Benefits for a third child in 2020-2021 on a mortgage

One of the significant achievements of recent times can be considered the adoption of the Federal Law “On Measures...” dated July 3, 2019 No. 157-FZ, which introduced a mortgage benefit for the third child or subsequent children.

Important! The benefit does not apply to the second child or firstborn. Only for the third, fourth, fifth and subsequent children. It does not matter whether the eldest child has reached the age of 18 or not.

According to paragraph 2 of Art. 1 Federal Law No. 157, you can receive a mortgage benefit at the birth of a third child if the following conditions are met:

- The mother or father of the children, as well as the children themselves, must be citizens of Russia.

- The third or subsequent child must be born between January 1, 2021 and December 31, 2022.

- The mortgage loan, which is planned to be repaid using the benefit for the 3rd child, must be taken out by a large family before July 1, 2023.

This benefit allows you to receive from the state an amount of 450 thousand rubles to repay an already taken mortgage on housing (house, apartment) or land plot for individual housing construction.

According to paragraph 4 of Art. 1 Federal Law No. 157, funds are transferred by bank transfer to the creditor bank and are used primarily to repay the principal debt. If the amount of debt is less, interest on the loan is repaid from these funds. If the total amount of debt is less than 450 thousand rubles, the state will transfer only the amount of the debt.

This benefit is provided once and can be used to repay one or more loans, including from different banks.

Registration of benefits

Decree of the Government of the Russian Federation dated September 7, 2019 No. 1170 approved the Regulations, which determine the procedure for obtaining benefits.

The mortgage benefit is issued by the bank that issued the loan. To apply, the borrower must submit an application to the bank and submit:

- passport and birth certificates (passports) of children, and in case of adoption (guardianship) supporting documents;

- document on the acquisition of real estate;

- mortgage documents (loan agreement, mortgage, etc.).

Since most of these documents are available at the bank, the final list of required papers should be clarified with the credit institution itself. After receiving the documents, the bank carries out all further actions to implement the benefit independently.

Important! The bank cannot charge a commission for processing documents and other services related to the exercise of the right to a mortgage benefit.

From the moment the application and documents are accepted from the borrower, if they are completed correctly, funds to repay the loan must be sent to the bank within 19 days.

Find out what other benefits are available to large families in ConsultantPlus. Trial access to the legal system is free.

Possible reasons for refusal of a subsidy

There are a number of reasons why a family may be denied a subsidy of 450 thousand rubles:

- The purpose of the mortgage does not meet the requirements specified in the law, for example, the loan was issued for the construction of a house or renovation.

- Incomplete package of documents or incorrectly completed certificates.

- Inappropriate spending of funds.

- The adoption of the child was incorrectly formalized or not confirmed by law.

If a subsidy is refused, it is recommended to correct the shortcomings and only then resubmit the application. And in order to assess the chances of approval, it is necessary to clarify the purpose of the mortgage loan in advance. It is important to remember that you can receive financial assistance in the amount of 450,000 rubles for 3 children to pay off the mortgage only once, even if the number of children increases.

What tax benefits can you get for the birth of a third child?

Another type of benefit is provided for by tax legislation. As in the case of a mortgage, benefits for the birth of a second child or first child do not apply. Parents with three or more children can be provided with two tax deductions:

- on property tax on housing;

- on land tax.

Find out if there are transport tax benefits for families with many children, find out in ConsultantPlus by getting free trial access to the system.

Benefits for the birth of a child (he must be the third or subsequent in the family) for tax payments for housing are provided in accordance with clause 6.1 of Art. 403 Tax Code of the Russian Federation. This benefit allows you to reduce the taxable area of an apartment by 5 (residential building - by 7) meters for each child.

For example, a benefit for the 3rd child (if there are three children in a family) will reduce the taxable area of the apartment by 15 meters. If there are five children, then the vacated footage will be already 25 meters.

According to sub. 10 clause 5 art. 391 of the Tax Code of the Russian Federation, if there are three or more children in a family, the family is exempt from paying land tax for 600 square meters of land owned by it.

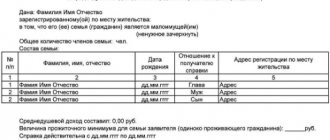

Parents can prepare and submit an application for benefits to the tax office themselves, attaching documents confirming this right:

- applicant's passport;

- documents for children (birth certificates or other documents confirming that there are three or more children in the family);

- title documents for housing or land.

Moreover, if the tax authorities have information about a large family and the property it owns (for example, other benefits or deductions were issued), then the inspectorate will independently reduce the amount of tax for a large family.

What kind of housing can families with children buy with a mortgage with state support?

It is important to know that not only are there requirements for the parties to the transaction, there are also requirements for the property you want to purchase. For most regions, the most important condition is the purchase of real estate on the primary market from a legal entity.

What you can buy:

- An apartment in a residential complex under construction from the developer,

- Already completed new building also from a legal entity,

- Private house with land,

- Housing on the secondary market in the Far Eastern Federal District, but only if it is located in a rural settlement.

It is allowed to use money for the construction of a private house from 2021, but under a contract agreement with a legal entity or individual entrepreneur

. It is important that all work is carried out exclusively under an official contract.

What mortgage funds cannot be used for under this program:

- To independently build a house;

- To purchase an apartment or room on the secondary market from an individual,

- For the purchase of commercial real estate.

Land plot for a large family

The answer to the question of what benefits for a third child are provided for by land legislation is given in Art. 39.5 of the Land Code of the Russian Federation. Regional authorities, by their regulations, must determine the rights of citizens to receive and the procedure for providing land plots to families with three children or more.

Land plots are provided to parents with many children, for example, in the Moscow, Voronezh, Bryansk regions, Krasnodar Territory, etc. Most often, land is allocated in rural areas. Moreover, in addition to having many children, applicants may be subject to additional requirements, for example:

- the need for improved housing conditions;

- residence in the area where the plot is requested for a certain period of time;

- a certain age or profession of parents, etc.

Therefore, in order to figure out whether a large family can receive a plot of land (and in general, what benefits are available for a 3rd child in the region), you need to carefully study the regional legislation or contact the social security authorities.

Advantages and disadvantages of the state program

Some families have already taken advantage of government assistance and appreciated the benefits of the subsidy, namely:

- the opportunity to accelerate the improvement of living conditions;

- reducing the burden on the family budget;

- prohibition on cashing out funds and using them for other purposes;

- simplicity of design.

Naturally, like any banking product, financial support in the amount of 450 thousand rubles to pay off a mortgage has its drawbacks, including strict requirements for real estate, one-time use, and the inability to use funds for other family expenses.

The subsidy opens up wide opportunities for large families. Find out more about mortgage programs with government support on the official website of Rosbank Dom.

Results

The legislation provides for a number of benefits for large families: taxes, mortgage repayments, and free receipt of land. Regions may establish other benefits (for travel, purchasing vouchers, etc.).

Sources:

- Tax Code of the Russian Federation (part two) dated 05.08.2000 No. 117-FZ

- Land Code of the Russian Federation dated October 25, 2001 No. 136-FZ

- Federal Law “On measures of state support for families with children in terms of repaying obligations on mortgage housing loans (loans)” dated July 3, 2019 No. 157-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In which banks can you get a mortgage with state support?

Preferential loans with state support are not issued by all banks, but only by those credit organizations that are on the list approved by the state. There are about 50 of them, that is, the list includes the largest and most trusted banks; the full list can be found at this link.

Where Russians turn most often:

- Sberbank;

- VTB,

- Bank "Dom.RF",

- Rosbank,

- Rosselkhozbank, etc.

The conditions are approximately the same for everyone, because the loan is issued with a subsidized interest rate.

However, each bank has the right to independently evaluate the borrower and his solvency, so personal requirements and the list of documents required to consider a mortgage application will vary.

Let's look at an example:

| Bank | Annual interest rate | An initial fee | Term | Additional terms |

| Sberbank of Russia | From 5% | From 15% | Up to 30 years old | It is possible to reduce the interest rate to 0.1% per annum under the program for subsidizing the rate by developers |

| VTB | From 4.3% | From 15% | Up to 30 years old | The rate from 4.3% to 5.3% is valid for the first 6 months, then it will be 6.5% per year |

| Bank "Dom.RF" | From 4.45% | From 15% | Up to 30 years old | Lending without proof of income, insurance does not affect the rate |

| Rosbank | From 3.5% | From 15% | Up to 25 years | During the first year or two, you can pay a third or half of the monthly payment |

Please note that the most favorable conditions and low rates will be available only to salary clients

. Therefore, we recommend that you contact the bank where you have a salary project (or transfer receiving your salary to the bank that offers the lowest interest rate).

Mortgage during pregnancy

It is not prohibited to take out a mortgage during pregnancy. There is no need to advertise this fact to Sberbank at all. However, in the third trimester it is unlikely to hide this from the loan officer. In addition, you should understand the severity of the financial burden at the birth of a child and evaluate the speed of re-issuing a mortgage under preferential terms.

When carrying only their first child, parents can only hope for a mortgage holiday or restructuring. As for expecting a second or third child, it is recommended to weigh all the possibilities and risks. To qualify for benefits, the birth must be successful (without death). But after the birth of the child, the woman goes on vacation and only the working father can apply for a mortgage.

Conditions for reviewing the repayment process

If the mortgage agreement is signed, then no one involved has the right to change it unilaterally. Sberbank, in principle, does not initiate adjustments to existing mortgages. Rather, it is characteristic of the debtors themselves to reduce individual debt obligations. Or their cancellation. Along with this, applicants have a guarantee of claims for mortgage deferment.

Individual adjustment of mortgage parameters by Sberbank is still acceptable, but if the borrower fails to comply with the conditions. For example, if he refuses voluntary insurance after signing all contracts. The fact is that such insurance gives a discount on the interest rate, and according to the rules of the insurance companies, the service contingent has a period within which they have the right to refuse everything.

Additional benefits from the bank

Sberbank’s customer focus helps the population served here, together with banking personnel, select the most appropriate service methodology. Promoting the activities of the state and taking into account the interests of civilians is quite acceptable and beneficial for the financial institution itself, since in this way it is guaranteed the successful completion of the mortgage.

Young Family Program

The named program is not a separate mortgage product. These are additional privileges of Sberbank, valid within standard mortgage categories. The inclusion of this discount offer, which reduces the rate, can be done independently in the online calculator and see the difference in payments. As of autumn 2019, a reduction of 0.4 points is guaranteed.

Mortgage restructuring during maternity leave

Postponement of the moment of payments in the same way and in accordance with the payment schedule is permissible thanks to restructuring. One of her motivations is to give birth to people's children. And it doesn’t matter which child it is. The most important factor is the financial viability of the parents after his birth.

If a couple or single parent still has a good level of family income (despite the presence of a newborn child) thanks to working alone and maternity benefits, then Sberbank may not approve the restructuring. However, in this case, the workers themselves are not interested in suspending payments. In addition, all such actions are reflected in the credit history, despite the official status of the procedure.

Legal basis

The central legal act at the federal level on allocated funds is PP No. 1711 of December 2021. When some of its provisions are changed and innovations are included, separate legislative acts are created and signed. The federal government and the President of the Russian Federation take part in their initiation.

Requirements for a participant by law

Orders regarding the identity of the applicant are considered in two main directions: his reliability and welfare. The second position is confirmed by documents brought to the manager from the official place of work. The reliability of a clientele is assessed mainly by its credit history. It includes all aspects of taking out loans and the specifics of closing them.

Who is entitled to benefits and deferments?

No classification of citizens is provided here. They are not required to receive the official status of needy or low-income people, and they do not need to meet any socio-demographic characteristics regarding government programs. The latter condition is available only for the “Young Family” campaign, where the age of applicants must be up to thirty-five years.

How to apply and where to apply for benefits

If the question concerns the selection of a specific Sberbank branch, then you are allowed to contact the same one where the mortgage was issued. Although, when moving to a new place of residence, the possibility of contacting another in the area of residence is not excluded, if mortgage servicing issues are dealt with here.

Regarding the need to visit government agencies, it is worth noting that such a need exists when issuing a certificate for maternity capital. It must be shown to the loan officer along with the rest of the documentation. For other areas of work within the mortgage framework, you have to turn exclusively to Sberbank itself. He evaluates and approves the candidacy based on the documents presented.

Is it possible to write off the debt completely?

This is quite possible with a remaining amount equal to the benefit included in the payment process. If it is less, then the remainder of the subsidy is distributed further depending on the specifics of the program. If this is parental capital, then the remaining money is used for other purposes. The remainder of the benefit of 450,000 for the third child goes back to the state budget.

If we are talking about the maximum reduction in the interest rate on a mortgage with state support for married couples, then the current norm here works throughout the entire mortgage. It has no effect on reducing dates or writing off the mortgage. The restructuring and refinancing mentioned earlier are not aimed at this either. They only relieve debt dependence.

Programs from Sberbank

The mortgage line of Sberbank's activities involves a variety of highly targeted and specialized products. The latter often work with marriages in which there is a child or several children. In this case, a variety of real estate is subject to purchase: at the stage of construction or already put into operation.

Refinancing

Such on-lending is characterized as the integration of several debts into one debt account in the bank system. The benefit from the partnership for Sberbank is determined by several parameters. Firstly, it attracts new finance and increases the quantitative indicator of mortgages and loans in general. Secondly, it receives a client who has proven solvency.

There are also clear advantages for the borrower himself. Especially if the rate offered by Sberbank is less than the average interest rate on a citizen’s current debts. Moreover, the unification of debts also implies the unity of the payment schedule. This means that there will be one payment date and a person will not have to track several schedules.

Repayment of part of the mortgage within the framework of an existing project

The previously mentioned maternity capital is also included in the payment process already with an existing mortgage. Connection and offers of 450 thousand for large families are also available. As for a mortgage with a rate reduced to 5%, it can be obtained through a refinancing channel from another institution.

By reducing the general level of the refinancing rate, the applicant can achieve a reduction in some debt volume. In fact, there will be a partial write-off. In addition to this, Sberbank offers to add funds for personal use. However, in this case, the benefit of debt reduction may not be entirely clear.

How can a family with children get a mortgage with state support?

To summarize: if you are interested in the conditions of the state program of preferential mortgages, and you want to take advantage of it, then you need to follow these simple steps:

- Decide on the bank where you will apply for a loan to purchase real estate - we traditionally advise choosing large market players, with extensive experience and a sufficient number of branches and ATMs in your city for the convenience of repaying the debt (many of them have rates below the maximum),

- Once again, carefully study all the conditions and requirements, and if necessary, contact the bank for advice. Make sure that you really are eligible to participate in the state support program,

- Find housing that will meet the program requirements. We advise you to use the service for checking new buildings and developers so that you do not have any legal problems. Here is the link to it,

- Contact a bank that has a family mortgage program in its arsenal and apply for its participation. Each bank has its own rules and requirements for the borrower, check the list of documents required from you, and proceed to apply for a loan.

Let us remind you that the terms of the program allow you to use maternity capital to pay off debt partially or completely.

You can use money from the state both to pay the down payment and to pay off the principal amount of the debt, and you do not have to wait until the child turns 3 years old.

Advantages and disadvantages

Perhaps the main disadvantage for parents is that significant assistance can only be expected at the birth of a second, or better yet, a third child. In addition, each proposal has its own orders, as well as restrictions that people must comply with. For example, the birth of the desired child and the conclusion of a mortgage agreement during certain time periods.

Another significant drawback is the uniform size of subsidies throughout the country. In regions remote from the center, the proposed amounts may even cover the entire mortgage, but for Moscow and the Moscow region they constitute a small part of it. In this case, you have to rely only on additional initiatives to close the mortgage from regional authorities.

The advantage of all existing projects is that they still significantly simplify life for established families, for whom it is difficult to combine childbearing with covering a mortgage. In addition, it is not prohibited to combine several similar projects, doubling the subsidized amounts due on the mortgage.