Improving the living conditions of families with children is one of the goals of the state maternity capital program. The money can be used to buy an apartment or house. How to do it right? What formalities must be followed? And what are the conditions for buying a house with maternity capital? Lawyer Yuri Kapshtyk answers questions.

In 2021, you can receive maternity capital at the birth of your first child. The state will pay each family where the first child was born a little more than 483 thousand rubles. At the birth of the second baby, the amount will increase and amount to 639 thousand. These funds cannot be used as you wish, only for clearly defined purposes. Buying a house is on their list. If parents want to purchase housing in which the family will be spacious and comfortable, they can do so.

pixabay.com/

The funds allocated by the state are not enough to purchase real estate in any region. Therefore, it is assumed that the amount of maternal capital will be added to the family’s own funds, a loan or money received from the sale of other real estate, for example, a small apartment that young parents want to exchange for more spacious housing.

“Buying a house with maternity capital in 2021 is possible,” says lawyer Yuri Kapshtyk. “The law allows investments in real estate aimed at improving living conditions.”

A few figures about maternity capital

Maternity (family) capital is a government program aimed at solving the demographic problem in Russia. Since 2007, the state began to allocate a certain amount to families in which a second child was born.

As a result, the program turned out to be so popular and effective that it has already been extended three times - first until 2021 instead of 2016, then until 2021, and recently until 2026 (and, they say, will eventually make it permanent).

And, indeed, maternity capital has touched almost every family in Russia in one way or another:

- In total, more than 10 million capital certificates were issued;

- the total amount of expenses under the program is 2.9 trillion rubles (for comparison, the annual volume of the federal budget is about 23 trillion);

- 93% of the total amount is spent on improving living conditions;

- scientists highly appreciate the effectiveness of the program - in the first 10 years, thanks to maternal capital, the birth rate increased by 20-25%;

- the decline in the birth rate in 2018-2019 could be associated with the unclear prospects of the maternity capital program, which was eventually extended.

Monthly payments from maternity capital

Thanks to the initiative of Vladimir Putin, starting from 2021, there is a new opportunity to manage maternity capital before the child turns 3 years old. Families in which a second child was born or adopted after January 1, 2021 can receive monthly payments from MSC funds. However, this is permitted provided that the monthly average per capita family income, calculated over the last 12 months, does not exceed the subsistence level for the working-age population, which is established for each specific region (see table by region). The payment amount is equal to the regional children's subsistence level .

This measure of social support is provided until the child turns 1.5 years old :

- From the date of birth - if the applicant applied for registration no later than six months after this date (funds for the missed period will be transferred in full).

- From the date of application - if it was made later than six months from the date of birth of the child.

With the application for an order to the Pension Fund, you must provide the following documents:

- Certificate for maternal capital or its duplicate.

- Identity cards of all family members of the applicant.

- Confirmation of residence of all members of the certificate holder.

- Confirmation of the applicant’s residence in the Russian Federation.

- SNILS of all members of the applicant's family.

- Information about family composition (certificate of marriage or divorce, birth of all children or a court decision on adoption, certificate of change of personal data).

- Certificate of bank details of the account opened in the name of the recipient of the certificate.

- Information about the income of the applicant and his family members.

- Reasons not to accept the calculation of the income of an individual family member.

- Documents confirming single-parent family composition (if the applicant applies as a single parent).

- A court decision or other documents confirming the recognition of a citizen as deceased, missing, deprivation of his parental rights (or decisions to cancel these documents).

- Identification documents and confirming the authority of the authorized person - in case he applies instead of the recipient of the certificate.

- Documents confirming the registration of guardianship, as well as permission from the guardianship and trusteeship authorities (TSA) to spend capital funds, if the guardians apply.

It is important to understand that this measure of social support applies only to the second child . Even if a third or subsequent child appeared in the family after 01/01/2018, it will not be possible to issue a monthly payment for him from the MSK for up to 1.5 years.

Who is eligible for the certificate

From 2007 to 2021

It was very simple to understand who has the right to maternity capital:

- the family must have two or more children;

- at least one of them must be born in 2007 or later;

- both the mother of the child and the children are citizens of the Russian Federation.

In 2020, the most serious changes were made to the program

throughout its history - by abolishing the rule about the second child, as well as dividing the amount of capital depending on what kind of child was born in the family and in what year.

Now, under the terms of the program, maternity capital is given to the following families:

- a second or subsequent child was born in the family from 2007 to 2021;

- the first child was born in the family in 2021 or later;

- a second child was born in the family in 2021 or later (if the first was born before 2019 inclusive);

Accordingly, now one more is added to the conditions that were in force until the end of 2021

: maternity capital is received by women who give birth to their first child in 2021 or later.

the father of the child can also receive maternity capital

, but only in a few cases:

- the father is the sole adoptive parent of this child;

- the child's mother has died or been deprived of parental rights to this child.

And if neither the mother nor the father of the children can receive maternity capital, the children themselves can receive it.

What can you spend money on from the certificate?

From the very moment of the launch of the maternity capital program, one key condition remained in it - money according to the certificate is not issued in hand

. They can be spent only on those purposes that in one way or another should ensure the future of the family and children, and only when the child for whom maternity capital was issued turns 3 years old (except for a few areas).

You can spend money from maternity capital for the following purposes:

- improving the family's living conditions. There are several options here:

- pay extra with maternity capital for part of the cost of housing when purchasing it. You can buy any suitable housing - both in a new building and on the secondary market, or even buy a private house;

- use the certificate to partially or fully repay interest on a mortgage loan;

- use the amount in the certificate as a down payment on a mortgage loan;

- repay the principal amount of a housing loan in full or in part with a certificate;

- send a certificate for the construction or reconstruction of a private house on your site. The money is allocated in two parts with an interval of 6 months (and to receive the second half of the amount you need to complete the main work on building the house);

- receive reimbursement of expenses for an already built house using a certificate. The main condition is that it must be built after 2007.

- payment for a child's education. You can use funds to pay for education in various institutions: from a private kindergarten and private school, to a driving school and a higher education institution. At the same time, a child student can even pay for accommodation in a university dormitory. The main thing is that the child is 3 years old (except for preschool fees), the eldest is under 25 years old, and the educational institution has a license;

- payment for goods and services necessary for social adaptation and integration into society of disabled children. This does not apply to medical services and rehabilitation goods, which the state already provides to disabled people free of charge;

- formation of a funded pension for the mother of children. At any time, maternity capital funds can be directed toward pension savings, and then at any time, withdrawn from there. True, the funded pension system has been in a “suspended” state for a long time, so the option is controversial;

- arrange a monthly payment for a second child under 3 years of age in the amount of the subsistence minimum. This can only be done by those families whose average income per family member is below two subsistence levels in the region.

That is, in fact, you can receive maternity capital in cash - for example, as compensation for expenses for an already built house (even if it was built before the birth of the child) or in the form of monthly payments - over 3 years the state will pay approximately 400 thousand rubles (living wage per child in the regions - about 11 thousand rubles).

At the same time, in 2015 and 2021, the state paid, at the request of families, 20 and 25 thousand rubles one-time

. There have been no such payments since then, and none are expected in the future.

How to get a certificate

The Russian Pension Fund is responsible for issuing certificates and organizing the entire process, but from 2021 this is no longer so important. If previously the mother had to personally contact the Pension Fund office and receive a paper certificate there, now everything is extremely simplified:

- after the birth of a child, this fact is registered in the registry office;

- The civil registry office sends data about this to the Pension Fund through its system;

- The Pension Fund of Russia, having received the data (including SNILS), issues a certificate within 15 calendar days;

- the parent will receive a certificate in the user’s personal account on the State Services portal.

Only if for some reason the certificate was not issued without application

, the mother should contact the Pension Fund with an application. This can be done directly at the State Services by filling out a simple form (you only need to enter information about the child), or by contacting the Pension Fund or MFC in person.

In addition, maternity capital certificates have already been converted into electronic document format

. That is, what will come to your personal account at State Services is a certificate.

Maternity capital for preschool education of children

Another new opportunity to use MSC before a child turns three years old is to pay for preschool education , childcare and childcare services. You can use the certificate to pay for kindergartens and nurseries, including private ones. However, they must be registered as legal entities, that is, operate in the form of organizations. You cannot use maternity capital to receive services from individual entrepreneurs.

List of required documents:

- Certificate for MSK or its duplicate.

- Passport and SNILS of the applicant.

- Confirmation of the applicant's place of residence.

- When applying to the Pension Fund or MFC, instead of the recipient of the certificate, his authorized representative - an identity card and documents confirming the place of primary residence and the powers of this authorized person.

- If necessary, confirm the change of personal data.

- Agreement for the provision of services concluded between the applicant and the educational organization, which specifies the obligations for the maintenance of children, care and supervision of them, as well as the calculation of the amount of payment.

How to use money from the certificate?

It all depends on what purposes you plan to spend maternity capital. In short, in most cases you need to fill out an application for disposal of maternity capital funds, but each situation has its own conditions:

- improvement of living conditions: the easiest way is to use capital for a mortgage, then you can fill out an application directly at the bank. If you plan to buy a home without a loan or build it, you need to write an application to the Pension Fund; this can be done through the MFC or your personal account on the department’s website. In each case, you need to attach a certain package of documents - for example, a purchase and sale agreement, an extract from the Unified State Register of Real Estate, an equity participation agreement, documents for the plot, etc.;

Important:after the housing becomes the property of the family, shares in it must be allocated to all family members (that is, both parents and all children). The law does not stipulate what shares these will be.

- child’s education: you need to write an application to the Pension Fund for the disposal of maternity capital funds and attach to it a certified copy of the agreement for the provision of paid educational services;

- monthly payment for the second child: you need to submit an application to the Pension Fund (by any means), all necessary data, including information on family income, is collected by the Pension Fund independently;

- mother's funded pension: one application to the Pension Fund is enough (and this decision can also be withdrawn upon application);

- means of social rehabilitation of a disabled child: you need to submit an application to the Pension Fund of the Russian Federation, attaching a rehabilitation program, documents for the purchased funds, as well as a certificate of conformity of the goods.

In any option, you can manage your maternity capital without leaving your home - through State Services or your personal account on the website of the Russian Pension Fund.

Using maternity capital to purchase housing for up to 3 years

After receiving a personal certificate, family capital can be used to purchase or build housing only to fulfill loan obligations to financial organizations (banks, credit cooperatives, etc.), or more precisely:

- payment of the first installment on loans or borrowings (including mortgages);

- repayment of principal;

- repayment of interest on loans or borrowings.

The law does not limit the number of credits and loans for which maternity capital can be used, so certificate funds can be used to pay for several housing loans at the same time. However, it is necessary to understand that MSC cannot be used to pay off penalties and other penalties for late payments according to the payment schedule.

Documents for the purchase or construction of housing using maternal capital

The main list of documents required for the purchase (construction) of housing using mat funds. capital:

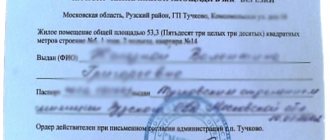

- Application for disposal of maternity capital.

- Certificate for family capital (its duplicate).

- Applicant's identity card.

- Documents confirming the place of residence (stay) of the certificate holder.

- The applicant's pension insurance certificate (SNILS).

- A marriage certificate must be additionally provided if one of the parties to the purchase and sale (construction) of housing transaction is the spouse of the certificate recipient or they carried out work on the construction or reconstruction of an individual housing construction project (IHC).

- A notarized obligation to allocate shares in the residential premises to all family members.

Documents required when paying the first installment on a loan or loan issued for the purchase (construction) of housing:

- A copy of the agreement (credit or loan) for the purchase or construction of housing.

- A copy of a state-registered mortgage agreement, if such conclusion is required by the terms of the credit agreement (loan).

Documents for ordering MSC to repay the principal debt and interest on a loan or loan:

- A copy of the loan agreement. If the certificate funds are used to repay the principal and interest on a credit (loan) received earlier, you must additionally provide a copy of this agreement.

- A certificate from the lender (the person who provided the loan) about the balance of the principal debt and interest on the loan or loan.

- A copy of the mortgage agreement that has passed state registration, if its conclusion is provided for in the loan agreement.

- Extract from the Unified State Register of Real Estate.

- If the individual housing construction project has not yet been put into operation, it is additionally necessary to provide a registered agreement for participation in shared construction or a copy of the permit for the construction of a private house.

- If the credit or loan was taken to pay the entrance and (or) share fee to the cooperative - confirmation of membership in the cooperative of the recipient of the certificate or his spouse.

- A document confirming the non-cash transfer of a loan to an account opened with a credit institution in the name of the MSC recipient or his spouse.

All copies of documents are provided to the Pension Fund , accompanied by originals , which will be returned to the applicant after verification.

Is it possible to use maternity capital for up to 3 years to buy an apartment?

It is allowed to use maternity capital to purchase an apartment or other housing without waiting three years from the birth (adoption) of a child when sending funds to pay off credits or borrowings .

To do this, the applicant must submit to the territorial body of the Pension Fund an application for the disposal of MSC funds and the necessary documents. This can be done in person, as well as through a legal representative or proxy (provided that additional identification documents and credentials are provided). Citizens living in the Russian Federation can submit an application for disposal and related documents through a branch of the Multifunctional Center.

An application for disposal of funds will be considered no later than one month from the date of its registration. After the decision is made, a corresponding notification is sent to the applicant within five days ; if the documents were submitted through the Multifunctional Center, then the notification is sent to the same branch of the MFC.

In addition to purchasing an apartment, MSC funds can also be used to fulfill obligations under a loan agreement for:

- buying or building a house;

- purchasing a share in a residential property from a relative;

- purchasing a room in a dorm or communal apartment.

Loan for maternity capital for the purchase of housing up to 3 years

According to Resolution No. 862 of December 12, 2007 on the rules for using maternal capital to improve housing conditions, capital funds can be used to repay a loan if it was provided under an agreement for the purchase or construction of housing, which was concluded with one of the following organizations:

- Credit organizations (legal entities) that carry out banking operations on the basis of a license issued by the Central Bank of the Russian Federation.

- A credit consumer cooperative (CCC), which has been operating for at least three years from the date of state registration.

- Another organization that provides loans under a loan agreement, the fulfillment of obligations of which is secured by a mortgage.

The lender must transfer funds by bank transfer to the personal account of the recipient of the certificate (or his spouse) opened with a credit institution.

To receive a loan from a credit cooperative, you must be a member—a shareholder. The advantages of this method are the short loan period - 2-3 months, as well as more loyal requirements for borrowers than in banks. Loan repayment by members of the CPC can be ensured by a guarantee, collateral, and other methods provided for by federal laws.

When applying to other credit organizations (this concept is not fully regulated by law) that provide mortgage loans, income and credit history are not as important as for banks. The amounts with which such companies work are approximately comparable to the size of maternal capital (400 - 500 thousand rubles). To make sure that the Pension Fund will approve the allocation of funds to pay for such a transaction, financial organizations carefully check the purchased housing and the applicant’s documents. Thus, the solvency of the loan recipient is secured by the funds of the certificate, and the real estate itself is under an encumbrance until the money is transferred from the Pension Fund.

The main stages of buying a home using a loan:

- Consideration of an application for a loan for the purchase or construction of real estate.

Usually you need to provide passport data, a certificate for maternal capital and information about the property. The acquisition of land for construction using MSK funds is not provided for by law. It is possible to build an individual housing construction project only on a plot that has already been registered as the property. - Registration of the purchase and sale transaction and signing of the loan agreement. After state registration of the agreement, funds are transferred in non-cash form by the lender to the real estate seller or applicant.

- Contacting the territorial Pension Fund with an application for disposal and the required documents. If a positive decision is made, the money will be transferred to the account of the organization that issued the loan within 10 working days .

Until 2015, families could receive a loan against maternity capital from a microfinance organization (MFO). However, this opportunity allowed citizens to cash out certificate funds without further spending them in the direction permitted by law. Because of this, changes were made to the law on additional measures to support families with children, prohibiting MFOs from working with maternal capital, as well as tightening requirements for the CCP (Article 1 No. 54-FZ of 03/08/2015).

Is it possible to pay off a mortgage with maternity capital if the child is under 3 years old?

Means mat. capital may be used to pay off mortgage obligations that arose both after the birth of the second or subsequent child, and before that moment. In this case, there is no need to wait 3 years to improve your living conditions.

Early transfer of funds is possible to:

- Payment of the first installment . When applying for a mortgage loan, banks always require a down payment, the amount of which can range from 10 to 30% of the cost of housing.

- Repayment of principal and interest on the loan.

The procedure for sending MSC for mortgage repayment is as follows:

- Registration of a personal certificate.

- Submitting an application for disposal (indicating the chosen direction of use and amount) and the necessary documents.

- Transfer of funds to the account of the credit institution that provided the money.

It is worth noting that the concept of “mortgage” itself does not mean a long-term loan at high interest rates. A mortgage involves pledging real estate as a way to fulfill loan obligations.

The bank may refuse to issue a loan due to low family income or bad credit history. Also, families themselves often do not want to take out a long-term mortgage and overpay interest. In these cases, you can contact KPK or other financial organizations that provide loans without real estate collateral.