Home / Shared construction / Law on Land Surveying 2021 477-FZ

A simplified procedure for registering ownership of certain categories of real estate and land plots has been in effect in Russia since September 2006, that is, for 14 years, and which should have ended on March 1, 2021 for capital construction projects.

The new law extends the dacha amnesty for capital construction projects for five years. Registration of rights to residential and garden houses will be carried out if there is a right to a land plot, on the basis of a technical plan prepared by a cadastral engineer in accordance with the declaration of the object drawn up by the owner of the land plot. Notifications of planned construction and its completion are not required.

- the owners of the plots cannot in any way influence the timing of the work, which depends on the decision of the municipal body;

- the complex nature of the work is fraught with errors when determining the boundaries of specific areas;

- If you disagree with the results of land surveying, land owners can appeal to a special commission for resolving disputes.

Expert advice . Land surveying allows you to resolve a dispute between the owners of adjacent plots regarding the boundaries of the area. To do this, a boundary approval act is drawn up, and if there is a conflict, boundary documents will be used as evidence in court.

In addition to minor technical changes, this law introduces a number of significant concepts and norms. Such as “complex cadastral works”. At the same time, the most important concepts in this area are still contained in Federal Law No. 221-FZ of July 24, 2007. In the latest edition, its text was signed and published in 2021. It contains the definition:

Thus, starting from June 1, 2015 and ending on December 31, 2021, clarification of the territory of the site could become absolutely free for citizens. This norm is reflected in the Federal Law “On Amendments to the Land Code of the Russian Federation” dated June 23, 2014 No. 171-FZ.

What is land surveying according to the new law of 2021

Land surveying is part of cadastral work and is regulated by Federal Law No. 221-FZ dated July 24, 2007. This document specifies the entire range of work that must be carried out in order to register real estate in the state cadastre. This includes the preparation of a boundary plan.

- if land surveying was carried out, then this paragraph will indicate “specified area”;

- for areas without land surveying – “declared area”.

- during land redistribution;

- allocation of a site;

- combining 2 or more plots of land;

- division of land;

- the formation of plots that were previously in state or municipal ownership, and are now leased, transferred into ownership or permanent loan, or privatized.

You may be interested in:: How to Top up a Social Card for Travel via the Internet

In case of controversial issues regarding incorrect land surveying, only the results of geodetic research, measurements and work can be taken into account. This fact is due to the fact that the setting of limits is preceded by an accurate determination of the turning points of the boundary of the site - the coordinates between which the line is laid.

The bill was developed in order to implement the Action Plan (“road map”) “Improving the quality of public services in the field of state cadastral registration of real estate and state registration of rights to real estate and transactions with it”, approved by Order of the Government of the Russian Federation dated December 1, 2012 N 2236-r .The law was adopted in 2014.

- The cadastral engineer must have a qualification certificate. Moreover, it is valid at the time of completion of the work.

- In addition, the specialist is required to join a self-regulatory organization of engineers of this qualification.

- He must have a compulsory liability insurance agreement.

Federal Law No. 218-FZ of July 13, 2015

This law directly concerns transactions with land plots , since they are also real estate and ownership can be registered on them.

There are a number of plots that are used by the owners. According to Federal Law No. 218, they cannot be sold as long as the site is owned by the municipality and not the real owner.

What exactly regulates

The Federal Law “On State Registration of Real Estate” regulates the relationship between citizens and legal entities in connection with the emergence of property rights. Any real estate must be legally assigned to the owner.

The right arises after the registration procedure and entering data into the Unified State Register of Real Estate.

Any real estate transaction, including a land plot, is considered concluded only subject to state registration .

What is the state real estate register

The State Register of Real Estate is an extensive and most reliable database containing information about all registered real estate properties.

Since the beginning of 2021, the Unified State Register of Real Estate has united the state cadastre and the register of rights .

The document that confirms the availability of information is an extract from the Unified State Register of Real Estate. Basic information from the register is publicly available.

Instead of a Certificate of Ownership, an extract from the Unified State Register of Real Estate is now issued. Both documents are equally legally significant .

Content

The Unified State Register contains the following data about the land plot :

- cadastral number;

- address;

- Owner's full name;

- square;

- cadastral value;

- presence of encumbrances;

- drawing (subject to land surveying).

Entering data

In order to enter new data into the Unified State Register, the following documents are required :

- statement;

- passport;

- title documents for the site;

- documents from which data will be entered (for example, land survey plan, purchase and sale agreement);

- court decision (when resolving a case through court).

After processing, the data is entered into the database.

Error correction

Errors in the Unified State Register can be technical and registry . The first can occur when an entry is made incorrectly. They are corrected after submitting an application to Rosreestr or through the MFC.

In the same way, registry errors are corrected, which greatly change the information and cause border crossings. To confirm your words, you need to provide documents or a court decision.

Registration of ownership

In order to fully manage the land, you need to formalize ownership. The law allows possession by right of use. But for a transaction of sale, gift or will, the land plot must be registered with Rosreestr.

Documentation

To register a land plot, as well as other real estate objects, the following documents will be required :

- passport;

- statement;

- title documents;

- boundary plan (if any);

- receipt of payment of state duty.

Who has the right to register real estate

Real estate is registered in the branches of the federal body Rosreestr . They are in every city.

It is very convenient to register ownership through the MFC offices or “My Documents”.

Is it possible to legalize land without documents?

The answer depends on the nature of the land acquisition. If the land was provided for use back in Soviet times, but the documents are lost, then you need to start searching for them to issue a duplicate. To do this, you should contact the city archives.

If ownership of a plot is based on squatting (on ownerless SNT lands) and does not cause inconvenience to other neighbors, then in order to legalize it you need to contact the municipality’s land management department. You will have to provide strong evidence and reasons that you cared about this land as if it were your own.

Illegality of the procedure

If the documents are not properly completed, the survey may be considered invalid and illegal. Most often, the procedure for signing an agreement with interested parties, who are neighbors of adjacent plots, is violated.

Responsibility for violation of registration rules

Responsibility for surveying and drawing up documents for the Unified State Register lies with the cadastral engineer . In case of a mistake, he bears financial responsibility and risks losing his qualification certificate. If extensive damage is caused, criminal liability is possible.

Laws on land surveying

Until the end of 2021, information about the boundaries of land plots must be displayed in the state cadastre, as stated in Law No. 477-FZ. Otherwise, the owner will lose the opportunity to dispose of the land plot, experts warn. According to officials, this innovation will help avoid controversial issues between neighbors. In the current conditions, a final resolution of the conflict is possible only in court, which creates a lot of inconvenience for owners.

Rosreestr has entered into agreements with 13 regions, which received subsidies from the federal budget for the implementation of complex cadastral work within the framework of the Federal Target Program (FTP) “Development of a unified state system for registration of rights and cadastral registration of real estate (2014 - 2021).”

Taking into account the existence of an approved land surveying project, changes in the boundaries of an existing land plot under an apartment building are carried out on the basis of the Agreement on the redistribution of lands in state or municipal ownership and (or) land plots in private ownership (Article 39.29 of the Land Code of the Russian Federation).

You may be interested in:: Benefits for Large Children for Utilities in Moscow: Do You Need to Be an Owner of an Apartment?

Thus, the owners of premises in apartment buildings have the right of common shared ownership of the land plot on which such houses are located, in accordance with Article 16 of the Law on the entry into force of the Housing Code of the Russian Federation, arises from the moment the land plot is formed and its state cadastral registration is carried out. At the same time, state registration of the right of at least one owner of residential or non-residential premises in an apartment building (and simultaneous state registration of the inextricably linked right of common shared ownership of common property in an apartment building, including a land plot) is a legal act of recognition and confirmation by the state the emergence of rights of owners of premises in an apartment building to the specified property, including a land plot.

General provisions

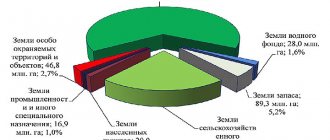

According to 2021 data, 58.6 million plots of land were registered in the real estate register of the Russian Federation.

Of these, only half of the total had documented demarcation and specified coordinates. That is why the regulatory framework of the Russian Federation is constantly being improved and updated with legislative amendments, which should bring together all the data on citizens’ land plots. The text of the law on land surveying contains guidelines for action: data on each of them must be provided to the Cadastral Chamber. Starting from 2021, officials planned to prohibit any transactions with real estate from the owner of a plot without established boundaries. In fact, the law is already in effect, although it has not been introduced in documents. Law 477 on mandatory land surveying assigns the following activities to the contractor:

- determining the size of the site and its data in the adopted coordinate system,

- documenting boundaries,

- consolidation of demarcation signs in kind.

The articles of the law enshrine the right of the land owner to turn to the public service (which is more expensive and take longer), and to use the services of a cadastral engineer from a private company, which includes Geo Service. Land surveyors must have certificates of cadastral engineers. During the measurements, they clarify the area of the plot, record agreement with the allocated boundaries of the owners of adjacent plots and draw up a boundary plan.

Land Surveying Law 2021 Law

The services of surveying specialists have always required certain financial costs. But amendments to the Land Code of the Russian Federation from June 1, 2015 obligated municipal authorities to allocate funds from the budget for these purposes. Thus, starting from June 1, 2015 and ending on March 1, 2026, clarification of the territory of the site could become absolutely free for citizens. This norm is reflected in the Federal Law “On Amendments to the Land Code of the Russian Federation” dated June 23, 2014 No. 171-FZ.

During land surveying, the boundaries and area of the land plot are determined. It is this data that is of practical importance when making transactions with land and drawing up purchase and sale agreements, leases, etc. Having the information obtained during land surveying, the owner will always be able to distinguish his plot from neighboring ones, as well as use various ways to protect his rights.

Providing services of cadastral engineers free of charge

According to 447-FZ, land surveying can be free. However, for example, in 2021, under this program, the boundaries of land plots have already been established only in Yakutia. In 2021, surveying is carried out free of charge in the Republic of Crimea. The cities of Sevastopol and Kamchatka are next on the list, but officials allocate such funds for this work that the quality of the work raises doubts among specialists. The capital of the Russian Federation and St. Petersburg were not included in the list of several regions of the Rosreestr pilot program.

In order for the owner to qualify for free land surveying services from the state, according to Law 477, he must:

- repurchase land purchased or leased after auction at the municipal level;

- get involved in a large-scale general cadastral and topographical work project.

The initiative to conduct a comprehensive survey comes from local municipalities. They make decisions about its feasibility and determine specific cadastral areas.

In the amendments to Law 477-FZ on land surveying, attention is drawn to the actual consolidation of the structure and plan for carrying out all activities to establish the boundaries of plots by land management specialists. At the same time, the requirement for land users to register their plots with the Cadastral Chamber becomes a mandatory legal norm.

Federal Law on land surveying 2021

A cadastral engineer carries out work in accordance with the rules, establishes and fixes boundaries. After completing the measurements, a corresponding act must be drawn up, which is signed by the owner of the land, neighbors, an employee of the geodetic company and a representative of the local administration.

However, such construction may also affect private land plots if their boundaries are not established (the coordinates of the characteristic points of the angles of rotation of the boundaries of land plots in the Unified State Register of Real Estate have not been determined), the developer may not know that, along with state and municipal lands, the construction will also cover his , private land.

You may be interested in:: Can the debt of bailiffs be put up for auction?

Article 2

1. This Federal Law comes into force on the date of its official publication.

2. The provisions of paragraph 4 of Article 346 20, paragraph 3 of Article 346 50, paragraphs 2 and 3 of Article 346 51 of Part Two of the Tax Code of the Russian Federation (as amended by this Federal Law) apply from January 1, 2015.

3. The provisions of paragraph 4 of Article 346 20 and paragraph 3 of Article 346 50 of Part Two of the Tax Code of the Russian Federation (as amended by this Federal Law) do not apply from January 1, 2021.

President of Russian Federation

V.Putin

Law 447 Federal Law on land surveying

- Land surveying is the establishment and registration of boundaries on a piece of your land.

- Boundary – the boundary of land holdings.

- Ownership of land is the ability to own, use and dispose of it.

- Horticultural lands are lands not intended for individual housing construction, but adapted for growing fruit and vegetable crops.

- Interleaving is repeated surveying, which is carried out by a specially authorized person already in the demarcated area in order to clarify certain information.

- PDO – public lands.

“Processing of personal data” - any action (operation) or set of actions (operations) performed using automation tools or without the use of such means with personal data, including collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data.1.1.4.

- The cadastral engineer must have a qualification certificate. Moreover, it is valid at the time of completion of the work.

- In addition, the specialist is required to join a self-regulatory organization of engineers of this qualification.

- He must have a compulsory liability insurance agreement.

It should be noted right away that the new law does not solve the problems of 11 million Russians who own land plots (statistics are given from the ARCHIVE website RB.RU). The current executive and legislative authorities are once again afraid or too lazy to take anything effective.

Article 1

Introduce into part two of the Tax Code of the Russian Federation (Collected Legislation of the Russian Federation, 2000, No. 32, Art. 3340; 2001, No. 53, Art. 5023; 2002, No. 30, Art. 3021; 2008, No. 48, Art. 5519; 2012, No. 26, Article 3447; 2014, No. 48, Article 6660) the following changes:

1) Article 346 20 shall be supplemented with paragraph 4 as follows:

"4. The laws of the constituent entities of the Russian Federation may establish a tax rate of 0 percent for taxpayers - individual entrepreneurs registered for the first time after the entry into force of these laws and carrying out business activities in the production, social and (or) scientific spheres.

Taxpayers specified in paragraph one of this paragraph have the right to apply a tax rate of 0 percent from the date of their state registration as individual entrepreneurs continuously for two tax periods. The minimum tax provided for in paragraph 6 of Article 346 18 of this Code is not paid in this case.

Types of entrepreneurial activity in the production, social and scientific spheres, in respect of which a tax rate of 0 percent is established, are established by the constituent entities of the Russian Federation on the basis of the All-Russian Classifier of Services to the Population and (or) the All-Russian Classifier of Types of Economic Activities.

At the end of the tax period, the share of income from the sale of goods (work, services) when carrying out types of entrepreneurial activity in respect of which a tax rate of 0 percent was applied, in the total amount of income from the sale of goods (work, services) must be at least 70 percent.

restrictions on the maximum amount of income from sales, determined in accordance with Article 249 of this Code, received by an individual entrepreneur when carrying out a type of business activity in respect of which a tax rate of 0 percent is applied. At the same time, the maximum amount of income provided for in paragraph 4 of Article 346 13 of this Code for the purpose of applying the simplified taxation system can be reduced by the law of the subject of the Russian Federation by no more than 10 times.

In case of violation of restrictions on the application of a tax rate of 0 percent established by this chapter and the law of a constituent entity of the Russian Federation, an individual entrepreneur is considered to have lost the right to apply it and is obliged to pay tax at the tax rates provided for in paragraph 1, 2 or 3 of this article for the tax the period during which the specified restrictions were violated.”;

2) Article 346 50 shall be supplemented with paragraph 3 as follows:

"3. The laws of the constituent entities of the Russian Federation may establish a tax rate of 0 percent for taxpayers - individual entrepreneurs registered for the first time after the entry into force of these laws and carrying out business activities in the production, social and (or) scientific spheres. Small and medium-sized businesses

Individual entrepreneurs specified in paragraph one of this paragraph have the right to apply a tax rate of 0 percent from the date of their state registration as an individual entrepreneur for a continuous period of no more than two tax periods within two calendar years.

Types of entrepreneurial activities in the production, social and scientific spheres, in respect of which a tax rate of 0 percent is established, are established by the constituent entities of the Russian Federation in accordance with paragraph 2 and subparagraph 2 of paragraph 8 of Article 346 43 of this Code on the basis of the All-Russian Classifier of Services to the Population and (or ) All-Russian Classifier of Types of Economic Activities.

If the taxpayer carries out types of business activities in respect of which a patent tax system is applied with a tax rate of 0 percent, and other types of business activities in respect of which a patent tax system is applied with a tax rate in the amount established by paragraph 1 of this article, or another taxation regime, this taxpayer is required to keep separate records of income.

The laws of the constituent entities of the Russian Federation may establish restrictions on the use by taxpayers specified in paragraph one of this paragraph of a tax rate of 0 percent, including in the form of:

restrictions on the average number of employees;

restrictions on the maximum amount of income from sales, determined in accordance with Article 249 of this Code, received by an individual entrepreneur when carrying out a type of business activity in respect of which a tax rate of 0 percent is applied.

In case of violation of restrictions on the application of a tax rate of 0 percent established by this chapter and the law of a constituent entity of the Russian Federation, an individual entrepreneur is considered to have lost the right to apply a tax rate of 0 percent and is obliged to pay tax at the tax rate provided for in paragraph 1 or 2 of this article , for the tax period in which the specified restrictions were violated.”;

3) in article 346 51:

a) paragraph 2 should be stated as follows:

"2. Taxpayers pay tax at the place of registration with the tax authority within the following terms (unless otherwise established by paragraph 3 of this article):

1) if the patent was received for a period of up to six months - in the amount of the full amount of tax no later than the expiration date of the patent;

2) if the patent was received for a period of six months to a calendar year:

in the amount of one third of the tax amount no later than ninety calendar days after the patent begins to be valid;

in the amount of two-thirds of the tax amount no later than the expiration date of the patent.”;

b) add paragraph 3 with the following content:

"3. Taxpayers who, in accordance with paragraph 3 of Article 346 50 of this Code, have lost the right to apply a tax rate of 0 percent, pay tax no later than the expiration date of the patent.”

Law 477 Federal Law on land surveying: latest news

Free surveying can be completed until December 31, 2021. This is the date when the dacha amnesty expires. You need to have time to submit an application to state geodetic companies. Each region forms its own list of commercial firms that are participants in the state/municipal contract. Program participants also provide the service free of charge.

Important!

Neighbors related to land surveying can be warned in several ways. A personal warning confirms the signature of the addressee on the written notification. If the form is sent by registered mail, you must keep the receipt receipt. Publication in a local print media is a method that is used in the absence of information about the owners of neighboring territories.

06 Jun 2021 lawbellex 137

Share this post

- Related Posts

- Debtor Pensioner Writ of Execution In One Region And The Debtor Himself Lives In Another Region

- Is the Moscow Region Social Card valid in St. Petersburg?

- How to Take Revenge on Neighbors Behind the Wall Using Ultrasound

- Kiselev Ya S Ethics Lawyer