the transfer can take up to 24 hours. Delays are possible when paying on holidays.

Paying for housing and communal services through Tinkoff is a convenient and simple way. You can quickly make a payment either through an ATM or through your personal account.

. In any case, payment is carried out without any difficulties.

Payment for housing and communal services

After activating your personal account, you can start paying for housing and communal services. This can be done in a few simple steps:

- Select the card from which the payment will be made.

- In the window that appears, click the “Payments” tab and follow the “Housing and Communal Services” link.

- Using a search engine or manually, enter the name of the service provider and enter all the details that the system requires.

- Check the entered data and click the “Submit” button.

- For security purposes, each transaction must be confirmed with a special code, which the system sends to your mobile phone in the form of SMS. Once the code is entered into the appropriate window, the payment transaction will be completed.

To save time, you can later create a payment template, which will eliminate the need to enter payment details for each payment.

For reference! For transferring funds to the account of the housing and communal services provider, a commission in the amount of 0.5% of the payment amount will be debited. To make a commission-free payment, you can withdraw money from a Tinkoff debit card at ATMs of partner banks and transfer it using a method that does not involve a commission.

In your personal account, you can install the “Autopayment” function. Its essence lies in the fact that at the time set by the client, funds for payment of housing and communal services will be written off automatically.

Payment for housing and communal services in Moscow

What payments does the bank accept without commission?

Card users are interested in whether there is a commission for housing and communal services, because it is difficult for beginners to understand each operation. As evidenced by the terms of service of the plastic card, no interest is charged for transactions made through online transfers. This applies to payments for:

- housing and communal services;

- electricity;

- telephone;

- Internet;

- gas;

- intercom.

There are also no fees for paying with a credit card.

At Tinkoff you can pay utility bills even for those who are not clients of the bank. A fee may be charged by the bank that issued the card. The exact amount of the commission fee must be clarified with the bank.

If you make a payment without authorization on the site, the commission is 2%. There is no commission when authorizing by phone to pay for housing and communal services.

Rates

You can calculate the exact cost of Tinkoff merchant acquiring on the bank’s official website in the appropriate section. The calculator has 2 main fields for entering information about working capital and the number of terminals.

Read also: How to craft a sower in terraria

Based on the information received, the service will offer the best payment option and a tariff that suits the conditions.

Tinkoff merchant acquiring for individual entrepreneurs in terms of tariffs is divided into 3 main offers from the bank.

Professional

- opening a current account is free with a monthly subscription fee of 4,990 rubles;

- free transfers to individuals to cards up to 1 million rubles;

- commission for transfers to legal entities in the amount of 19 rubles per transaction;

- funds are credited to the account balance in the amount of up to 4%;

- for cash deposits – 0-0.1%, for withdrawals – 1-15%.

Where can I deposit money for utilities?

If you have a Tinkoff card, you can pay for utility bills. This can be done either through your personal account or an ATM.

Via ATM

Tinkoff ATMs are only available in large cities. They are usually located in shopping centers. Payment is made according to the following instructions:

- You need to insert the card into the ATM and enter the PIN code.

- After this, you should select the “Payments” and “Housing and Utilities” section.

- Then you need to enter the service provider and his details, which the system requests.

- All data must be checked, after which you should click on the “Submit” button.

You must take the receipt with you . An SMS notification about the payment will be sent to your phone from Tinkoff Bank. At this point, payment for housing and communal services is completed.

Online

You can pay for utilities through your personal account on the bank’s website . This is the easiest way

. Online payment is carried out as follows:

- You should log into your personal account using your login and password. As a security measure, the bank sends an SMS to your phone.

- You need to find the “Payments” and “Housing and Utilities” tabs.

- You need to find the right service provider.

- Then enter the account number and payment period.

- The required information is indicated in the “Additional information” line. For example, enter meter readings.

- Then enter your full name. payer.

- The amount is indicated.

When the information has been verified, you can click on the “Pay” section. You must confirm the operation using the code that will be sent via SMS.

After successful payment, the information can be saved as a template. Then next time you don’t need to enter all the necessary details again

.

It is possible to set up automatic payment

. You just need to set the frequency.

If the supplier’s list does not contain the required company name, then payment for housing and communal services can be made differently. It is often used in small towns

.

To do this, you need to enter the company’s TIN and then check the details. The rest of the steps are the same as in the normal procedure

. If you have any difficulties making a payment, you can contact the operator for help.

Making payments using a QR code is a new service that Russians are just beginning to use. On receipts there is a square with a code that allows you to quickly provide details and make payment

. This simplifies the process.

To pay, you need a receipt and a mobile bank or ATM installed on your phone with a QR code scanner, and a card. Using mobile banking, payments are transferred as follows:

- You should go to the application, click the “Pay” tab.

- Then select the items “Organizations” and “Legal Entities”.

- Then press the “Scan receipt” button and insert the QR code into the scanner.

- Details are specified automatically. All that remains is to indicate the amount and confirm the operation.

You can pay through a Tinkoff ATM using a QR code like this:

- A card is attached to the reader.

- You must provide a PIN code.

- Then the housing and communal services section is selected.

- You will be prompted to scan a QR code.

- All information will appear automatically, you just need to check and confirm it.

All Tinkoff ATMs have a QR code payment function. This is a convenient and easy way to make a payment.

Registration procedure

So, the entire procedure for paying utility bills comes down to the following sequential steps:

- Registration – first you need to complete the registration procedure on the bank’s official website. This procedure includes the following steps:

It is not recommended to use sequential combinations on the keyboard or names and dates, as scammers can cleverly take advantage of this.

Tinkoff Internet Bank. Registration:

Step-by-step instruction

So, having registered on the bank’s website, you can safely begin the process of paying for utilities. To do this, we sequentially perform the following steps:

- You must select a card with which to pay for housing and communal services.

- Go to the “Payments” tab and select the “Utilities” box. You will be presented with a wide list of various utility services available for payment through Tinkoff Bank.

All data should be entered extremely carefully, without making mistakes.

Also, using the Tinkoff Bank website, you can not only pay for housing and communal services, but also check the existence of debt for certain types of services.

Once the code is entered, the amount requested for payment will be automatically withdrawn from the card and transferred to the account of the housing and communal services company.

Additionally, it should be noted that payment can also be made through a special mobile application, which is freely available to anyone.

How to pay for housing and communal services?

It is convenient to pay for utilities using a Tinkoff card ( no commission is charged ):

- On the bank’s page, in the “Payments” section, select “Housing and Utilities”.

- Specify the payee. Further actions depend on the selected organization (see further paragraphs 3 and 6).

- You may be asked to find out the debt for utility services or immediately proceed to payment (select the “Pay housing and utility services” item). In the first case, you need to indicate the payer code and mobile phone number to which an SMS with a confirmation code will be sent, and click “Login”.

- Based on the results of the debt verification, the system will issue the amount due. To make a payment, you need to indicate your card number at the top of the interface

. Payment of utility bills in Tinkoff. - If you immediately proceed to payment (without first checking the debt), then you need to indicate the payer code, period, amount of voluntary insurance (optional), card number and amount.

- The form to fill out may vary depending on the selected payee. Usually the personal account and payment period, payment amount and details of the bank card from which it will be made are indicated. Other information may be required (for example, meter readings).

There are no difficulties, since depending on the parameter to be filled in, the user is provided with the following help:

- when you hover your mouse over a question mark, a corresponding tooltip is displayed;

- the field directly indicates what needs to be written (for example, “Full name of the payer”);

- You are prompted to select a ready-made value from a list that opens by clicking in the corresponding field.

The transfer period depends on the specific payment.

Attention! You can log in to pay without commission, otherwise it will be 2%. If the payment is made from a card from another bank, after clicking the “Pay” button you will be redirected to the appropriate web page of the issuer.

How to quickly pay housing and communal services through your personal account?

- Select a card to pay.

- Using a quick review, find the management company to which you are going to transfer the amount.

- Enter your payment details.

- Check that the entered data is correct.

- Confirm the transfer of funds using the “Submit” button.

- Receive a password code that will be sent via SMS, enter it to confirm your actions.

After entering the code from SMS, the specified amount will be withdrawn from the card and almost immediately credited to the account of the housing and communal services company.

Have you not yet become a client of an online service that is leading in Russia in terms of service quality? Do it now!

Payment of fines at Tinkoff

The procedure depends on the type of fine:

- On the page www.tinkoff.ru/payments/ go to the “Government Services” section.

- If there is a traffic violation, select the category “Traffic Police Fines” . Here, using the vehicle registration certificate or driver’s license number, you can check for unpaid fines, and using the resolution number, you can pay off the debt (the “Pay” tab).

- The remaining fines are paid in the “Rosreestr” category. The corresponding value is selected in the “Payment Type” field

. Also enter personal data, INN of the Rosreestr department, OKTMO code (indicated in the payment document, if it is absent, enter 0), amount and bank card details.

Tinkoff Bank offers to make payments with or without authorization (selected by clicking the mouse), in the latter case a 2% commission is charged.

Registration of a personal account at Tinkoff Bank

If you don’t have a personal account yet, you will need to obtain access to the bank’s online services using a simple account creation procedure:

- Indicate your mobile number to receive SMS passwords.

- In a new window, fill in personal information - from passport to driver’s license. The more data is specified in the account, the easier it is to subsequently use the bank’s payment service. For example, by entering information about a foreign passport, the user can easily purchase an air ticket online.

- As documents change and information in them is updated, you need to reflect this data in your account.

Further payments are made from your personal account after entering a confirmation password.

How to pay for Internet through Tinkoff

- Follow the link www.tinkoff.ru/payments. In the payment category, select "Internet".

- Specify the provider, enter your personal account and amount, fill in the details of the bank card from which the payment will be made (if paying without authorization).

Log in to pay without commission (otherwise the bank will charge 2% of the amount). You can get authorized even if you are not a Tinkoff client

. Enter your phone number and create a profile for your next payments.

How to pay with a Tinkoff card abroad

When paying abroad using a card, the owner is charged a slightly larger amount than the purchase price, due to conversion.

So, if a client has an account in rubles, when paying abroad they are exchanged for the debit currency at the current rate. In addition, a commission is charged for conversion, and if the national currency is not the dollar or euro, there will be as many as three steps: ruble - dollar/euro - national currency.

Depending on the country of use, when paying with a Tinkoff card abroad, you can lose about 3-6% on commissions and conversions.

What can you pay with Tinkoff Bank?

All popular services are paid, as well as purchases of goods, fines and other debts to government agencies, debts under executive documents. Transfers from card to card are also made here; Tinkoff supports work with all issuers.

At any time of the day you can pay for housing and utilities and mobile communications, television and the Internet , home telephone and education, pay for government services, and make a purchase in an online store. You can also:

- pay for parking, use of toll roads and other transport services, including taxi service;

- make payments to tour operators and network marketing enterprises;

- transfer money to accounts on social networks;

- pay for participation in popular online games (Steam, World of Tanks, etc.);

- buy plane or train tickets, pay for a hotel, transfer funds to charity.

You can repay a loan or transfer money to an electronic wallet, as well as make many other payments: for insurance, security services, accepting bets at a bookmaker’s office, etc.