From April 2021, Sberbank will introduce, in other words, a commission for making interregional transfers between clients. Previously it was 1%. However, a new commission for transfers came into force instead Withabove 50,000 rubles per month.

If a client transfers funds to individuals in large amounts, then it is more profitable for him to connect to a paid subscription and, within its framework, make free transactions and payments. There has never been such a product in domestic banks.

Advantages of payment through Sberbank Online

Payments through remote systems from Sberbank involve the use of two equal products - Internet banking or a mobile application. The first is more convenient to use from a tablet, laptop or computer, the second from a tablet or smartphone on the iOS or Android operating systems. Payment through Online Banking and the application allows you to:

- Save time. There is no need to visit branches, stand in line at the cash desk or at the MFC.

- Complete transactions without filling out paper. All forms are registered electronically, which eliminates the possibility of errors in the recipient's account number or other details.

- Don't worry about information security. All data is protected using logins, passwords, SMS codes and additional internal encryption. Unauthorized persons do not have access to your personal account. If there is no client activity on the page or in the application for more than 15 minutes, the session is automatically closed. To access the online bank, you will need to re-enter your login, password and SMS confirmation with a one-time password. With their help, all transactions are confirmed, except for transfers of funds between the client’s personal accounts.

- Get financial savings. Many operations are carried out at reduced rates. The commission fee is either lower than at the box office or completely absent.

To gain access to online banking, you can order a card or register yourself on the official Sberbank website. To use the Mobile Application, you must first download it from the Play Store or AppStore, depending on the operating system of your smartphone. Operations in online banking can be carried out from any computer anywhere in the world, and the mobile application is tied to the device. Therefore, when traveling abroad, you should take your phone with you or use online banking to make payments.

Online banking transactions are available 24 hours a day, but some settlements may be delayed. For example, payments to organizations of legal entities whose current account is opened with another servicing bank may not be available during non-operating hours. Or the transaction on the payer’s account will be recorded, but the payment will only go out on the next business day.

How to transfer money online without commission to other SberBank clients

From your contacts

As in the first case, we start with the “Payments” button. But then, instead of “Between our own”, we select the line “To SberBank Client”. You will see a page with contacts from your phone.

And if you want to transfer money to one of them, then type the name in the search bar. The desired contact will appear after a few letters, then click on it:

Pay attention to the Sber icon. It usually stands with a contact whose phone number is linked to SberBank. If it is not there, you will not be able to transfer money from this window.

There is an icon, feel free to click on the name and find yourself on the next page. Here you need to do the following:

- Enter the transfer amount. By the way, in this window the input keyboard appears immediately.

- Select your account for debiting money (if you have several).

- Click the right arrow in the line with the amount.

By the way, there is even the opportunity to write a message to the recipient. It’s also a nice bonus if you need to add some comment in addition to the transferred money.

By phone number

First, you do everything the same as it was written at the very beginning, only having reached “Contacts”, from the proposed methods, now select the line with the inscription “Phone”:

And then enter your phone number and press the right arrow:

Further, as already described above with the transfer to your contacts. If suddenly an information window appears as in the picture below, this means either this subscriber is not a client of SberBank, or his account is connected to another phone number, or whatever is written there.

By the way, if you want to continue your actions, do not forget to click “Got it.” In the case where the phone number is not really connected to the SMS banking service, then this is the next way to transfer money to a SberBank client without commission.

By card or account number

There's not much to talk about here. Everything is done in the same way as in previous cases, with the only difference that instead of a phone number, a card or account number is entered. True, there is a small plus sign when entering a card. You can scan it, if you have it at hand, of course.

That's all about commission-free transfers to SberBank clients in the four cases described. According to statistics, these are the most frequently performed small transactions in Sberbank by individuals.

What services and bills can be paid?

Sberbank does not limit clients to whom they can transfer payments. It can be:

- public utilities;

- administrative fines;

- taxes and fees;

- services of cellular operators;

- payments in favor of legal entities for goods, services, works;

- fines for violating traffic rules;

- payment for kindergarten or clubs;

- services for entrepreneurs and representatives of small and medium-sized businesses;

- tuition fees;

- insurance payments.

The only requirement for the document on which payment is made is that it must contain the necessary details:

- recipient's current account;

- information about the servicing bank;

- personal account of the payer, if necessary;

- amount to be paid and other additional information.

Payment for mandatory and regular payments in favor of organizations providing housing and communal services to Sberbank Online differs from payments under an invoice in favor of other legal entities.

How to pay for housing and communal services or a traffic police fine

Payment of receipts through remote systems, such as Mobile Banking or Internet Banking, takes place in the following sequence:

- Log in to the application or your Personal Account.

- Select the payments tab.

- Find in the list the payment you plan to make.

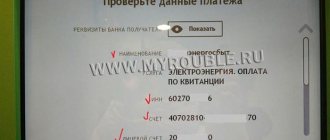

- Fill in the fields: for example, personal account, receipt number, full name, meter readings or other data.

- Enter the amount yourself or wait for the program to generate an automatic calculation, for example, when paying for gas or electricity.

- Please check all completed fields.

- Click next and wait for the one-time password to arrive on your smartphone.

- Fill in the confirmation field with the password from the SMS message. If the push notification function is activated, the data will be entered automatically when using the Mobile application. For a personal account on a computer, numbers must be entered only manually. The one-time password is valid for 300 seconds, which is due to additional security measures for financial data and access to it.

Data on the completed payment to the recipient is received during the business day or on the next banking day. This depends on how the agreement between Sberbank and the service provider is drawn up.

Payment of an invoice in favor of any organization

If you cannot find the one you need in the list of organizations, scroll to the bottom of the page. There is a record there for those who have not found the recipient, but their details are known. Or open the "Others" tab. You can also select the payment field using the details of the issued invoice in your Personal Account. In the form, fill in the following fields:

- Account number, INN, BIC, which can be found in the issued invoice or on the website of the organization receiving the funds. When the payer does not have BIC data, you can select the name of the bank that services the recipient organization. If the data is entered correctly, a legal name will appear, for example, JSC Biograd, LLC Network Solutions, etc.

- From the entire list of your available accounts opened with Sberbank, select the one from which the payment will be made, for example, from a salary card or credit card.

- Enter the purpose of the payment, for example, payment for goods supplied, services provided or work performed according to the invoice, invoice, certificate of completion. If the document has a number and date, enter this information as well.

- Enter your personal information as the payer if these fields require information and there is no auto-fill. For some organizations, it is very important that the name of the payer and the name to whom the invoice was issued match, so pay close attention to this point. For other institutions, the address is more important. Check that all information is correct.

- Enter the amount due from the invoice.

- Request a one-time password to confirm the transaction.

- Enter the numbers from the SMS sent to the authorized phone number.

All information about payments made goes into the payment history.

Payment by QR code

Institutions and organizations that often issue payments to individuals practice issuing receipts with a QR code. This makes the payment process easier for the client. It is enough to scan the picture, and the Online payment system itself will recognize the data for filling out the form. This method can be used by customers with mobile banking or paid through self-service terminals. In the application, the payment process is structured like this:

- Open the application.

- Select the Payments tab.

- Activate the appropriate one.

- Launch the QR code scanner and hold the receipt to your smartphone camera.

- If the scanner does not recognize the code, turn on the backlight to improve image brightness.

- Enter the amount to be paid and confirm with a one-time password.

What is a translation subscription?

The subscription allows you to carry out basic operations with an account in an amount over 50,000 rubles. without charging any remuneration. Therefore, if a client needs to send payments and transfers frequently and in large quantities, then it is beneficial for him to activate the package. To use the service, you must be a client of Sberbank and have a plastic debit card of the Bank in Russian currency.

It is important! Please be aware that there is a significant subscription limitation. Connecting a subscription will allow the user to transfer funds only to another Sberbank client.

Types of subscriptions, conditions and costs

The main question that interests users is how much does it cost to connect a subscription to Sberbank? Specific conditions depend on the option selected. It is convenient to evaluate the differences between types of subscriptions in the form of a table.

| Types of Sberbank subscriptions | For transfers | For payments and transfers | Plus 50 thousand rubles. |

| What's included in the package? | Making non-cash transfers to the accounts of the Bank's clients, incl. from card to card. | Non-cash transfers to cards and accounts of other Bank clients, as well as making payments, for example, payment of fines or housing and communal services | Possibility of increasing the limit by an additional 50 thousand rubles. Until the end of the month |

| 1 month | 199₽ | 299₽ | 99₽ |

| 3 months | 499₽ | 749₽ | – |

| 1 year | 1599₽ | 2499₽ | – |

As can be seen from the table, if a Sberbank user sends a large number of money transfers, then it is more profitable for him to subscribe for a longer period.

If the client needs to exceed the limit, then in this case the Sberbank reward will be applied - 1%, but not more than 1000 rubles. It is valid even if the transfer of funds is carried out in one region.

However, if a Sberbank client needs to increase the limit, then he can activate the service - “Plus 50 thousand rubles.” Within its framework, he will be able to receive 50 thousand rubles. in excess of the limit for making non-cash transfers to other clients of the Bank.

For such clients, there is an alternative option - the First and Private Banking service package. It includes unlimited transfers without commission.

Instructions for connecting a subscription on your phone through the application

The most convenient way to connect a service package is through a mobile application. To do this you need to use the following instructions:

- Log in to the application.

- Click on the “account” icon in the upper left corner.

- At the bottom of the page that opens, select “transfers without commission”.

- Go to the menu that opens.

- Select the appropriate tariff.

- Select the debit account and click on the “Continue” button.

- Click on the "Pay" button.

How to activate a package in your Sberbank@Online account?

It is currently only possible to connect to the service using a mobile application. There is no information on connecting from a computer. Customers are asked to activate the service and use it from their phone. According to information from the support service, technical specialists are already working to implement this function to connect a package of services through the desktop version of the personal account.

How do I turn off automatic renewal?

Sberbank provides automatic renewal of the service for users who have activated it. If an individual wants to refuse to use the service, this can be done at any time. To do this, go to your “Profile” in the mobile application and turn off auto-renewal in the “Tariffs and Limits” section.

It is important! Making payments and transfers without charging a commission is allowed only with non-cash payment methods.

However, if you want to carry out such transactions via an ATM, a commission of 1% will be applied, with a maximum of 1000 rubles. regardless of region.

When making a transaction through a cash register, a fee of 1.5% (not less than 30 rubles, not more than 1000 rubles) is applied, regardless of the region.

Thus, if you plan to make non-cash transfers in an amount exceeding RUB 50,000, then it is more convenient to buy a subscription.

- about the author

- Recent publications

● Education: higher, TSTU, organizational management, risk management and insurance● Internet entrepreneur, blogger;● practicing investor (since 2021 I invest in stocks, mutual funds, ETFs);● expert in freelancing and personal finance management.

● I live on passive income (I came to this from scratch)

Templates

If payments in favor of certain organizations are made frequently, then it is more convenient to create a template. They are visible in a separate folder in the menu on the right, which is easy to access and you don’t have to search and fill in the details every time.

There are three ways to create a template:

- When making a payment, during confirmation, activate the “Create template” button.

- Find a transaction with a payment already made in the history and create a template for it.

- In the “My Templates” folder, select the Create button.

Payment by barcode

Today, clients of a financial institution can pay for the services received using a barcode, which is present on almost all receipts issued by public utilities, commercial organizations and government agencies. These QR codes are needed so that individuals do not waste time and nerves manually entering data from notifications. To fill out the details in the payment order, they just need to scan the code, after which the system will automatically receive all the necessary information.

Payment of receipts by barcode is very popular among smartphone owners who have installed mobile applications on them. This service is also available to clients of a financial institution who have registered accounts on its official web resource. To make payments using QR codes, individuals need to act in a certain sequence:

- Authorization in the system is carried out.

- Select the “Payments” section in the menu.

- Click on the button: “Transfer to organization”, “Payment of fine or housing and communal services”.

- If the service is available to a client of a financial institution, the “Scan barcode” button will be displayed on the monitor.

- The individual must turn on the webcam and take a photo of the receipt.

- In order for the system to quickly recognize the QR code, it is necessary to achieve a high-quality image.

- A special form indicates the amount to be paid and the method of conducting the transaction.

- The financial transaction is confirmed.

READ Connecting NFC for payments in Sberbank: detailed installation guide

Auto payments and auto transfers

Autopayments are not available for all service providers. You can configure their automatic implementation mainly for the housing and communal services sector or cellular operators. In the menu in the automatic payments tab:

- select "Connect";

- enter the name of the service provider organization;

- fill in the fields and details;

- confirm via SMS.

When there is no longer a need for automatic payment, for example, a change of place of residence when paying for utilities, it can be completely removed or suspended for a certain time.

For some payments, you can select specific payment dates or periods. If there are funds in the account from which the payment is to be made, it will proceed automatically. A notification will be sent to your smartphone indicating that the payment has been successfully completed or that there are not enough funds in your account to process it.

Using the same scheme, you can set up automatic transfers in favor of other individuals. For example, regularly topping up a relative’s account or a child’s card. Both the sender and the recipient of the funds will receive notifications about the successful execution of the transaction. Auto translation settings are also confirmed by SMS.

Remote services allow users of Mobile Banking and Sberbank Online to free up time. If the templates are set up and they are automatically processed, it only takes a couple of minutes. Sberbank connects online services to its cardholders for free, and a number of services are provided with a minimum commission, so clients save not only time, but also money.

5 / 5 ( 2 voices)

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What can you pay for?

There are no restrictions on transactions in Sberbank Online. Individuals who have a personal account in the system can pay for the following services:

- utilities;

- for kindergartens;

- for studying;

- television, telephone, internet;

- fines;

- state duties;

- services provided by the management company, etc.

In order for individuals to be able to pay for notices without any problems, they need to enter the correct details in the payment order.

Some receipts have a QR code, which makes filling out the payment form much easier. The system automatically scans it, and all details are immediately displayed in the required columns. READ Payment for Ufanet through Sberbank tools

Comments: 6

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Boris

04/04/2021 at 00:38 there is no simple step-by-step instructions on how to pay for the goods

Reply ↓ Anna Popovich

04/04/2021 at 01:17Dear Boris, the interface of the Sberbank mobile application is intuitive. To pay for goods, you can enter your card details in the payment window on the seller’s website or transfer money using your account (phone number) yourself. If you need help, you can contact the bank's support service by calling 900 from your mobile phone.

Reply ↓

13.10.2020 at 20:35

Personal account for Internet payments. I wanted to link the payment to a bank card, but there you need to fill out a field where you indicate the entire bank card number. This confuses me, because... banks do not recommend doing this

Reply ↓

- Anna Popovich

10/14/2020 at 16:18

Dear Galina, if you do not indicate the card number, the service will not be able to automatically debit funds.

Reply ↓

10/07/2020 at 14:03

How can you pay just a personal bill with just the account numbers without any data from a Sberbank card and using a mobile banking application?

Reply ↓

- Anna Popovich

10/07/2020 at 14:50

Dear Anatoly, enter your personal account number in the online application and, if necessary, confirm the operation with an SMS password. How do you encounter payment problems?

Reply ↓

How to use SberPay? How to pay for a purchase at the checkout?

There are two options - with a minimum number of actions in the application and two touches of the smartphone to the payment terminal, or with activation of SberPay in the application and one touch of the smartphone to the terminal.

Option 1:

- Open the Sberbank Online application.

- Bring your smartphone to the terminal.

- Unlock your device.

- Bring your smartphone to the terminal again to make a payment.

Option 2:

- Open the Sberbank Online application.

- Go to "Payments".

- Select "Payment SberPay".

- Unlock your device.

- Bring your smartphone to the terminal to make a payment.

The first option seemed less convenient to me, since it is better to set everything up in advance and use your smartphone to pay only once. On the other hand, with the first option, after the first application of the smartphone, the amount will be displayed on the screen, which will be debited from the account after the second application.

By the way, if you decide to disable unlocking your phone with a password, SberPay will automatically be disabled, since this is a mandatory security requirement. After this, you will have to activate the payment system and add cards again.

You can also read a more recent overview of setting up the SberPay service (with the addition of MIR cards): here. Perhaps there will be details you are interested in, since the application has undergone changes over time.

What are Sberbank's tariffs for paying for housing and communal services?

To pay utility bills using Sberbank services, a commission is provided, like any financial institution. It varies from 0% to 3% and depends on the existence of an agreement concluded with the service provider to the consumer. With many companies, a service agreement allows you to pay for services with a 0% commission. Its size is set by each bank in accordance with the method of payment execution. Depending on the channel for payment for housing and communal services, the consumer will be charged a commission in the following amount:

- 1% of the payment amount (maximum 500 rubles) is charged when paying for housing and communal services through Sberbank online, Mobile Bank or with connected automatic payment;

- 1.2% (maximum 500 rubles) costs when using a bank card at any ATM or Sberbank terminal;

- 2% (minimum 10 rubles and maximum 2000 rubles) commission when paying a receipt using terminals in cash;

- 3% (minimum 25 rubles and maximum up to 1500 rubles) will be a commission for settlements through a bank cash desk using a client card;

- 3% (minimum 30 rubles and maximum up to 2500 rubles) for cash payments at the Sberbank cash desk.

The most profitable way to pay utility bills is considered to be remote methods.