All articles

37345

2021-03-13

In this article you will find out how much the state fee for an extract from the Unified State Register of Real Estate will require, how you can make the payment, what method will help you save and when is the best time to deposit money. You can order an extract from the Unified State Register on our official website, signed with the digital signature of a Rosreestr employee.

When selling a residential property, the buyer has the right to request a certificate from the Unified State Register . This document confirms ownership and may be required in other situations. Having submitted a request to certain government agencies, the applicant will be placed in a queue for the issuance of a document and their application will be accepted only after paying the mandatory fee.

Payment of the state fee for an extract from the Unified State Register is a mandatory step in order to obtain a certificate. The method of receipt does not matter whether the subject applies independently to Rosreestr or submits an application online using the website, the application will be accepted after depositing funds, the amount of the state fee in 2021 for an extract from the Unified State Register depends on the method of obtaining the document.

The amount of state duty for an extract from the Unified State Register of Real Estate

The fee is paid to the state, in return the state provides the necessary services and issues certificates. The amount of the mandatory monetary fee, the procedure for payment methods are regulated by law, for all regions of the Russian Federation the conditions are the same and must be fulfilled. There are no benefits or discounts; the subject pays the amount specified in the law.

The amount of the fee depends on the data specified in the document, on the type of certificate, on the method of receipt:

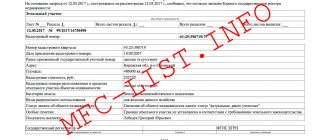

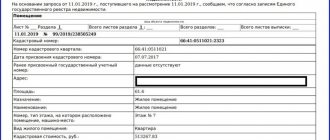

- State duty for an extract from the Unified State Register of Real Estate (standard) – price 350 rubles. (electronic version) , 600 rub. (paper type).

- The state fee for an extract from the Unified State Register of Rights on the transfer of rights is 850 rubles. (electronic version) , 1800 rub. (paper type).

- Certificate of cadastral value - price 350 rubles. (electronic version) , 600 rub. (paper type).

The amount of the state duty for an extract from the Unified State Register of Real Estate, which displays information about how many owners had real estate from 850 to 1800 rubles. To obtain documents confirming ownership (title papers), you need to pay a fee in the amount of 350 to 600 rubles, depending on the method of receipt. Payment of the state fee for an extract from the Unified State Register through Rosreestr depends on the information displayed.

Attention! Today, an extract from the Unified State Register (electronic), signed with a qualified electronic signature (EDS), is recognized as equivalent to a paper document with a blue seal from a Rosreestr employee, in accordance with Art. 6 of the Federal Law of April 6, 2011 No. 63-FZ “On Electronic Signatures”. You do not have to order a paper extract; you can buy an extract from the Unified State Register without leaving your home, and without paying a state fee.

AMOUNT OF FEE FOR PROVIDING INFORMATION CONTAINED IN THE USRN

| Document type | Information submission form, applicant | ||||

| in the form of a paper document | in the form of an electronic document | ||||

| individuals, government bodies, other government bodies <*> | Legal entities <*> | individuals, government bodies, other government bodies <*> | Legal entities <*> | ||

| a copy of an agreement or other document expressing the content of a unilateral transaction, completed in simple written form, contained in the registry file (except for an enterprise as a property complex), for 1 unit in rubles | 340 | 1080 | 170 | 450 | |

| a copy of an agreement or other document expressing the content of a unilateral transaction with an enterprise, completed in simple written form, contained in the registry file for the enterprise as a property complex, for 1 unit in rubles | 1080 | 1590 | 450 | 560 | |

| a copy of the boundary plan <**>, technical plan <***>, permission to put the facility into operation for 1 unit in rubles | 1740 | 5220 | 580 | 1110 | |

| a copy of the document on the basis of which information about the territory of a cadastral quarter (territory within a cadastral quarter), a territorial zone, a zone with special conditions for the use of the territory, the territory of a cultural heritage object included in the Unified State Register of Cultural Heritage Objects (monuments) is entered into the Unified State Register of Real Estate history and culture) of the peoples of the Russian Federation, territories of rapid socio-economic development, zone of territorial development in the Russian Federation, about the gambling zone, about forestry, about specially protected natural areas, special economic zones, hunting grounds, for 1 unit in rubles | 1740 | 5220 | 580 | 1110 | |

| a copy of another document on the basis of which information about the property is entered into the Unified State Register of Real Estate, for 1 unit in rubles | 460 | 1270 | 240 | 530 | |

| extract from the Unified State Register of Real Estate about the property, for 1 unit in rubles | 870 | 2550 | 350 | 700 | |

| extract from the Unified State Register of Real Estate on recognition of the copyright holder as incompetent or partially capable for 1 unit in rubles | 1100 | x | 470 | x | |

| extract from the Unified State Register of Real Estate on registered agreements of participation in shared construction for 1 unit in rubles | 1740 | 3420 | 820 | 1630 | |

| extract on the contents of title documents, for 1 unit in rubles | 680 | 1930 | 450 | 900 | |

| analytical information | 1740 | 5220 | 350 | 700 | |

| extract from the Unified State Register of Real Estate on the main characteristics and registered rights to the property | 460 | 1270 | 290 | 820 | |

| extract from the Unified State Register of Real Estate on the transfer of rights to the property | 460 | 1270 | 290 | 580 | |

| an extract from the Unified State Register of Real Estate on the rights of an individual to the real estate he/she has (possessed) | on the territory of 1 subject of the Russian Federation | 750 | 2080 | 470 | 760 |

| on the territory of 2 to 28 constituent entities of the Russian Federation | 1450 | 2900 | 580 | 990 | |

| on the territory of 29 to 56 constituent entities of the Russian Federation | 1790 | 3240 | 760 | 1160 | |

| on the territory of 57 or more constituent entities of the Russian Federation | 2080 | 3480 | 870 | 1280 | |

| extract on the date of receipt by the rights registration authority of the application for state cadastral registration and (or) state registration of rights and documents attached to it | 460 | 1270 | 290 | 820 | |

| cadastral plan of the territory | 1740 | 5220 | 350 | 700 | |

| extract on a zone with special conditions for the use of territories, territorial zone, territory of a cultural heritage site, territory of rapid socio-economic development, zone of territorial development in the Russian Federation, gambling zone, forestry, specially protected natural area, special economic zone, hunting ground, coastline (border of a water body), territory surveying project | 1740 | 5220 | 350 | 700 | |

| extract on the border between the constituent entities of the Russian Federation, the border of a municipal entity and the border of a populated area | 1740 | 5220 | 350 | 700 | |

| certificate of persons who received information about the real estate property | 1270 | 820 | |||

——————————

<*> With the exception of applicants who, in accordance with federal laws, have the right to free provision of information contained in the Unified State Register of Real Estate. <**> Including a copy of the description of land plots, drawn up in accordance with the order of Roszemkadastre dated October 2, 2002 No. P/327 “On approval of requirements for the preparation of survey documents submitted for registration of land plots for state cadastral registration” (registered with the Ministry of Justice Russia on November 13, 2002, registration No. 3911, lost force on January 1, 2009 due to the adoption of the order of the Ministry of Economic Development of Russia dated November 24, 2008 No. 412 “On approval of the form of the boundary plan and requirements for its preparation, an approximate form of notification of holding a meeting to agree on the location of the boundaries of land plots" (registered with the Ministry of Justice of Russia on December 15, 2008, registration No. 12857, lost force due to the adoption of Order of the Ministry of Economic Development of Russia dated November 21, 2021 No. 735 "On establishing an approximate form of notice of a meeting on coordinating the location of the boundaries of land plots and invalidating certain orders of the Ministry of Economic Development of Russia" (registered with the Ministry of Justice of Russia on December 22, 2021, registration No. 44873), if such a description is available in the registry file. <***> Including a copy of the technical passport of the property, prepared by the body (organization) for state technical accounting and (or) technical inventory, if such a passport is available in the registry file.”

AMOUNT OF FEE FOR PROVIDING INFORMATION CONTAINED IN THE EGRN BY PROVIDING ACCESS TO THE FEDERAL INFORMATION SYSTEM FOR MAINTAINING THE EGRN

| Method for obtaining information | Applicant | Rates | Information about the territory of the cadastral quarter (territory within the cadastral quarter), territorial zone, zone with special conditions for the use of the territory, territory of a cultural heritage site included in the unified state register of cultural heritage objects (historical and cultural monuments) of the peoples of the Russian Federation, about specially protected natural territories, in rubles | Information about the territory of rapid socio-economic development, the zone of territorial development in the Russian Federation, the special economic zone, the gambling zone, forestry, hunting grounds, borders between the constituent entities of the Russian Federation, the boundaries of municipalities and the boundaries of settlements, in rubles | ||||

| Tariff 1 <1> no more than 100, in rubles | Tariff 2 <2> no more than 1,000, in rubles | Tariff 3 <3> no more than 10,000, in rubles | Tariff 4 <4> no more than 100,000, in rubles | Tariff 5 <5> no more than 500,000, in rubles | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Viewing information contained in the Unified State Register of Real Estate (hereinafter referred to as USRN) without generating an electronic document | government bodies, other government bodies <6> | 370 | 1820 | 8210 | 62020 | 246240 | 46 | 23 |

| individuals | ||||||||

| legal entities | 730 | 3650 | 16420 | 124030 | 492480 | 90 | 46 | |

| Generation of an electronic document containing information from the Unified State Register of Real Estate, certified by an enhanced qualified electronic signature of the rights registration authority | government bodies, other government bodies <6> | 460 | 1940 | 9120 | 68400 | 273600 | 110 | 230 |

| individuals | ||||||||

| legal entities | 910 | 3650 | 18240 | 136800 | 547200 | 230 | 340 | |

| Sending notifications about changes contained in the Unified State Register of basic and additional information about the property, information about the rights to it, restrictions on rights and encumbrances of the property | government bodies, other government bodies <6> | 110 | 570 | 1140 | 6840 | 39900 | ||

| individuals | ||||||||

| legal entities | 230 | 1140 | 2280 | 13680 | 57000 | |||

———————————

<1> Tariff 1 provides the opportunity to obtain, within 1 year, information contained in the Unified State Register of Real Estate (hereinafter referred to as the EGRN), by providing access to the federal state information system for maintaining the Unified State Register of Real Estate (hereinafter referred to as the FSIS EGRN) in a manner selected in accordance with with the procedure for providing information contained in the Unified State Register of Real Estate, approved by order of the Ministry of Economic Development of Russia dated December 23, 2015 No. 968 (registered by the Ministry of Justice of Russia on April 28, 2021, registration No. 41955), as amended by order of the Ministry of Economic Development of Russia dated June 20, 2021 No. 378 (registered with the Ministry of Justice of Russia on August 24, 2021, registration No. 43384), dated June 29, 2021 No. 344 (registered with the Ministry of Justice of Russia on September 21, 2018, registration No. 52214), dated December 10, 2021 No. 694 (registered with the Ministry of Justice of Russia on January 17, 2021, registration No. 53390), dated March 20, 2021 No. 144 (registered with the Ministry of Justice of Russia on June 24, 2021, registration No. 55004), dated March 29, 2021 No. 173 ( registered with the Ministry of Justice of Russia on April 26, 2021, registration No. 54524), July 19, 2021 No. 433 (registered with the Ministry of Justice of Russia on August 8, 2021, registration No. 55529) (hereinafter referred to as the Procedure), in relation to no more than 100 real estate objects and (or) copyright holders of real estate objects.

<2> Tariff 2 provides the opportunity to obtain, within 1 year, information contained in the Unified State Register of Real Estate, by providing access to the FSIS Unified State Register of Real Estate in the manner chosen in accordance with the Procedure, in relation to no more than 1,000 real estate objects and (or) copyright holders of real estate objects.

<3> Tariff 3 provides the opportunity to obtain, within 1 year, information contained in the Unified State Register of Real Estate, by providing access to the FSIS Unified State Register of Real Estate in the manner chosen in accordance with the Procedure, in relation to no more than 10,000 real estate objects and (or) copyright holders of real estate objects.

<4> Tariff 4 provides the opportunity to obtain, within 1 year, information contained in the Unified State Register of Real Estate, by providing access to the FSIS Unified State Register of Real Estate in the manner chosen in accordance with the Procedure, in relation to no more than 100,000 real estate objects and (or) copyright holders of real estate objects.

<5> Tariff 5 provides the opportunity to obtain, within 1 year, information contained in the Unified State Register of Real Estate, by providing access to the FSIS Unified State Register of Real Estate in the manner chosen in accordance with the Procedure, in relation to no more than 500,000 real estate objects and (or) copyright holders of real estate objects.

<6> With the exception of applicants who, in accordance with federal laws, have the right to free provision of information contained in the Unified State Register of Real Estate.”

How to pay the state fee - procedure

When paying the state fee for an extract from the Unified State Register, you need to find out the recipient’s details first. After this, you can choose a method. If you do not find out the details in advance, the proposed methods will lose their relevance.

When contacting a government agency in person, the applicant is given a payment receipt, which displays all the necessary details. You can make a payment at a terminal, ATM, or bank cash desk.

In order to understand how to pay the state fee for an extract from the Unified State Register, you need to determine which body (MFC or Rosreestr) the funds will be transferred to.

Then you need to choose a method of depositing money.

Payment is made in the following ways:

- Internet banking (if such a service is provided by the bank in which the applicant’s personal account is opened).

- Terminal.

- ATM.

- Bank.

At the time of submitting your request, you can use the service for ordering statements. The state fee is paid to the MFC for an extract from the Unified State Register, and a terminal is installed in government agencies. The subject can contact the MFC for a certificate and pay the fee there.

The following are exempt from paying state duty:

- Federal government bodies, government bodies of constituent entities of the Russian Federation and local government bodies when they apply for state registration of rights to real estate and transactions with it;

- The Central Bank of the Russian Federation, when applying for the performance of legally significant actions established by Chapter 25.3 of the Tax Code in connection with the performance of the functions assigned to it by the legislation of the Russian Federation;

- Individuals recognized as low-income in accordance with the Housing Code of the Russian Federation for performing actions provided for in subparagraph 22 of paragraph 1 of Article 333.33 of the Tax Code, with the exception of state registration of restrictions (encumbrances) of rights to real estate.