Why is it so important to check documents before purchasing an apartment?

- Good Reasons for a Buyer to Inspect a Property

For ordinary citizens, checking legal integrity is especially important, since not only the future life of the family, children, etc., but also considerable money is at stake.

If an unexpected surprise comes up at the transaction stage and the deal is declared invalid, it will most likely not be possible to fully return the painstakingly accumulated money. And if you fall for scammers, the consequences are generally extremely difficult to predict. In the case of the most negative outcome, you risk being left both without an apartment and without money.

- Good reasons for a seller to have a property inspection

The seller should also not neglect to check all the nuances, if only because of his additional security.

After all, if the transaction is declared invalid, the funds will have to be returned. In general, it is safer and more profitable to buy real estate with a professional realtor, lawyer or through reliable, popular agencies. But if this option does not suit you for some reason, you can always use useful online real estate verification services.

What is property tax?

Property tax is a tax on a residential building, apartment (room), garage, parking space, unfinished construction site, other buildings, structures, premises.

Residential buildings include residential buildings and houses located on land plots provided for personal farming, dacha farming, vegetable gardening, horticulture, and individual housing construction.

The property tax for individuals is local and its rate is established by regulations of municipal authorities (in the federal cities of Moscow, St. Petersburg and Sevastopol - by the laws of these constituent entities of the Russian Federation).

You need to know that paper notices are not sent to owners of taxable property in the following cases:

1) the presence of a benefit, deduction, or other grounds established by law that exempt the owner of the taxable object from paying tax 2) if the total amount of obligations reflected in the notification is less than 100 rubles, except for cases established by law 3) the taxpayer is a user of the Internet service of the Federal Tax Service of Russia – the taxpayer’s personal account and did not send a notification about the need to receive tax documents on paper.

Property tax rates

Tax rates are established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol), in amounts not exceeding the following values: - rate 0.1%

for residential buildings, parts of residential buildings, apartments, parts of apartments, rooms, garages and parking spaces;

economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction; — rate 2%

In relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of the Code, in relation to taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of the Code, as well as in relation to taxable objects, the cadastral value of each of which exceeds 300 million rubles

- rate 0.5%

Other objects of taxation

For objects that fall under the base rate of 0.1% of the cadastral value, tax rates can be reduced to zero or increased, but not more than three times, by regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol)

For example, in Moscow, tax rates on property of individuals (apartment, room, residential building) are differentiated depending on the cadastral value: - 0.1% - up to 10 million rubles. — 0.15% — from 10 to 20 million rubles. — 0.2% — from 20 to 50 million rubles. — 0.3% — from 50 to 300 million rubles. For any real estate with a cadastral value of more than 300 million rubles. a 2% rate applies. You can find out the rates in any region of the Russian Federation on the Federal Tax Service website. You must select the accrual type, period and region. As a result, detailed information about rates in a specific region will be displayed.

Benefits for property tax for individuals

15 categories of taxpayers have the right to federal benefits, among them the following: pensioners, disabled people of groups I and II, as well as disabled children, participants of the Second World War and other military operations, heroes of the USSR and the Russian Federation, military personnel (the full list of preferential categories is indicated on the tax website services).

Tax benefits are provided for the following types of real estate:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures specified in subparagraph 14 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- economic building or structure specified in subparagraph 15 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- garage or parking space.

Tax benefits are provided in respect of one taxable object of each type

at the choice of the taxpayer, regardless of the number of grounds for applying tax benefits. This point requires a separate explanation. For example, a pensioner owns two apartments, one house and one garage. In this case, only one apartment is subject to taxation, i.e. an apartment, a residential building and a garage are different types of taxable objects.

The tax benefit does not apply to real estate used by the taxpayer in business activities.

The payer must independently notify the Federal Tax Service that he has a benefit.

If the taxpayer-owner of several real estate objects of the same type fails to provide notice of the selected taxable object, a tax benefit is provided in respect of one taxable object of each type with the maximum calculated tax amount.

In addition to benefits at the federal level, there are regional (local) benefits. Information about all types of benefits can be found by contacting the tax authorities or the contact center of the Federal Tax Service of Russia.

Tax deductions for personal property tax

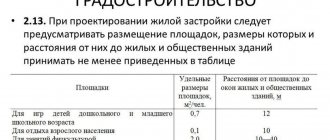

In those regions of the Russian Federation where the tax base is calculated based on the cadastral value of real estate, the following tax deductions are applied when calculating the tax:

- for an apartment

, part of a residential building, the cadastral value is reduced by the cadastral value of

20 square meters

of the total area of this apartment, part of a residential building; - for a room

, part of an apartment, the cadastral value is reduced by the cadastral value of

10 square meters

of the total area of this room, part of an apartment; - for a residential building,

the cadastral value is reduced by the cadastral value of

50 square meters

of the total area of this residential building (at the same time, for tax purposes, houses and residential buildings located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, gardening, individual housing construction , refer to residential buildings);

Municipal authorities (legislative bodies of state power of the federal cities of Moscow, St. Petersburg and Sevastopol) have the right to increase the amount of deductions provided for by the Tax Code.

Online service Dominfo

This is the first online service that checks an apartment using 27 databases for arrest, bail, and various restrictions.

In addition, the service contains all the information about real estate, management companies, developers and housing and communal services. So, as a result of checking the property of interest, you will have a complete history and full names of all previous owners, who, by the way, will be checked against “black lists”. Your final expert report will contain all documents from the Rosreestr and Unified State Register database, which are signed with an electronic digital signature and have legal force.

What I would like to especially note. This service was created by professional real estate lawyers who understand such issues better than other specialists. Moreover, in addition to the inspection, you will be able to manage your home and pay all utility bills on time.

Advantages of the DomInfo service:

- Upon registration, a free “Extract from the Unified State Register” for your property

- Upon registration, a free “Certificate of cadastral value”

- Opportunity to learn about current announcements from housing and communal services

- It is possible to obtain information about housing and communal services tariffs

- Chat with neighbors at home

- The ability to quickly obtain information about cap. repairs

- There is an option to “Submit a Complaint”

The final report looks like this:

What information about real estate can you get for free?

1. Get advice on transactions with real estate or find out the status of your application to the registration authority.

To improve the quality of public services, the Federal Cadastral Chamber is developing a call center. By calling there at 8 800 100 34 34, you can find out the status of your appeal or application, get advice on transactions with real estate or accounting services, and also make an appointment with the institution’s specialists.

The Departmental Call Center (DCTC) is a division of the Cadastral Chamber. VTsTO operators answer any questions related to real estate 24/7.

Important. The waiting time for a response from the operator may be increased, since due to the epidemiological situation in the country, the VTsTO acts as the main channel of information and interaction with applicants on real estate transactions.

2. Make a list of documents necessary for real estate transactions.

If you want to make any transactions with real estate - buy or sell, re-register a property, register a mortgage, enter data about a previously registered property, etc. — with the help of the “Registration is Easy” service you will be able to draw up a complete and correct package of documents necessary for any, even the most non-standard and complex, real estate transaction.

To use it, you need to go to the official website of the Cadastral Chamber in the “Services and Simple Registration” section, then click on the “Go to service” button and perform the necessary actions.

3. Find out the cadastral number of the property, the area of the land plot, the type of permitted use, etc.

A service that interactively provides publicly available information from the Unified State Register of Real Estate (USRN) online will help here - the Public Cadastral Map. Also, knowing only the address or cadastral number of a multi-story building, you can find out its year of construction, wall material, number of floors, and purpose.

Previously, the Federal Cadastral Chamber compiled a short educational program about what information you can find out about a property without leaving your home and having only the address of a specific land plot or its cadastral number.

4. Find out the cadastral value of the property.

Using the Rosreestr service “State Cadastral Valuation Data Fund” you will be able to view in real time reports on the determination of cadastral value, reports on the assessment of market value, on the basis of which the results of determining the cadastral value are disputed, as well as systematized information about the objects of assessment. To do this, you need to go to the Rosreestr website in the “Individuals” section, then select “Get information from the state cadastral valuation data fund”, then click “Find out more”.

Important. To view the cadastral value of a property, in the “State Cadastral Valuation Data Fund” service, you must use the search for real estate by cadastral number.

5. Check the authenticity of the extract from the Unified State Register of Real Estate (USRN).

The service allows you to generate a printed representation of an extract received electronically and check the correctness of the electronic signature with which it is signed. To do this, you need to upload the xml file and click on the “Check” button, then select the “Show file” function.

If you need to check the correctness of the electronic signature, you need to attach an xml file, the resulting sig file and click on the “Check” button.

6. Get background information on real estate properties online.

You can generate a request by cadastral number or address of a property and find out the cadastral value, status, area, address and date of cadastral registration of a property online using the “Reference information on real estate” service.

You may need such information when purchasing real estate. We advise you to double-check the information received from the seller. This way you will protect yourself from fraudulent activities and will know exactly the parameters of the land plot or apartment you are purchasing.

7. Calculate land tax and property tax.

There is a Tax Calculator service on the website of the Federal Tax Service. With its help you can calculate property tax for individuals or land tax. Simply select the region, then the tax period for which you need to calculate the tax, then the cadastral number of the property. The system will automatically generate for you the amount that you need to pay for your real estate.

Online service DomClick from Sberbank

Another equally popular online service for searching, selling, buying and renting residential and commercial real estate, as well as obtaining a Sberbank mortgage.

Pros:

- Here, the legal check of the property before purchase is also checked by a lawyer. As a result of the check, you get:

- Legal opinion

- Written legal opinion in electronic form

- Detailed recommendations from lawyers to reduce risks and additions to the purchase and sale agreement

- Documentary proof that you are a bona fide buyer

What to pay attention to

Let’s immediately make a reservation that it is best not to rely on chance and check the car for encumbrances, even if the owner seemed to you to be a decent and honest person. As we know, God protects those who are careful.

There are a number of signs that should alert the buyer first of all. Among them:

- absence of the original registration certificate (perhaps the document is kept in the bank as collateral, and it will be returned only after the loan is repaid);

- low price;

- the vehicle had been in use for less than 3 years before the sale (3 years is the average time to repay a loan to purchase a car, so if you are offered an almost new car (and even without a title), it’s time to postpone the deal);

- the seller’s reluctance to provide his passport data, vehicle registration certificate, CASCO policy or a notarized permission to sell from his spouse.

You can read more about checking a car in our free book “Secrets of Safe Car Buying.”

If you are a professional car seller, use the “Autocode Pro” unlimited car check service. “Autocode Pro” allows you to quickly check a large number of cars, add comments to reports, create your own lists of liquid vehicles, quickly compare options and store data about cars in an orderly form.

How to find out if there are encumbrances on a car

There are several ways to check a car for encumbrances. Let's look at each of them.

Check through credit bureaus. Today there are plenty of organizations providing similar services. The cost of the report is from 600 rubles. and higher. If the seller offers you a car purchased on credit, this information is indicated in the credit history. To apply, the seller's passport information is required.

Check with the FSSP. To make a request to the Federal Bailiff Service, you must know the full name and passport number of the current owner. If the car is under arrest, pledged or taken on credit, but it has not yet been paid off, this information must be in the FSSP database.

Check at the traffic police. State Traffic Inspectorate employees do not have the right to register vehicles with encumbrances. Therefore, information about seizures and other problems with a particular car flows into the traffic police database. To apply, you will need the car's title and registration certificate.

Verification through a notary. If the car is pledged, information about this is contained in the Register of Pledged Property. You can find out about this by contacting a notary, who will send the corresponding request. The price of the service is 100 rubles.

Consequences of the ban

The most harmless consequences are fines. If the new owner of the car does not submit documents to the traffic police in time to register the car, then he will have to pay. How much will it cost:

- Individuals will pay about 2,000 rubles.

- Legal entities – up to 10,000 rubles.

- Officials – up to 3,500 rubles.

To free the car from restrictions, the former owner of the car must pay off the debt. But this does not always happen!