The program allows you to:

- Conveniently and quickly understand who owes, how much and for what (with the ability to select by the amount and terms of the debt)

- Automatically generate warnings and claims for debtors

- Print color receipts for debtors

- Track settlement payment schedules

- Make automatic calls to debtors

- Increase collection rates using new methods of accepting payments: payment through online banking and through a mobile application

In this article we will look at all these program features in more detail.

Report to inform about debt in the house

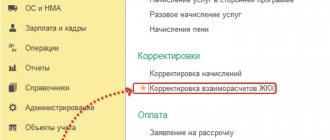

Before moving on to the specialized block Working with debtors

Let's look at the report from the

Service Charges

, which our clients often ask us to set up to inform residents. This report contains a list of apartments and their debt amount that owe more than a specified amount.

Go to the Report on accruals and debts

and go to

Settings

.

Adding a grouping by Building and Address

, in the fields we leave only

the Final balance

.

In the conditional design, you can rename the names of groups by making the following settings:

For example, the Personal Account field. Address. Building

change to

Home

In the Selection

we do:

- selection according to the required building

- selection by debt amount

If you need to add informational text for residents, the following setting opens up the ability to edit the report.

This is what an example report looks like:

Ways to deal with collectors

Now we will tell you directly about the methods of protection if you are presented with a collection debt. Unfortunately, even a written refusal to interact with debt collectors does not guarantee that they will not continue to ruin the debtor’s life. Therefore, it is not worth waiting patiently until they leave you alone.

Legal protection

As soon as you are faced with claims from creditors or collectors, it is advisable to contact a lawyer. This is not only necessary for immediate protection of rights. The lawyer will explain what options of action can be used in different situations, where to go with complaints and statements. The legislation allows the following methods of legal protection:

- defending interests in the courts - you can get a deferment or installment plan for payments, reduce the amount of the penalty, apply the statute of limitations to the entire debt or for certain periods;

- if you have nothing to pay off your debts, apply for bankruptcy; now this can be done for any amount of debt, but it is advisable to start the procedure with a debt of at least 350 thousand rubles. (because bankruptcy costs are quite high). However, according to the new law, it will be possible to become bankrupt for free, and the debt can be only 50 thousand rubles;

- contacting NAPCA or the prosecutor's office if the collection organization carries out illegal activities.

For example, bankruptcy will stop accruing penalties on the debt, and the procedure will be monitored by the arbitration court and the manager. This eliminates problems if threats are made over the phone, on social networks or in person. In these cases, you need to contact law enforcement agencies.

Protection through law enforcement agencies

The actions of debt collectors may fall under an administrative offense or a criminal offense. Here are several cases when the police are obliged to conduct a pre-investigation check and initiate a criminal case:

- intentional destruction, damage or theft of the debtor's property;

- threats expressed in any way, if they are perceived by debtors as a real danger;

- causing harm to the life and health of the debtor, members of his family or other persons (if significant harm to health is not caused, the collector will be held administratively liable);

- dissemination of defamatory information (through the media, on the Internet, in personal communication with strangers).

All these facts must be stated in a written statement. The police are required to conduct an investigation within three days. If the facts are confirmed, a criminal case will be initiated. The debtor will be recognized as a victim, and the violator will be prosecuted.

We analyze debt quickly and conveniently

Scheme of working with debtors in the program “1C: Accounting in housing and communal services management companies, HOAs and housing cooperatives”

In the block working with debtors, we identify debtors through the monitor “ Working with debtors”

". In the selections you can specify the minimum amount, the term of the debt

From the monitor you can generate a Certificate of Debt, Information about the debt on drugs form 3, Information on collection.

For debtors found based on the specified criteria, warnings and a statement of claim can be automatically generated. After the documents are generated, all data about them will be stored in the program on the Debtor’s Document Journal

.

List of notifications sent to the debtor

How to talk to a debt collector correctly?

A conversation with a debt collector can ruin your mood, lead to stress or more serious consequences. If you receive a call after submitting a refusal to engage, file a complaint with NAPCA. If a refusal is not stated, we recommend that you adhere to the following rules when talking:

- always ask the collector to introduce himself, name his organization, its basic data;

- at the slightest manifestation of threats or insults, try to record the conversation, but do not get into an altercation;

- even if you really owe money, try not to directly admit this fact in conversation or in writing (such points can be used to restore the statute of limitations in court);

- You can stop the conversation at any time, since they cannot force you to communicate with the collector.

Calls or personal conversations with any persons other than the debtor himself are unacceptable. If you have given your consent to the collector for a personal meeting, it is advisable to conduct the conversation in front of witnesses and record the conversation. This will reduce the risk of physical violence and will provide evidence in case of misconduct.

We do not recommend agreeing to personal meetings with debt collectors or engaging in lengthy telephone conversations. It is much easier to file for bankruptcy or pursue other protection options than to be constantly stressed.

Tracking payment schedules under a court agreement

The program has a report to track the payment schedule that is specified in the court agreement.

Colored receipts

receipt . document (order No. 43/pr)

,

Plat. the document (order No. 454 in accordance with post. No. 354)

has a data collection setting where you can set the interval for the total amount.

After the personal accounts of debtors have been selected by the program, you can print them on colored paper

What to expect for people with problem debt

What the government will do and how the banks will behave can be assumed, but cannot be stated with certainty. Financiers think that we will see improvements in credit legislation, but not complete amnesty and debt forgiveness. As always, the safest solution is to do it yourself if possible, rather than expecting unreasonable improvements. Of course, it is worth monitoring changes in laws and taking advantage of possible relaxations, but you need to check the conditions carefully - if you understand them incorrectly, you may face negative consequences. In any case, it’s worth knowing what borrowers can expect from lenders—and which ones.

From banks

Banking organizations are also suffering losses amid the crisis, which is especially noticeable in the consumer lending segment. In 2021, interest rates may rise or conditions for issuing loans may tighten. But at the same time, lenders are trying to make conditions more attractive for existing borrowers. It is not profitable for the bank itself if a person stops paying. Therefore, if a creditor sees that a client is experiencing difficulties, he increasingly meets halfway:

- offers deferments and credit holidays;

- reduces the amount of payments by increasing the term - this is called restructuring;

- refinances the loan at a new interest rate.

Credit history does not deteriorate after such measures, but such programs, unfortunately, only work for people who have not previously had any arrears. If you have found yourself in a difficult situation before, it may be worth negotiating with the creditor individually - programs are also being developed for people with overdue debts.

From collectors

It may be even more profitable for a borrower to work with collection agencies than with a bank. Collectors who purchased a loan under an assignment agreement do not impose additional fines and penalties, and can also write off and forgive part of the debt. Like banks, it is more profitable for them if the client pays, even a small amount, so agencies often offer borrowers individual flexible repayment terms. For example, EOS always takes the client’s side and helps develop a payment scheme that will not burden him.

From the bailiffs

If it comes to enforcement proceedings and the bailiffs are handling the debt, then in 2021 the FSSP will most likely resume active activities. Last year, service employees were limited in their activities due to events caused by the epidemic, but in 2021 their work is returning to normal. It is expected that bailiffs will act most actively in relation to borrowers of large banks: they regularly remind the FSSP about enforcement proceedings against their debtors. But even in such a situation you can find a way out if you try to agree with the bailiffs on a repayment schedule that is convenient for everyone. There is one more positive change: amendments to Article 446 of the Code of Civil Procedure will prohibit bailiffs from communicating with third parties without written consent and from seizing pets for debt. Previously, arresting a cat or dog was a standard practice; now owners will not have to fear for their pets.

Useful:

What professions are in demand in your city?

Services for working with debtors

Automatic calling of housing and communal services debtors

Service Automated phone calls with payment reminders

allows:

- Automatically send voice messages.

- Generate lists of debtors from the 1C program: Accounting in housing and communal services management companies, homeowners' associations and housing cooperatives.

- Customize the text of the voice message you need.

- Determine and pronounce individually for each resident his data.

Advantages:

- 24/7 service, including weekends and holidays.

- A multi-channel service has been implemented: more than two phone calls are processed simultaneously.

- There is an optimization of time and money: you save up to 70% on the maintenance of the contact center.

- Statistics are available (generation of various reports) for detailed data analysis.

Price:

What actions of collectors are unacceptable?

A debt collector is not a bailiff. Therefore, collection agencies cannot engage in enforcement actions, seize or seize property, or impose prohibitions and restrictions. Also, illegal actions of debt collectors include:

- violation of the number, frequency and time of calls, sending letters and SMS;

- any appeals with demands and threats against relatives, close persons or colleagues of the debtor;

- attempts to interact with the debtor if he submitted a written refusal;

- committing illegal actions falling under the Criminal Code of the Russian Federation - unauthorized seizure of property or money, uttering threats, using violence, damaging or destroying things, vehicles and real estate.

General control over collection activities is carried out by the FSSP. Therefore, the bailiffs can and should file a complaint if the collector goes beyond his powers and harasses with calls and letters, despite the refusal to cooperate. If you receive threats, or the collector uses physical force or tries to take away (destroy) property, you need to contact the police.

Psychological impact

Even without physical violence, the debt collector can exert psychological pressure on the debtor himself, his family members and other relatives. These actions may occur:

- in rude conversations on the phone, insults;

- in calls at night or early in the morning, on weekends;

- putting pressure on family members and relatives, including minor children;

- in hidden or indirect threats that are difficult to bring under the article of the Criminal Code of the Russian Federation.

Pressure may consist of leaving inscriptions in the entrance or on the walls of the house demanding repayment of the debt, in an attempt to tell the debtor’s employer or colleagues about financial problems. Even if such actions do not lead to harm to health, the debtor’s normal life will be impossible.

Online payment by QR code

- Residents can pay for housing and communal services online, using bank cards through their mobile device.

- The tenant sees the QR code on the receipt.

- Using a mobile device, scans with an application for reading QR codes

- The service page will open on the mobile device; registration on the site is not required.

- The tenant enters the card details and pays for housing and communal services.

- Receives information about the execution of payment for housing and communal services.

Payments are made through the MONETA.RU payment service:

license of the Central Bank of the Russian Federation No. 3508-K dated July 2, 2012

Benefits of the service

- The service is free and does not require maintenance costs.

- Quick start and easy setup.

- Acceleration of payment collection.

- Reducing overall debt levels.

- High level of safety and protection.

- The service operates 24 hours a day, without weekends or holidays – residents can pay for housing and communal services at any time

Experts told how debts for housing and communal services are collected in Russia and abroad

The State Duma plans to consider a bill prohibiting the disconnection of utilities to housing and communal services debtors.

This idea is supported by the Minister of Construction and Housing and Communal Services of Russia Vladimir Yakushev. In an interview with the Izvestia newspaper, he stated that he “is not a supporter of shutdowns and punishment of people, especially if a person finds himself in a difficult life situation.”

“Civilized methods are needed. We must explain that you have to pay for services. Disconnection from utilities is the most extreme measure,” he noted.

However, according to him, “for the complex to work efficiently, it must be properly financed.” And currently, the population’s debts to housing and communal services amount to about 573 billion rubles.

The problem of collecting debts from defaulters is acute not only in Russia, but also in other countries.

“There is practically no such liberal system as ours, when people can use public services and not pay for them,” notes Svetlana Razvorotneva, executive director of the NP Housing and Communal Services Control.

In most countries, she notes, today there is an advance payment for housing and communal services, she says.

This is the case, for example, in Cyprus, Great Britain, France and Germany. At the same time, the fines for non-payment are quite high.

One of the most stringent laws on the collection of housing and communal services debts is in Latvia. Shutting off water, sewerage and heating is often used to put pressure on non-payers, especially during the cold season.

If the defaulter is the owner of a privatized apartment, it can be put up for auction by decision of a bailiff - sometimes even for a debt of about 50 euros. The final price of the home often does not reach the market price, so if the amount to be paid exceeds several thousand euros, even selling may not help. The rest of the debt will still have to be repaid.

A striking example from the judicial practice of Latvia is the story of human rights activist Vladimir Bogdanov, who became the only one in the country who refused to receive the status of a non-citizen after the collapse of the USSR.

Bogdanov did not pay his bills on principle as a sign of protest against the “predatory” tariffs and argued in court that he simply could not do this because he had not entered into an official agreement with anyone. The cost of housing and communal services in the country is indeed quite high. Based on 2021 data, households paid an average of about 13.4% of their income to utilities.

At the same time, Bogdanov’s family had the necessary amount - the relatives were ready to pay it, but they demanded a feasibility study from the court. As a result, the human rights activist was evicted, although he filed a complaint with the ECHR and went on a hunger strike.

However, in Latvia, as in many other countries, privatized apartments are not common.

According to NUS Amulex lawyer Vasily Yaroshenko, the cost of utilities there is slightly higher than in Russia, and a significant part of the population rents housing, since its maintenance is expensive.

If a tenant does not pay rent for more than three months, he ends up on the street at the will of the owner, who in this case deals with housing and communal services.

Sometimes, due to a citizen’s debt, his neighbors may suffer, media reports. Local utilities can deprive an entire house of heat and water because of one apartment.

Galina Khovanskaya, Chairman of the Russian State Duma Committee on Housing Policy and Housing and Communal Services, is against collective responsibility for non-payment of utility services.

In her opinion, shutting off the sewer system “is a pure disgrace, because in an apartment building it leads to unsanitary conditions and the neighboring residents suffer, and not the defaulter himself.”

“And now you cannot turn off the heat in the house, you cannot turn off the cold water supply, because this concerns conscientious taxpayers. Hot water can be turned off. The power supply is turned off, naturally, with a certain period of notice,” she said.

Eviction in Russia is also possible, but it is extremely rare, says Yaroshenko. However, in practice, people are usually evicted not to the street, but to a less comfortable room.

Sometimes unconventional methods are used - for example, in the summer of 2019 in Samara, a so-called “talking pyramid of shame” appeared in front of the house of one of the defaulters. A tape recorder was built into the metal structure, periodically broadcasting text with information about the defaulter and the amount of his debt.

Such measures can be applied by companies that are not included in the register of the Federal Bailiff Service, explains Yuri Kudryakov, General Director of Unicom24. “In this situation, the debtor himself is unprotected, because if the law is not prohibited, then it is permitted,” he notes.

In January 2021, it became known that the Russian authorities may allow collection agencies to work with citizens’ debts for housing and communal services.

However, a mandatory pre-trial return procedure will not be provided for in such cases.

President of the association of collection agencies SRO NAPKA Elman Mehdiyev emphasizes another problem: today not only consumers have debts for housing and communal services. According to him, management companies stand between apartment residents and service providers, often interested only in collecting funds and avoiding settlements with the resource supplying organization.

Such companies themselves often underpay - according to statistics, they account for 40% of the volume of debts, and in the future this amount can only increase.

“Unfortunately, we constantly say that the population does not pay and we think about how to influence them, but we lose sight of unscrupulous management companies,” Mehdiyev notes.

Often, such companies direct the collected funds not to pay for utilities consumed by residents, but to their own needs - often in the interests of specific individual founders. Suppliers are not receiving their money, and debts to them are growing.

“And no bans on the sale of debts will help if you can “leave” through deliberate bankruptcy. And forced collection through the courts and the FSSP stops working for strange reasons,” the expert emphasizes.

It is this problem, in his opinion, that the state must solve.

Housing and communal services: Personal account

The mobile application will allow residents to control charges and services, submit meter readings, pay receipts (both basic charges and major repairs), and also keep abreast of news in the housing and communal services sector.

Data into the application is loaded from the 1C: Accounting program in housing and communal services management companies, homeowners' associations and housing cooperatives

Pros for residents:

- Ability to view the history of payments for housing and communal services.

- Viewing receipts for the accrual period

- There is a barcode for convenient payment through the terminal

- View and transfer meter readings

Advantages for the Management Company:

- Payment from a mobile device speeds up payment collection

- Automatic downloading of transmitted meter readings

- Increasing loyalty among residents who keep up with the times

Did you like the article? We still have a lot of interesting and useful materials

.

We also provide support for 1C programs. The terms and conditions can be found here

=)

Help through court

If collectors present a debt that has already been outstanding in court, you can apply for a deferment or installment plan. To do this, you need to confirm that the reasons for the request are valid. For example, you can submit documents about dismissal or reduction, a certificate of salary reduction, and confirm the assignment of a disability group.

Since collectors cannot forcibly withhold money from salaries or bank accounts, a determination on deferment or installment plan must be submitted to the FSSP.

Filing for bankruptcy may be the best option, especially if you do not have property to sell. After completion of the procedure, most debts will be written off, which makes any subsequent actions of the collectors illegal. The disadvantage of bankruptcy is the additional costs of paying remuneration to the manager and the risk of losing property.

Video on the topic

Collectors

Author:

Vladislav Kvitchenko

CEO . Practicing lawyer in the field of bankruptcy of individuals. persons Since 2015, she has been successfully handling insolvency cases. Vladislav is brilliantly versed in bankruptcy law, gives expert comments on legal situations and actively publishes in specialized publications.

What to do if you didn't take out a loan?

You may face claims from collectors, even if you have already repaid the debt, or have never been late at all. This may be due to the following reasons:

- if errors were made when drawing up the assignment agreement or executive documents (for example, if information about the namesake was incorrectly indicated in the writ of execution);

- if the bank sold the repaid debt to collectors;

- if the collection organization initially collects a non-existent debt.

If you are not a debtor, any actions taken by debt collectors against you are a violation of the law. Immediately contact the police or the FSSP and describe in detail all illegal actions. If a mistake was made by banks or courts, it is necessary to submit a request to eliminate it. Our lawyers will provide you with the necessary assistance in these matters.

Call us or contact us through the online chat form.

We will write off your debts through bankruptcy with a guarantee

Our lawyer will call you in a few minutes and answer all your questions

our team

Vladislav Kvitchenko

CEO

Tatiana Smirnova

Senior bankruptcy lawyer persons

- Grigory Nechaev

Bankruptcy lawyer persons

- Oleg Martin

Financial analyst

- Yaroslav Mitkov

Junior bankruptcy lawyer persons